Tight Deadlines, Unclear Tasks, Clashing Assignments Are Giving You Sleepless Night?

Get Assignment Help from MyAssignmenthelp.com and Secure Your Grade

The main headquarters of NIKE Inc. have been located in Beaverton, Oregon since 1990. Leading the executive team of NIKE Inc. is Mark Parker. According to the official NIKE website, “Parker joined Nike as one of our first footwear designers back in 1979, and he’s been at the center of Nike innovation ever since,” (About NIKE, Inc.). He is now President and CEO of the company. Alongside him are co-founder Philip H Knight, who serves as the Chairman of the Board of Directors, and Charlie Denson, who holds the position of NIKE brand president.

NIKE Inc. is a publicly traded company that sells athletic products under the NIKE brandname and affiliate brands. At the end of fiscal 2011, NIKE Inc. earned a $20.9 billion in revenue. The brand carries products for men and women and covers a range of products from cross-training shoes to the NIKE+ technology platform. Action sports, athletic training, basketball,football, soccer, running, and tennis are only a few of the many activities NIKE manufactures products for. Several NIKE affiliates specialize in one of these sports, such as NIKE Golf, a sub-branch that designs golf equipment, balls, footwear, bags, and other accessories for the global market. NIKE golf is not the only affiliate contributing to NIKE Inc. Cole Haan, a luxury brand with more than 180 retail location and a fiscal 2011 sales total of $518 million. Converse, known as “America’s Original Sports Company” realized $1.1 billion in sales in fiscal 2011. Hurley International, an action sports apparel company earned $252 million in sales that same year. Nike claims, “As part of our growth strategy, we continue to invest in opportunities that will generatethe highest possible long-term returns,” (About NIKE, Inc.). Altogether, the affiliate brands contributed $2.7 billion in Nike Inc. revenue last year.

Sales have consistently increased within the industry. From 2002 to 2007 there has been a steady growth of about 2.8% per year . This pattern is forecast to continue through the year 2012.Although the growth rate of the industry is low, sports participation rates have never been static. There are also outside sales from users who are not looking to purchase the shoe for athletic use. According to a 2008 survey, only 19% of people purchase athletic shoes solely for sports orexercise (Mintel, 2008).

Other factors that affect the purchase of athletic shoes are comfort, price, performance, style, brand, technology, and endorsement. In the same 2008 survey, users revealed they rate comfort at 99% importance and price at 94% importance. It is important to realize that, even though the respondents in the survey indicated only 13% importance to celebrity endorsement, there has been research that shows this is inaccurate. Mintel believes “respondents may be understating the importance of celebrity endorsement. Mintel’s Sports Enthusiasts-U.S., July 2007, found that 38% of obsessed sports enthusiasts purchased licensed sports clothing in the past months” (Mintel, 2008).

Like many industries, the athletic shoe industry is facing difficulaty due to the state of our economny. While there has been steady growth in the industry, inflated prices are causing sales to remain static (Mintel, 2008). The competition for market share in the athletic shoe industry is a thre at because of innovative brands in the industry. On the other hand, technological advancements in terms of promotion and product pose exciting opportunities. There are also opportunities to reach the consumers at department stores, where sales are currently down 21.8%(Mintel, 2008).

