1. Exacta, s.a., is a major French producer, based in Lyon, of precision machine tools. About two-thirds of its output is exported. The majority of these sales are within the European Union. However, the company also has a thriving business in the United States, despite strong competition from several U.S. firms. Exacta usually receives payment for exported goods within two months of the invoice date, so that at any point in time only about one-sixth of annual exports to the United States are exposed to US Dollar currency risk.

The company believes that its North American business is now large enough to justify a local manufacturing operation, and it has recently decided to establish a plant in South Carolina. Most of the output from this plant will be sold in the United States, but the company believes that there should also be opportunities for future sales in Canada and Mexico.

The South Carolina plant will involve a total investment of $380 million and is expected to be in operation by the year 2015. Annual revenues from the plant are expected to be about $420 million and the company forecasts net profits of $52 million a year. Once the plant is up and running, it should be able to operate for several years without substantial additional investment. Although there is widespread enthusiasm for the project, several members of the management team have expressed anxiety about possible currency risk. M. Pangloss, the finance director, reassured them that the company was not a stranger to currency risk; after all, the company is already exporting about $320 million of machine tools each year to the United States and has managed to exchange its dollar revenue for euros without any major losses. But not everybody was convinced by this argument. For example, the CEO, M. B. Bardot, pointed out that the $380 million to be invested would substantially increase the amount of money at risk if the dollar fell relative to the euro. M. Bardot was notoriously risk-averse on

financial matters and would push for complete hedging if practical.

M. Pangloss attempted to reassure the CEO. At the same time, he secretly shared some of the anxieties about exchange rate risk. Nearly all the revenues from the South Carolina plant would be in U.S. dollars and the bulk of the $380 million investment would likewise be incurred in the United States. About two-thirds of the operating costs would be in dollars, but the remaining one-third would represent payment for components brought in from Lyon plus the charge by the head office for management services and use of patents. The company has yet to decide whether to invoice its U.S. operation in dollars or euros for these purchases from the parent company.

M. Pangloss is optimistic that the company can hedge itself against currency risk. His favoured solution is for Exacta to finance the plant by a $380 million issue of dollar bonds. That way the dollar investment would be offset by a matching dollar liability. An alternative is for the company to sell forward at the beginning of each year the expected revenues from the U.S. plant. But he realizes from experience that these simple solutions might carry hidden dangers. He decides to slow down and think more systematically about the additional exchange risk from the U.S. operation.

Questions

a. What would Exacta’s true exposure be from its new U.S. operations, and how would it change from the company’s current exposure?

b. Given that exposure, what would be the most effective and inexpensive approach to hedging?

2. Discuss how diversification reduces risk. Comment on the beta of a portfolio with a large number of randomly selected stocks. (Hint: your discussion should include the increased importance of diversification post 2008 financial crisis.)

Statement of the problem

According to the given information it can be denoted that being the leading manufacturer of exactitude machine tools located in Lyons, Exacta, S. a., is looking forward to build a local plant for manufacturing in United States. The larger part of sales of the company is with the European Union. In United States, Exacta exports almost two-third of its output. Agreed by Exacta, s.a, management group, the sales level at United States is not only sufficient enough but also is in huge in order to have a unit in local manufacturing. The company also anticipates that in future there are possibilities of Expansion of business activities in the Market of Mexico and Canada.

The Financial director of Exacta Organization, Mr. Pangloss, seems to be curious about this new venture after surveying the circumstances. With the provided information it was clear In South Carolina, the preliminary investment in order to establish the manufacturing plant; $380 million will be required. The facts state that there is a big opportunity to be successful, but then there are some shortcomings and anxieties related to the risks for expansion of business in International forum.

The CEO of the Company Mr. M. B. Bardot as considered has clarified worried regarding the probable in reference to the exchange rate or the Currency. As per the information, though it is clear that Mr. M. Pangloss has made his efforts in order to boost the confidence of the CEO by stating the possible risk related to currency is not a new challenge for the organization. It can be true as according to the fact, presently the Organization is exporting tools of machine in US every year, whose worth is around $320 million. To do so, the company never witnessed any type of losses that are significant that were incurred due to risk of exchange rates and the dollar revenues for Euro.

