Recent decline in the global oil prices has shown the overarching influence and impact of OPEC member States’ collective energy policies on the global energy security vis-a-vis both the oil industry and national economies. Critically discuss different policy measures that non OPEC member States can take to mitigate the impact of OPEC’s current trend as an international oil producer cartel?

In June, 2014 the crude oil price has decreased by over 40%. The cost was $115 per container at that point. Although the present cost is near $60 per container. In overall oil market, OPEC engaged 40%. Due to reduce in cost of crude oil, change the OPEC. They cover unsuccessful to assemble the conformity on production curves. The cost of oil is completely depends on demand and supply of the product, and economic action influence the demand of force. The demand of force is high in northern hemisphere. In several regions, its price is high in summer due to use of air condition. Weather conditions and geopolitical factor change the supply of oil (Wakeford, n.d.).

During, recent economy of world, the price of oil is affect due to some reason. The recent economic movement is weak. As per the outcome demand of product is declining. Secondly, misunderstanding is Iraq and Libya. These two countries are well recognized for oil production. They manufacture collectively almost four million containers per day. But here is no result on production of them. The market is mostly artificial by geopolitical threat. According to statement, America is the main production of oil. But America had no export services and import of their oil in fewer manners. It creates a bunch of extra supply. The last reason is that Saudis and their Gulf partners are not attracted to give up their own market share to renovate the price. Saudi Arabia can carry on with the low price since its oil production is very high and the cost of production is very low (Simmons, n.d.).

As per the recruitment, the report includes the impact of OPEC member, and state’s combined force policies on the global energy security vis-à-vis both the oil industry and nationwide economics due to decrease in oil prices. It is also emphasize on the considerable procedures that non OPEC members can take to moderate the impact of OPEC’s current trends as an international oil producer association.

In OPEC, there are five members it was found in 1960. OPEC also joined up with another six countries. There production cost is declining and the demand of their product is also declining due to numerous factors together with world recession.

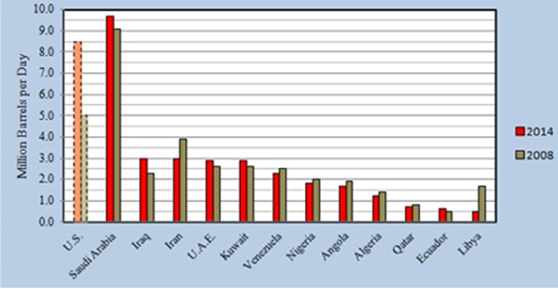

OPEC set quotas of production for stabilizes the price from 1982 to 1985. In this only some members are producing oil above the quotas, due to this they fail in production process. In 2008- 2009 the price of the product is diminish by 70%, and in 2001, is was double and in 2014, they decline by over 40%. As the similar moment, the exports of OPEC have declined 1 million containers in a day. The combine of export has also distorted during that time for different factor (Lopez-Murphy, Lopez-Murphy and Villafuerte, 2010).

Algeria

Figure: (Lopez-Murphy, Lopez-Murphy and Villafuerte, 2010)

Algeria:

Algeria overall income is depending on the export and imports of their oil production and natural gas. Hydrocarbon export was 97% of total income earned from export and this income was also 50% of total fiscal revenues. Due to the rise in price the, the income ongoing declines. It suffers income loss of $560 by declining price of $1 per container. Thus, export level decline by 4.3% and GDP decline by 0.8%. This country has faced numerous reasonable and societal problems due to decline in income of oil (Cashin, 2012).

Iran:

In Iran, exported income is about 36% and it contributes 80-85% to the whole wages from exports. In Iran, it was predicted by central bank which govern the foreign requirement of liability is $ 26.4 billion. Due to decline in income of Iran’ oil, it is complicated to repay the debt, due to this Iran will features high quantity of budget shortage. Iran faces inflation that is rise in price and jobless. It endure income loss in oil export $ 1 in value of falling $1 in oil price. Thus, loss in income, country will endure cash calamity (Deutch, Schlesinger and Victor, 2006).

Iraq:

Iraq majorly depends on the export of oil and authorize of united nation. Other than that export of oil is rising gradually. Thus, it is predicted that it will produce more income. There is major role on decrease in global oil price due to rise in export of oil.

Indonesia:

In 1998, the income of Indonesia, decline with 32% ($3.5 billion) and in 1997 ($5.1 billion).Thus, it fall in economic calamity. It was probable to fall 13.5-20% in real (Appel, 2007).

Kuwait:

The income of Kuwait is concerning 90% of government revenue. It contributes more or less half to the GDP of the countryside (Darwish, 2007).

Saudi Arabia:

The main creator of OPEC is Saudi Arabia. It is measured as manager in quota decision. Saudi Arabia faces difficulties, due to the economic disaster of Asian financial system. The deal of 60% of Saudi occurs in Asia. The contact of declining oil price is both optimistic and unenthusiastic in Saudi Arabia.

