Section I: Trend – General Motors

For your course project, assume you have just earned your master's degree in finance and are now employed by the Cosmo K Manufacturing Group. Your employment is contingent on your successful completion of several tasks over the next four weeks and the successful completion of a comprehensive exam to obtain company certification in finance. Each week, your supervisor, Gerry, will assign you projects of interest to the company that will test your competence in finance. Under these projects, you will be required to complete several specific tasks.

You will conduct a ratio analysis and a trend analysis for a company of your choice, one which is listed on the New York Stock Exchange (NYSE) or the National Association of Securities Dealers Automated Quotations (NASDAQ). I have not picked a company yet so you can pick one.

Gerry has decided that you need some experience in evaluating other firms in the marketplace. Accordingly, he has asked you to select any company listed on the NYSE or the NASDAQ. For your selected company, identify and download the most recent financial statements for the last three to five years, to include the following:

• Balance sheet

• Income statement

• Per share data

Tasks:

Gerry would like you to complete the following tasks and submit your report by the end of the week:

• Identify the predominant industry in which your company operates. Find the industry averages for that industry for the following ratios:

o Current ratio

o Debt ratio

o Quick ratio

o Debt-equity ratio

o Total asset turnover

o Profit margin

o Inventory turnover

o Return on assets

o Receivables turnover

o Return on equity

• Calculate as many of the listed ratios for your selected company as possible using the financial statements you acquired.

• Conduct a trend analysis for the last three to five years. What trends can you identify? What do they indicate?

• Compare the ratios for the last common year to the industry averages. What conclusions can you draw regarding your company's performance? What are your company's strengths and weaknesses?

• Identify the changes that need to be made by the company to improve its performance, as compared to the industry, on the basis of the ratios.

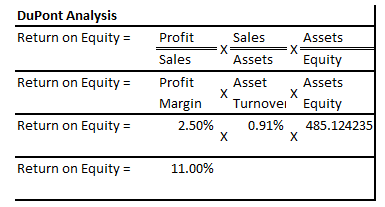

• Conduct a DuPont analysis for your selected company. What conclusions can you draw for improving your company's performance on the basis of this analysis?

This report aims to perform ratio and trend analysis for General Motors – NYSE listed corporation engaged in automobile industry. Data has been sourced from www.Morningstar.com for General motors and other peers operating in the industry. Since this analysis involves working on ratios which are absolute numbers, reporting of financial data in different currencies have been ignored.

Section II – Industry Comparison

Section I provide insights into trend analysis of General Motors. Latest financial performance and ratios are compared with the industry peers in Section II. Section III suggests areas of improvement for General Motors to improve its financial performance using Ratio Analysis. Section IV uses DuPont Analysis to provide suggestions on bettering the current financial performance.

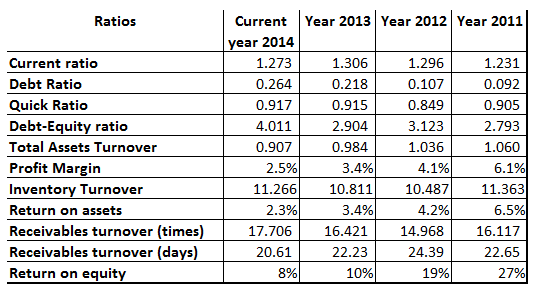

Trend of ratios - General Motors

Source: Financials obtained from www. Morningstar.com for trend analysis

Interpretation: From the trend above, it is noted that there the quick ratio has been consistent over the period and is pegged at around 0.9 indicating steady liquidity position for General Motors. It suggests that the company has sufficient liquid assets to meet its current obligations. Similarly the current assets ratio has also been stable at around 1.2-1.3 times. Debt ratio which is calculated as the ratio of debts to total assets, have seen a steady rise from 0.09 (9%) in 2011 to 0.264 (26%) in 2014. This is corroborated by the trend in Debt-Equity ratio as well. Here Debt-Equity is measured as ratio of Total liabilities to Total Equity. Debt-Equity ratio has increase from 2.793 in 2011 to 4.011 in 2014. This either implies that General Motors have increased its debts or there has been decline in shareholders equity during the same period. General Motors’ profit margin has been declining over the period as is also evident from the declining trend in Return on equity and Return on Assets. The inventory turnover and receivables turnover has been fairly stable for General Motors. Total Assets turnover has fairly stable as over the 4 year period.