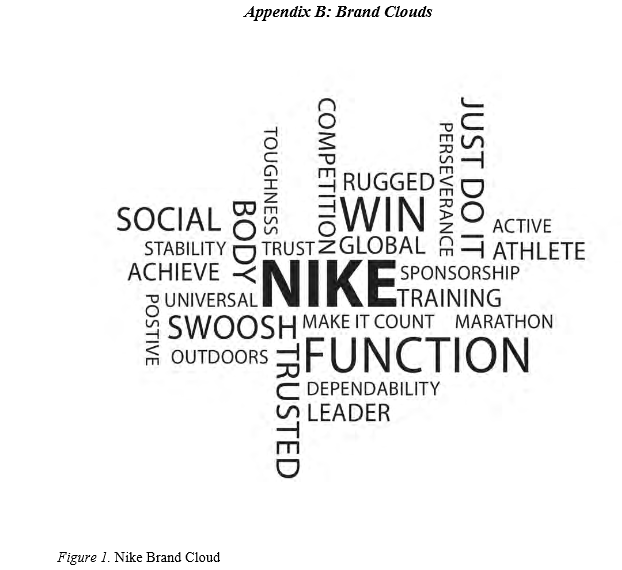

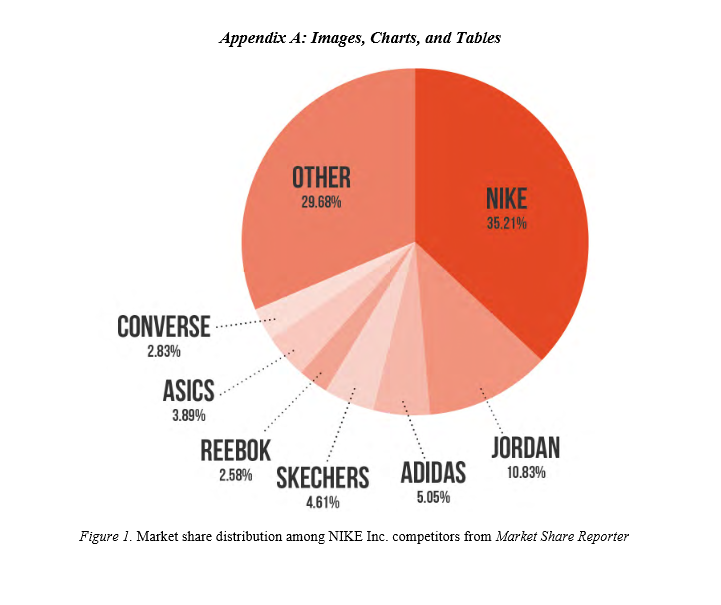

NIKE has a few clear-cut competitors in the market for athletic shoes.Adidas stands as NIKE’s top competitor. Adidas has the marketing power to expand its brand and positive brand standing within the industry: the company will sponsor the 2012 Olympics in London (London 2012 Olympic Partners). Adidas can steal casual, urban runners who have preconceived notions of NIKE as a brand strictly for “the competitor”. Adidas’s brand owns 32 percent of the market for athletic shoes (Ed. Robert S. Lazich and Virgil L. Burton, III). The Reebok brand is a subsidiary of Adidas that also owns a decent portion of the market. While much of Reebok’s 6 income is from apparel and cleat sales, its athletic shoes own about 2.58 percent of the market for athletic shoes (Ed. Robert S. Lazich and Virgil L.Burton, III). Reebok, however, is aggressively moving to increase its market share this year. Their updated line of “Zigtech” shoes position the brand as a fitness shoe instead of a competitive shoe (Reebok Zigactive: Ochocinco vs. Annie). Reebok has also upped its social media efforts to cater to the interactivity consumers gravitate towards.

Skechers, with their shape up brand, own 4.61 percent of the market for athletic shoes (Ed. Robert S. Lazich and Virgil L. Burton, III). Skechers has built their brand’s image around the casual runner. Their shape-ups product has attracted some casual runners, especially women,

due to its combination of fashion and comfort in an athletic shoe.

Finally, Japanese company Asics owns a 2.83 percent share of the athletic shoe market (Ed. Robert S. Lazich and Virgil L. Burton, III). Asics has gained ground steadily in recent years after being virtually unknown in the past. They do not stand as much of a threat to NIKE in their current position.

Looking at all of NIKE’s competition this year, the two companies that pose the largest threat to NIKE are Adidas and Reebok. Adidas controls the largest portion of the athletic shoe market outside of NIKE and its subsidiaries. Their newer “Adidas is All In” advertisements seek to position their brand as an exciting product that can make any person feel like a rock star (Adidas Is All In). Reebok, though they do not control the largest portion of the shoe market outside of NIKE, is making a push to promote their products as catering to the lifestyles of the consumers. The company has recently launched an improved line, “zigtech”, that helps the consumer enjoy “the sport of fitness” with their innovative design and responsive cushioning (Reebok Zigactive: Ochocinco vs. Annie). In the coming sales year, Adidas and Reebok have the potential to steal urban, casual runners from NIKE’s current market holding.

