Question:

Write a report on the utilisation of standard costing system as a measurement tool of productivity and quality. Discuss the effects of standard costing system on the profitability, financial planning and behaviour of employees of the business organisations by referring to at least ten published articles.

“Meaning of Costing (Standard)”

Ordinary Costing is the carry out for substitute for a predictable cost known as real cost. It changes periodically recorded variances in displaying expected as well as actual costs. This particular approach simplifies alternative to cost like FIFO and LIFO methods (Seal, Garrison & Noreen, 2012). It assumes the historical cost information in maintaining stock. Standard Costing includes estimated creation on all activities in and within company. Using standard costs includes applications that are time-consuming for collecting actual costs. Standard costs are used in case of close approximation with actual costs at the same time.

Ideal Standard

Ideal Standard or costs considers as a standard for attainment under favorable conditions in possible ways. It includes performance levels as under ideal standards for achieving in best possible combination of factors like materials as well as labor. It is the highest output in and with best equipment as well as layout for future analysis purpose. It underlies maximum efficiency for utilization of various production resources (Lee, 2014). Addition to that, maximum output should be handled at minimum cost under ideal condition. This Standard reflects on goals as well as targets without any kind of hope of performance levels that needs achievement for future purpose.

Practical Standard considered as average standard for attainment purpose for specified time. It is preferably long enough in covering complete business cycle. This particular standard is set depending upon the normal capacity in representation of volume at the time of peak and slack periods (Horngren, Harrison & Oliver, 2012). Constant unit costs employs throughout cycle in regard with changes in current cost as well as selling prices.

|

Cost (Actual) |

Standard Costs |

|

Actual Costs are those costs that are required by manufacturers in assigning ever-changing actual cost for each individual component in the manufacturing process at the same time. It includes materials, overhead as well as labor at associated time for an accurate final price. These are typically acquired in form of purchase order as per manufacturing order. |

Standard costs is considered as traditional method of costing by the manufacturers as required for assigning predetermined estimate values in each of the attributes like materials, labor as well as overhead. Most of the discrete manufacturers like stock widget manufacturers produces same thing as preferred by standard costing. |

|

Actual costing tends by manufacturers for frequent changing costs like job shops, compounders as well as assemblers and volatile raw materials. |

Standard Costing relates variances as considered as management tool. It is calculated variances in approximation of actual costs. |

Discussion on the importance of standard costing system to business organization

Standard costing system is a vital method by which standard cost are employed in desired form. In accordance with ICMA, Standard costing system is the preparation as well as usage of standard costs by their comparison in actual cost. It helps in analysis of variances in point of variances. It is the method for cost ascertainment for preparation of statistics like standard cost, actual cost as well as differences known as variance. Standard costing system discloses deviation cost in case of standard as well as clarifies in causes (Horngren & Horngren, 2012). Management immediately informs sphere of operations in providing proper remedial actions in necessary terms. Standard Costing System involves ascertainment as well as usage of standard costs. It records actual costs as well as compare actual cost from standard costs for finding out variance.

- Standard Costing is considered as the law of dimension for recognized by power. It provides measure in case presentation assessment for future analysis purpose. It ensures ascertainment of performance evaluation in business operations. It helps in supplying ways for utilizing proper material, labor as well as overheads for gaining economy in the near future.

- This particular system minimizes wastage for detecting variance as well as suggesting proper corrective actions. Standard Costing System enables motivating employees of business firm as well as improving performance by setting standard at the same time. It enables management for supplying necessary data in relation with cost demand as well as submits quotations in fixing up selling price of a particular business firm.

- Under Standard costing system, it includes cost centers for established responsibility for assigning concerned departments and persons. It increases effective delegated authority at the same time. It helps in managing proper inventory valuations like work-in-progress as well as finished products. It acts as a control device for the purpose of management (Horngren, 2011).

- It is a proper normal costing scheme with full contribution as well as participation. It creates optimistic and moneymaking attitude at every levels of organization for the same. It helps management in taking corrective decisions like fixation of price as well as making or buying decisions for firm beneficiary for future analysis purpose (Fields, 2011).

- Typical scheme encourages reappraisal of various methods. It includes resources as well as technique in helping reduced unfavorable variances in an overall manner. Standard costing acts as a guide to management in case of management functions in formulation of prices as well as production policies. It is most effective cost control system as under standard costing as reviewed and analysis at regular intervals in case of improvements for proper immediate actions. It analysis variances as well as measurement for detecting inefficiencies and mistakes for investigating reasons

- Standard costing system helps in drawing management attention in alignment with items for processing according to desired plan. Standard costs involve predetermined costs that are useful for planning as well as budgeting (Epstein & Lee, 2012). It helps in estimating effects of changes in case of cost-price-variance relationship for decision-making process.

