Relationship between Inflation and Unemployment

Questions:

1. Explain whether there is a relationship between inflation and unemployment. Should government interfere and reduce inflation and unemployment?

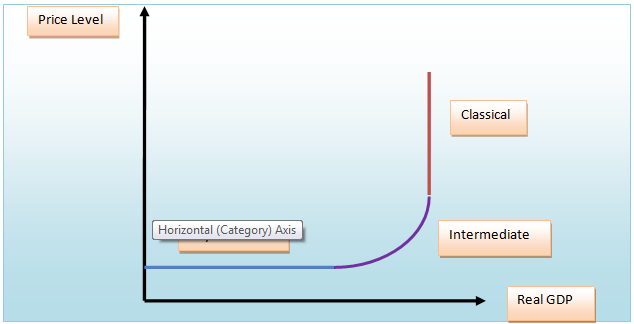

2. Using your home country as a case study outline and analyse inflation, unemployment and growth trends. Identify what range of the aggregate supply curve your country is operating in?

3. Explain how monetary policy can influence an economy, including the exchange rate and employment levels?

Are You Getting Buried Under the Overwhelming Academic Pressure?

Get the Much-Needed Essay Writing Help from our Professionals and Secure High Grades

The economic nature has witnessed a significant change in the recent years. Evidently, the inter-relationships among countries have increased greatly, specifically ever since the globalization. So, the threat of financial breakdown in a particular country may impact upon other countries including that of the enhancement in the financial relationships among countries. The recession that the world had faced during 2008-2009 had created an increased effect in the economies of the individual nations on account of the interrelationships. Commonly, there are several factors that lead to considerable impacts upon the growth as well as development of any economy, and all these factors are better known as indicators of the economic performances. All these factors involve the unemployment rate, inflation rate, national output, GDP growth rate, per capita income, etc. Each of the factors is indicative of how effective an economy is at performance. The government is also responsible for adopting different measures in context to financial policies to enhance the economic conditions. The key objective of this essay is to reflect upon the link between different indicators as well as the measures which are being adopted by the respective government for improving the conditions of economy.

(a) Relationship between Inflation and Unemployment

Both the factors of inflation and that of unemployment act as major indicators of economic performances within an economy. The concept of inflation refers to the increment in the general level of prices within an economy. On the other side, the concept of unemployment refers to the increase in the total percentage of individuals who seek for jobs to earn livelihood but somehow could not get one. Thus, when individuals seek for jobs but are not capable of getting one are referred to as unemployed (Lehmann, 2011). The yearly increase in the percentage of unemployed individuals across the globe contributes towards the increase in the overall rate of unemployment. Hence, it may be said that these two factors of unemployment and that of inflation are important indicators in an economy. In the case of inflation, it is thoroughly undesirable for any economy. Higher rate of inflation is practically undesirable in the society as this leads to considerable increase in the level of price of products and services. This gives rise of difficulties that are faced by the common public. On other side, unemployment situation is also undesirable in the society as increased number of people remains without work and this enhances the overall burden upon the society. Also, this affects the overall output.

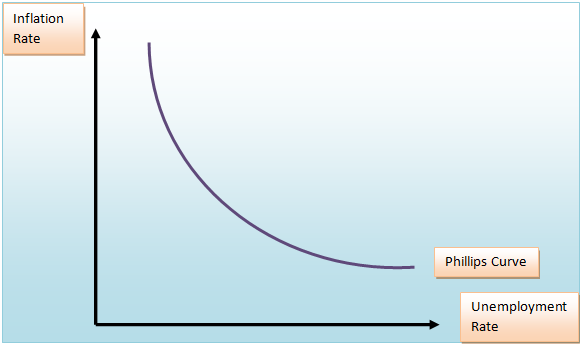

Negative Relationship between Inflation and Unemployment

From research evidences it has been identified that a significant trade off exists amidst that of unemployment as well as inflation. This refers to the presence of a negative relationship amidst that of inflation as well as unemployment (Lanne and Luoto, 2013). The inverse link amidst the two concepts is shown in the Phillips curve. It can be identified that with the increase in the rate of inflation, there is a significant fall in the rate of unemployment. The locus of different combinations of rate of inflation and their corresponding rate of unemployment within an economy produces the Phillips curve (Kitov, n.d.). Here, it may be said that the negative link amidst the mentioned two factors is identified in the short run. This type of link is not proved to be existing in the long run. In the below diagram, the link amidst inflation as well as unemployment during the short run or Phillips curve is depicted:

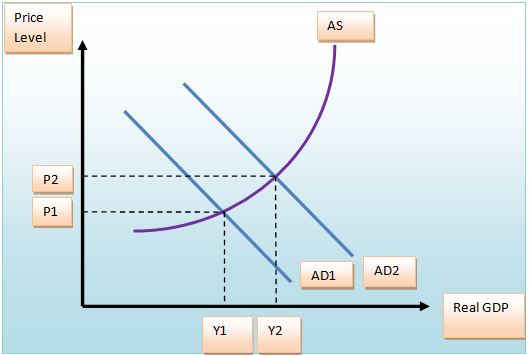

Thus, naturally from the represented figure it may be inferred that the rate of unemployment may be decreased within an economy if the government successfully introduces various policies of inflation. So, the concept of inflation is not absolutely undesirable within an economy. It is commonly known that there are basically two types of inflation within an economy. These include demand pull as well as cost push inflation (KELLY, 2000). Within the demand pull inflation, the total demand of an economy enhances and causes a shift of the total demand curve towards the right side. This enhances the level of price including that of the output level within any economy. Hence, an organization hires increased number of employees in the process of production or catering to incremented aggregate demand. This often leads to decrease the overall rate of unemployment. In the below diagram, the effect of demand pull inflation may be represented.

As per Milton Friedman, this Phillips curve is solely valid within the short run. In the long run, the policy of inflation would not address the issue of unemployment of any economy (Jean Louis, n.d.).

Government Intervention:

It has been identified that both the concept of inflation as well as unemployment are undesirable within the society (Inflation and unemployment in economies in transition, 2000). However, a trade-off exists amidst the two concepts which means an increment in any of the factors would result in the decrease of the other factor. Hence, importantly effective measures are to be taken for maintaining the steady balance amidst these factors of inflation as well as unemployment, and thereby maximize the economic as well as social welfare within an economy. So, government intervention is crucial to implement different policies as well as procedures for increasing the level of unemployment in an economy. This intervention is also helpful in maintaining the level of inflation up to the extent of tolerance. Government may intervene within an economy with the support of the various fiscal policies. The monetary instruments involve tax rate as well as governmental expenditure. On the other side, the fiscal measures involve the financial supply as well as interest rates. These may be utilized for increasing or decreasing the rate of inflation and even the rate of unemployment.

Types of Inflation within an Economy

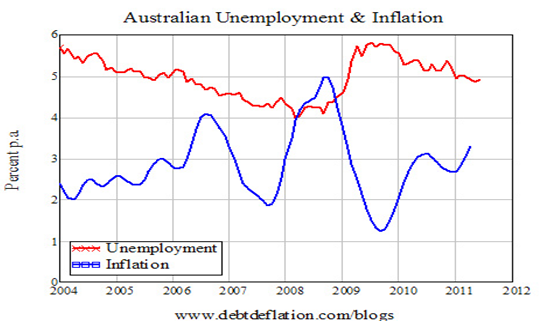

In this context many instances may be highlighted which would present the negative link amidst the rate of inflation and that of the unemployment rate. In the below diagram, it highlights the trend of inflation as well as unemployment.

Source:

It is easily identified that with the increase in the rate of inflation there is significant fall in the rate of unemployment within the economy. Some exceptions are there as well. During the year 2011, it has been identified that the rate of inflation as well as that of unemployment has incremented. During the year 2012, both rates of unemployment and inflation have reduced. In the economy the government intervention is referred to as one of the most effective measures which helped in lessening both rate of unemployment and that of inflation within the economy.

(b) Inflation, Unemployment and Growth Trends in Australia:

In almost every economy, the unemployment and inflation are referred to as two key indicators of the economic performance. These aspects even impact upon the level of growth of any economy. Hence, it may be said that a link exists amidst the unemployment rate, inflation rate, and that of growth rate. With respect to this, unemployment, inflation, and growth trends in Australia during the past years may be depicted and thereby a relationship may be derived.