The lesser price may be helpful for positive reasons. The cost of produce oil is extremely fewer and it has high store. There are some remuneration which may be proficient such as prevent in use of substitute energy capital, capture the own market distribute, prevent the asset in non-OPEC oil.

On the other side, the income regularly depends on oil export. It contributes 88% to the total income. It has share of 75% in satisfy revenues and contribute to 40% in GDP. Thus, reducing revenues, the expansion rate of GDP will decline and Saudi Arabia may features budget shortage.

Qatar:

The income of Qatar from oil export is on 70% of total supervision income. While the oil price is declining, the country is immobile to improve the production ability.

Nigeria:

It is experiential that the wages of Nigeria starting, crude oil export have payment of 90% in foreign exchange salary; the income of Nigeria has declined due to decrease in worldwide oil price. It create a large result on the economy and the financial development of Nigeria.

Iran

Libya:

It is experiential that here is 36% reject in wages of Libya ($9 billion). The income of oil donates 95% to the firm exchange income. Due to refuse in oil prices, the expansion of economy was very rear. The country is bounce to relate more traditional financial strategy and to decrease in expenses of public transportation.

UAE:

The increase of financial system of UAE becomes very measured, due to decrease in global price. The result is not so much like extra Gulf States. It earn various part of income from other industry and trade. As declining of income, the country has full exploit to decrease its government expenses.

Venezuela:

The income of Venezuela has also decrease by falling of global oil price and it has huge negative force on its economy.

Mexico:

Falling in global oil price has better force on supply market of Mexico. The supply is declining.

Russia:

The income of Russian has also concentrated due to decline in global oil cost although there is export of high volume.

The past say that OPEC has support the high oil market price for global crude oil by declining the equipment. The delivery of oil has not condensed due to fall in global oil cost by a quantity of members of OPEC. But a few members have exposed their indifference to export in low down price. It has practical in most of case; member that export of oil has summarized from 2008-2014 and currently is opposite high income deficit (Hassan, 2011).

The Saudi Arabia has good quality, of financial situation and good construction capability. Although of that, the country has chosen the low down price strategy. It might generate negative result on utmost members of OPEC. Negative result may damage the revenues and economy of the highest members which might guide to steady the Cartel.

As reduce in oil price, the manufacture cost of goods and services will be elevated in the economy and income boundary will diminish. Price stage and price rises of an economy can be partial by the global oil price turn down as well as the monetary market of an economy can also be precious.

The globe customers will helpful and gainful for overwhelming the energy at a lower price. But it is danger for the producer. It will decrease the income and resources spending.

Non OPEC countries, recent invention is about 60% of total production of oil. Non OPEC member consist of production in USA, Mexico, North Sea etc and the Non OPEC is completely different from the OPEC actions. Non OPEC, oil sector are restricted by the private company, and their price of lifting is advanced than the OPEC. It is see that the share market of the OPEC is rising, and also generate problems to the Non OPEC. While 1993, the production of Non OPEC has been rising and the worldwide price of is falling day by day (Al-Rashed and León, 2015).

Producer is normally the price takers instated of price maker in Non OPEC countries. They are bounce to believe the market price is somewhat to manage the prices, by running the production. Lesser affect can also put in force and it can guide to refuse in price (Zhang, Fan and Wei, 2009).

Iraq

Policy 1: The impact of OPEC’s recent tendency as an international oil producer stage is helpful to moderate. The member of OPEC countries have liable that non-OPEC countries are not proposed to collaborate with them. Collaboration is one of the reasons for, global price is decreasing. But it is not easy to handle them. The global market is majorly subjective by geo-political factor. It is simply achievable, when the limitation of geo-political can be solved. It is forecasted that the demand of oil will rise in upcoming years. Although, there are many sources that accomplish the demand, it will not easy to receive income by oil producer (Energy security challenges for the 21st century: a reference handbook, 2010). If the OPEC and non-OPEC does not take help of each other, then it will be extremely difficult to handle the recent tendency of oil industry. The recent tendency of oil market will be impacted in their wealth of future market. So, it is necessary to stabilize the market, for their future benefits. Other than, there are some areas of ambiguity, which are connected with the oil industry in current market. Suspicions are linked with the stage of demand in future, strategy development and development of innovative technology. These doubts can simply be eliminated, when OPEC and Non OPEC will take the action together (PrebiliÄ and Juvan, 2014).

Policy 2: The impact of OPEC’s recent tendency can be moderate, if the domestic product is increased. While, if the domestic production of oil is increasing, then automatically reduces the imports and make it self-determining. Due to increasing in oil creation, the tendency of reserving oil will be elevated. Due to this cause, the Non OPEC countries, their economy rate may not be affect by OPEC. From 2008, US production of crude oil will better constantly and in 2011, the net of import has exceeded. Currently, it is rising at significant charge (Winzer, 2012).