- Standard Costing System helps in making organization at cost-conscious stage as well as focus on standard cost in case of variance analysis in the most appropriate way. Standard costing is fixed for each product as well as its components and process operations. It aims at improving overall production efficiency in ultimate reduced cost as well as increased profits (Epstein & Lee, 2011).

- Standard costing system enables in providing incentive schemes to workers as well as supervisor

- Normal estimate scheme simplifies in using charge manage procedures in an effective way

- Standard costing system concerns as an effectual tool for industry planning, subsidiary estimate as well as budgeting and inventory valuation. Standard Costing System implements for saving cost as well as elimination of cost work for future analysis purpose (Eldenburg, 2011).

- Standard Costing System helps in implementation of budgetary control system in case of operations in desired way. It requires delegation of authority as well as responsibility for effective utilization for setting standards for reduces profit fluctuations in method valuation.

Standard costing system usefulness in measuring productivity as well as quality

Performance measures in recognizing element in Total Quality Management programs. Managers as well as supervisors direct several effects of an organization in instituting wide range of changes. Performance measurement in managing outcome as well as main purpose in reduced variation of work product or process at the same time. The profit can be regarded as the difference between the revenues as well as expenses over a certain period of time. The measurement of productivity can be regarded as a problem area owing to different difficulties that is inherent in specifically defining as well as quantifying different outputs and inputs that comprises of the productivity quotient.

Practical Standard

The main goal is to strive for sound decisions for affecting products as well as services. Performance measurement is a tool for improving organization goals as well as vision. Proper use of standard cost methods for enhancing high level of efficiency. It requires using standard costing techniques in efficient measurement of cost of goods sold as well as allowing effective budgeting and price setting in the most appropriate way.

Efficiency variance is considered as the difference between actual units usage in an expected amount. It expected amount for usual standard quantity of direct materials, labor as well as machine usage time for product assignment. Efficiency variance as applied to services. It is calculated for hours as required for audit completion versus budgeted amount (Drury, 2012).

Direct material is also known as material yield variance as well as calculated as:

“Actual unit usage- Standard unit usage/*Standard cost per unit”

Direct labor is also known as labor efficiency variance and relates with material usage in relation with efficiency. It is calculated as:

“Actual Hours- Standard Hours* Standard overhead rate

It is important to understand the fact that key components of efficiency variances lies for setting of standard. For instance, number of units of direct material assumes for the absence of scrap. It relies upon fact of standard amount in amount of scrap value for continuous negativity efficiency variance at the same time. It is a theoretical standard for meeting circumstances in optimal nature. Realistic standard incorporates certain reasonable inefficiency levels for close actual results. It is preferable in case of avoiding depressing series in case of negative efficiency variances.

Direct Labor variance measures firm ability in utilizing labor in accordance with expectations. Variance is useful in spotlighting for areas in production process for usage of labor hours as anticipated for future analysis purpose (Strasen, 2012).

- Variance is calculated as the difference between actual labor hours in case of producing an item for standard amount.

- Variance outcome in unfavorable conditions as reviewing by industrial engineers for underlying process

- It improves reduced production hours in required way. It is a simplified product design for reduced assembly time

- It reduced amount of scrap as produced by the process. It increases amount of automation process. It alters workflow for future analysis purpose.

- It emphasis upon multitude of variables as involved in difficult way for creation of standard for comparison to actual results

- It emphasis upon causes of labor efficiency variance like instructions for employees in receiving written work instructions

“Actual hours- Standard Hours * Standard rate= Labor efficiency variance”

Standard hours represents best estimate of business organization. It relates with an optimal speed by the production staff members in case of manufacturing of goods as far as possible. It figures out considerable assumptions in regard set up time production. It runs under employee skill levels as well as production duration in other factors. Standard based training for assumptions in minimum for employees in an overall manner (Burritt, 2011). Work Station configuration for acting as a work center for standard costing in creation of ways in the most appropriate way.

Variable overhead efficiency discrepancy displays the dissimilarity between real as well as budgeted hours for working purpose. It is applied in case of standard variables as per transparency rate per hour. The formula is:

“Standard overhead rate* (Actual hours –standard hours)= Variable overhead efficiency variance”

Constructive variance implies real variable overhead expenses as incurred per labor hours in expected ways. Variance mainly focuses on attention for overhead costs varying largely from expectations (Bhattacharyya, 2011). Variance overhead expenditure variance requires collection of manufacture expenses in sequence as submitted by manufacture department. Predictable labor hour’s estimates industrial engineering as well as production schedules staff members. It is purely based upon historical as well as project efficiency and equipment in case of capacity levels at the same time. There are wide range of possible causes required for variable overhead spending variance. These are as follows:

- Account Misclassification- It involves in variable overhead categories in incorrect classification as part of variable overhead in the most appropriate way.