The information also did explore that recently the Company exercises a credit period of two month in order to pay for its goods which are exported. Hence, it indicates that about one-sixth part of money [previously stated as 320 million] has been before and now depicts to the currency oriented risk, at any point of time. Again it has also been stated that Mr. Pangloss has faith in the company’s sufficiency in to prevaricate itself against risk related to currency with issuing bond as a way. Hence, it can be stated that certain initiatives might check and correct the amount of investment with the help of an equivalent dollar liability. This transaction would be in dollars. In reference to the given context of the information, it point towards the existence of another alternative for the company. It demonstrates that the Company can sell forward the expected revenue contract of $420 million preceding the progress with this project. Before proceeding with this project such kind of information would help the Organization.

Now, It is a fact that as the Director in Finance, Mr. Pangloss is acquainted with the fact that the responsibility to carefully handle the risk in regard to the exchange rate depends on him. The exchange rate might increase in future if such investments are made. In accordance with the information given, it can be denoted that an opportunity to earn probable amount of profit around $52 million per year can be made, if other affecting factors doesn’t change. There won’t be the requirement of any type of excess investment during operation that would exceed the time frame.

Required options for management review

This kind of Expansion in the U.S. market will increase the international survival of Exacta, which is advantageous for the company. Hence, it can be inferred that Mr. Pangloss as the manager in finance department needs to investigate and speculate any sort of dependent matters from U.S. investment. This can be done by the help of using techniques to check its existing as well as factual exposure. These techniques will help to take a decision on which certain specific method of hedging will be effective and would not be cost effective to the organization.

- From its new operation in U.S market what would be the true exposure of Exacta

- How the exposures from its new operation will, will differ from that of the current exposure of the company?

- In respect to that exposure, what could be the possible low cost and effective approach for hedging?

The two available alternatives for management review like:

- In requirement of the establishment of this new plan in South Carolina of United States of America, an investment of 380 dollar can be made by issuing bonds of US dollars. This would balance the amount of investment in dollars can be done with the aid of a equivalent liability of Dollars.

- To sell forward the contract of probable revenue of 420 million dollars before proceeding with the project, as this could an effective option for the organization (Announcements, 2014).

The following are the information that would support in conclusions, is as follows:

- $380 million is the total amount to be invested for the new plant in United States.

- The operation expects annual revenue will be around $420 million.

- The net profit annually as per the expectation will be $52 million.

- $320 million is already being exported each year without any loss incurred in regard to exchange risk and currency.

- According to the CEO Mr. M.B. Bardot, the amount of investment of $380 million might be able to prove to make a significant amount of loss for dollar depreciation against Euro.

- The revenue will be earned in dollars from South Carolina new plant.

- About 2/3rd of the operating cost will be in Dollars.

- 1/3rd contribution would be from head office charges for services in management and patent use, and apparatus fetched from Lyons.

In charge for patents, the decision of using Euro or Dollar is yet to be decided.

Table 1: US $ per Euro

|

*Shows U.S. $ per Euro |

||||

|

|

Spot Rate |

Fwd Rate |

||

|

1 Month |

3 Months |

1 Year |

||

|

Euro |

1.25 |

1.2501 |

1.25 |

1.2507 |

Source: https://www.xe.com/currencyconverter/convert/?From=EUR&To=USD

The above table represents the exchange rate of US dollar with Euro. From the above table, it can be said that in one month, the euro will be worth same as it is now. This indicates that the Euro is holding its value till one month (Berk & DeMarzo, 2007). The table also shows that in three months, the Euro will have gone down the value and in one year, the euro will have gone up in value. Therefore, it indicates that, while in three month time, there are more Euros required to buy $1, in one year time, it will be the opposite, that is, there will be less Euros required to buy $1.