In its advertising campaigns today, NIKE attempts to capture consumers through functional and emotional benefits. In its “Make it count” campaign, NIKE shows people all across the country performing a variety of athletic activities in the NIKE shoes, showing the functional benefit of the shoes to be that they allow the owner to participate in any activity to their fullest (NIKE, #makeitcount). The ad then moves into the company’s new slogan, “Make it count”, creating the emotional appeal that NIKE shoes will help the consumers to create a difference in their lifestyles through their actions. Overall, the ad campaign creates a brand personality that marvels NIKE as both an exciting and successful product which gives consumers the ability to perform at a greater level while feeling important in their new shoes.

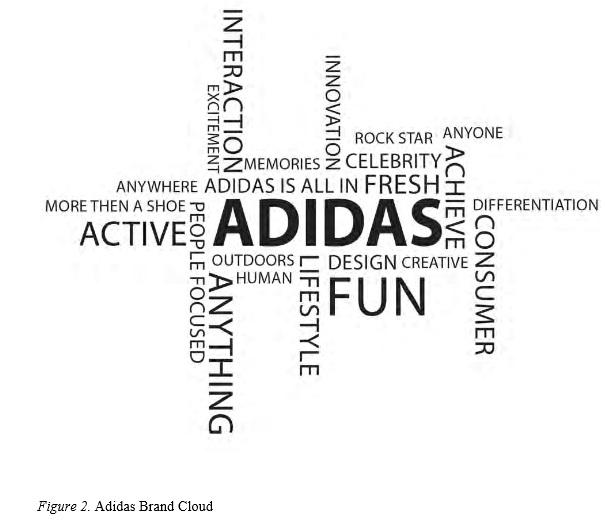

NIKE’s main competitor, Adidas, also attempts to reach the more active athletes who strive to defeat their competition. Adidas tries to prove that their shoe will make athletes more prepared to face the competition through the use of their shoes. On the company’s website, Adidas lists two of its goals in its mission. They say, “We are innovation and design leaders who seek to help athletes of all skill levels achieve peak performance with every product we bring to market. We are consumer focused,” (About Us, Adidas-group.com). This is where Adidas differentiates themselves from NIKE’s strategies. Adidas tries to create top-of-mind brandpresence while associating shoes with innovation and change. They help consumers see that they can live a life of glory with the brand’s shoes.

In their recent “Adidas Is All In” campaign, Adidas has effectively brought about functional and emotional attributes relating to the brand (Adidas, Adidas Is All In Commercial). Their sixty-second spot aired over television and the Internet, showing a functional benefit of asleek, comfortable shoe that can help the consumer accomplish active tasks to the best of their ability. Adidas, however, separates from NIKE through their emotional appeals. In the sixty-second spot, everyone from athletes to citizens are HAVING FUN and creating lasting experiences. When Adidas says that they are “All In”, they create a brand personality geared towards those looking for excitement in their athletic and running experiences rather then just function.

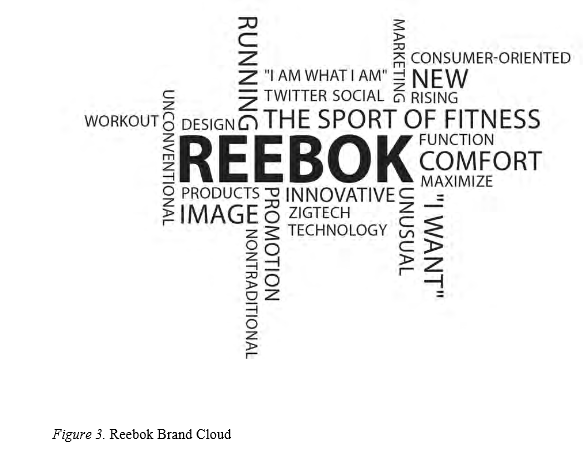

Following the lead of Adidas, Reebok creates a brand that is based around the consumer. Their slogan, “I am what I am”, stresses the idea that Reebok’s shoes can serve many different purposes to different types of consumers. On their company website, Reebok has a box at the top of the screen that says, “I want” with the ability for the consumer to add information based upon their interests (Reebok.com).