- Outsourcing- It includes activities for sourcing in shifting to supplier and vice versa

- Supplier pricing- It includes suppliers change in prices as well as reflection on efficient principles

Ideal Standard

Variable overhead expenditure concept is the majority applicable situations in the manufacture process for identical productive units (McFarland, 2012).

Production volume variance helps in measuring the overhead amount for unit production. It is considered as the difference between actual units produced for specified period as well as budgeted units for budgeted overhead rate at the same time. It is the measurement used for ascertainment of materials as well as production of management staff for producing goods. It is in accordance with planned expectations for expected overhead amount in an overall manner (Atkinson, 2012). From the business perspective of production process, production volume variance depends upon measurement of budget for creation of few months before. It is the measure for viewing at the ability of production operation in meeting the production schedule at specified time. Calculation of production volume variance is as follows:

“(Actual units produced-budgeted units produced) *Budgeted overhead rate

Effects of standard costing system on the profitability, financial planning and behavior of employees of business organizations

Profitability

In the recent world, standard costing system finds business methods like product line planning as well as productivity monitoring and advance cost measurement in operating and efficient organization in case of profitability. Managers require information regarding standard cost in determination of efficiency in business operations. Managers develop standard cost system in motivational effect of standard in case of employee productivity at the same time. Steps in effective implementation as well as maintenance in case of standard cost system.

The technique for measurement of productivity focuses on various business aspects of performance of an organization, by means of important information regarding the standard cost accounting, thereby provides an effectual scheme to assess the productivity of an association and its different sector. The standard costs comprise the cost of goods sold for each finished product. Using standard costing, the gross profit margin for each finished good is easily determined by subtracting the standard cost from the product’s selling price. A favorable variance indicates that standard costs exceed actual costs, while an unfavorable variance means that actual costs are higher than standard costs. Differing factors may account for variances. Therefore, the standard costing system has an effect on the improved level of production that again in turn affects the overall standard costs for different labor as well as direct overhead.

Standard costing essentially acts a yardstick that can be used for the purpose of comparison with different standard costs. Therefore, standard costing can be considered as a basis for the purpose of measurement of performance. Thereafter, the performance might be measured and based on that the hypothetical financial planning can be carried out. This system also provides a strong basis for the regular tracking and control on expenditure incurred on different items. In addition to this, the system of standard costing also offers a basis for the customary check as well as control of materials, usage of price, cost of labor as well as overhead expenses. Again, the comparison of the standard cost with the actual cost can help in controlling as well as reduction of cost by means of constant system of tracking as well as comparison of results. This in turn can also help in appropriate financial planning that helps in tracking, recording and controlling and thereafter helps in augmentation of the overall productivity of the operations.

Actual Costs

The standard costing has an impact on the behaviors of the employees as well as managers. There are different organizations that can reward the employees for the purpose of achievement of standards or else for the purpose of attaining performance at a certain level that is quite lower than the standard cost. Therefore, in this case the standard costing can help in affecting or motivating the employees. Therefore, the employees might possibly seek to carry out operations in a very effectual as well as economical manner. The use of standards for the purpose of assessment as well as systems of rewards can also help in motivating the employees and improvement of the effectiveness of the employees.

Price Variance is considered as the actual unit cost out of purchased items. It is deducted from standard cost and multiplied by quantity of total units purchased at specified period

Formula of Price Variance

“(Actual Cost Incurred- Standard Cost)* Actual Quantity of Units Produced= Price Variance”

Price Variance is the actual cost incurred as lower in comparison with standard cost known as favorable price variance. If the actual cost is higher in comparison with standard cost, it is known as unfavorable price variance at the same time. It reveals achieving favorable price variance as achieved by purchasing goods especially in large quantities. It may put in business risk in inventory quantities in the most appropriate way (Gönen, 2012). Purchasing department commits little inventory for buying in smaller quantities. It tends in resulting in case of unfavorable price variance in an overall manner. Therefore, operational plan of business results in driving price variance types for incurring in the future business activities.

In case of variance analysis, direct material price variance considers as the difference between standard cost as well as actual quantity of materials used or purchased (Callen, 2012). It posses two components namely direct material usage variance as well as direct material total variance

Direct labor rate Variance is considered as the measure of difference between actual costs of direct labor as well as standard cost of direct labor for utilization at specified time.