Table 2: Exacta Currency Risk

|

Description |

U.S. $ - now |

Euro - now |

Euro - 1 month |

Euro - 3months |

Euro - 1 year |

|

Investment |

$ 380,000,000.00 |

€ 304,000,000.00 |

€ 303,975,681.95 |

€ 304,000,000.00 |

€ 303,829,855.28 |

|

Annual revenues |

$ 420,000,000.00 |

€ 336,000,000.00 |

€ 335,973,122.15 |

€ 336,000,000.00 |

€ 335,811,945.31 |

|

Net Profits |

$ 52,000,000.00 |

€ 41,600,000.00 |

€ 41,596,672.27 |

€ 41,600,000.00 |

€ 41,576,717.04 |

|

2/3 Op Costs |

$ 245,333,333.33 |

€ 196,266,666.67 |

€ 196,250,966.59 |

€ 196,266,666.67 |

€ 196,156,818.85 |

|

1/3 Op Costs |

$ 122,666,666.67 |

€ 98,133,333.33 |

€ 98,125,483.29 |

€ 98,133,333.33 |

€ 98,078,409.42 |

* U.S. dollar price = euro price in France / # Euros per dollar

* Euro price = $ price in U.S. / # $ per euro

(Bos, Mahieu & Dijk, 2001; Campbell, Medeiros & Viceira, 2007)

The above table provides details of the two investment strategies along with their currency risk exposure in terms of spot rate, 1 month forward rate, 3 months forward rate, and 1 year forward rate.

Now, from the above table it is noted that if the organization aims to sell forward expected revenue, then, it will evidenced gain of € 336,000,000.00 - € 335,811,945.31 = € 188,054.69

Now, since, the payment is received within two months of purchase, only 1 / 6 th of the money will

2. The risk management practices are the most significant aspect of Portfolio optimization succeeding to global financial crisis. Many expansions have taken place in the whole process of portfolio risk management. Nevertheless the construction for diversification using portfolio theories have become the pillars of investment decisions (christoffersen,2003). The global financial crisis of 2008 saw many doubts in the financial markets on the benefits and the limitations of diversification. At the same time the importance of diversification in reducing the risk of the portfolios came out (chen & Yu, 2011 ; Moran, 2010). The section here will go through a proper study on the process of diversification and its advantages and disadvantages. The diversification of the portfolio principally rotates around the mean variance analysis to develop its risk return aspect (Figlewski, 2003; Hicks, 2000; Horcher, 2005). As per the mean variance analysis the diversification of the portfolio is done in two different ways(Jorion,2005; King & Slorach, 1996; Lucas, 2010). At first a specific risk or variance level, the level of expected rate of return is determined, then for a specific return level, the risk or variance of the portfolio can be maximized to a good extent. Markowitz said that, by using any of the two approaches, the portfolio can be estimated (Arnold, 2013). The portfolios then collected in the mean variance space are termed as efficient frontier (Berk, 2013). Thus by eliminating the non-efficient portfolios, and mean variance analysis, diversification of portfolios can be estimated. Markowitz formulated that on a given level of risk a rationale investor will accept the portfolio which has the largest expected return on investment. Specifically, modern theory of portfolio endeavours to account for the risks and expected return. In short, it represents the most expected return at a given amount of risk at one point of time. The mathematical model developed by Markowitz for the optimization of portfolios can be formulated as shown below:

Required financial information

Min w´ ∑w

Subject to,

w´ e = 1

w´ µ = m

Where, ∑ denotes the covariance matrix of stock returns;

W = (w1, w2, …… , wn) = vector of portfolio weights;

µ = vector of expected return;

m = target portfolio return;

e = (1, 1, 1, ……, 1)

