Historical Overview of Queensland Floods

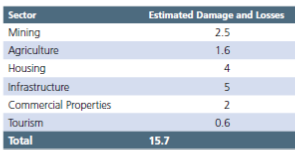

The floods in the Queensland region in the year 2010-11 was more crucial as it came after previous year witnessed draught in the region. The state of Queensland faces rainfall from the periods of December to March. But the crisis like situation in the region developed due to excessive rains in the period of November. This was also the second highest flood in the region not seen since twentieth century (Raiffa, 1997). Queensland experience of floods is not new but in 2010-11 period it was peculiar especially on account of the La Nina weather pattern that brought with it heavy rain events and storms. During La Nina weather pattern the waters in the Northern coast became extremely warm making Queensland more susceptible for rains. Damages to roads, communication links, and losses to the tune of $ 900 million to the primary industries were noted. In response to the damages the Australian government decided to invest a massive $ 5.6 billion in the rehabilitation and restoration work in the flood hit areas. Number of measures was taken to ensure that the impact of the natural calamity could be mitigated. One such measure by the Australian Government under the leadership of Prime Minister Julia Gillard was the introduction of one off levy. The one off levy was imposed on the middle income earning citizens, and was of 0.5 percent (Joint Flood Taskforce, 2011). As per the estimates of the Queensland floods the total damage is close to $ 16 billion. It is estimated that the damages were much higher compared to some of the other natural calamities that happened in Elbe flood in Germany in the year 2002, and Mexico City earthquake in 1985. (Table 1)

As stated in the early part of the study, a one off flood levy of 0.5 percent was introduced on the middle income group. The application of the levy can be seen in the Table 2. The income slabs were decided and it was noted that the person earning an income of more than $ 50000 will be liable for a levy of 0.5 percent, while those earning an income of more than $ 100000 will be liable for a slab of 1 percent.

While imposing the levy Australian president mentioned that the levy was more or less similar to the income tax slabs and was imposed on the income of certain group of people. The people that were affected by the floods were not liable to pay the levy. The levy rates were justified by saying that anyone who earns $ 60000 in a year will be paying only $ 1 extra per week according to the levy system. The application of the levy for the only year 2011-12 was also given. The estimated recovery from this levy was $ 1.8 billion. There was a challenge in front of the government in terms of the budget of damage and therefore this levy was one of the means to mitigate the expenditure (Coates, et al., n d). The government segregated this expenditure and mentioned that the short term assistance to the flood affected citizens was $ 600 million, while subsidies given to businessmen and farmers were $ 120 million. The government also ensured that the extra resources were put in place so that the relief measures were on a fast track mode. Colson (2011) is of the view that the people have the option to reject the surprises from their elected leaders. They are better off when they are provided with the predictable options. The compulsion being put on the people has been the sole reason for rejection rather than anything else, states Colson (2011) indicating the argument of Gittins in his blog.

Impact of 2010-11 Queensland Floods

Keane (2011) criticized the policy of levy as an approach by the lazy government. The criticism of the tax was on the manner the funds were being misused and the debt levels of the country that was lower in advanced economies. The government measure was more of being charging the people for being sympathetic and it was more of a voters gimmick. Coorey (2011) mentions that the levy could have been avoided and instead the budget estimates could have been curtailed. However, cuts in the budget could have caused another wave of criticism. The higher costs of living in Australia were cited as one of the reasons by opposition and critics like News.com (2011). News.com (2011) mentions that already the cost of living is very high especially in Sydney, and Prime Minister has failed in terms of the administrative and political approach.

Berg (2011) points out on the policies like Automotive Transformation Scheme by the government and mentions that the scheme will directly route $ 3.4 billion of tax payer’s money in the automobile industry. These kinds of measures could have been avoided and instead the tax has been put in the name of disaster management. The money offered to the car industry to revive itself at the expense of the tax payers was not a wise decision.

