Table of Contents

The time horizon is simply the set period of time you look into the future when you make a plan. It is the most important step in any decision.

This period is critical for investors, business managers, and researchers.

For an investor, the time horizon definition is the amount of time they expect to keep an asset before they sell it. This is usually done to reach a specific financial goal. Knowing the meaning of time horizon is foundational. It controls three key factors:

The time horizon is always based on necessity. If you need money for a house down payment in three years, your time horizon is fixed. A young person saving for retirement has a very long and flexible time horizon. This difference in flexibility guides your entire investment strategy.

A time horizon research is a methodology used by the marketers to fulfil the purpose of effective research design. A useful research methodology is a combination of the physical, social, and cultural site comprising the research study. For qualitative research, marketers are primarily concerned about a substantive and accurate approach to the study. Also, this allows the researchers to study the participants in their natural environment achieving a better understanding of the research.

Thus, to help the researchers get a better understanding of the subject, time horizon can be categorised in the following two categories.

Thus, the concept of time horizon research revolves around the significance of these two productive approaches to prepare an unmatched market strategy.

In business, the time horizon is key for Business strategy and long-term planning and how resources are used. It shows the time over which costs are spent and benefits are expected. This controls how managers measure success. At the same time, organizations must plan within specific legal frameworks, including contract law and commercial time limits, which often determine how quickly obligations must be met and how long agreements remain enforceable.

In a business context, the time horizon is crucial for strategic planning. It determines whether managers prioritize short-term profits (e.g., optimizing for quarterly reports to please shareholders, a key focus of Accounting principles and time periods) or long-term growth and sustainability. By consciously evaluating the time frame, managers can better align departmental goals, from marketing campaigns to infrastructure development, often requiring expert assignment help to accurately model outcomes.

A common mistake in business is short-termism. This means focusing too much on immediate profits and quarterly earnings. This often hurts the company’s ability to create value over many years. It can happen because of pressure from major shareholders.

For example, a management team exhibiting short-termism might cut the budget for essential research and development (R&D) this year to meet a revenue target, boosting immediate profit but severely damaging the company’s competitive position three to five years down the line, unlike sustained efforts required for Long-term branding strategies like Family Branding. A strategic, long-term horizon would dictate maintaining or increasing R&D, recognizing that the long-run gains in market share outweigh the short-run reduction in reported earnings.

Understanding the time horizon is also vital for How Time Horizon affects SWOT and PESTLE analysis.

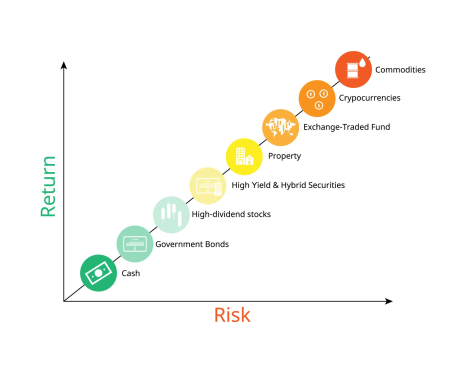

The relationship between the time horizon and risk tolerance is the most crucial principle in finance: the longer the time horizon, the more risk an investor can afford to take, as they have time to recover from short-term market volatility.

Investment strategies are generally split into three time frames:

Short Term Horizon (Typically 1-3 Years)

Medium Term Horizon (Typically 3-10 Years)

Long Term Horizon (Typically 10+ Years)

Long-term investment is the most powerful because of compounding. Compounding means you earn money not only on your initial savings but also on the money you already earned. Over 30 or 40 years, the money earned from compounding is much larger than the money you originally put in.

A long horizon also lets you invest in assets that are illiquid (hard to sell quickly), such as Private Equity. These often require commitments of 10 to 12 years. The trade-off is simple: taking on the risk of illiquidity for a long time often leads to higher returns.

All investments face risks. Your time horizon determines which risks are the most serious:

The longer your time horizon, the more you must focus on protecting yourself from inflation.

The concept of the time horizon is not limited to finance; it is a fundamental pillar of scientific and social research, as well as macroeconomic policy. In quantitative fields, the time horizon is also fundamental for Statistical analysis of time series data.

In research, the time horizon is the period during which data is collected for a study:

In economics, the time horizon is a crucial factor for government decisions. Economic models use two different sets of rules:

If you are struggling with complex concepts like asset allocation, illiquidity premiums, the difference between short-run and long-run economic models, or designing appropriate risk management strategies across different investment horizons, then seek Expert Financial Assignment Help. We provide detailed, original solutions and comprehensive support when you need to Pay an expert to handle my finance homework.

The time horizon is the set period you are planning for. This could be how long you plan to hold an investment or how long a business expects a new strategy to take effect.

A longer time horizon means you can take more risk because you have time to recover from market losses. A shorter horizon means you must choose safer, more liquid assets.

This is when managers focus too much on quick results, like quarterly profits, instead of making decisions that will help the company grow over many years.

A longitudinal study has a long time horizon, collecting data over many years to see how things change. A cross-sectional study has a short time horizon, collecting data only once at a specific time.

Compounding lets you earn returns on the money you already earned, not just your savings. Over a long time (10+ years), this effect grows exponentially, which means your wealth grows much faster.

In the short-run model, prices are fixed, and policy can immediately affect the economy. In the long-run model, prices can change freely, and policy mainly affects the overall growth potential, not the immediate situation.