Reebok has created a brand image and personality that puts the consumer first. Their shoes inspire the consumer to be whatever they wish, but be aided in their tasks by what they wear. This is important, because Reebok isn’t forcing their consumers to have a competitive athlete persona.

Reebok also largely differentiates from its competitive field through its innovation in functional benefits. Their new lines of “Zigtech” shoes promote comfort and performance in their unique design. The common human being works out and matches NFL star Chad Ochocinco in all activites during the course of the commercial, showing the functional benefits of the shoe by saying that it will help to better your workout performance (Reebok, Reebok Zigactive: Ochocinco vs. Annie). At the end of the commercial, text says “The Sport of Fitness hasArrived”. In separating sport from fitness, Reebok has created an emotional appeal towards the runners and workout experts that can create brand loyalty.

urban runners to buy NIKE shoes. Consumers within the ages of 18 to 24 years old are more likely to try out new athletic shoe brands on a more consistent basis then any other age group (Mintel, 2008). This age group also uses athletic shoes in a fairly consistent manner, exercising more then any other age group. Around 54% of this age group runs or jogs regularly as opposed to much lower numbers in older generations (Mintel, 2008). Additionally, New Balance and Reebok have created more brand loyalty among older consumers (Mintel, 2008). It would be difficult to change the perception of NIKE products to older generations who have already formulated their beliefs about running shoe brands. In marketing a casual, non-competitiveatmosphere associated with NIKE shoes to urban runners between the ages of 18-24, the products can become top-of-mind to this age group. The age group stands as a mix of emergent consumers. In creating positive associations related to a casual experience with the products, NIKE can make the 18-24 year old consumers brand loyal going into the future and increase the company’s total sales now and in the future.

realistic and reachable to consumers.

Reebok’s newest 2012 campaign is for the co-branded deal with the brand CrossFit (Zmuda 2011). The campaign titled “The Sport of Fitness Has Arrived” focuses on strength and conditioning programs, and how staying fit can also be a sport. The premiere commercial of this campaign opens with a helicopter, and then shows an unseen object being placed in a train car. The bulk of the commercial focuses on the train car being transported in different ways throughout the world, while onlookers stop what they are doing to watch. Stereotypical action movie music is played as the red train cars are transported, until they reach their destination; the consumer. One brave consumer opens the train car, and the commercial immediately changes to shots of people partaking in an extreme fitness and weight training routine as the music becomes more intense. “The Sport Of Fitness Has Arrived” appears, looking as though it was spray-painted on a wall, then the brands appear for the last two seconds of the commercial. (Youtube/Reebok, 2012) (Zmuda 2012).

CrossFit and Reebok brands. However, due to the fact that the Reebok/CrossFit agreement was signed for ten years, it will be likely to see more emotional end self expressive traits in the campaigns once familiarity is established.(Zmuna, 2012)

Adidas takes a creative route by focusing on big names and star power to bring attention to the company in its most recent campaigns. The “adidas by Stella McCartney” SS collection advertising campaign features multiple commercials of the same model featured wearing different clothing in different exotic locations with the same song “Education” by Femme. This campaign features a self-expressive appeal by making the brand fashionable and desirable to the audience. (SS12 Collection, www.youtube.com/adidas) The “Adidas All In” campaign features celebrities such as Katy Perry, Derrick Rose, and B.o.B, but focuses more on their star power rather than their academic performance (explaining why non athletes such as Katy Perry are being featured) (Youtube/Adidas, 2012). The use of celebrities is another self-expressive brand position, since they are not focusing on introducing the products, but rather depending on fans of these stars to purchase the products they are promoting. (Griner, 2011)