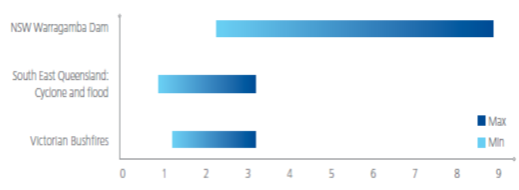

The Queensland disaster is not the last one considering the rainfall and geographical location. Therefore an adequate cost and benefit plan is required to avoid such calamities or atleast mitigating the same. This can be done by a program that ensures the building of new houses that can tackle the problems of cyclones (Deloitte, 2013). The benefits cost ratios for building the new houses has the capability for reducing the risks of natural calamities by 2/3rd. Chart 1 mentions the ranges of cost and benefits analysis that will be possible if counter measures to avoid disasters are taken. The other option is to increase the wall size of Warragamba Dam by 23 meters. The estimates from Deloitte, (2013) states that the present value of the cost of the floods could be reduced by $ 3 billion from a period of 2013 to 2050. This measure also creates a benefit cost ratio value of almost 9, as seen in Chart 1.

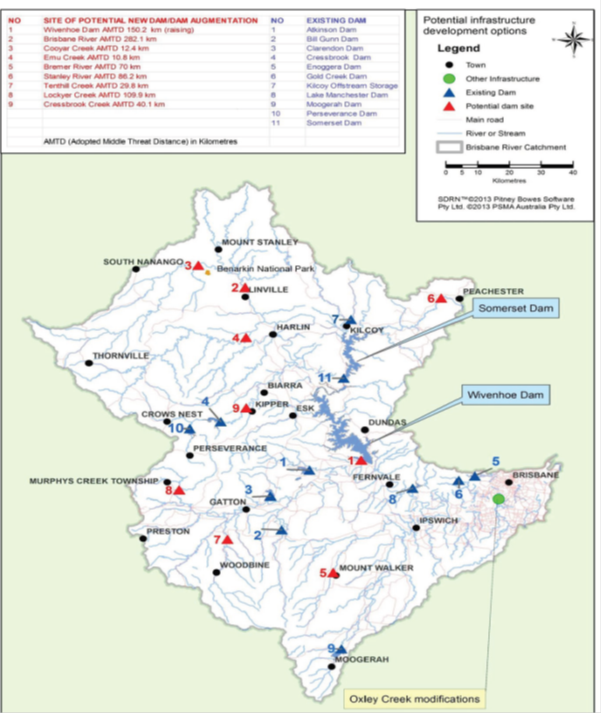

The other measure that has been though by Queensland Government (2014) is the building of new dams in the region to lessen the impact of the floods. The changes in the timing of dam operations have been also thought of as a measure to counter the risks. This is due to the fact that in case of floods there is the requirement of streamlining the water so that the floods in the downstream regions are avoided. The government has identified the locations where the new dams are to be build (Queensland Government, 2014). Engagement of public so as to increase the land usage in a proper manner and planning for the floods is very important (Coates, 2012).

Conclusion

From the report it becomes clear that the measure of levy in case of the floods in Australia was not the last remedy. Raising $ 1.8 billion from the levy has invited criticisms for the government that is already spending $ 3.4 billion of tax payer’s money for the recovery in the Automobiles market. It should be about getting the priorities at the right place. The studies also mentioned that the geographical location of Queensland is such that it remains affected from flood, draughts, and problems like cyclones. For this a strong measure is required to be taken like building of infrastructure that can up the ante against the natural calamities (Clemen, 1997).

The option of raising the dam wall and creating a cost benefit analysis is sound enough to minimize the extent of losses. Putting a levy in times when the other options are available is not a sound strategy especially in the cases when the cost of living is higher in the region. The government should also be promoting schemes like the environmental awareness programmes in the region and the analyses and forecasts of the rainfall and cyclones should be made. The paper clearly points out that the arguments in favour of the levy tax have not been taken in good faith by the critics. There was a strong resilience from the public that is already cutting down its expenses in order to take into account the costs. Weather patterns in Queensland keeps on changing every year and therefore the requirement of effective policy measures that can counter risks of natural disasters is required.