Formula

“Direct Labor rate Variance”

= “Actual Quantity*Actual Rate- Actual Quantity*Standard rate”

= “Actual Cost- Standard Cost of Actual Hours”

Analysis

Favorable labor variance helps in suggesting cost-efficient employment of direct labor by particular business organization (Williams, Van der Wiele & Dale, 2012). There are several reasons for favorable labor rate variances like:

- It requires hiring un-skilled as well as semi-skilled labor that adversely affect labor efficiency variance

- It mainly decreases overall wage rates in current markets for increased supply of labor. It is because of influx of immigrants that results in relaxation of immigration policies at the same time

- It relates with inappropriate high setting of standard cost of direct labor in attribution for inaccurate planning in the near future

An adverse labor rate variance relates with indicating higher labor costs for specified period in comparison with Standard

Some of the causes for adverse labor rate variance mainly include:

- It increases national minimum wage rates for future analysis purpose

- It engages in hiring of more skilled labor in anticipation of standard known as labor efficiency variance

- It relates with inefficient hiring of HR Department

- It ensures effective negotiations by labor unions

Variance Overhead spending variance refers as the difference between actual as well as budgeted rates in case of variable overhead (Rumbaugh et al., 2012). This variance mainly focuses on attending of variances for overhead costs that vary largely from expectations.

“Variance Overhead spending variance”

= “Actual hours worked*(actual overhead rate- standard overhead rate)”

Fixed operating cost expenditure discrepancy considered as the dissimilarity between real fixed visual projection expenses as incurred as well as budget overhead expenses at the same time. In case of unfavorable variance, it relates with actual fixed overhead expenses as anticipated as a whole (Fleischman, Boyns & Tyson, 2012).

Standard Costing

Formula:

“Fixed overhead spending variance”

= “Actual fixed overhead-budgeted fixed overhead”

Financial Planning refers as the major part of standard costing as well as variance analysis at the same time. Variances arises due to reasons ranges from unrealistic standards to operational causes. It fails into account from various expected increase in the wage rates. It increases direct materials usage for hiring of low skilled labor in the near future (Boaden & Dale, 2012). It requires planning inefficiencies for large variances for setting faulty standard in the most appropriate way. It deals with planning computation as well as operational variance one after other. It is difficult in ascertaining ways for precise causes as well as assigning responsibilities of related operational variances for specified individual as well as department within business organization. It is argued that causes as well as responsibilities differ from variances at times. Variance analysis fails in providing basis for investigation for promotion of better understanding of facts in operational environment in and among organization management for the same.

It is important to understand the fact that behavior of employees directly proportional to reward system as well as motivation. Motivation from senior authority encourages employees in working together for attainment of future goals as well as objectives of an organization. Reward system can be in terms of monetary and non-monetary that enhances working culture in and within business organization (Mandal & Shah, 2012). Standard costing as well as variance analysis encourages short-termism for inherent tendency towards attainment of short-term as well as quantified objectives and results in an effective manner. Negative perception of business organization standard costing as well as variance process reveals that employees manage during the budget setting. It fails in viewing the unfair process as far as possible. It is important for business organization on matters relating to performance management system for wide range of quantitative and qualitative measures. It encourages management in adopting long-term views in alignment with organization strategic direction as a whole.

Most of the small business owners are of the opinion that budgeting as non-essential task as it is time-consuming. Leaders operate business activities without any kind of strategic financial plan of any form. It serves no purpose in considering business organization in understanding starting point as well as tracking progress at the same time.

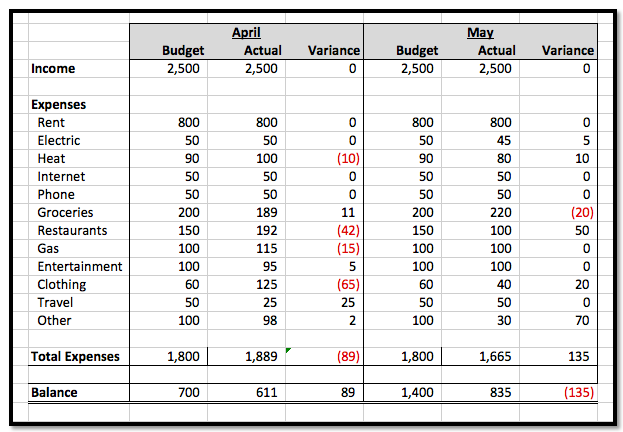

Figure: Budget Vs Actual

(Source: Benninger, 2012)

Business leaders conducts budget versus actual comparison. This particular process helps in using financial data for assessing close company spending as well as generation of revenue in meeting financial forecasting projections as included in given budget. It takes time in conducting the comparison but business leaders determine ways for working upon the funding process as far as possible. There are several reasons found for discrepancies noticed in budget as well as real quantity for expenditures plus revenues (Duck, 2012). These differences happen in case of the capacity of financial system. Buyer requirements as well as preference vary widely from actual actions by competitors. These factors are unpredictable in nature as well as reflect exact cause for resulted variances.