The rate of inflation is termed as the general increment in the level of price within an economy. Commonly, the economy of Australia is one of the emerging economies across the globe. The interrelationship with other countries has been identified as adequately significant. Australia, as a nation, maintains effective relationship with several other nations in terms of trade relations or foreign direct investment. So, the shortage of products results in price rise and this in turn increases the rate of inflation within the economy. During December 2014, the rate of inflation was identified at 5. During 2012, the rate was around 8.98 and throughout the rate remained 11.16% during November 2013 (Inflation and unemployment in economies in transition, 2000). The WPI or the Wholesale Price Index is the key measure which is applicable in Australia for inflation. However, some debate occurs about the Consumer Price Index (CPI) to be more effective measure of representing economic inflation. The most significant groups included in CPI are food, tobacco, and beverages. Other products are fuel, transport, housing, light, clothing bedding, communication, medical care, education, and footwear. In the table below, inflationary measures are given:

|

Australia Prices |

Last |

Previous |

Highest |

Lowest |

Unit |

|

Inflation Rate |

5 |

4.38 |

11.16 |

4.38 |

percent |

|

Consumer Price Index |

144.90 |

145.50 |

145.50 |

105.00 |

Index points |

|

GDP Deflator |

171.30 |

159.30 |

171.30 |

100.00 |

Index points |

|

Producer Prices |

179.80 |

181.50 |

185.70 |

97.50 |

Index points |

|

Producer Prices Changes |

0.11 |

0.00 |

34.68 |

-11.31 |

percent |

|

Export Prices |

312.00 |

284.00 |

312.00 |

100.00 |

Index points |

|

Import Prices |

518.00 |

459.00 |

518.00 |

100.00 |

Index points |

|

Food Inflation |

5.00 |

3.50 |

14.72 |

3.50 |

percent |

|

Inflation Rate Mom |

-0.41 |

0.21 |

1.77 |

-1.00 |

percent |

Sources:

Demand Pull Inflation

In the below diagram the rate of inflation in Australia from 1959 till 2013 has been shown. It is identified that the alterations within the inflation rate is higher in the early decades. As per the recent decades, the fluctuation within the price level is reduced as well as the rate of inflation is maintained at low level. During 2009, the CPI was quite high as 14.97%. The actual cause of such an inflation rate may be said to as world financial recession of that time.

Source: (Holliday, 2004)

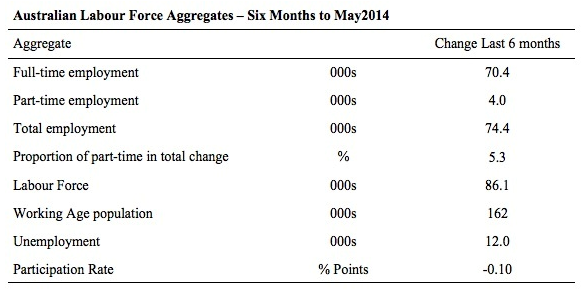

Now, the trend of unemployment in Australia may be evaluated. Commonly it is known that rate of unemployment means the percentage of individuals who are basically willing to take up a job but fail to receive such opportunities from the market. The concept of unemployment is practically undesirable within the economy (GUEST and DORAISAMI, 1994). The population density at the country is moderate and evenly distributed. So the employment opportunities must be at par with the distribution of population. The rate of unemployment in Australia was on average 7.58% from 1980s to mid 2012. The rate was almost 6.30% in the year 2011. It considerably reduced in the year 2012. The rate of unemployment in Australia during 2013 was at its zenith. The respective Labor and Unemployment authority reported about the unemployment conditions within the country. The graph shown below represents the unemployment rate in Australia.

Source: (Warne and Vredin, 2006)

As depicted in the above graph, it is identified that the rate of unemployment in Australia had increased steadily ever since 2000 to 2013 (Warne and Vredin, 2006). The rate was the highest during the year 2011 to 2012, and ever since then it had shown an even trend. After the major set-back of 2012, the rate of unemployment in Australia reduced considerably and became quite stable in the henceforth years.

Source: (Sum, n.d.)

As referred to in the above chart, the rate of unemployment during the recent years has reduced considerably on account of improved government intervention within the world economy. It is identifiable with evidences that the national government of Australia has adopted some effective measures to counteract the alarming situation and also provide key job opportunities within the nation (Eckes, 2011). On the other side, expansion of multiple lateral industries particularly in the private sector has led to the increased job opportunities meant for all deserving individuals.