References

- Australian Government n d, Australian Budget, The Australian Government Budget 2013-2014 handed down on 14 May 2013, allocated $50 million per year over two years to reduce flood risk.

- Berg, C 2011, Drowning In Gillard's Flood Levy Spin [Online], Accessed on 19 August 2014.

- Clemen, R T 1997, Making Hard Decisions: An Introduction to Decision Analysis, PWS-KENT: Boston, MA, USA.

- Coates, L, Haynes, K, Gissing, A, Radford, D n d, The Australian experience and the Queensland Floods of 2010–2011, In The Handbook of Drowning: Prevention, Rescue, Treatment, Bierens, J J L M , Ed. Springer-Verlag Publishing: Berlin, Germany, 2012; Chapter 10–17.

- Coates, L 2012, Moving Grantham? Relocating Flood Prone Towns Is Nothing New [Online], Accessed on 19 August 2014.

- Colson, P 2011, [Online]

- Coorey, P 2011, Gillard’s flood levy sets of wave of criticism [Online], Accessed on 19 August 2014.

- Insurance Council of Australia 2011, Flooding in the Brisbane River Catchment, ICA Hydrology Panel: Sydney, Australia.

- Joint Flood Taskforce 2011, Joint Flood Taskforce Report March, Report prepared for the Brisbane City Council, Brisbane, QLD, Australia.

- Johnston, E, Needham, K, Tovey, J 2011, Insurers Say no to Brisbane; Brisbane Times: Brisbane, [Online], Accessed on 19 August 2014.

- Keane, B 2011, Labor’s Lazy Levy [Online], Accessed on 19 August 2014.

- com 2011, No Excuse For Flood Tax Abbott [Online], Accessed on 19 August 2014.

- Queensland Government 2014, Flood Mitigation Infrastructure Option Revealed [Online], Accessed on 19 August 2014.

- Raiffa, H 1997, Decision Analysis: Introductory Readings on Choices under Uncertainty, McGraw Hill: New York, NY, USA.

- SMH 2011, Gillard Confirms one-off Flood Levy [Online], Accessed on 19 August 2014.

Table 1:

Table 1: Estimates of Damage, PMO, IBIS

Table 2:

|

Income Slab |

Levy (In % terms) |

|

$ 50000 |

Nil |

|

$50001-100000 |

0.5 |

|

$ 100000 Above |

1 |

Table 2: Levy as per income slabs, SMH

Chart 1

Chart 1: Cost Benefit Analysis, Deloitte (2013)

Chart 2

Chart 2: Bribane River Catchment, Queensland Government (2014)

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2015). Queensland Floods: Impact, Response, And Mitigation Measures. Retrieved from https://myassignmenthelp.com/free-samples/proposed-flood-levy-to-fund-the-rebuilding-of-areas-of-queensland-damaged-by-the-severe-floods.

"Queensland Floods: Impact, Response, And Mitigation Measures." My Assignment Help, 2015, https://myassignmenthelp.com/free-samples/proposed-flood-levy-to-fund-the-rebuilding-of-areas-of-queensland-damaged-by-the-severe-floods.

My Assignment Help (2015) Queensland Floods: Impact, Response, And Mitigation Measures [Online]. Available from: https://myassignmenthelp.com/free-samples/proposed-flood-levy-to-fund-the-rebuilding-of-areas-of-queensland-damaged-by-the-severe-floods

[Accessed 25 May 2025].

My Assignment Help. 'Queensland Floods: Impact, Response, And Mitigation Measures' (My Assignment Help, 2015) <https://myassignmenthelp.com/free-samples/proposed-flood-levy-to-fund-the-rebuilding-of-areas-of-queensland-damaged-by-the-severe-floods> accessed 25 May 2025.

My Assignment Help. Queensland Floods: Impact, Response, And Mitigation Measures [Internet]. My Assignment Help. 2015 [cited 25 May 2025]. Available from: https://myassignmenthelp.com/free-samples/proposed-flood-levy-to-fund-the-rebuilding-of-areas-of-queensland-damaged-by-the-severe-floods.