Increase in the price of coffee in 1997

1.What do you think caused the large increase in the price of coffee in 1997? Discuss?

2.Use supply and demand diagrams to explain?

a) The fall in coffee prices in the late 1990s and early 2000s, in the period 2011–13 and the latter part of 2015 and into 2016

b) The increase in coffee prices from 2004 to 2011 and in 2014

3.Discuss the concepts of elasticity of demand and supply and external factors influencing the equilibrium position of coffee market in 2017?

Coffee is an important beverage as many of the small producers in developing countries make their living through the plantation of coffee. Before 1989 the prices of coffee were controlled by cartel known as International Coffee Agreement (ICA). ICA was responsible for imposing quotas and determining the prices due to which the coffee market was stable. However, in 1989 ICA collapsed due to its failure to renew. This also led many social problems to crop. There were many other reasons for the crash of the global coffee market such as oversupply and overproduction of coffee, and stocking of coffee. It was only after 2004, the prices of coffee recovered which was due to the increase in the global demand for coffee. Good harvest of coffee and the rise in the demand led the coffee market gain its recovery in the year 2008 ("The Coffee Crisis". Coffee & Conservation. N.p., 2017).

1. Increase in the price of coffee in 1997:

The year 1997 was a volatile one in the market for coffee. The prices of coffee was decreasing in the global market mainly due to collapse of coffee cartel and secondly due to the oversupply and high inventories of low quality of coffee beans. However, in 1997 the prices of coffee had increased. The main reason for the increase in prices was low inventory of coffee and the second was the uncertainty about the effects of El Nino (Lanza and Manera 2016). Extensive intervention of the government, the behavior of cartel and the importance of the distribution and processing in the market are significant characteristics of the coffee market. High inventories leads to the fall in the prices of the product. A low inventory of coffee was one of the reasons for the rise in the price of the product. This was mainly due to the rise in the demand for the product all over the world (Dube and Vargas 2013).

Using supply and demand diagrams to explain the fall in coffee prices

The uncertainty of the weather conditions also lead the price of coffee to increase. The fear of freeze and the crops being frosted was the reason for the prices of coffee to rise. The frost and freeze had destroyed the coffee plantation in the year 1996 due to which the stock of coffee beans had declined. This led the prices of the coffee to rise. The production of coffee was also expected to be low in Columbia, the world’s second largest producer of coffee beans. Arabica was the principal variety of coffee whose price had unexpectedly increased in the early 1997 (Dragusanu et al. 2014). The interest of the speculators and the investors made the prices of coffee to rise. The rise in the price of coffee had made many new middle class coffee growers to join the market again. The frost in Brazil had made the prices of coffee to rise suddenly.

2. (A) Using supply and demand diagrams to explain the fall in coffee prices in the late 1990s and early 2000s, in the period 2011–13 and the latter part of 2015 and into 2016:

The phenomenon of supply and demand plays a great role in the determination of the price of commodities. The coffee market operates under a free market. Free market is a condition where the prices of a product are determined with the changes in the demand and supply. Demand can be defined as the need or a desire for a commodity which is backed by purchasing power. Demand is inversely related with the prices. As the price rises the demand falls and vice versa. Supply is the amount of commodities that a supplier is willing to supply at a given price and at a given time period (Wilson and Wilson 2014). Supply and price is positively related. As the price raises the supply also rise and vice versa. The supply curve is represented by an upward sloping graph while demand curve is represented by a downward sloping graph. The point where the demand and supply graph intersects is the equilibrium point.

The period between late 1990s and early 2000s:

The major reason for the fall in prices of coffee after the year 1989 was the collapse of the cartel of coffee, the ICA organization. However, this was not only the reason for the fall in prices of coffee. Oversupply was another reason that led to the price of coffee to decline. The reason for the high production of coffee was the increase in the fund by the world development banks. The highest contributor of coffee production in this period was Vietnam. This country increased production over 1100% in the decade beginning in 1991 (Claar and Haight 2015). The supply of coffee increased by around 3.6 per cent a year outstripping the 1.5 per cent annual increase in demand. The growth in supply was largely caused by new plantings in Vietnam and Brazil. In 2002 world demand was estimated to be around 106 million bags; but production was over 120 million bags with a further 40 million bags held in stock (Marescotti and Belletti 2016).

Using supply and demand diagrams to explain the increase in coffee prices

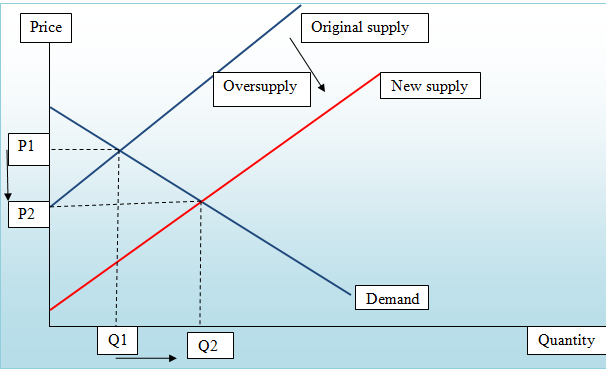

The phenomenon of oversupply led to the increase in production and a fall in prices which can be explained using following diagram.