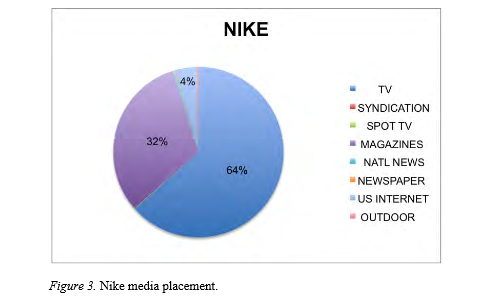

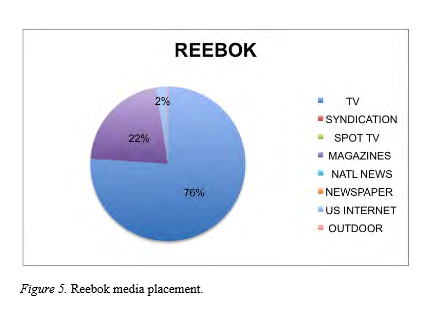

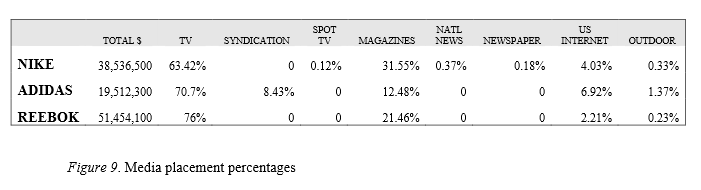

Like NIKE, Reebok put most of their advertisements on television (76%), magazines (22%), and the Internet (2%) (Appendix A, Figure 4). In addition, they also put advertisements outside (.23%), but their focus was more on the other three. Out of NIKE, Adidas, and themselves, Reebok was the company that had the least amount of diversity of ads (in the least amount of places) but spent the most money of these companies on advertising costs-totaling upto a whopping 51.4 million dollars (Ad$pender).

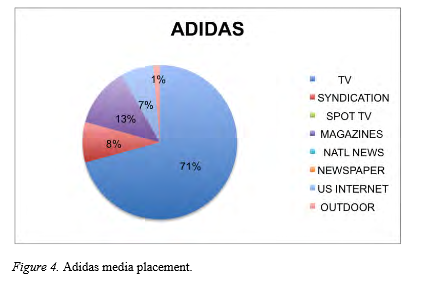

Last year, Adidas spent most of their advertising money on television (71%) and magazines (13%) like NIKE, but they also put more ads on syndication (8%), theInternet(7%),and outside advertisements (1%) compared to the other two companies (Appendix A, Figure 5).This gave Adidas an advantage because they had advertisements in two more places than NIKE-making people want to buy their brand and resulting in more overall sales. In addition, Adidas also spent the least amount of money on these ads-only adding up to 19.5 million in 2011(Ad$pender).

The biggest change that NIKE needs is to develop a stronger social media strategy campaign. For example, social media networks, like Facebook and Twitter, are the most usedwebsites of our typical NIKE target consumer. Since our target consumer is under the age of thirty years old, either male or female, lives in an urban area, and isn’t necessarily athletic but enjoys working out, these social media networks are fun and exciting for trying to attract this new kind of customer to our company. In the past, with our “Just Do It” campaign, we were focusing more on the competitive, dedicated athlete, when we need to be focusing more on the lifestyles that our target audience portrays in today’s society. NIKE shoes can be used in anyway a person wants to-whether it is competing against others, for fun activities or simply just for daily use. With our new campaign, #makeitcount, and addition to putting more advertisements on theInternet(specifically Facebook and Twitter), NIKE will soon catch up to our top competitors in the places where our target audience is-on social media networks.

With fresh campaigns each year, and sometimes many times per year, NIKE has the ability to keep in touch with its young consumers. A good example of such a campaign was the recent “Write the Future” campaign for consumer participation. A more recent call for amateur athletes to compete for a commercial spotlight was also successful. With famous tennis, footballand basketball stars, NIKE manages to stay trendy with young generations and hold their attention long enough to inspire.