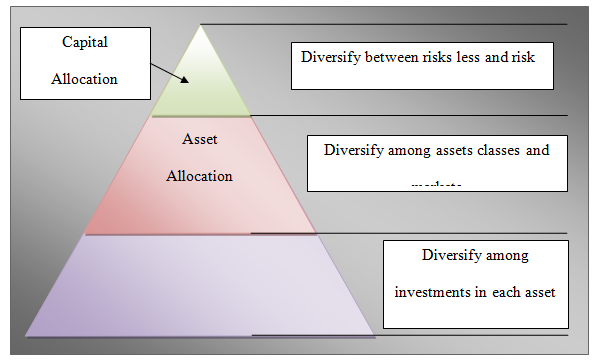

from the view of an individual investor, optimizing the risk return trade off can be estimated using the above given optimization problem shows that the method of diversification does not only applies on risk alleviation but also it also guides the investors in making through investment decisions( Chen& Yu, 2011; Moran,2010). The traditional portfolio theory has three strata of diversification of the portfolio. At first the allocation of capital is done then the needs to employ the allocation of assts is done and then it is followed by the selection of security ( Roache & Merritt, 2006). The process of allocating capital rotates around the process of allocating capital between highly risky and marginal risky assets. The allocation of the capital depends on the overall estimated risk of the portfolio( Chen & Yu, 2011 ; Moran, 2010). It tells about the amount of capital that should be invested on risky assets( Clarke, silve and Thorley,2013; Duchin & Levy, 2009). So, this is an important factor that determines the level of return of the portfolio considering this particular level of risk(Ross, Westerfield & Jordan, 2000; Ross, Westerfield & Jaffe, 2005). Once the allocation of capital has been done the allocation of the assets takes place. This explores the capacity of each asset and determines the level of risk that it holds and the market to which it belongs(Campbell, Mederios & Viceira, 2007). The allocation of the assets generally specifies the level of risk it holds and the portfolio that it belongs to( Rudin & Morgan, 2006). The proportion of assets allocation is adjusted after fix intervals in order to maintain a particular level of return. The figure that is mentioned below represents a proposed asset allocation at a particular investor`s portfolio.

Figure: Proposed asset allocation: [source: Smart, Megginson & Gitman, 2004].

The proportion of assets that must be included in the portfolio entirely depends on the expected level of return and the risks that are associated with all these assets ( Campbell, Medeiros & Viceira, 2007). Here the figure shows that the domestic stocks include 35% of risks, bonds intermediate have 28%of risks, and international securities have 12% risks. If the portfolio is fairly diversified, then the risk of the portfolio is actually much lesser than the sum of each single asset(Duchin & Levy, 2009). The third step of diversification of portfolio rotates around the selection of security. In this stage a security is being selected from each of the asset criteria. This is an indication that there is an opportunity to utilize company or industry diversification( Clarke, Silva & Thorley, 2013; Duchin& Levy, 2009). An important outcome that can be seen here is that if an investor invests at various securities from various industries instead of selecting a huge number of securities from one industry, then it would reduce the risk associated with it. It will minimize the level of risk (Berk, DeMarzo and Harford, 2012). The three steps known as the levels of diversification(Smart, Megginson & Gitman, 2004).

Diversification and Risk Reduction

Figure: Level of diversification: [ Source: Smart, Megginnson & Gitman, 2004]

The market crash that took place in the 2008, the portfolio had become highly volatile. The shortcomings of diversifications can easily be understood by this figure. The figure given below shows the mean correlation of the S & P 500 indices increased during dot-com bubble as well as the attack of 9/11. Hence there was a huge global melt down in that year. The world economy saw a major drop in the investments and there was no profit on portfolios and the risk on investment was very less.

Figure: The average correlation of the sectors in the S & P 500 indices is calculated over two year rolling window.[ Source: Clarke, Silva & Thorley, 2013].

The expectancy of portfolio diversification is significant for a long run which can mislead the investors. Thus the investors should invest in multiple securities in order to minimize the risk.

Table 1: US $ per Euro

Shows US $ per Euro

|

Spot Rate |

Fwd Rate |

|||

|

1 Month |

3 Months |

1 Year |

||

|

Euro |

1.14 |

1.47 |

3.72 |

14.5 |

Source: https://www.investing.com/currencies/eur-usd-forward-rates

From the above table, it shows the valuable exchange rate of US dollar with Euro. From the table, it is observed that the value of will be increased in one month. It indicates the positive trend of Euro. This table shows that the value of Euro will go up to 3.72 within three month. The value of forward rate will further increase within one year. This data indicates that there will be fewer Euros required to purchase one dollar and in one year there will be less Euro required to purchase one dollar.