Figure: The effect of oversupply in coffee market

(Source: as created by author)

The above diagram shows that price is measured in Y axis and quantity in X axis. The lines marked in blue are the original demand and the supply curves. P1 is the original price of coffee and Q1 is the quantity demanded and supplied of coffee at price P1. Now since the production of coffee increased by 1100% the supply curve of coffee shifted to its right. The reason for the shift was that the supply increased not due to the change in price was due to increase in funding. The new supply curve is marked in red in the above diagram. Now since the demand for coffee did not rise as the increase in supply the prices for coffee declined. The demand curve is the original demand curve and the supply curve is the new supply curve. The prices decreased from P1 to P2 and the quantity of coffee increased from Q1 to Q2. The supply of coffee outstripped the increase in demand due to which the prices of the coffee fell in the period 1990 to 2000.

The period 2011–13 and the latter part of 2015 and into 2016:

The price of coffee again fell in the period 2011-2013 and in the latter part of 2015 to 2016. The reason for this fall in prices was again the increase in supply of the coffee. The coffee market started recovering after the year 2000. The demand for coffee was rising in the market due to which the prices were also rising. A good harvest of crops was another reason for the rise in price of coffee (Jaffee 2014). Seeing the recovery in the coffee market many new middle class coffee growers joined the market. This led the production of coffee to rise again. The supply of coffee again outstripped the demand for coffee due to which the price of coffee again fell as shown in the diagram above. The beginning of depression in urbanized countries was ascertaining the growth in demand and, as a result, the world growth in supply outstripped the world growth in demand. By the end of 2013 prices were at a six year low (Rios and Shively 2016).

Concepts of elasticity of demand and supply and external factors influencing the equilibrium position

(B) Using supply and demand diagrams to explain the increase in coffee prices from 2004 to 2011 and in 2014:

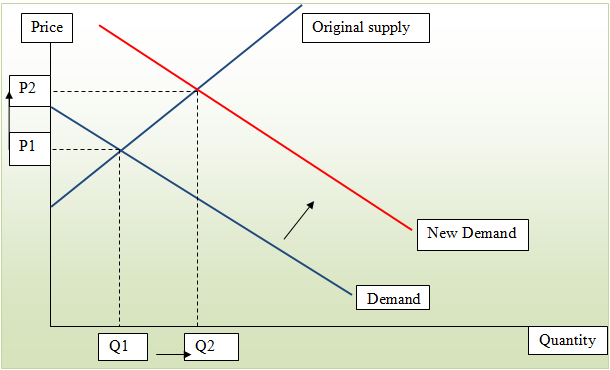

The prices of coffee had increased after 2004. It was the highest in the year 2008 at $1.33 per lb, its highest level since July 1997. The main reason for the rise in the price of coffee was due to the rise in the demand for coffee globally and the farmers diversifying into other crops. This led the stock of inventories to fall and the supply to reduce and the demand to rise which led the price of coffee to rise. The new coffee markets of China and Russia had emerged due to which the demand for coffee had increased. Coffee prices then soared in 2010, reaching over $2.30 by April 2011 (Bonnet and Villas-Boas 2016). These price rises were largely the result of poor harvests in Central America and Vietnam and were then driven further upwards by speculation. This can be explained with the help of diagram as follows:

Figure: The effect of rise in demand in coffee market

(Source: as created by author)

The above diagram shows that price is measured in Y axis and quantity in X axis. The lines marked in blue are the original demand and the supply curves. P1 is the original price of coffee and Q1 is the quantity demanded and supplied of coffee at price P1. Now since the demand of coffee increased the demand curve of coffee shifted to its right. The reason for the shift was that the demand increased not due to the change in price was due to new coffee markets emerging. The new demand curve is marked in red in the above diagram. Now since the supply for coffee did not change with the change in demand, the price for coffee increased. The supply curve is the original curve and the demand curve is the new curve. The prices increased from P1 to P2 and the quantity of coffee increased from Q1 to Q2. The demand of coffee outstripped the supply which led the prices to rise after 2004 (Topik 2015).

3. The concepts of elasticity of demand and supply and external factors influencing the equilibrium position of coffee market in 2017:

Price elasticity of demand is the responsiveness of the change in total demand of the product due to change in the per unit price of the product. A product have relatively inelastic demand is said to have price elasticity less than one which means that change in the quantity demanded of a product is not much affected with a change in price. A product have relatively elastic demand is said to have price elasticity greater than one which means that change in the quantity demanded of a product is affected largely due to a change in price (Cleaver 2014). Coffee is a product that has its substitutes such as tea, milkshakes and others. Therefore, the demand for coffee is elastic in nature as it is observed that a small change in price leads to a large change in the quantity.

