The following report has been presented to JK so that a better management of daily business activities could be made possible. The report consists of the analysis done on the format in which things are done in his entity. The risks that are presented in the study is linked to the cashiering process. It has been described in a detailed manner along with the control steps that should be taken by JK for mitigation. Therefore after implications of the plan, it would be possible for JK to minimise the present risk regarding cashiering management.

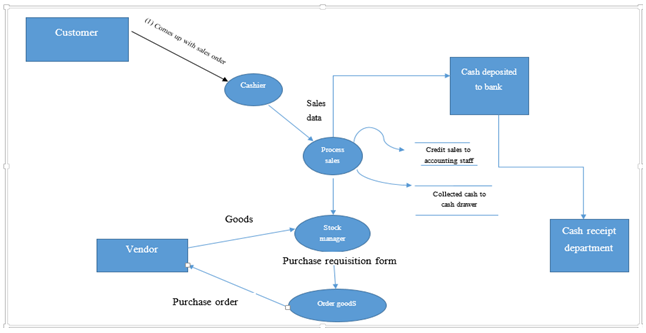

This methodology is being used to show the process which is being used in the existing system. It can be ascertained from the flow of diagram than which information is made available to the system and which one is being received from it. The interaction with other systems is being also identified by using this technology (Liou, 2015). After the development of the system is being done, it could be checked that whether the initial requirement of the entity has been meeting.

CASE i.e. computer aided software engineering are usually used for presenting data flow diagram because advantages are attached to it. In situation where CASE tools are utilized for formation of data flow diagram than the available advantages are that it will not allow use of a non-standard notation for all the items in the diagram and the other is that some rules have to be followed while using it which do not allow the user in making connections between the different items that should not be allowed.

Data flow diagram of the case:

Figure 1: Logical DFD

It can be said that process map is a flow diagram of the primary processes of an entity. It specifically shows the persons who have been involved in the operations of the entity. It is not limited to a single department or function of the entity and all the operations of an entity are part of it (Dumas, Mendling and Reijers, 2013). There are seven types of process maps which include seven types of flow in accounting which are cash flow, disbursement flow, collection flow, information flow, material flow, quote flow and order flow.

A flow of activities has been described by the process map. The interactions and sequence of related process steps can be called as the flow of the process. While drawing a process map it has been tried to minimise “backflow” of arrows that go from bottom to top or left to right. A better understanding of operations is available through process maps; they are also used for generating new ideas of process improvement or stimulate discussion (Gunasekaran, 2016). The process map is also used for highlighting the problems and identifying delays or gaps, duplication, bottlenecks of the operations of the entity. There may be various forms of process map but they all tend to use SIPOC format and a standard UML for symbols.

Figure 3: Process map

- The sale is being done physically through stores and online stores as well.

- Sale order of online visitors is generated on the website of the store and made available to customers at the same time.

- The operation of JK Saddlers Ltd includes inflow of data of customers, making sales order, cashier management and Banking payments.

- The payment of online customers is received directly in the bank account of the entity.

The diagram has been presented in accordance with information available regarding the case and assumptions which have been made as well. The diagram depicts that the information of customer sales order is received at the shop as well as at online stores (Evans, 2001). The sales order is prepared by the sales person and presented to the cashier for completion of other operations of the entity. It can be said that the flow of data moves to owner or management through the cashier.

By considering the given case scenario following risk has been assessed in current cashiering process which has high possibility for imposition of threat on business:

Management by a single person: In the present system, the main risk available in the cashiering process is that all the things are managed and controlled by one person only. In this case, if any fraud has been made by him than in that case he can make changes in all the accounts as in the system of the entity and in the mail received too.

Allocated authorities: The other risk which is available in the system that is the authority present with the cashier regarding the selling price of the product (Mendling, 2013). As in the present case the entries have been made by the same person, cash collection and price determination is also being done by that person only. Hence, it is an easy job for him to manipulate the books of accounts in the manner he needed because he is responsible for all the related operations of management.

Misuse of cash: In the present case risk regarding the misuse of cash is also available as no check has been made on the amount of cash collected on an everyday basis. It could be possible that the cashier uses the cash for some days and deposit again the same amount without informing the owner.

Lack of synchronization: In accordance with the given situation, cash activities are not properly organized due to which business will face issue in cash management. Further, all activities are connected to previous one due to which there is high rigidity.

Due to the above-cited risk, there is a high threat of manipulation in the cashiering process which can create a loss to the business. In addition to this, if these risks are not appropriately mitigated profitability and liquidity of the business will be adversely affected.

