Table of Contents

A claim letter is more of a complaint letter that a consumer writes to a company to highlight an issue with the product or service. The primary purpose of a claim letter is to explain a situation with relevant details and to show how an individual is eligible for compensation. Knowing how to write a claim letter is important in order to obtain the intended result. In this blog, we will learn A-Z of writing compelling claim letters, so you get your due.

Before we discuss how to write a claim letter, let’s understand what a claim letter is. A claim letter, also known as a ‘letter before action’, is a formal way of informing a second party why they are disappointed with a product or service. Primarily, a claim letter is written to:

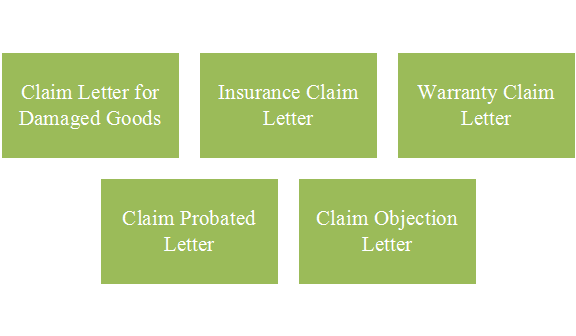

A claim letter is the initial step of legal proceedings against a company for failing to offer satisfactory service or genuine products as per company policies. Various kinds of claim letters are used to communicate the problem and ask for a refund, compensation, or replacement for a defective product in a professional tone. Here are some claims buyers generally make:

Receive high-quality, original papers, free from AI-generated content.

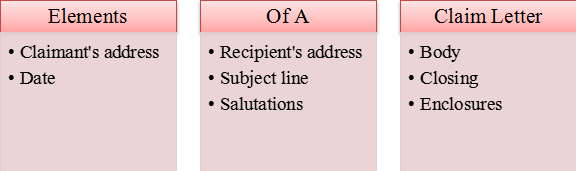

Whether you want to learn how to write a letter for an insurance claim or warranty claim, first, you need to be clear about the components of a claim letter. The following are the primary elements of a claim letter:

laimant’s address: A claim letter should start with the claimant’s (the person writing for a claim) address. If you are a claimant, write your address at the top, followed by the street name, city and zip code.

Date: Mention when you have written the claim letter in the expanded form, like 07 May 2022 or May 07, 2022.

Recipient’s address: Write the defendant’s complete address, name or professional title (if the name is unknown), company name, and address.

Subject line: Write a clear and short subject line mentioning the type of claim you want to make

Salutations: Always start your claim letter with a suitable greeting. You can use salutations like “Dear” followed by the name or personal title.

Body: The body of the letter should briefly highlight the purpose of the letter with the important details. Claim letters are formal, so stick to the point and avoid unnecessary details. Break your explanation into 2 to 3 paragraphs to improve readability. Once you are done explaining your issue, end the paragraph by thanking the authority for making time to read your letter. Also, don’t forget to suggest a solution for your claim and the expected date by which you want the settlement.

Closing: Use words like “sincerely” or “faithfully” to end your letter on a formal note. Remember to include your signature below your name and contact information.

Enclosures: If you wish to enclose documents with your letter, you can list out your documents after closing your letter.

So, based on these elements, a standard claim letter structure should look like this:

Your Name/Company’s Name

Your Address/Company’s Name

Date

Recipient’s Name

Recipient’s Address

Salutation (Recipient’s Name)

Body Paragraph 1

Body Paragraph 2

Body Paragraph 3

Enclosing Statement

Signature

When learning how to write a claim letter, it’s important to master the must-know guidelines. So here’s what you should remember to learn how to write an appeal letter for a health insurance claim:

| DO stick to block format and include the mandatory components while maintaining proper spacing, font style, and size. |

| Don’t make invalid claims without any evidence. |

| Do provide complete details of the defective product or dissatisfactory service. |

| Don’t be rude, sarcastic, angry, or abusive. |

| Do add details like purchasing and arrival date, model number(s), quantity number, size, colour, the total paid amount it/them, etc., for defective products |

| Don’t address the company as a whole. Make an effort to find the person of contact. |

| Do be clear about whether you want a refund or a replacement and mention it in the letter. |

| Don’t make mistakes while listing your claims if you don’t wish to worsen things. |

| Do check the terms and conditions before making a claim. Make sure it’s a manufacturing fault and is no fault of your own. |

| Don’t forget to send your claims within the prescribed time to make sure your claims stand valid. |

| Do remain courteous and be polite and respectful with your tone. |

| Don’t be on bad terms with the people involved with the business. Mistakes happen, be positive and try to maintain a good term. |