Industry comparison:

Source: Financials obtained from www. Morningstar.com for ratio analysis

Interpretation: General Motors’ current ratio is marginally better than the industry whereas its quick ratio is lower than the industry. It has been able to recover its dues from its debtors at a much faster rate than the industry. However, its ability to sell its inventory is lower than the industry. Peers in the industry have Debts of 37% of its Total Assets as against General Motors’ 26%. However, its Debt Equity ratio is fairly aggressive as against peers in the industry. Debt-Equity ratio of 4 indicates that the company’s 80% financing is from Debts.

- Collection from receivables of General Motors is very quick vis-à-vis the industry

- Current ratio of General Motors is slightly lower than the industry and so is tis quick ratio. Thus it is fairly poised to meet its current obligations without unnecessary strain on its liquidity

- Assets turnover is higher indicating efficiency in its operation of General Motors (Anon, n.d.)

- Aggressive weightage on debts for financing its activities

- Inventory of General Motors take more time to be sold than the industry

- Lower return on equity mainly due to huge reliance on debts

- General motors have been generating lower return on its assets

Suggestions as under:

- General Motors need to work on improving inventory turnover ratio. This will reduce its strain on its working capital and better its current and quick ratios

- General Motors needs to evaluate the reduction in reliance on external sources of funds for its business

- A lower quick ratio despite lower debtors turnover implies utilisation of its short term funds for financing long term debts in addition to raising more debts in the process

DuPont analysis is an effective tool to gauge the company’s efficiency in generating profits, management of assets and striking a critical balance between owned and borrowed funds. (Wayne, 2012).

General Motors has significantly higher reliance on external sources of funds which has an increasing effect on Return on Equity. Reduction in Debts will have a direct increasing impact on the Return on Equity. Low Asset turnover indicates General Motor’s ineffective in utilising its assets to drive sales reflecting idle fixed assets or high inventory turnaround time (Peavler, 2014).Further, General Motors operates on slim margin of 2.5% which is lower than the industry in which it operates.

Anon n.d., Assets Turnover Ratio, [Online], Available at: https://www.investopedia.com/terms/a/assetturnover.asp, [Accessed date: January 18, 2016]

Morning Star, 2016, Financials for various companies, [Online], Available at: https://financials.morningstar.com/income-statement/is.html?t=GM®ion=USA&culture=en_US, [Accessed date: January 18, 2016]

Rosemary Peavler, 2014, What is Total asset turnover and how is it calculated?, [Online], Available at: https://bizfinance.about.com/od/financialratios/f/Total_Asset_Turnover.htm, [Accessed date: January 18, 2016]

Wayne Thorp, 2012, Deconstructing ROE: DuPont Analysis, [Online], Available at: https://www.aaii.com/computerizedinvesting/article/deconstructing-roe-dupont-analysis, [Accessed date: January 18, 2016)

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2016). Essay: Ratio And Trend Analysis Of General Motors.. Retrieved from https://myassignmenthelp.com/free-samples/ratio-trend-analysis-general-motors.

"Essay: Ratio And Trend Analysis Of General Motors.." My Assignment Help, 2016, https://myassignmenthelp.com/free-samples/ratio-trend-analysis-general-motors.

My Assignment Help (2016) Essay: Ratio And Trend Analysis Of General Motors. [Online]. Available from: https://myassignmenthelp.com/free-samples/ratio-trend-analysis-general-motors

[Accessed 31 May 2025].

My Assignment Help. 'Essay: Ratio And Trend Analysis Of General Motors.' (My Assignment Help, 2016) <https://myassignmenthelp.com/free-samples/ratio-trend-analysis-general-motors> accessed 31 May 2025.

My Assignment Help. Essay: Ratio And Trend Analysis Of General Motors. [Internet]. My Assignment Help. 2016 [cited 31 May 2025]. Available from: https://myassignmenthelp.com/free-samples/ratio-trend-analysis-general-motors.