Core competences

Discuss about the Case Study for Strategic Analysis of General Electric.

The following reports tends to evaluate the multitudes of strategic decision making processes applied by the company in terms of increasing market share, mitigating the level of risks pertaining to engagements in financial and technological sectors. Application of numerous sets of strategic management tools taking into consideration the industry dynamics along with the diversity in terms of operations of GE are made. The implementation of balanced scorecard method was made in order to assess the company’s strategies in terms of multiple criterions primarily the financials, consumer perspectives regarding the company. Moreover, evaluation of leadership of Jack Welch and Jeff Immelt has been made in regards to strategies, corporate restructuring policies along with discussion on whose approach can be followed by the company.

The company has succeeded towards creation of major degree of core competence both in terms of external measures such as market consolidation, ability to penetrate newer markets rapidly through usage of knowledge gained in course of operating in other markets (Geenergyfinancialservices.com. 2016). De Barros and Medeiros (2013) stated that underpinnings pertaining to prevailing market conditions tends to facilitate intense rivalry between firms, and those firms that succeeds towards creating synergies among its different sets of operations tends to benefit majorly. The presence of GE in various high growth industries enhanced the company’s ability at transferring the degree of risk from one industry domain onto another. Moreover, Král and Králová (2016) states the fact that higher degree of market presence results towards enhancement of market exposure by the firms thereby assisting towards collection of material information on lesser time frame than its competitors. Operations in over 170 countries worldwide has facilitated towards gaining higher quantum of market exposure enabling the company in policymaking and strategizing taking into changing market dynamics. Zentner (2015) advocated the fact that in order to improve revenue generation capability and streamlining introduction of newer sets of products, upkeep of relevant advancement in technology and strategy is prerequisite. Moreover, reliance on emerging global trends in order to undertake future expansionary measures facilitates towards creation of entry barriers by the company once it is able to capital upon such trends (GE Capital Global Holdings. 2016). In terms of internal competencies the company employs the best talents around the globe for its operations and has succeed in bringing in high level of diversity in workplace through recruitment of accountants, auditors, engineers, physicists amongst others (Financial Times. 2016).

Strategic analysis

Strategic analysis comprises of evaluation of a firm’s current and prospective frameworks of operations. Strategy analysis is focused upon the investigation of the degree of alignment of the firm’s strategy with that of its long-term objectives. Moreover, it aims towards ensuring that the co-ordination among the company’s different sets of financing, operating along with the investing activities is complementary to each other. General Electric has operations in over 170 countries with employee strength of over 330,000 as based on data available on December 2015 (Ge.com. 2016). In terms of stock market operations, the company has been listed in NYSE, Euronext Paris and London Stock Exchange among others. The company is engaged in several businesses pertaining to aviation, healthcare, lighting, transportation, power generation, energy resources, electricity, oil & gas distribution, renewal energy and capital (Ge.com. 2016)

General Electric Corporations is engaged in multiple sectors comprising of operations in power generation and hydro generations, healthcare services along with providing capital procurements towards different sets of industries. The company was founded in 1892 and has its headquarters in Boston, Massachusetts. The products offered by GE includes electricity and water distribution facilities, energy products comprising of petroleum and LPG products, aerospace engines, electrical motors, healthcare services and software solutions to other industries. The company, after a tumultuous financial period leading to downgrading of its securities and large financial losses with regards to GE Capital, the primary source of revenue generation by GE, has focused upon gaining market share through offering innovative products. Moreover, the company has increased expenditure pertaining to research and development and aims towards introducing newer sets of services and products that stretches its product line and results in catering to larger segment of the markets (ge.com. 2016).