Price elasticity of supply is the responsiveness of the change in total supply of the product due to change in the per unit price of the product. The harvest of coffee is seasonal. Since the time period plays an important role the supply of coffee is inelastic in short run as the supply cannot be increased with the change in price (Talbot 2015).

The external factors influencing the equilibrium position of coffee in 2017 are change in income level, and the demand for coffee to increase likely. This is due to the change in the choice of younger generation. The weather conditions in Brazil are likely to decline the production of Robusta coffee. Hence, the external factors that will change the equilibrium position of coffee is change in the choice of consumers, weather conditions, increase in international prices and the rapid appreciation of the US dollar (Fergus and Gray 2014).

Conclusion

The price of coffee was declining after 1989 due to collapse of the cartel and the oversupply of coffee. However, after 2000 the coffee market started recovering due to rise in the global demand and the new markets joining the industry. Hence, it can be concluded that the market of coffee is volatile in nature where the prices are influenced by the demand and supply of the coffee. The demand of coffee is elastic while its supply is inelastic. The prices of coffee are fluctuating in nature. It is not the coffee industry that face loss but the coffee planters as they get very small fraction of the money.

References

"The Coffee Crisis". Coffee & Conservation. N.p., 2017. Web. 14 Mar. 2017.

"There's A Major Global Coffee Crisis Brewing". Time.com. N.p., 2017. Web. 14 Mar. 2017.

Bonnet, C. and Villas-Boas, S.B., 2016. An analysis of asymmetric consumer price responses and asymmetric cost pass-through in the French coffee market. European Review of Agricultural Economics, p.jbw001.

Claar, V.V. and Haight, C.E., 2015. Correspondence: Fair Trade Coffee. The Journal of Economic Perspectives, 29(1), pp.215-216.

Cleaver, T., 2014. Economics: the basics. Routledge.

Davidson, Lauren. "Coffee Crisis To Hit Within Three Years As Finer Tastes Lead To Shortage". Telegraph.co.uk. N.p., 2017. Web. 14 Mar. 2017.

Dragusanu, R., Giovannucci, D. and Nunn, N., 2014. The economics of fair trade. The Journal of Economic Perspectives, 28(3), pp.217-236.

Dube, O. and Vargas, J.F., 2013. Commodity price shocks and civil conflict: Evidence from Colombia. The Review of Economic Studies, 80(4), pp.1384-1421.

Fergus, A.H. and Gray, A., 2014. Fair Trade Awareness and Engagement: A Coffee Farmer's Perspective. Business and Society Review, 119(3), pp.359-384.

Jaffee, D., 2014. Brewing justice: Fair trade coffee, sustainability, and survival. Univ of California Press.

Lanza, A. and Manera, M., 2016. Economic Impacts of El Niño Southern Oscillation: Evidence from the Colombian Coffee Market.

Marescotti, A. and Belletti, G., 2016. Differentiation strategies in coffee global value chains through reference to territorial origin in Latin American countries.Culture & History Digital Journal, 5(1), p.007.

Rios, A.R. and Shively, G.E., 2016. Farm size and nonparametric efficiency measurements for coffee farms in Vietnam.

Talbot, J., 2015. Information, finance, and the new international inequality: the case of coffee. journal of world-systems research, 8(2), pp.215-250.

Topik, S., 2015. Trade History: From the Tree to the Futures Market, the Historical Process of Coffee Commodification, 1500–Today. International Political Economy Series Series Standing Order ISBN 978–0–333–71708–0 hardcover Series Standing Order ISBN 978–0–333–71110–1 paperback, p.17.

Wilson, A.P. and Wilson, N.L., 2014. The economics of quality in the specialty coffee industry: insights from the Cup of Excellence auction programs. Agricultural Economics, 45(S1), pp.91-105.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2018). Factors Affecting Coffee Prices: Demand And Supply Diagram. Retrieved from https://myassignmenthelp.com/free-samples/coffee-crise-an-unfair-bean-count.

"Factors Affecting Coffee Prices: Demand And Supply Diagram." My Assignment Help, 2018, https://myassignmenthelp.com/free-samples/coffee-crise-an-unfair-bean-count.

My Assignment Help (2018) Factors Affecting Coffee Prices: Demand And Supply Diagram [Online]. Available from: https://myassignmenthelp.com/free-samples/coffee-crise-an-unfair-bean-count

[Accessed 22 January 2026].

My Assignment Help. 'Factors Affecting Coffee Prices: Demand And Supply Diagram' (My Assignment Help, 2018) <https://myassignmenthelp.com/free-samples/coffee-crise-an-unfair-bean-count> accessed 22 January 2026.

My Assignment Help. Factors Affecting Coffee Prices: Demand And Supply Diagram [Internet]. My Assignment Help. 2018 [cited 22 January 2026]. Available from: https://myassignmenthelp.com/free-samples/coffee-crise-an-unfair-bean-count.