Government Intervention

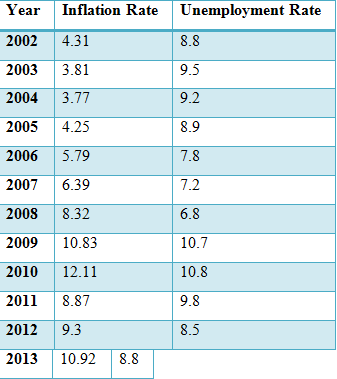

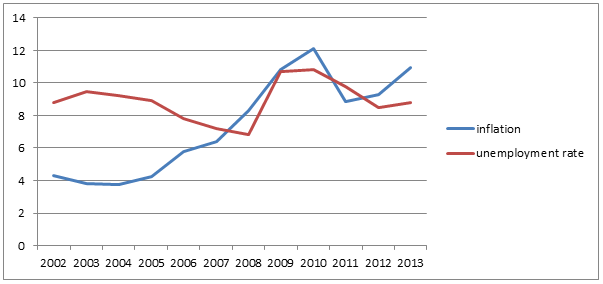

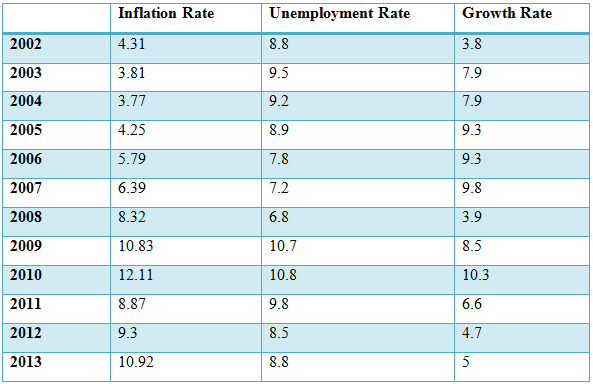

Commonly, a negative link is identified amidst inflation as well as unemployment. Hence, the normal trend of the mentioned two factors for Australia may be identified. In the given table, relevant data is provided against the two factors during the year 2002-2013 (Fasenfest, 2014).

Source:

For Australia, the trend line for inflation as well as unemployment is depicted.

Source: (Lehmann, 2011)

As depicted in the given graph, it may be identified that during the year 2002 to 2007, the Phillips curve relationship is significant as the rate of unemployment has decreased with the rise in the rate of inflation (ROY, 2011). Ever since the year 2008, the Phillips relationship fails to be properly maintained and so the rate of both inflation as well as unemployment has increased and decreased at the same time.

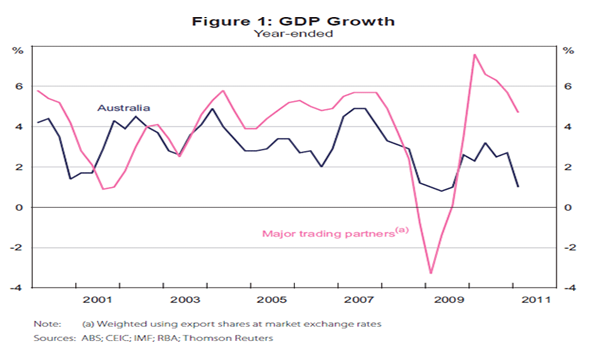

Source: (Ruge-Murcia, 2004)

From the given figure it is identified that during the year 2001 the GDP was considerably low and since then it increased on a steady basis. During the year 2009, the down fall of the Australian GDP was highly noticeable (Crosby and Olekalns, 1998). The nation had faced a tough time in context to the global economy. Since then, the overall GDP of the nation has been on a consistent rise.

Source: (Ribba, 2006)

The following graph represents the trend line for all three economic indicators during the year 2002 to 2013 in Australia.

Source: (Collignon, 2012)

(c) Effects of Monetary Policy:

The monetary policy is regarded as one of the key government instruments which is utilized for implementing changes within different economic factors within the country. Although this monetary policy measures, the relevant authority of a nation is said to control the monetary supply within the economy for maintaining stability and also to bring about sustainable economic growth within the country (Lim, Chua and Nguyen, 2013). The financial policy normally targeted at the interest rate as well as inflation rate to increase the growth as well as stability of the economy. This monetary policy may be either expanded or contracted. The expanded monetary policy enhances the money supply within the economy and the consequence is easily identifiable. On the other side, the contraction monetary policy reduces the supply of money within the economy and the consequent outcome is also identifiable.