The major sets of competitors of General Electric comprise mainly the electrical appliances companies. Primary among such competitors are Emerson Electric Company, NACCO Industries, Harman International, Sony Corporation and Whirlpool Corporation (NASDAQ.com. 2016). In case of its healthcare services the company faces major competition from Toshiba Corporations along with Siemens and Phillips Healthcare (Hoovers.com. 2016). The oil and natural gas unit of GE has Baker Hughes Incorporated, Schlumberger Omnes, Inc. and Archrock Inc competing against the company (NASDAQ.com. 2016)

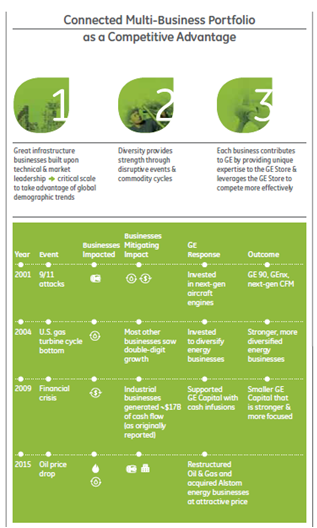

Figure 1: Portfolio of GE over the Years

(Source: ge.com, 2016)

The major recalibrations made by the GE Group in terms of changes made in portfolio are aimed towards diversifying its activities amongst healthcare, energy and financial services sectors. Moreover, even though transportation business has displayed large profit margins, the company has not taken initiative towards expansion of its investing activities pertaining to transportation services and products. Moreover, large acquisition of firms known for their innovations in healthcare provides evidence that the firm focuses on diversifying from its core businesses to include newer sets of portfolio that increases the overall portfolio returns along with high growth prospects.

Competitors

Relevant Strategies:

The immediate objective of GE should be to improvise upon its global presence in coming up with newer sets of products that tends to cater to the emerging trends in global markets such as investments in solar powered energies. Moreover, portfolio of the company needs to include higher percentage of application-based technologies. Further, inclusion of research and development of Artificial Intelligence can result in heightened degree of financial prospects as the sector provides major returns on investments. Much of GE’s woes came from the fact that the company has been a conglomerate and despite reducing the number of sectors from company’s portfolio, the firm has been unsuccessful at repeating the levels of earnings that it previously did. Thereby dissemination of a portion of the company, onto sectors that have high growth rate but current returns from which showcases inadequacy, can in fact improve the decision-making and strategizing activities. Further, with the advent of nuclear non-proliferation treaty the company can cater to significant amount of foreign governments towards meeting their energy requirements using nuclear energy.

Figure 2: Snapshot of company strategies in accordance with market trends

(Source: ge.com. 2016)

Balance scorecard enables organizations, both profitable and non-profitable ones, in evaluating the degree of deviations of the company’s financial and operating performance from its strategic objectives (Schmidt. 2015). The balance scorecard approach presents managers with four sets of strategic analysis alternatives to assess the degree of non-alignment between business decisions and the strategies of organizations. Moreover, Gobble (2012) states that through assessing growth prospects, internal operations, enhanced value creation for its consumers in accordance with effective financial and management and policy making the degree of non alignment can be gauged.

Figure 3: Balanced Scorecard Framework

(Source: As created by the Author)

The strategic shifts in GE’s operations through higher priority for its financial services along with the infrastructural businesses are a result of corporate restructuring. Divestments from activities that has slow growth rate and entering into businesses with stronger growth prospects is a priority for the company and shifting of its business from consumer electronics to financial services showcases the strategic shifts in portfolio management. Presence of the company in 170 countries provided scope for initiating cultural diversity at workplace. Moreover, contributions towards growth and revenue earning abilities of the company followed by larger pool of prospective employees to choose from has enabled the company towards bringing in various sets of expansions in operations into day to day operations in order to improvise upon business decision making of the company.

Relevant Strategies

Longer-term strategies of GE focus on recalibrating the business portfolio in terms of reducing the beta factors from its broad set of investments. The degree of dependence upon GE Capital as the primary source of revenue of the GE Group has to be reduced over time. The volatility in regards to the financial sector followed by weaker sets of regulation imposed by the Federal Reserve and the SEC has vitiated the reliability of revenue generation from financial services (Geenergyfinancialservices.com. 2016). However, diversification in terms of portfolio through mitigating risks from sectors and operations providing low rates of growth onto investments that have high growth prospects can improvise the overall, financial performance along with efficiency and solvency position of the company.

The company expanded its presence in the electronics market through newer sets of domestic and industrial appliances (Ge.com. 2016). Through facilitating diagnostic instruments such as CT and MRI scanners in its healthcare services the company and expansions of its healthcare services through numerous acquisitions of diagnostics units GE’s objectives was to improve its perception of a reliable brand among its customer base (Ge.com. 2016). Assisting consumers towards the decision-making processes regarding selection of products that compliments their activities and preferences can be beneficial for GE in terms improving the customer retention statistics. Benefits of a long product line catering to large segments of market can lead towards the consolidating the brand image among consumers.