Policy 3: It can be moderate if the supply is rising. In International market, if they seek to export more oil, then it resolves more profits as well the market share of Non OPEC countries will also raise. The supply can be enlarged by high production of domestic oil. If the production and supply of non-OPEC countries increases then, on the other, hand decreased in the OPEC country production (Knetsch, 2007).

Policy 4: Under these policy Non OPEC countries, will focus on petroleum oil. Due to this, petroleum oil expenditure will diminish, and the demand and supply of petroleum oil can be unbiased. Fuel is the major thing, due to this transport system in the world are running. There are few types of oil like battery, bio-fuels etc are used then the demand of original oil will be decreased (Balat, 2007).

Conclusion:

It is tricky to state that, how the global prices of oil will reject. However, policy of Saudi Arabia will concern more than the others members of OPEC. The other country keep on trying to export the oil at lesser pricing policy and help to sustain market share for them, then the economy of other members will be precious. Due to this, they will endure some economical problem such as revenue loss, price rises etc (The US gasoline situation and crude oil prices, 2004).

References

Al-Rashed, Y. and León, J. (2015). Energy efficiency in OPEC member countries: analysis of historical trends through the energy coefficient approach. OPEC Energy Review, 39(1), pp.77-102.

Appel, G. (2007). Opportunity investing. Upper Saddle River, NJ: Financial Times Press.

Balat, M. (2007). The Role of Nuclear Power in Global Electricity Generation. Energy Sources, Part B: Economics, Planning, and Policy, 2(4), pp.381-390.

Cashin, P. (2012). The differential effects of oil demand and supply shocks on the global economy. [Washington, D.C.]: International Monetary Fund.

Darwish, M. (2007). Desalting fuel energy cost in Kuwait in view of $75/barrel oil price. Desalination, 208(1-3), pp.306-320.

Deutch, J., Schlesinger, J. and Victor, D. (2006). National security consequences of U.S. oil dependency. New York: Council on Foreign Relations.

Energy security challenges for the 21st century: a reference handbook. (2010). Choice Reviews Online, 47(06), pp.47-2929-47-2929.

Hassan, F. (2011). Effects of environmental agreements on OPEC exports of oil. Saarbrücken, Germany: Lambert Academic Pub.

Knetsch, T. (2007). Forecasting the price of crude oil via convenience yield predictions. Journal of Forecasting, 26(7), pp.527-549.

Lopez-Murphy, P., Lopez-Murphy, P. and Villafuerte, M. (2010). Fiscal Policy in Oil Producing Countries During the Recent Oil Price Cycle. Washington, D.C.: International Monetary Fund.

PrebiliÄÂ, V. and Juvan, J. (2014). New energy security paradigm. Dela, 0(41), p.41.

Simmons, E. (n.d.). Oil and gas transportation.

The US gasoline situation and crude oil prices. (2004). OPEC Review, 28(2), pp.149-153.

Wakeford, J. (n.d.). Preparing for peak oil in South Africa.

Winzer, C. (2012). Conceptualizing energy security. Energy Policy, 46, pp.36-48.

Zhang, X., Fan, Y. and Wei, Y. (2009). A model based on stochastic dynamic programming for determining China's optimal strategic petroleum reserve policy. Energy Policy, 37(11), pp.4397-4406.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2016). Policy Measures For Non-OPEC Members To Mitigate The Impact Of OPEC's Current Trend. Retrieved from https://myassignmenthelp.com/free-samples/decline-in-oil-price-and-its-impact.

"Policy Measures For Non-OPEC Members To Mitigate The Impact Of OPEC's Current Trend." My Assignment Help, 2016, https://myassignmenthelp.com/free-samples/decline-in-oil-price-and-its-impact.

My Assignment Help (2016) Policy Measures For Non-OPEC Members To Mitigate The Impact Of OPEC's Current Trend [Online]. Available from: https://myassignmenthelp.com/free-samples/decline-in-oil-price-and-its-impact

[Accessed 30 May 2025].

My Assignment Help. 'Policy Measures For Non-OPEC Members To Mitigate The Impact Of OPEC's Current Trend' (My Assignment Help, 2016) <https://myassignmenthelp.com/free-samples/decline-in-oil-price-and-its-impact> accessed 30 May 2025.

My Assignment Help. Policy Measures For Non-OPEC Members To Mitigate The Impact Of OPEC's Current Trend [Internet]. My Assignment Help. 2016 [cited 30 May 2025]. Available from: https://myassignmenthelp.com/free-samples/decline-in-oil-price-and-its-impact.