In 2004, the Nike Foundation was established with the mission to improve the lives of adolescent girls in third world countries. Within the last decade, the company has paved the way for Fortune 500 companies to instate recycling programs and the reduction of carbon emission. NIKE has also been placed as one of the World’s Most Ethical Companies, Greatest Places to Work and Top Places To Launch A Career. For nine years, the company has also been voted as one of the Best American companies for gay, lesbian, bisexual, and transgender employees (Nike.com). With such a positive brand image, NIKE may seem indestructible, however, trouble came with the guilty plea to running an interstate dogfighting ring by endorser Michael Vick.Though the company’s partnership with Vick was terminated, more trouble arrived nearly nine years after sponsoring professional golfer, Tiger Woods, with the allegations and admittance of an extramarital affair.

Multiple endorsers of Woods did not remain with him when the scandal made headlines, but NIKE stood by their top producer of golf product sales, hoping for a steady rate of return in sales despite his misrepresentation. Though NIKE lost 105,000 customers, ditching Woods could have cost the company $1.6 million in profits (Schultz, 2010). Months after the breaking news faded, the company produced a television commercial with Woods’ father asking Woods questions about the scandal. Woods responded truthfully, fessing up to the dramatic incident of his infidelity. NIKE has also chosen to continue sponsoring Penn State athletics through the tumultuous sex abuse scandal involving head football coach, Joe Paterno, in 2011 and have no plans to change the name of their Joe Paterno Child Development Center building despite pressure by upset NIKE consumers (Thomaselli, 2011). Despite ethical concerns of consumers and critics, NIKE has continued to blossom in the face of adversity, also standing by NBA star,Kobe Bryant, after allegations of sexual assault.

To maintain a positive public image NIKE sponsors high school sports events, endorses a Reuse-A-Shoe program, and has made charitable donations of millions of dollars (Nike.com). However, work must be done to recover the company’s profile amongst human rights activists and organizations in the wake of multiple lawsuits in 2004. Nike has faced several obstacles when it comes to unequal pay of workers, harsh and toxic work environments, child labor, sexual harassment, and unionization (Teinowitz, 2003). Though NIKE attempted to regain positive perceptions with the “No Sweat Challenge” against internationally sweatshop-produced sneakers, they have not found much success.In 2008, Adidas began their “Celebrate Originality” campaign, which featured in-store workshops to create personalized shoes. Interactive television touchscreens and cameras were present to create a different, interactive, and memorable experience for the customers. The company also launched Adidas.tv featuring claymation films, celebrity Youtube videos, and shopping. An earlier partnership with denim apparel company, Diesel, inspired the Originals line for the “true aficionados” denim and sneakers. Like NIKE, Adidas has faced a few hardships, namely through charges of withholding employee compensation (Mirando, 2012). The company promised there would be no future abuses.

Reebok has approached demographics differently in their sales and campaigning. In 2005, the company launched a young Latino website called Barrio BBK for the U.S. Hispanic market. The site features videos, games, and music. Everything is written in Spanglish, indicating a sense of assimilation, the music is reggaeton, the feel is urban, and the advertisements feature famous Latino singers, actors and athletes. Following the success of the site was Reebok’s partnership for the production of a new sneaker with Daddy Yankee. This partnership was a smart move, as Daddy Yankee is an enormous Latin pop icon. The company has also worked with singers Katy Perry and B.o.B., athlete David Beckham, and the infamous Kardashian family. Reebok has had difficulties in their public relations department due to failed guarantees of their Reetone sneakers. With many dissatisfied customers, Reebok has been forced to pay $25 million in FTC violations (Crain, 1997). In addition, the “EasyTone” campaign that attempted to promote the Reetone in its early days failed because of it’s alleged sexism and blatant objectification.

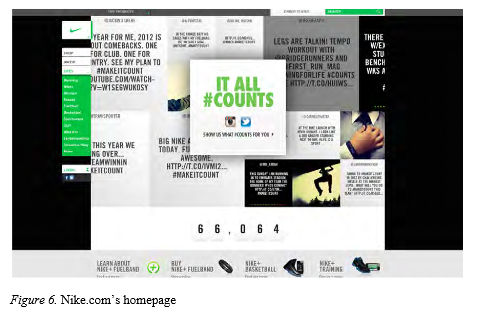

NIKE Inc. has a range of interactive tools that allow users to experience the brand first-hand (Nike, 2012). The repetitive use of Twitter.com hash tags and the ability for users to share experiences help consumers hear the thoughts of their peers and adopt opinions. A Pew Research Center survey conducted in 2011 found,“Twitter use by Internetusers ages 25-34 has doubled since late 2010 (from 9% to 19%)” (Smith, 2011). This survey also explains users are twice aslikely to use Twitter if they live inurban areas, which directly appliesto our target segment.