Table 2: The Currency Risk of Exacta

|

Description |

U.S. $ - now |

Euro - now |

Euro - 1 month |

Euro - 3months |

Euro - 1 year |

|

Investment |

$ 380,000,000.00 |

€ 333,333,333.33 |

€ 258,503,401.36 |

€ 102,150,537.63 |

€ 26,206,896.55 |

|

Annual revenues |

$ 420,000,000.00 |

€ 368,421,052.63 |

€ 285,714,285.71 |

€ 112,903,225.81 |

€ 28,965,517.24 |

|

Net Profits |

$ 52,000,000.00 |

€ 45,614,035.09 |

€ 35,374,149.66 |

€ 13,978,494.62 |

€ 3,586,206.90 |

|

2/3 Op Costs |

$ 245,333,333.33 |

€ 215,204,678.36 |

€ 166,893,424.04 |

€ 65,949,820.79 |

€ 16,919,540.23 |

|

1/3 Op Costs |

$ 122,666,666.67 |

€ 107,602,339.18 |

€ 83,446,712.02 |

€ 32,974,910.39 |

€ 8,459,770.11 |

Euro price in France/ Euro per dollar = U. S dollar price

$ Price in US / $ per euro = Euro Price

(Bos, Mahieu & Dijk, 2001; Campbell, Medeiros & Viceira, 2007)

From the above table, represents the two investment strategy as per their above mention currency risk exposure according to the value of spot rate, one month forward rate, 3 month forward rate as well 1 year forward rate.

There is an opportunity to get the profit if the company develops the strategy to sell the forward expected revenue. It will provide a gain of (€ 112,903,225.81 – € 28,965,517.24) = € 83937708.57.

As per the data, the payment is received within two month of purchase, 1/6 of the total money will be at risk.

In this calculation, the value of the risk will be € 83937708.57 * (1,6) = € 13989618

In the above data, the change in dollar will be = (14.5 – 1.14)/ 1.14 = 11.72

Conclusion and recommendations:

The prime company Exacta is one of the affluent of the invoice its US operation in Euros which relates to the selling activities as per the parent organization (Campbell, Medeiros & Viceira, 2007). The main reason of that the value of Euro is increasing within the time frame of one year during the operation. The above calculation indicates, at the time of payment made, this will be beneficial for the organization than the payment is occurred in dollars (Chen & Yu, 2011; Moran, 2010). As per the prior reason, it concluded that this happened due to the fact that the operation of the company in the US will provide fewer amount of the Euros within one year of the operation as per the comparison of the strategy in the US.

Beta of a Portfolio

a) From the above calculation it is observed that the new operation in the U.S, This Company Exacta get the transaction exposure. This will happened due to the delay of two months as per the payment in term of foreign currency transaction.

In the above context, it is observed that M Pangloss have to estimate current exposure as per the risk related to currency which considered one sixth as per the total annual sales of $ 320 million, which will provide the total amount of $ 53.33 million. On the other way The Exacta true exposure of its new operation will be $ 174.67 million. This data is the combination of the operating expenses and the net profit. This is one of the fact that the as the organization has developed a plan to take loan as per the US dollar that need to be funded in the investment amount $ 380 million. This decision need to be taken as per the reason that the US revenue has to employ to mitigate the interest on the debt. In this case, the net income is one the main component return to France over the cost related management fees and patents.

The organization has to make decision to get the money as per Euros over France of $ 380 million as per the same purpose. In this case, the company requires counterbalancing of the speculation in the $ 420 million of the annual revenues with the one sixth portion of the current risk. If the management of the company selected this option, then the company will get $ 70 million at the risk from the revenue and the investment risk will be $ 253.33 million, this combined the value of $ 323.33 million.

It also observed that the value of dollar depreciated against the value of euro within the time frame of one year by 11.72. In this case the transaction exposure is not negligible. On the other hand it is also said that 11.72 will decreased according to the euro proceeds. In this case the organization should sell forward dollar (Coyle, 2000). This is happened due to the exports of this company taken place in term of Euros.

b) From the table 1, it is observed that the value of Euro will be appreciated within one year of time. M. Pangloss’s need to sell one year forward which expected the revenue contract per year is going to be ineffective as per the US dollar. When the company sell one year forward in US dollar then it will lose money as the value of euro is appreciating and on the other hand the value of the dollar is decreasing.