Fiscal Policies

The expansionary monetary policy normally increases the supply of money within the economy. This type of monetary policy is generally implemented for stabilizing the rate of unemployment at the time of recession by decreasing the rate of interest. Another aspect is also evident in this case that increment in money supply results in the increase in the rate if inflation within the economy on account of reduction of monetary value. Hence, increased monetary supply enhances the rate of inflation. On the other hand higher rate of inflation means decreased rate of unemployment. So, expansionary monetary policy may reduce the rate of unemployment within the economy by incrementing the level of inflation with increased money supply within the economy. This concept also enhances the prices of bonds and that of higher investment in capital because of lesser rate of interest. The exchange rates are much influenced by this monetary policy. Because of this expansionary monetary policy, increase occurs in the demands of foreign currency and also simultaneous fall in the demands of the domestic currency because of the rise in the monetary value of the domestic country.

On the other side, the contractionary monetary policy is generally implemented by reducing the supply of money within the economy. The government may implement this type of contractionary monetary policy with some effective measures. The Australian government may sell the securities in the open market, and enhance the requirements of reserve at the banks or by incrementing the rate of federal discount (Collignon, 2012). Hence, within this policy measure, the rate of interest raises within the economy as well as considerable fall in investment. This decreases the rate of inflation within the economy. The availability of bonds within the market is enhanced, and bonds are usually bought by foreign buyers. So the demand for domestic currency goes higher and so the demand for foreign currency lessens within the market. Hence, rate of exchange of the domestic currency would appreciate and that of the foreign currency would be depreciated within the market.

So, it may be inferred that the contractionary monetary policy would enhance the rate of interest, lower the prices of bonds, lessen the capital investment, and also appreciate domestic currency with depreciation of foreign currency.

So, it may be inferred that monetary policy may considerably impact upon the economy by affecting different economic indicators within the economy (Chadha, 2011). This monetary policy in used by several respective authorities within a country and this relies upon the link amidst the aggregate supply of money as well as the interest rate. The monetary policy may affect the rate of growth within the economy. With respect to some contexts, this monetary policy may prove ineffective in addressing the economic issues (MONTERO, 2012). For instance, on triggering inflation by increased demand for wage, it enhances the firm’s total cost. Here in such contexts, the monetary policy cannot be relied upon.

Operations of open market are key tools which are utilized in situations of implementing monetary policy. In some nations, respective government uses measures for getting desirable outcomes within the economy. For instance, in times of world financial crisis, national governments adopted some key measures with respect to monetary policies to attain stability within the economy (Armstrong, 2012). The Federal Open Market Committee had created an almost zero target range for rate of federal funds. The Federal Reserve had even attempted to hold on the long term securities within the market and also a kind of downward pressure was put upon the rate of interest. Hence, expansionary monetary policy was introduced by different nations to attain the economic stability after world financial crisis.

Negative Link Between Inflation and Unemployment

Conclusion:

To draw suitable conclusion, it may be inferred that during the recent years there has been significant rise in the competition amidst various firms, particularly at the global context. Similar competition is evident among different countries. It is also identifiable that some nations are developed ones while some are on the developing phase (Nile, 2002). Different developing nations such as Australia, China, and India are emerging significantly within the world economy by increased rate of performance as well as growth. So, it is increasingly important that government of different nations adopt effective measures which may help in enhancing the economic performance of any country in terms of unemployment rate, inflation rate, growth rate, exchange rate, etc (Palley, 2003). Here in this report, the link between that of inflation as well as unemployment is represented. In case of Australia, the inflation rate, the growth rate, and the unemployment rate are depicted as well as the impact of monetary policy upon different indicators is also highlighted.

References

Armstrong, S. (2012). Australian Trade Policy Strategy Contradictions. The World Economy, 35(12), pp.1633-1644.

Chadha, J. (2011). Policy rules under the monetary and the fiscal theories of the price-level.Macroeconomics and Finance in Emerging Market Economies, 4(2), pp.189-212.

Collignon, S. (2012). Rebalancing the Global Economy. Global Policy, 3(2), pp.154-168.

Crosby, M. and Olekalns, N. (1998). Inflation, Unemployment and the NAIRU in Australia. The Australian Economic Review, 31(2), pp.117-129.