Reference List

Atkinson, A. (2012). Management accounting. Upper Saddle River, N.J.: Prentice Hall.

Benninger, L. J. (2012). Standard Costs for Income Determination, Control, and Special Studies. The Accounting Review, 25(4), 378-383.

Bhattacharyya, D. (2011). Management accounting. Noida, India: Pearson.

Boaden, R. J., & Dale, B. G. (2012). Managing quality improvement in financial services: a framework and case study. Service Industries Journal,13(1), 17-39.

Burritt, R. (2011). Environmental management accounting and supply chain management. Dordrecht: Springer.

Callen, J. L. (2012). Efficiency measurement in the manufacturing firm.Journal of Productivity Analysis, 2(1), 5-13.

Drury, C. (2012). Management and cost accounting. Andover: Cengage Learning.

Duck, R. E. V. (2012). The use of management accounting techniques in industry. Journal of Management Studies, 8(3), 355-359.

Eldenburg, L. (2011). Management accounting. Milton, Qld.: John Wiley & Sons.

Epstein, M. & Lee, J. (2011). Advances in management accounting. Bingley, UK: Emerald.

Epstein, M. & Lee, J. (2012). Advances in management accounting. Bingley: Emerald.

Fields, E. (2011). The essentials of finance and accounting for nonfinancial managers. New York: American Management Association.

Fleischman, R. K., Boyns, T., & Tyson, T. N. (2012). The search for standard costing in the United States and Britain. Abacus, 44(4), 341-376.

Gönen, S. (2012). THE USAGE OF TOTAL COST OF OWNERSHIP TOGETHER WITH QUALITY COSTING. World of Accounting Science,14(3).

Horngren, C. & Horngren, C. (2012). Management accounting. Toronto: Pearson Canada.

Horngren, C. (2011). Introduction to management accounting. Upper Saddle River, N.J.: Prentice Hall.

Horngren, C., Harrison, W., & Oliver, M. (2012). Accounting. Upper Saddle River, N.J.: Pearson Prentice Hall.

Lee, J. (2014). Engineering asset management 2011. London: Springer.

Mandal, P., & Shah, K. (2012). An analysis of quality costs in Australian manufacturing firms. Total Quality Management, 13(2), 175-182.

McFarland, W. B. (2012). The Basic Theory of Standard Costs. The Accounting Review, 14(2), 151-158.

Rumbaugh, J., Blaha, M., Premerlani, W., Eddy, F., & Lorensen, W. E. (2012). Object-oriented modeling and design (Vol. 199, No. 1). Englewood Cliffs, NJ: Prentice-hall.

Seal, W., Garrison, R., & Noreen, E. (2012). Management accounting. London: McGraw-Hill Higher Education.

Strasen, L. (2012). Standard costing/productivity model for nursing. Nursing economic$, 5(4), 158.

Williams, A. R. T., Van der Wiele, A., & Dale, B. G. (2012). Quality costing: a management review. International Journal of Management Reviews, 1(4), 441-460.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2017). Understanding Ordinary Costing, Standard Costing, And Efficiency Variances. Retrieved from https://myassignmenthelp.com/free-samples/introduction-on-standard-costing-system.

"Understanding Ordinary Costing, Standard Costing, And Efficiency Variances." My Assignment Help, 2017, https://myassignmenthelp.com/free-samples/introduction-on-standard-costing-system.

My Assignment Help (2017) Understanding Ordinary Costing, Standard Costing, And Efficiency Variances [Online]. Available from: https://myassignmenthelp.com/free-samples/introduction-on-standard-costing-system

[Accessed 23 May 2025].

My Assignment Help. 'Understanding Ordinary Costing, Standard Costing, And Efficiency Variances' (My Assignment Help, 2017) <https://myassignmenthelp.com/free-samples/introduction-on-standard-costing-system> accessed 23 May 2025.

My Assignment Help. Understanding Ordinary Costing, Standard Costing, And Efficiency Variances [Internet]. My Assignment Help. 2017 [cited 23 May 2025]. Available from: https://myassignmenthelp.com/free-samples/introduction-on-standard-costing-system.