As per the circumstances, to develop the most effective approach of hedging for this company which require certain measure like issuing US dollar bond of the South Carolina Plant, management se rvice fees in Euros as well as bill the home office patent. When the company takes this measure then the risk related to the exchanging currency will be reduced (Campbell, Medeiros & Viceira, 2007). Another reason is that the patent and management fees will be paid out of the one third of the total cost which generates from France. The sales of one year forward revenue contract in term of Euros represents that this company gets more investment if the management of the company use spot rate (Berk, DeMarzo and Stangeland, 2010). As per the proposal, the selling of forward expected revenue contract is very effective idea. This is helpful as the management of the company accepted the payment within the two month of purchase (Brealey, Myers and Marcus, 2012). It also noted that the one sixth of the total value is considering the currency risk as per the time frame due to the selling of forward expected revenue contract (Fisher & Kumar, 2010). If the above scenario deviates from the calculated revenue then the company will face the trouble.

From the calculation it can be observed that the 380 million dollar bonds as per the funding of U.S. plant which can be treated as ineffective investment. The main reason of that the dollar bonds have to be issued as per the US dollar that can provide positive impact to the company (Campbell, Medeiros & Viceira, 2007). From the above charts it can concluded that the value of dollar is going to depreciate within the time frame of one year (Brooks, 2013). This situation raises the question if the investors are going to invest in bonds or not. If they invest then they will face the definite loss. In this case the bond holders have to sell the bonds as the money will provide more value to them. This indicates that if this company uses the bond amount to finance the capital for new plant then the company will not get the sufficient fund for future investment.

Announcements. (2014). Financial Management, 43(2), pp.467-471.

Arnold, G. (2013). Corporate financial management. Harlow, England: Pearson.

Berk, J. (2013). Corporate finance. [S.l.]: Prentice Hall.

Berk, J., & DeMarzo, P. (2007). Corporate finance. Boston: Pearson Addison Wesley.

Berk, J., DeMarzo, P. and Harford, J. (2012). Fundamentals of corporate finance. Boston: Prentice Hall.

Berk, J., DeMarzo, P. and Stangeland, D. (2010). Corporate finance. Toronto: Pearson Canada.

Bos, C., Mahieu, R., & Dijk, H. (2001). On the variation of hedging decisions in daily currency risk management. Amsterdam: Tinbergen Institute.

Brealey, R., Myers, S. and Marcus, A. (2012). Fundamentals of corporate finance. New York: McGraw-Hill/Irwin.

Brealey, R., Myers, S., and Allen, F. (2011) Principles of Corporate Finance, 10th ed. McGraw-Hill Irwin: New York.

Brooks, R. (2013). Financial management. Boston: Pearson.

Campbell, J., Medeiros, K., & Viceira, L. (2007). Global currency hedging. Cambridge, Mass.: National Bureau of Economic Research.

Campbell, J., Medeiros, K., & Viceira, L. (2007). Global currency hedging. Cambridge, Mass.: National Bureau of Economic Research.

Chen, C., & Yu, C. (2011). International Diversification, Product Diversification, Firm Return, And Firm Risk. Academy Of Management Proceedings, 2011(1), 1-7. doi:10.5465/ambpp.2011.1.1cy

Chen, C., & Yu, C. (2011). International Diversification, Product Diversification, Firm Return, And Firm Risk. Academy Of Management Proceedings, 2011(1), 1-7. doi:10.5465/ambpp.2011.1.1cy

Christoffersen, P. (2003). Elements of financial risk management. Amsterdam: Academic Press.

Clarke, R., Silva, H., & Thorley, S. (2013). Risk Parity, Maximum Diversification, and Minimum Variance: An Analytic Perspective. The Journal Of Portfolio Management, 39(3), 39-53. doi:10.3905/jpm.2013.39.3.039

Coyle, B. (2000). Hedging currency exposures. Chicago: Glenlake Pub. Co.

Duchin, R., & Levy, H. (2009). Markowitz Versus the Talmudic Portfolio Diversification Strategies.The Journal Of Portfolio Management, 35(2), 71-74. doi:10.3905/jpm.2009.35.2.071

Eptas, A., & Leger, L. (2010). A Mean-Variance Diagnosis of the Financial Crisis: International Diversification and Safe Havens. JRFM, 3(1), 97-117. doi:10.3390/jrfm3010097

Figlewski, S. (2003). Estimation error in the assessment of financial risk exposure. New York, NY: New York University Salomon Center, Leonard N. Stern School of Business.