In accordance with the above description, it can be noticed that JK is required to develop an appropriate plan to mitigate risk. For this aspect, they are required to take following steps:

Recruitment of employees: JK should appoint more staff members as it is given in the case that it is a small retail business but has healthy cash flow. Therefore, JK is financially viable in appointing another employee (Chang, 2016). The format of management can be changed in a way that rather the operations should be distributed between them or the work of one should be checked by another. This step is required to be taken because constraint of employees is reducing their efficiency. In addition to this, recruitment of qualified staff will enhance their scope of profitability.

Better control procedures: The authority of billing and collecting cash should not be made available to the same employee. Checking of work by the owner is not mentioned in the present case which is an important part of management. Surprise check regarding the price on which goods are being sold to the customer should be done to analyse the discount being allowed by the cashier. By applicability of above-described facts, better control process can be implemented. In addition to this, proper checking can be done to ensure quality in work performance.

Policies and procedures: The risk regarding price can be controlled by making policies about the amount of discount or rebate in selling price will be available to customers. As the sale is done to both other retailers and individuals; different policies relating to discount allowed should be made available to the cashier (Rosemann and vom Brocke, 2015). The benefit available to the entity will be that the customers will avail discount as previously and risk regarding the selling price will be also eliminated.

Updated technologies: An eye can be kept on the manager by using technology also. The camera can be installed at the place of the cashier to ascertain that whether the cash that has been collected by the cashier is being deposited the same day or not. The risk regarding misuse of cash can be avoiding by application of this policy.

In accordance with the present study conclusion can be drawn that risk regarding cashiering management is required to be mitigated in an appropriate manner else it can create severe issues for business. Evaluation of risk of JK Cashiering process shows that company is not managing their operational activities in a viable manner. It is because; there are various deficiencies in their control system. However, they can make improvement in their process by considering recommendation provided in the file for smooth cash flow. Along with this, management of the company will also be able to make a reduction in the possibility of risk of error.

Chang, J.F., 2016. Business process management systems: strategy and implementation. CRC Press.

Dumas, M., Mendling, J. and Reijers, H.A., 2013. Fundamentals of business process management (Vol. 1, p. 2). Heidelberg: Springer.

Evans, T., 2001. System Documentation. [Online]. Available through <https://www.timothydevans.me.uk/sysdoc.html>. [Accessed on 19th August 2016].

Gunasekaran, A., 2016. International Journal of Process Management and Benchmarking. [Online]. Available through <https://www.inderscience.com/jhome.php?jcode=ijpmb>. [Accessed on 19th August 2016].

Liou, C.C., 2015. Study on establishment of quality management system documentation. Cengage learning.

Mendling, J., 2013. Fundamentals of Business Process Management. In GI-Jahrestagung. P. 157.

Rosemann, M. and vom Brocke, J., 2015. The six core elements of business process management. In Handbook on Business Process Management 1 (pp. 105-122). Springer Berlin Heidelberg.

van Rensburg, A., 2008. A framework for business process management. Computers & industrial engineering. 35(1). Pp.217-220.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2017). System Documentation And Risk Analysis: (JK Saddlerys Cashiering Function) Essay.. Retrieved from https://myassignmenthelp.com/free-samples/system-documentation-and-risk-analysis-jk-saddlerys-cashiering-function.

"System Documentation And Risk Analysis: (JK Saddlerys Cashiering Function) Essay.." My Assignment Help, 2017, https://myassignmenthelp.com/free-samples/system-documentation-and-risk-analysis-jk-saddlerys-cashiering-function.

My Assignment Help (2017) System Documentation And Risk Analysis: (JK Saddlerys Cashiering Function) Essay. [Online]. Available from: https://myassignmenthelp.com/free-samples/system-documentation-and-risk-analysis-jk-saddlerys-cashiering-function

[Accessed 31 May 2025].

My Assignment Help. 'System Documentation And Risk Analysis: (JK Saddlerys Cashiering Function) Essay.' (My Assignment Help, 2017) <https://myassignmenthelp.com/free-samples/system-documentation-and-risk-analysis-jk-saddlerys-cashiering-function> accessed 31 May 2025.

My Assignment Help. System Documentation And Risk Analysis: (JK Saddlerys Cashiering Function) Essay. [Internet]. My Assignment Help. 2017 [cited 31 May 2025]. Available from: https://myassignmenthelp.com/free-samples/system-documentation-and-risk-analysis-jk-saddlerys-cashiering-function.