GE has managed to diversify its business operations on multiple occasions based upon the emerging sets of opportunities that came up in the manufacturing services. The diminution of its income prospects as an aftermath of the global financial crisis resulted in stringent sets of policy implementations (Sorkin, 2015). Moreover, the potential opportunities in financial sectors around the globe have resulted in larger proportion of GE Capital in the overall portfolio. Over 65% of the GE group’s revenue arises from markets outside the United States, resulting in higher growth prospects in markets such as South Asia and the Middle East. GE’s business is growing at double-digit figures in emerging markets. Whereas, in rising economies such as Brazil, China in addition to India the growth figures are even larger touching growth rates of over 20% (ge.com. 2016). Moreover, despite a high growth in its transportation businesses GE’s automotive and locomotive businesses continue to be outside of its core businesses.

The primary strategy pertaining to GE shall have to be lesser degree of reliance upon financial services despite GE Capital coming close to asset and capital management capabilities of large banks such as CITIGROUP, Goldman Scahs and Bank Of America. The secondary strategy should be towards diversification of activities onto newer domains that stands to gain huge profits over longer terms such as Artificial Intelligence, Solar Energy and Super Sonic Aviation. Higher expenditure on product innovations, more emphasis upon marginal expansion, and optimal allocations of financial and non-financial resources is what the GE’S strategy is based upon. Creation of new sets of growth framework is to be prioritized by the company’s higher management. Increasing sets of investments in the fundamental technology sector followed by incremental participation of the company into coupling of manufacturing and advisory services can be beneficial towards streamlining the present policy implementation. The initiation of converging advisory services along with product innovation has beneficial for the company in the recent past. For instance after initiating the Durathon Plant, the company focused upon providing consultation and assistance regarding the selection of battery sources and configuration that solves the energy requirements of its consumers. Moreover, the company has to reinstate its strategies in the energy sector in a manner of reducing manufacturing of energy products that yield low sales volume. Instead, the company should foster divergence of its strategies into reselling products of other manufacturers in markets that GE has a better accessibility than such manufacturers. GE has had been able to showcase the reinvention of its marketing strategy that puts emphasis upon capitalizing on competitor’s lack of market exposure as compared to GE (Albany Business Review., 2016). The company should be cautious towards acceptance of large-scale acquisition spree whereby the constraints of becoming a market leader are heightened through ambiguous preferences of consumers and complex nature of products. The past year saw the operations of GE diversifying into consulting services about financial instruments followed by an initiative to increase its presence towards energy storage sector as the company recalibrated its aims to capitalize upon emerging issues pertaining to energy requirements (Geenergyfinancialservices.com. 2016).

Balanced Scorecard Framework

Jack Welch was instated as the CEO of General Electric in the year 1981 following an exit of Reginald Jones. Welch focused upon expansion of the company through diversifying activities from its initial business of electricity, power and lighting of the company into newer sectors such as financial services, automation, and medical apparatus (The Economist. 2016). Under his guidance, the management approach along with the company approach has been towards providing products that are simple in nature but has high amount of functionality. In terms of management decision-making approach, Welch has been instrumental towards bringing in concepts of constructive conflicts in functioning of operations and production managers. Moreover, Jack Welch advocated the prevention of bureaucratic processes ongoing at the time he joined General Electric and implemented management reforms that are focused upon improving the quantum of openness, linearity in decision-making and fostering of creative atmosphere (The Economist. 2016).

During his tenure as CEO of GE, Jack Welch had initiated massive restructuring pertaining to the company’s portfolio. His decisions pertaining to acquisition has aimed at industries that had high rate of growth along with incremental returns over the long periods. Moreover, he recalibrated the organizational structure of the company through massive job cuts and eliminated multilayered hierarchy of the management. Massive forms of restructuring through sellout of business with low profit and inclusion of sectors onto the company portfolios that have been amongst the topmost achievers in their domain has been key trademark of Jack Welch’s approach (Financial Times. 2016). Moreover, such restructuring resulted towards movement of the company into technology driven industry domains along with service sectors.

Under Welch’s management, the line managers were provided targets pertaining to cost of production and budgetary costs regardless of the prevailing market conditions. Further, Jack Welch changed the process of procuring annual and quarterly financial targets through transferring the target setting procedures from the purview of line managers onto the accounts controller. The high amount of paper work involved in the budgetary processes were replaced through use of five page standard playbook that tends to present the shortcoming and functional issues faced by the company (Financial Times. 2016).

Jack Welch initiated the process of imbibing and developing leadership skills among the lower managements along with management trainees through enhanced exposure of the company’s decision-making culture, introduction of mentoring scheme along with provision of high incentives. He also introduced the performance based bonus system in place for the higher and mid level managerial personnel and such initiatives resulted towards heightening the process of talent recognition. Prior to his retirement, Jack Welch focused towards rewarding the top 20% performing employees while relieving the bottom 10% of their duties from the company thus providing the employees with the impetus of working efficiently to get into the top 20% or face the risks of relegation to the bottom 10%. “The implementation of six sigma function in the operations of General Electric can be attributed to Welch post which the deliverance of production, service and line managers improved considerably” Gary Hamel (Harvard Business Review. 2012). The emergence of GE Capital occurred during the “Welch Era” which resulted in the financial service section of the company becoming the largest source of revenues for the company (Mycc.cambridgecollege.edu. 2016). GE Capital amassed a vast segment of financial services sector providing all forms of services in terms of capital procurement, investment activities, trading, medical and health insurances along with loan advisory services (Geenergyfinancialservices.com. 2016). In times where diversification policies were experiencing massive financial downturn resulting in unpopularity of such policies, Jack Welch continued diversifying GE’s activities resulting and thereby highlighted the substantial opportunity of high income and mitigation of tailed risks from one industry to another.

Figure 3: General Electric portfolio in 2001

(Source: ge.com 2016)

The initiative undertaken by the GE management under the leadership of Jack Welch resulted in globalization of business operations with widespread expansion in market activities outside of North America. These expansionary measures resulted towards implementing knowledge derived from a separate market based in a separate geographical location onto other markets that GE operated in (The Economist. 2016). Moreover, the process of market penetration and consolidating activities were streamlined during Welch’s tenure creating an overall synergy enhancement by parallel developments of diversification and market expansion (The Economist. 2016). During the tenure of Welch, the business portfolio saw an increase by manifolds through inclusion of GE Aircraft, GE Plastics, GE Capital and GE Specialty Materials. Moreover, awarding Welch with the CEO of the Century title during 1999 highlights the enormous contribution he had upon GE.

Jeff Immelt took over the role of CEO in the year 2001 from his predecessor Jack Welch bringing in management style and strategic decision making that were vastly divergent to that of his predecessor. Immelt followed a policy of improving the morale and levels of motivation pertaining to the employees and managerial personnel of GE through limiting the quantum of stringent performance evaluation that prevailed during Jack Welch’s time (Harvard Business Review. 2012). Moreover, the level of job insecurity that was prevailing at GE prior to Immelt’s joining has dropped considerably with Immelt bringing in newer sets of policies that focused more upon integration and employee co-ordination rather than employee motivation (Financial Times. 2016). The occurrence of 9/11 right after his appointment as CEO followed by large sets of financial scandals in the North American markets led towards exacerbating investor’s grievances along with skepticism on the part of various other stakeholders concludes Gary Hamel (Harvard Business Review. 2012). The imminent result was a faltering in the stock prices of the company by magnitudes unseen by its investors. Immelt reiterated the fact the objective of the management should be to foster long-term growth instead of focusing upon policies that tends to cater to short terms instances of high profit margins and EBITDA (Sorkin. 2015). Under his leadership, the transparency of the company’s financial and operating activities was enhanced and facilitated improved dissemination of information pertaining to the customers, creditors, corporate regulators and industrial community.

Jeff Immelt initiated the processes of parlance between the degrees of diversifying activities in terms of conglomeration along with fostering creation of subsidiaries that were market leaders in their respective sectors. Immelt laid down newer sets of strategies through identification of emerging issues that are anticipated to have repercussions globally such as imminent energy crisis, shifts in manufacturing and production, globalization of R&D activities in production industries, nanotechnology in addition to emergence of technology driven healthcare facilities (ge.com. 2016).

Figure 2: GE portfolio in 2012

(Source: ge.com 2016)

In during the mid 2000s Immelt announced restructuring of GE’s portfolio, thereby reducing dependency on plastics and insurance business. Whereas on the other hand, taking up the level of financial services and capital lending by the firm onto higher proportion of the total portfolio (Král and Králová, 2016). Jeff Immelt reinstated the performance benchmark pertaining to the company through setting up targets of achieving growth rate at 200-300% of that of global GDP rate. However, the performance analysis pertaining to the company displayed the fact that in terms of revenue figures not much improvement can be seen after Jeff Immelt took over. Moreover, the return on equity along with the ROIC has dropped from the levels of 26% and 27% in 2001 to 14.2% and 11.9% in 2012 thereby highlighting a fall in investor’s earnings (Ge.com. 2016). The strategies Immelt followed towards lowering dependency of GE on financial services and increasingly diversifying its activities onto technology driven services and manufacturing heavy activities assisted GE towards mitigating repercussions of financial crisis.

Figure 4: Proposed restructuring of GE portfolio.

(Source: ge.com 2016)

Expansion of its global operations in both emerging and developed markets along with up gradation of product manufacturing base has been initiated under the leadership of Immelt. The reposition of GE by Immelt onto sectors that are manufacturing and technology based led to lowering the quantum of exposure to the global financial crisis with creation of buffer (The Economist. 2015). During current tenure of Jack Immelt, the company oversaw massive strategic shifts as GE recalibrated itself for nuclear-based power plant services along with entering the healthcare sector through manufacturing high resolution imaging devices for medical diagnostics.

The comparison amongst the leadership of Jack Welch and Jeff Immelt highlights the fact that under Welch the company has undergone massive expansionary measures and diversification whereas under Immelt the company has showcase higher levels of adaptability to prevailing market conditions. In terms of present volatile business scenarios, GE requires a manager who will be able to foresee the restructuring of portfolio according to market opportunities. Moreover, in order to alleviate the revenue generation margins the company has to set up stricter targets for its managers and employees to achieve. Thereby, for diversification of activities Jeff Immelt’s style of leadership is preferable over that of Jack Welch. However, massive depletion in the levels of returns displays the fact that Jeff Immelt has largely been unsuccessful at carrying on the quantum of market consolidation as that of his predecessor. Thereby, it can be assumed that Jack Welch leadership would have been more preferable for GE over that of Jeff Immelt.

Conclusion:

The portfolio of GE has displayed considerable changes over the years displaying the level of dynamism that such company has been subjected to under the leadership of Jack Welch previously followed by Jeff Immelt. The company witnessed highest degree of expansion under the guidance of Jack Welch. However, the strategies implemented by Jack Welch during his tenure pertaining to the incentive structure focused upon short-term profitability and financial benefit based on employee performance instead of focusing upon value creation in terms of product services. GE should be able to put more amount of focus on the present position of the firm by focusing on the reshaping of the policies for the business by way of the setting up of the health care facilities, energy sector, and broadcasting and entertainment facilities. The positioning strategy further includes the different types of strategies implemented for providing an exit process for the slow-growth areas in the business and the reallocation of these resources for the implementation of the different types of growth strategies to enter into new business ventures. Perspective applied by the company for the positioning is further based on creating a way for the growth platforms for the purpose of the new business policies.

References and Bibliography

Abdallah, C. and Langley, A., 2014. The double edge of ambiguity in strategic planning. Journal of Management Studies, 51(2), pp.235-264.

Albany Business Review. (2016). GE executives turn former Quirky building into innovation hub - Albany Business Review. [online] Available at: https://www.bizjournals.com/albany/morning_call/2016/03/ge-executives-turn-former-quirky-building-into.html [Accessed 24 Sep. 2016].

Al-Essa, R.K., Al-Rubaie, M., Walker, S. and Salek, S., 2015. The Strategic Planning Process of the GCC Regulatory Authorities: Barriers and Solutions. In Pharmaceutical Regulatory Environment (pp. 205-229). Springer International Publishing.

Alshaher, A.A.F., 2013. The mckinsey 7S model framework for e-learning system readiness assessment. International Journal of Advances in Engineering & Technology, 6(5), p.1948.

Arrfelt, M., Wiseman, R.M., McNamara, G. and Hult, G.T.M., 2015. Examining a key corporate role: The influence of capital allocation competency on business unit performance. Strategic Management Journal, 36(7), pp.1017-1034.

Chungyalpa, M.W. and Bora, B., 2015. Towards conceptualizing business strategies. Int. J. Multidiscip. Approach Stud, 2(1).

Cieśla, M., 2016. Sustainable Logistics Strategies of Transnational Corporations. Sustainable Logistics and Strategic Transportation Planning, p.347.

de Barros Jerônimo, T. and de Medeiros, D.D., 2013. Enabling the strategic planning of small and medium-sized information technology through advanced results: a configurational perspective of Mintzberg 5Ps. International Journal of Business Innovation and Research, 7(6), pp.663-678.

Dibrell, C., Craig, J.B. and Neubaum, D.O., 2014. Linking the formal strategic planning process, planning flexibility, and innovativeness to firm performance. Journal of Business Research, 67(9), pp.2000-2007.

Dixon, T.S., 2014. Assessing an animal humane society using McKinsey's 7s framework to make recommendations for organizational improvement (Doctoral dissertation, PURDUE UNIVERSITY).

Engert, S., Rauter, R. and Baumgartner, R.J., 2016. Exploring the integration of corporate sustainability into strategic management: A literature review. Journal of Cleaner Production, 112, pp.2833-2850.

Financial Times. (2016). General Electric: Post-industrial revolution - FT.com. [online] Available at: https://www.ft.com/content/81bec2c0-b847-11e5-b151-8e15c9a029fb [Accessed 14 Sep. 2016].

Frost, F.A., 2015. New Product Development-Biotechnology in Australia. In Global Perspectives in Marketing for the 21st Century (pp. 287-296). Springer International Publishing.

GE Capital Global Holdings, L. (2016). GE Capital Global Holdings, LLC: Private Company Information - Businessweek. [online] Bloomberg.com. Available at: https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=473054 [Accessed 14 Sep. 2016].

Ge.com. (2016). Fact Sheet. [online] Available at: https://www.ge.com/about-us/fact-sheet [Accessed 13 Sep. 2016].

Geenergyfinancialservices.com. (2016). Energy Financing, Energy Investing | GE Energy Financial Services. [online] Available at: https://geenergyfinancialservices.com/ [Accessed 14 Sep. 2016].

Geenergyfinancialservices.com. (2016). Energy Financing, Energy Investing | GE Energy Financial Services. [online] Available at: https://geenergyfinancialservices.com/ [Accessed 14 Sep. 2016].

Gobble, M.M., 2012. Innovation and strategy. Research-Technology Management, 55(3), pp.63-67.

Goetsch, D.L. and Davis, S.B., 2014. Quality management for organizational excellence. pearson.

Gold, S. and Heikkurinen, P., 2013. Corporate responsibility, supply chain management and strategy: In search of new perspectives for sustainable production. Journal of Global Responsibility, 4(2), pp.276-291.

Gyepi-Garbrah, T.F. and Binfor, F., 2013. An Analysis of Internal Environment of a Commercial-oriented Research Organization: Using Mckinsey 7S Framework in a Ghanaian Context. International Journal of Academic Research in Business and Social Sciences, 3(9), p.87.

Hbs.edu. (1993). Jack Welch: General Electric's Revolutionary. [online] Available at: https://www.hbs.edu/faculty/Pages/item.aspx?num=12836 [Accessed 14 Sep. 2016].

Hirsch, S., Burggraf, P. and Daheim, C., 2013. Scenario planning with integrated quantification–managing uncertainty in corporate strategy building. foresight, 15(5), pp.363-374.

Hoejmose, S., Brammer, S. and Millington, A., 2013. An empirical examination of the relationship between business strategy and socially responsible supply chain management. International Journal of Operations & Production Management, 33(5), pp.589-621.

Hoovers.com. (2016). !company_name! Names of Competitors. [online] Available at: https://www.hoovers.com/company-information/cs/competition.GE_Healthcare_Ltd.8c78e7e9616a2aea.html [Accessed 12 Sep. 2016].