Overall, the exceptional interaction level offered by Nike.com helps build positive feelings about the brand by making the NIKE brand transparent and accessible.

A variety of NIKE Inc. child websites provide sport-specific information for competitive athletes.

This ensures users will visit the NIKE Inc. website for activities separate from online purchasing. This strategy heightens the likelihood of brand exposure and adds to users’ value of the NIKE brand. The overall experience of NIKE.com is improved for users whoseinterests align with these child websites; however, casual runners are not addressed in most of the content.

NIKE.com excels in both function and aesthetic (Appendix A, Figure 6). Awwards.com lists one of NIKE’s child websites as a “Best CSS Website”, a prominent design award (CSSAwards, 2012). Nike.com’s simple interface ensures a pleasant user experience through the conventional navigation system, clear language, and concise content. Action photographs of athletic, healthy men and women are featured on most of the pages. Overall, the website’s style works to create a young,energetic image for Nike.com.

reading about Adidas basketball on Facebook or following Adidas marketers on Twitter.However, most of the Adidas interaction options are geared towards competitive athletes through the intimidating imagery, titles, and content. Specific options for casual or beginning runners are not included on the homepage.

Adidas website is centered around sales. Instead of creating content or articles to entice visitors to stay on Adidas.com and interact with their products, Adidas’s main navigation contains links to sub-brands. These pages contain a few story previews and video clips, but they focus on products and product descriptions. Casual runners will find no specific informationrelating to their athletic apparel or shoe needs in these pages.

Aesthetically, Adidas is similar to Nike, providing a clean layout and interesting visuals (Appendix A, figure 7). Photographs feature professional athletes and interesting action shots, but fail to reference casual runners. The function of the website is effective. Users can easily find 20 products, information, and interaction opportunities.

Reebok launched a new website on March of this year. The website focuses on an interaction element similar to the up-and-coming social media trend of “pinning”. Videomaterial, articles, and images are all linked on the homepage and serve as interesting, interactive elements for users. In addition to this “pin board” interaction, a search bar located near the primary site navigation allows users to search for ‘what they want’ with just a few keystrokes (Reebok International Ltd., 2012).

With the redesign, Reebok added much more accessible and applicable content. Now, articles and tutorials are placed on the homepage where viewers will quickly see them. This brand interaction will help Reebok keep visitors on their website for activities besides shopping.

The new aesthetic and function of Reebok.com are almost equal that of NIKE and Adidas(Appendix A, figure 8). The website is functional and simple to navigate, providing the trendy “pinboard” navigation and clear secondary link system. Similarly, the design is simple, minimalistic, appealing to young visitors.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2015). Nike Inc. Situation & SWOT Analysis. Retrieved from https://myassignmenthelp.com/free-samples/nike-inc-situation-swot-analysis.

"Nike Inc. Situation & SWOT Analysis." My Assignment Help, 2015, https://myassignmenthelp.com/free-samples/nike-inc-situation-swot-analysis.

My Assignment Help (2015) Nike Inc. Situation & SWOT Analysis [Online]. Available from: https://myassignmenthelp.com/free-samples/nike-inc-situation-swot-analysis

[Accessed 30 May 2025].

My Assignment Help. 'Nike Inc. Situation & SWOT Analysis' (My Assignment Help, 2015) <https://myassignmenthelp.com/free-samples/nike-inc-situation-swot-analysis> accessed 30 May 2025.

My Assignment Help. Nike Inc. Situation & SWOT Analysis [Internet]. My Assignment Help. 2015 [cited 30 May 2025]. Available from: https://myassignmenthelp.com/free-samples/nike-inc-situation-swot-analysis.