Here’s an example of how to write an appeal letter for an insurance claim denial:

Your name

Address

Date

Name of the company

Address

Dear sir/madam (or name of person);

Re: (Policy number, Claim number)

I am writing this letter in response to your letter dated (the 1st of March), offering $1,999 to fix my claim. The amount is not enough considering the benefits I was promised at the time of buying the policy.

I request you reconsider the offer. If I do not get a suitable offer, I will have no alternative but to approach the Public Financial Service for further action.

I am looking forward to your reviewed offer within the following ten days.

Yours sincerely

Signature

(Your name)

Let’s now check how to write a claim letter for a warranty:

Lisa Gomes

Principal

St. John’s School

London

Date: March 4th, 2022

Jenny Cameron

Manager

ABC Equipment Ltd.

11, Dickenson Street

London

Dear Miss Jenny,

I would like to inform you that the installation of our water coolers by your company at St. John’s School was supposed to be completed by March 10th, 2022. Your company has failed to install new coolers and upgrade the warranty of the existing ones.

We bought eight water coolers with invoice no. 1117 dated March 1st, 2022. Out of eight, only two have been installed, and the installation of six other coolers is still pending, along with activating the warranty. We are very disappointed that you failed to meet your commitment.

We request you complete your work by March 15th and upgrade the warranty, or take back the uninstalled coolers and process a refund by March 18th.

Kindly respond at your earliest. If otherwise, we will be taking the necessary steps to resolve this situation.

Sincerely,

Lisa Gomes

Principal

St. John’s School

London

How to Write A Diminished Value Claim Letter – Example 3

Date]

[Adjuster Name]

[Insurance Company & Address]

Re: [claim number]

Your Insured:

Loss Date

Claimant Name”

Dear Mr. /Ms.,

As you are aware, on March 11th, 2022, my vehicle was damaged due to a collision by your insured________. All the evidence provided shows your insured’s fault in the cause of the accident and other damages.

Due to the damages, the vehicle’s resale value has drastically reduced. I have enclosed the documents stating the same. I, hence, request reimbursement of the diminished value of my car of $1,200, including the cost of an appraisal and DV.

Please send the payment within a week of the notice to resolve this issue promptly. In case of any delay, kindly contact me directly. I look forward to hearing back from you.

Sincerely,

Signature

[Your name]

Enclosure: Diminished value appraisal

You must understand that a claim letter doesn’t guarantee the claims you make. If you wish to deny a claim, remember to include the following in your letter:

By now, you should be clear about writing claim letters. Ensure you give yourself enough time to practice improving your writing skills. Good luck!

Ans. If you are wondering how to write an appeal letter for a dental claim or insurance claim, these tips might help you get started:

Ans. Here’s what a standard structure of a claim letter looks like:

Your Name/Company’s Name

Your Address/Company’s Name

Date

Recipient’s Name

Recipient’s Address

Salutation (Recipient’s Name)

Body Paragraph 1

Body Paragraph 2

Body Paragraph 3

Enclosing Statement

Signature

Ans. Before you learn how to write an appeal letter for a medical insurance claim, it’s important to understand what a claim letter is. A claim letter, or a “letter before action”, is a persuasive letter a consumer sends to a business to highlight an issue with a product or service and demand a resolution for damaged or defective products or unsatisfactory services.

Ans. Knowing how to write a letter to claim medical expenses is imperative as it’s a crucial part of the insurance claim process. It enables the insurance adjuster to determine the right amount for your damages. Hence, while writing your insurance claim, be sure to include all the necessary details related to a situation or accident, the date of loss, the policy number, and the amount claimed.

Ans. An insurance claim is an official request made by the policyholder to the insurer to compensate for the losses covered under the insurance plan. For example, a sudden fire in Southern Australia damaged approximately 100,000 acres of land. The farmers and landowners demanded claims from their insurance companies to cover the unforeseen damages. You can refer to claim letter examples to learn how to write a cover letter to the insurance company for a claim.

Ans. The steps to start a claim are as follows: