Tools of finance and accounts to analyze performance

Question:

Describe about the Performance of Greene King plc and Mitchells and Butlers Plc?

This assignment has discussed some tools of finance and accounts in order to analyze and investigate the financial performance of Greene King. This assignment also dealt with the non financial performance of the company. This company has grabbed the leading position within the pub and brewing industry of United Kingdom. This company has achieved an extra ordinary sale in 200 years of its operation. Greene King has operated more than 1900 pubs, restaurants and hotels in the market. This company has taken the technique of innovation within the process of operating business. Business objective of this company is to provide effective value to its customers by providing prolonged service. Rate of dividend of this company has been grown in the year of 2014. On the other hand, the revenue of this company has also been increased by 8.9 % in 2014. The year 2014 is one of the most successful years of the Greene King.

In order to investigate the financial performance of Greene King Plc the author has taken another company among same industry, named Mitchells and Butlers Plc. This company also runs 1700 restaurants in U.K. Vision and objective of This Company is to provide various opportunities in service those will satisfy the actual needs and demands of the guests of those restaurants. Its main aim is to increase the value of shareholders of the company.

Mitchells and Butlers Plc has got hold of 173 pubs in the year of 2014. This company has 4300 employees. This hotel and restaurant industry is highly competitive within U.K. Therefore, every company needs to do effective operation in order to attract customers within the competitive sector of market.

In order to investigate the performance of Greene King plc author has done a SWOT analysis in order to know the strengths, weaknesses, opportunities and threats of the company while operating business within the competitive sector of market.

|

Strengths Ø Product of this company is highly effective among the customers Ø It is very popular within the U.K market as it has operated its business operation by 200 years Ø Balance sheet of this company is strong Ø It pays high dividends to its shareholders or investors |

Weakness Ø The service and product of this company are monotonous as it has no diversification |

|

Opportunities Ø It has obtained a high rate of growth Ø People of United Kingdom often try food from outside therefore restaurant and pub business therefore has been increased a lot

|

Threats Ø Market sector of restaurants is highly competitive in U.K Ø Greene King plc often faces immense competition and rivalry from other organization |

Figure 1: SWOT analysis of Greene King Plc

|

Strengths Ø Mitchells and Butlers Plc has increased its financial performance Ø This company also has a strong rate of share within the market of United Kingdom. It largely operate 1700 restaurants Ø Team management of this hotel is strong and effective

|

Weakness Ø This company has not paid dividends to the share holders Ø This company hardly differentiate products from the services |

|

Opportunities Ø Trend of the customers within U.K is influencing

|

Threats Ø Competitive market and rate of rivalry is also high within the market Ø Legislation of Government has posed a threat to this company |

Figure 2: SWOT analysis of Mitchells and Butlers Plc

1.2.1. Profitability ratios:

Profitability ratios help to analyze and understand the rate of profit of a company. Return on employed capital, return on equity, gross profit margin, operating profit margin, net profit margin are involved in order to analyze the profitability ratio of a company. Therefore, in this ratio analysis, profit of two companies by the year of 2012, 2013, and 2014 has been analyzed.

|

Profitability Ratios |

||||

|

2014 |

2013 |

2012 |

||

|

Return on capital employed |

Net Operating Income/ ( Total Assets - Current liabilities) |

7.01% |

8.02% |

7.38% |

|

Return on Equity |

Net Income / Equity |

9.04% |

9.82% |

10.83% |

|

Net Profit Percentage |

Net Income / Net Sales |

7.38% |

7.99% |

8.98% |

|

Gross Profit Percentage |

Gross Profit / Net Sales |

8.08% |

9.29% |

10.97% |

|

Operating Profit Percentage |

Operating Income / Net Sales |

15.32% |

19.18% |

18.53% |

Table 1: Profitability ratio of Greene King Plc

Graph 1: Profitability ratio of Greene King Plc

|

2014 |

2013 |

2012 |

||

|

Profitability Ratios |

||||

|

Return on capital employed |

Net Operating Income/ ( Total Assets - Current liabilities) |

6.38% |

6.94% |

5.81% |

|

Return on Equity |

Net Income / Equity |

7.85% |

10.50% |

7.42% |

|

Net Profit Percentage |

Net Income / Net Sales |

4.72% |

6.75% |

3.71% |

|

Gross Profit Percentage |

Gross Profit / Net Sales |

6.24% |

7.49% |

4.39% |

|

Operating Profit Percentage |

Operating Income / Net Sales |

13.40% |

14.83% |

12.28% |

Table 2: Profitability ratio of Mitchell and Butlers Plc

Graph 2: Profitability ratio of Mitchell and Butlers Plc

Return on Capital Employed: The comparison of return on interest and tax has been calculated by this ratio. In the case of Greene King Plc, the amount of return on capital employed has been increased in the year 2014 than 2012. Therefore, this company has achieved a positive rate of return on capital employed. Rate of profit through investment is high of Greene King Plc. In the year of 2014, this company has gained a lot of profit in order to operate the business activities among the U.K market.

SWOT analysis of Greene King

In case of Mitchells and Butlers, return on capital employed is also positive. 2012 was the challenging year for this company. However, it has recovered a lot in current years of its operation.

Return on Equity: In case of Greene King Plc, rate of return on equity has declined a lot during the year of 2013 to 2014. Therefore, positive return on investment has been received by the equity share holders of the organization. However, high rate of share capital has affected on the return on equity of this company. Therefore, Greene King Plc needs to boost the return on investment in order to meet the needs of operation.

In case of Mitchells and Butlers, return on equity has been declined a lot in the year of 2014 than the year of 2012. Increased number of equity share has caused the declining of return of the equity of this particular company.

Net profit Percentage: This percentage of Greene King Plc has also been decreased from 2012 to 2014. This company has to pay a compensation of insurance in 2014. For this reason, net profit percentage of this company has declined a lot.

On the other hand, Mitchells and Butlers also have to face a decline in the margin of profit from the year of 2014 to 2012. However, high operation cost has also helped this company in the process of increasing net profit margin of the company within the year of 2012 to 2013.

Gross profit Percentage: Gross Profit Percentage has also been decreased by the extra pay to the insurance compensation of the Greene King Plc.

Gross Profit percentage of Mitchells and Butlers has also been declined from 2012 to 2014.

Operating profit Percentage: On the other hand stated that, operating margin ratio helps to measure the percentage of total profit or revenue among the income of operation of the particular company. Operating profit percentage therefore helps to determine the amount of profit after payment and the cost of operation of a company.

However, the operating profit percentage of Greene King Plc has decreased from the year of 2014 to 2012. Therefore, operating profit margin has a positive impact on the business operation of the company. In the year of 2014 to 2012, the cost of operation has been increased and has impacted negatively upon the operating profit margin of the company.

On the other hand, Mitchells and Butlers have gained a positive margin of operating profit. In the year of 2012 to 2014, the operating profit of this company has been declined due to the cause of high operating cost. However, in the year of 2014 to 2013, operating profit this company has been declined.

1.2.2. Liquidity Ratio:

This ratio therefore helps to determine the skill of a company for settling the liabilities of current business operation. As per stated that, in order to determine the liquidity placement of the company, current ratio and quick ratio always help in this particular process.

|

Liquidity Ratios |

2014 |

2013 |

2012 |

|

|

Current ratio |

Current Asset/ Current Liabilities |

0.797242 |

0.474571 |

0.481846154 |

|

Quick Ratio |

Quick Assets / Current Liabilities |

0.738007 |

0.396106 |

0.391384615 |

Table 3: Liquidity ratio of Greene King Plc

Profitability ratios of both companies

Graph 3: Liquidity ratio of Greene King Plc

|

Liquidity Ratios |

2014 |

2013 |

2012 |

|

|

Current ratio |

Current Asset/ Current Liabilities |

0.552504 |

1.089835 |

0.969838 |

|

Quick Ratio |

Quick Assets / Current Liabilities |

0.508885 |

1.033097 |

0.909513 |

Table 4: Liquidity ratio of Mitchell and Butlers Plc

Graph 4: Liquidity ratio of Mitchell and Butlers Plc

Current ratio: In the year 2014, current ratio of Greene King Plc was 0.797. In 2013, the current ratio was 0.474 and 0.481 for the year 2012. On the other hand, defined that, the perfect ratio should be 2:1. Greene King Plc has strong liquidity position. Therefore, this company is not able to meet the efficient liabilities with its assets. This company therefore uses the inventory with effective techniques.

In case of Mitchells and Butlers Plc, current ratio is 0.55 in 2014, 1.089 in 203 and 0.969 in 2012. As per the current ratio shows, the liquidity position of this company is not so effective.

Quick ratio: Greene King Plc has positive quick ratio. In 2014, quick ratio of this company was 0.738, 0.396 for 2013 and 0.391 for the year 2012. Proper quick ratio is 1:1. According to the rate of quick ratio, it can be stated that, it cannot effectively manage the current assets.

On the other hand, Mitchells and Butlers have a negative quick ratio. This indicates that, this company can manage the current liabilities with the current assets.

1.2.3. Efficiency ratio:

This shows the efficiency ratio of two companies.

|

Efficiency ratios |

2014 |

2013 |

2012 |

|

|

Inventory Turnover Ratio |

Cost of Goods Sold / Inventory |

105.2033 |

111.0037 |

125.1034014 |

|

Stock Holding Period ( Days) |

365/ Inventory Turnover |

3.469474 |

3.288179 |

2.917586541 |

|

Debtor's Payment Period ( Days) |

Net credit sales / Average Debtors |

21.62126 |

16.16644 |

16.62390671 |

|

16.88153 |

22.57763 |

21.95633111 |

Table 5: Efficiency ratio of Greene King plc

Graph 5: Efficiency ratio of Greene King plc

|

Efficiency ratios |

2014 |

2013 |

2012 |

|

|

Inventory Turnover Ratio |

Cost of Goods Sold / Inventory |

6.777778 |

8.916667 |

5.346154 |

|

Stock Holding Period ( Days) |

365/ Inventory Turnover |

53.85246 |

40.93458 |

68.27338 |

|

Debtor's Payment Period ( Days) |

Net credit sales / Average Debtors |

32.83333 |

26.31944 |

33.73214 |

|

11.11675 |

13.86807 |

10.82054 |

Table 6: Efficiency ratio of Mitchell and Butlers Plc

Graph 6: Efficiency ratio of Mitchell and Butlers Plc

Inventory turnover ratio, Stock holding price and Debtor’s turnover ratio helps to determine the efficient operation of the particular organization.

Mitchell and Butlers Plc have increased its inventory turnover. On the other hand, Greene King Plc has a positive efficiency ratio. Inventory ratio turnover ratio is also positive for Greene King Plc. This company can manage inventory with effective as well as efficient process.

1.2.4. Financial Structure: This provides detail analysis of financial structures of two companies.

|

Financial structure |

2014 |

2013 |

2012 |

|

|

Interest coverage ratio |

EBIT / Interest Expense |

1.112051 |

0.935919 |

1.149270483 |

|

Price/ Earning ratio |

Current Share Price / Earnings Per share |

18.7871 |

22.21451 |

10.92436975 |

|

Dividend Yield |

Dividend per share / Current Share Price |

28.40 |

26.60 |

24.80 |

Table 7: Financial structure of Greene King Plc

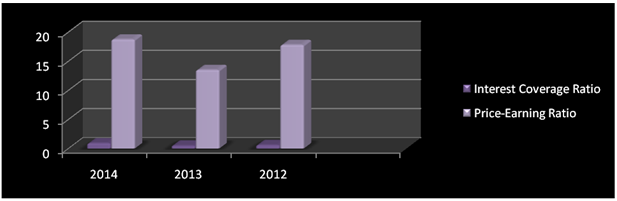

Graph 7: Financial structure of Greene King Plc

|

Financial structure |

2014 |

2013 |

2012 |

|

|

Interest coverage ratio |

EBIT / Interest Expense |

0.931818 |

0.505338 |

0.601449 |

|

Price/ Earning ratio |

Current Share Price / Earnings Per share |

18.76106 |

13.52564 |

17.82456 |

|

Dividend Yield |

Dividend per share / Current Share Price |

0.00% |

0.00% |

0.00% |

Table 8: Financial structure of Mitchell and Butlers Plc

Graph 8: Financial structure of Mitchell and Butlers Plc

Interest coverage ratio, Dividend Yield ratio and Earnings ratio help to determine the financial structure of the particular organization.

Greene King Plc has increased the amount of sale in the year of 2014. Ratio of interest coverage is positive. As the profit of the company has been increased a lot, the investors has attracted to this company. On the other hand, Mitchells and Butlers have also increased its margin of profit. This company has also opened some outlets of restaurants and pubs.This process has been resulted in gaining extra advantage from the investors.However, this company does not pay regular dividend to its share holders. However, impact of the company upon the company is positive.

As stated by cash flow statement helps to states the flow of cash of the organization. Cash flow projection within the activities of operation, investing and dividend. Therefore, Greene King Plc has opened 1900 bars and restaurants in U.K. It has operated its business operatio by 200 years within U.K. Total cash flow of this company through different activities of operation is 204.3 pound. Increased amount of operating cost has been resulted the decline in net cash flow of the company. In the year 2014, company has increased its investing operation. This company has opened many new restaurants. It has also increased its payment of dividend activity. Therefore, the net cash flow of the organization has also been increased.

On the other hand, cash flow statement of Mitchells and Butlers has been increased with the investment process of this company. This company has acquired Dining Limited and Orchid Pubs in order to expand the business activities of the organization. For this reason, this company has expanded a lot and resulted in the increase of profitability of the organization among the competitive market sector.

There are various types of indicators of the non financial performance of the particular company.

1. Satisfaction of employees: Greene King Plc often provides strong emphasis on building trust among the employees. This company has maintained effective relation among the employees of the organization. This company has maintained a strong value in order to build a strong relation between the employees of the organization.

It also maintains an effective operation within the stakeholders of the organization. Relation between external and internal stakeholders is well maintained by the organization. Quality employees do work for this organization. This organization also gives proper training and development program for the employees. However, this company spends money in order to gather innovative ideas for the better performance of the employees.

Various types of innovative solution of the company impact upon maintaining effective relation with the supply chain and logistics as well as operation management of the company. Decision making process of this company is also influenced by the process of innovation. This company also has implemented some regulations and standards in order to maintain the culture of the particular organization. This company also maintains effective standard of health and safety within the entire organization.

2. Corporate Governance: Greene King Plc has lacked from several initiatives of corporate governance. It does not do cross shareholdings with some other organizations. This company has put emphasis on the distribution of rights among the participants of the organization. Therefore, various decision making process has tackled by several types of rules of corporate governance. The objectives as well as aims of this organization has structured as per the rules and regulations of Corporate Governance. This organization is fully motivated by the values and beliefs of the organization.

Corporate social responsibility: Every business organization should do effective task of corporate social responsibility apart from gaining profit from its business operation. It is many the non financial as well as nonprofit area of action. However, by delivering effective corporate social responsibility, this company can build an effective image and reputation within the competitive sector of the market. It can take several actions for the needy people of the society abroad.

This company also can take initiatives in order to aware people about heal and safety and many other things. By attaining deep responsible work, people will start trusting this organization hence indirectly it will increase the name and sales of the organization. Effective corporate social responsibility also provides a chance to gain competitive advantage within the competitive sector of the market of hotel and restaurant industry of U.K.

Conclusion and Recommendation:

This assignment has discussed total financial condition of Greene King Plc and Mitchell and Butlers Plc in order to analyze the position of Greene King Plc. Operating cash flow of Greene King Plc has increased. In 2014, EBDITA of several pubs has been increased by 5.5% from 3.4 % in 2014. This company has also taken positive initiative in order to improve the expansion of retail business within the market. This company has paid a high rate of dividend to the shareholders. This company operates its effective business operation within the competitive sector of hotel and restaurant industry within United Kingdom. This company has also seen growth in order to gain the revenue and growth among the other rival as well as competitive zone of industry. Growth of this company is 4.5 %.

However, rate of corporate tax of Greene King Plc is low. The rate of corporate tax was 24% in the year of 2013 and the rate has declined by 1% to 23% in the year of 2014. However, this company has lacked from the strategy of mergers and acquisition to the other company. Mitchell and Butlers Plc have acquired two hotels and restaurants. Therefore, Greene King Plc has to take the strategy and effective technique of mergers and acquisitions of different small companies in order to expand its business activities within competitive sector of market. However, this company has the value of employees. This company tries to maintain effective relation with the employees as well as other stakeholders of the organization. Therefore, this company has operated its effective business operation within U.K for the 200 years. Therefore, it has gained a reputation, image and popularity among the market. Therefore, this company should take some strategic decision in order to attain the competitive market sector of United Kingdom.

Reference list

Ahila, R and X. Antony Thanaraj, Role Of Hotel Industry In The Promotion Of Tourism (Discovery Pub. House, 2013)

Arnold, Glen, Corporate Financial Management (Pearson, 2013)

Attig, Najah et al, 'Institutional Investment Horizons And The Cost Of Equity Capital' (2012) 42 Financial Management

Doukas, John A. and Andreas Walter, 'European Financial Management Association ( EFMA ) Annual Meetings: A Retrospective Evaluation' [2013] European Financial Management

Epstein, Marc J and John Y Lee, Advances In Management Accounting (Emerald, 2011)

Farquhar, Jillian Dawes, '‘Key Account Management In Financial Services’' (2005) 10 J Financ Serv Mark

Gazely, Alicia M and Michael Lambert, Management Accounting (SAGE Publications, 2006)

Gray, Sidney J. and Richard M. Levich, 'Tribute To Frederick Choi, Co-Editor, Journal Of International Financial Management And Accounting, 1987-2012' (2013) 24 J Int Financ Manage Account

Grieve, Ian, Microsoft Dynamics GP 2013 Financial Management (Packt Pub., 2013)

Hansen, Don R and Maryanne M Mowen, Management Accounting (South-Western College Pub., 2000)

Heikal, Mohd, Muammar Khaddafi and Ainatul Ummah, 'Influence Analysis Of Return On Assets (ROA), Return On Equity (ROE), Net Profit Margin (NPM), Debt To Equity Ratio (DER), And Current Ratio (CR), Against Corporate Profit Growth In Automotive In Indonesia Stock Exchange' (2014) 4 IJARBSS

'Higher Net Profit But Lower Turnover Forecast For Akzonobel In 1Q 2013' (2013) 2013 Focus on Powder Coatings

Hospitality Consulting, BDO, 'Trends In The UK Hotel Industry' (1996) 8 Int J Contemp Hospitality Mngt

Jameson, S.M. and K. Hamylton, 'The CRE’S Investigation Into The UK Hotel Industry' (1992) 4 Int J Contemp Hospitality Mngt

Jiang, Fuxiu, Bing Zhu and Jicheng Huang, 'CEO's Financial Experience And Earnings Management' (2013) 23 Journal of Multinational Financial Management

Loehlin, John C., 'Does Relative Bargaining Power Explain The General Factor Of Personality?' (2014) 63 Personality and Individual Differences

Mahmudi, Hamed and Michael Pavlin, 'Corporate Payout Policy, Cash Savings, And The Cost Of Consistency: Evidence From A Structural Estimation' (2013) 42 Financial Management

MihalicÌŒ, Tanja, Daniela Garbin PranicÌŒevicÌ and Josip ArnericÌÂÂ, Changing ICT Competitiveness Role Over Time

Murinde, Victor, Accounting, Banking And Corporate Financial Management In Emerging Economies (Elsevier JAI, 2007)

McCool, Barent, 'The Need To Be Prepared:Disaster Management In The Hospitality Industry' (2012) 01 J Bus Hotel Manage

Nakamura, Masao, 'Joint Venture Instability, Learning And The Relative Bargaining Power Of The Parent Firms' (2005) 14 International Business Review

Nicolàs, Cristina, Microsoft Dynamics NAV Financial Management (Packt Publishing, 2013)

Quek, Mary, 'Globalising The Hotel Industry 1946–68: A Multinational Case Study Of The Intercontinental Hotel Corporation' (2012) 54 Business History

Saygılı, Hülya, 'CONSUMPTION (IN)EFFICIENCY AND FINANCIAL ACCOUNT MANAGEMENT' (2011) 64 Bulletin of Economic Research

Shin, T., 'Explaining Pay Disparities Between Top Executives And Nonexecutive Employees: A Relative Bargaining Power Approach' (2014) 92 Social Forces

Stickney, Clyde P and Clyde P Stickney, Financial Accounting (South-Western Cengage Learning, 2010)

Stickney, Clyde P, Financial Accounting (AIPI], 2010)

Swieringa, Robert J., 'Robert T. Sprouse And Fundamental Concepts Of Financial Accounting' (2011) 25 Accounting Horizons

Tarrant, Crispian, 'UK Hotel Industry — Market Restructuring And The Need To Respond To Customer Demands' (1989) 10 Tourism Management

Trippi, Robert R., 'A Note On Modifying The Mean-Absolute Deviation Portfolio Optimization Model To Account For Nonstationarity Biases' (1992) 21 Financial Management

Uddin, Shahzad and Mathew Tsamenyi, Research In Accounting In Emerging Economies (Emerald, 2010)

Usmen, Nilufer, 'Transfer Prices: A Financial Perspective' (2012) 23 J Int Financ Manage Account

Vlachos, Ilias and Aleksandra Bogdanovic, 'Lean Thinking In The European Hotel Industry' (2013) 36 Tourism Management

Wood, Roy C., 'The Economic Ascent Of The Hotel Business' (2013) 38 Tourism Management

GREENE KING - Annual Report 2014 (2015) <https://www.greeneking.co.uk/files/pdfs/2014/greene_king_annual_report_2014.pdf>

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2016). Analysis Of Financial And Non-Financial Performance Of Greene King And Mitchells And Butlers Essay.. Retrieved from https://myassignmenthelp.com/free-samples/financial-and-management-account-greene-king-plc-and-mitchells-and-butlers-plc.

"Analysis Of Financial And Non-Financial Performance Of Greene King And Mitchells And Butlers Essay.." My Assignment Help, 2016, https://myassignmenthelp.com/free-samples/financial-and-management-account-greene-king-plc-and-mitchells-and-butlers-plc.

My Assignment Help (2016) Analysis Of Financial And Non-Financial Performance Of Greene King And Mitchells And Butlers Essay. [Online]. Available from: https://myassignmenthelp.com/free-samples/financial-and-management-account-greene-king-plc-and-mitchells-and-butlers-plc

[Accessed 30 May 2025].

My Assignment Help. 'Analysis Of Financial And Non-Financial Performance Of Greene King And Mitchells And Butlers Essay.' (My Assignment Help, 2016) <https://myassignmenthelp.com/free-samples/financial-and-management-account-greene-king-plc-and-mitchells-and-butlers-plc> accessed 30 May 2025.

My Assignment Help. Analysis Of Financial And Non-Financial Performance Of Greene King And Mitchells And Butlers Essay. [Internet]. My Assignment Help. 2016 [cited 30 May 2025]. Available from: https://myassignmenthelp.com/free-samples/financial-and-management-account-greene-king-plc-and-mitchells-and-butlers-plc.