Ibrahim, A.B., 2015. Strategy Types and Small Firms' Performance An Empirical Investigation. Journal of Small Business Strategy, 4(1), pp.13-22.

Kim, K.H., Jeon, B.J., Jung, H.S., Lu, W. and Jones, J., 2012. Effective employment brand equity through sustainable competitive advantage, marketing strategy, and corporate image. Journal of Business Research, 65(11), pp.1612-1617.

Král, P. and Králová, V., 2016. Approaches to changing organizational structure: The effect of drivers and communication. Journal of Business Research.

Kruehler, M., Pidun, U. and Rubner, H., 2012. How to assess the corporate parenting strategy? A conceptual answer. Journal of Business Strategy, 33(4), pp.4-17.

Lo, F.Y., 2013. The dynamic adjustment of environment, strategy, structure, and resources on firm performance. International Entrepreneurship and Management Journal, 9(2), pp.217-227.

Minoja, M., 2012. Stakeholder management theory, firm strategy, and ambidexterity. Journal of Business Ethics, 109(1), pp.67-82.

Mycc.cambridgecollege.edu. (2016). [online] Available at: https://mycc.cambridgecollege.edu/ICS/icsfs/GEsTwoDecadeTransformation.pdf?target=e0045b95-2a4e-4a59-a2fe-25f802d18a31 [Accessed 24 Sep. 2016].

NASDAQ.com. (2016). General Electric Company Competitors. [online] Available at: https://www.nasdaq.com/symbol/ge/competitors [Accessed 12 Sep. 2016].

Nyakoe, F.K., 2014. Strategy evaluation and control practices at Kenya Bureau of Standards (Doctoral dissertation, University of Nairobi).

Schmidt, H.J., 2015. Corporate Strategy and Corporate Branding: Reference Frame and Examples of Integrated Corporate Strategic & Brand Management (CS&BM). In Business Architecture Management (pp. 35-51). Springer International Publishing.

Singh, A., 2013. A study of role of McKinsey's 7S framework in achieving organizational excellence. Organization Development Journal, 31(3), p.39.

Sorkin, M. (2015). G.E. to Retreat From Finance in Post-Crisis Reorganization. [online] Nytimes.com. Available at: https://www.nytimes.com/2015/04/11/business/dealbook/general-electric-to-sell-bulk-of-its-finance-unit.html?_r=0 [Accessed 14 Sep. 2016].

Strand, R., Freeman, R.E. and Hockerts, K., 2015. Corporate social responsibility and sustainability: An overview. Journal of Business Ethics, 127(1), pp.1-15.

The Economist. (2016). Jack Welch | Economist - World News, Politics, Economics, Business & Finance. [online] Available at: https://www.economist.com/topics/jack-welch [Accessed 14 Sep. 2016].

Vecchiato, R., 2015. Creating value through foresight: First mover advantages and strategic agility. Technological Forecasting and Social Change, 101, pp.25-36.

Young, M.N., Tsai, T., Wang, X., Liu, S. and Ahlstrom, D., 2014. Strategy in emerging economies and the theory of the firm. Asia Pacific Journal of Management, 31(2), pp.331-354.

Zentner, A., 2015. A fork in the road of change: A comparison of simple and complex organizational change models. Available at SSRN.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2017). Strategic Analysis Essay: General Electric Case Study.. Retrieved from https://myassignmenthelp.com/free-samples/strategic-analysis-of-general-electric.

"Strategic Analysis Essay: General Electric Case Study.." My Assignment Help, 2017, https://myassignmenthelp.com/free-samples/strategic-analysis-of-general-electric.

My Assignment Help (2017) Strategic Analysis Essay: General Electric Case Study. [Online]. Available from: https://myassignmenthelp.com/free-samples/strategic-analysis-of-general-electric

[Accessed 07 June 2025].

My Assignment Help. 'Strategic Analysis Essay: General Electric Case Study.' (My Assignment Help, 2017) <https://myassignmenthelp.com/free-samples/strategic-analysis-of-general-electric> accessed 07 June 2025.

My Assignment Help. Strategic Analysis Essay: General Electric Case Study. [Internet]. My Assignment Help. 2017 [cited 07 June 2025]. Available from: https://myassignmenthelp.com/free-samples/strategic-analysis-of-general-electric.