Eckes, A. (2011). The Seamy Side of the Global Economy. Global Economy Journal, 11(3).

Fasenfest, D. (2014). Global Economy, Global Dialog. Critical Sociology, 40(2), pp.171-172.

GUEST, R. and DORAISAMI, A. (1994). THE IMPACT OF INFLATION, UNEMPLOYMENT AND SECULAR INFLUENCES ON THE DISTRIBUTION OF PERSONAL TAXABLE INCOMES IN AUSTRALIA. Economic Papers: A journal of applied economics and policy, 13(4), pp.11-22.

Holliday, S. (2004). Climate change and the global economy. Ibis, 146, pp.2-3.

Inflation and unemployment in economies in transition. (2000). Economic Modelling, 17(3), p.337.

Jean Louis, R. (n.d.). Low-Inflation-Targeting Monetary Policy: Is the Curse for Not Following the Leader High and Persistent Unemployment Rate at Home? - Evidence from OECD Countries.SSRN Journal.

KELLY, G. (2000). Employment and concepts of work in the new global economy. International Labour Review, 139(1), pp.5-32.

Kitov, I. (n.d.). Exact Prediction of Inflation and Unemployment in Japan. SSRN Journal.

Lanne, M. and Luoto, J. (2013). Does Output Gap, Labour's Share or Unemployment Rate Drive Inflation?. Oxf Bull Econ Stat, 76(5), pp.715-726.

Lehmann, E. (2011). A Search Model of Unemployment and Inflation*. The Scandinavian Journal of Economics, 114(1), pp.245-266.

Lim, G., Chua, C. and Nguyen, V. (2013). Review of the Australian Economy 2012-13: A Tale of Two Relativities. Australian Economic Review, 46(1), pp.1-13.

MONTERO, R. (2012). DOES LINEARITY IN THE DYNAMICS OF INFLATION GAP AND UNEMPLOYMENT RATE MATTER?. Revista de análisis económico, 27(1), pp.3-26.

Nile, R. (2002). Australian Studies: Australian history, Australian studies and the new economy.Journal of Australian Studies, 26(74), pp.201-216.

Palley, T. (2003). The Backward-Bending Phillips Curve And The Minimum Unemployment Rate Of Inflation: Wage Adjustment With Opportunistic Firms. Manchester School, 71(1), pp.35-50.

Ribba, A. (2006). The joint dynamics of inflation, unemployment and interest rate in the United States since 1980. Empirical Economics, 31(2), pp.497-511.

ROY, S. (2011). Unemployment Rate and Divorce*. Economic Record, 87, pp.56-79.

Ruge-Murcia, F. (2004). The inflation bias when the central bank targets the natural rate of unemployment. European Economic Review, 48(1), pp.91-107.

Sum, V. (n.d.). Unemployment, Consumer Confidence, Business Confidence, Inflation and Monetary Policy. SSRN Journal.

Warne, A. and Vredin, A. (2006). Unemployment and Inflation Regimes. Studies in Nonlinear Dynamics & Econometrics, 10(2).

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2016). Get Essay Help, Secure High Grades With Our Professionals.. Retrieved from https://myassignmenthelp.com/free-samples/assessment-research-essay-on-relationship-between-inflation-and-unemployment.

"Get Essay Help, Secure High Grades With Our Professionals.." My Assignment Help, 2016, https://myassignmenthelp.com/free-samples/assessment-research-essay-on-relationship-between-inflation-and-unemployment.

My Assignment Help (2016) Get Essay Help, Secure High Grades With Our Professionals. [Online]. Available from: https://myassignmenthelp.com/free-samples/assessment-research-essay-on-relationship-between-inflation-and-unemployment

[Accessed 20 May 2025].

My Assignment Help. 'Get Essay Help, Secure High Grades With Our Professionals.' (My Assignment Help, 2016) <https://myassignmenthelp.com/free-samples/assessment-research-essay-on-relationship-between-inflation-and-unemployment> accessed 20 May 2025.

My Assignment Help. Get Essay Help, Secure High Grades With Our Professionals. [Internet]. My Assignment Help. 2016 [cited 20 May 2025]. Available from: https://myassignmenthelp.com/free-samples/assessment-research-essay-on-relationship-between-inflation-and-unemployment.