Fisher, B. & Kumar A. (2010). McKinsey Quarterly: The Right Way to Hedge. Retrieved from https://www.mckinseyquarterly.com/The_right_way_to_hedge_2644

Fisher, B. & Kumar A. (2010). McKinsey Quarterly: The Right Way to Hedge. Retrieved from https://www.mckinseyquarterly.com/The_right_way_to_hedge_2644

Grieve, I. (2013). Microsoft Dynamics GP 2013 financial management. Birmingham, UK: Packt Pub.

Helbæk, M., Lindest, S. and McLellan, B. (2010). Corporate finance. New York: McGraw-Hill.

Hicks, A. (2000). Managing currency risk using foreign exchange options. Boca Raton, [Fla.]: CRC Press.

Holden, C. (2012). Excel modeling in corporate finance. Boston: Pearson.

Horcher, K. (2005). Essentials of financial risk management. Hoboken, N.J.: Wiley.

Jandik, T. and Lallemand, J. (2014). Value impact of debt issuances by targets of withdrawn takeovers.Journal of Corporate Finance, 29, pp.475-494.

Jorion, P. (2005). Financial risk manager handbook. Hoboken, N.J.: Wiley.

Khan, A. (n.d.). DHS financial management.

King, R., & Slorach, J. (1996). Corporate finance. London: Blackstone Pr.

Laeven, L. (2003). Does Financial Liberalization Reduce Financing Constraints?. Financial Management, 32(1), p.5.

Lucas, D. (2010). Measuring and managing federal financial risk. Chicago: University of Chicago Press.

Moran, M. (2010). Diversification and Risk Management with Index Products During the 2008 Financial Crisis. The Journal Of Index Investing, 1(1), 117-130. doi:10.3905/jii.2010.1.1.117

Parrino, R., Kidwell, D. and Bates, T. (2012). Fundamentals of corporate finance. Hoboken, NJ: Wiley.

Renneboog, L. and Zhao, Y. (2014). Director networks and takeovers. Journal of Corporate Finance, 28, pp.218-234.

Roache, S., & Merritt, M. (2006). Currency risk premia in global stock markets. [Washington, D.C.]: International Monetary Fund.

Ross, S., Westerfield, R. and Jaffe, J. (2010). Corporate finance. New York: McGraw-Hill/Irwin.

Ross, S., Westerfield, R., & Jaffe, J. (2005). Corporate finance. Boston: McGraw-Hill/Irwin.

Ross, S., Westerfield, R., & Jordan, B. (2000). Fundamentals of corporate finance. Boston: Irwin/McGraw-Hill.

Rudin, A., & Morgan, j. (2006). A Portfolio Diversification Index. The Journal Of Portfolio Management, 32(2), 81-89. doi:10.3905/jpm.2006.611807

Smart, S., Megginson, W., & Gitman, L. (2004). Corporate finance. Mason, Ohio: Thomson/South-Western.

Taillard, M. (2013). Corporate finance for dummies. Hoboken, N.J.: John Wiley & Sons, Inc.

Walker, M. (2000). Corporate Takeovers, Strategic Objectives, and Acquiring-Firm Shareholder Wealth. Financial Management, 29(1), p.53.

Watson, D. and Head, A. (2013). Corporate finance. Harlow, England: Pearson.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2016). Managing Currency Risks For Exacta’s New U.S. Essay: Diversification.. Retrieved from https://myassignmenthelp.com/free-samples/financial-management-exacta-organization.

"Managing Currency Risks For Exacta’s New U.S. Essay: Diversification.." My Assignment Help, 2016, https://myassignmenthelp.com/free-samples/financial-management-exacta-organization.

My Assignment Help (2016) Managing Currency Risks For Exacta’s New U.S. Essay: Diversification. [Online]. Available from: https://myassignmenthelp.com/free-samples/financial-management-exacta-organization

[Accessed 25 May 2025].

My Assignment Help. 'Managing Currency Risks For Exacta’s New U.S. Essay: Diversification.' (My Assignment Help, 2016) <https://myassignmenthelp.com/free-samples/financial-management-exacta-organization> accessed 25 May 2025.

My Assignment Help. Managing Currency Risks For Exacta’s New U.S. Essay: Diversification. [Internet]. My Assignment Help. 2016 [cited 25 May 2025]. Available from: https://myassignmenthelp.com/free-samples/financial-management-exacta-organization.