Hedge Funds: Strategies and Risks

Question:

Explain the Alternative Investment Classes and their role in Investment Portfolio?

- Investment Management is managing the portfolios of clients by buying or selling or securities or assets having a certain goal or objective to maximize return and reducing risks, involved in such securities.

Alternative investments are different from the regular or traditional type of investment, traditional investment consist of stock and bonds whereas alternative investment are generally not as liquid as stocks, bonds and it consists of hedge funds, investment in venture capital, private equity, exchange traded fund, commodities, currencies, financial derivatives, investment in art, antiques, precious metals, gold and silver, investment in wine, stamp etc. Investment in alternative assets requires regular updated knowledge about the market, and common investors do not generally invest in such securities. (Tuchman, 2013) (Tuchman, Investment Mahangement For Serious Savers, 2013) Different types of alternative investments are enumerated below:-

These are funds available for a limited number of investors, and required a huge amount of initial investments. Hedge funds are not regulated, and such funds promise to fetch a positive return even when the market is down. Such funds are basically introduced for the purpose of risk reduction, and hedge fund can take an extreme long short position in one counter or two counters. Names like SAC Capital, Bridgewater, Global Alpha (Goldman) are most renowned hedge instruments. Lack of diversification or lack of clarity can be a real problem in such funds.

Transfer of interest is limited as there is no secondary market involved as such. Sometimes the expenditures can offset the profit earned for employing a comparatively costly hedge fund strategy. These are some of the risks associated with hedge funds. There are several strategies to get absolute return; such strategies are convertible arbitrage strategy, equity market long short, global macro strategy, fixed income arbitrage, fund of funds etc. (Diedrich, 2014)

- Convertible arbitrage strategy works by purchasing an optionally convertible bond(OCB), computing the delta of the call option embedded with the OCB, and short selling the equity(i.e. no of bonds * delta as computed)

- Equity market long short refers to going long in an underpriced and going short in an overpriced stock.

- Global macro strategy is flexible and most refined strategy which takes advantage of arbitrage opportunities in currency, commodity, equity and debt markets all over the world.

- The objective of fixed income arbitrage is to reduce the interest rate risk.

- Fund of fund involves hedging for multiple investors. A disadvantage is this is that it is an expensive strategy.(Friedland, 2011) (Jackson, 2013)

Private equity, unlike public equity are not traded in the country’s stock exchange, it deals with stocks of private companies or public companies who stocks have turned out to be delisted from the recognized stock exchange. The objective of this asset is to undertake those concerns which have potential to generate growth in future, and selling those entities in a higher value. (Dumon) (Idzorek, 2007)

There are some risks involved in the investment of private equity, professional advice and going for a renowned private equity firm can mitigate the risks of potential losses. Clear idea about the offerings by checking documents would also help the investors to get ideas before investing. (Pelletier, 2013) There are several strategies like Leverage buy out, venture capital, mezzanine capital, distressed to control strategy.

Exchange traded funds are developed to check the activities and motions of currencies or commodities in the market. Currency ETFs like Yen, Euro the investment in such assets is basically meant for short term investments. An example would be Powershares DB US Dollar Bullish Fund (UUP). Commodity ETFs on the other hand gives protection against rise and fall of inflation index. An example of commodity ETF is i Shares S&P GSCI(R) Commodity-Indexed Trust (GSG).

Investment of ETF suffers from some disadvantages. Suppose the market is an inactive one then there varies chances that the investors would definitely purchase units of ETFs even if it is traded in the market. The discounts and premiums of such units also vary as the type of ETFs and time period influence the same. (Myers, 2011)

Private Equity: Investing in Growth

Suppose Mr. A is planning to purchase a plot of building which is meant for office purposes from XYZ Pty Ltd with an objective to sale the property after two years and earning maximum return from such sale, this is a private investment in such plot of building which is an investment in a real estate property.

It mostly earns favourable returns unless some uncertainties are attached to it. Changes in the economy of the country, regional market changes, financing risks are some of the weaknesses of this type of investment. Other than these, its disinvestment strategy, capital gain and hedging of inflation makes it more reliable. (Baron, 2013)

Investment in gold has been safe and perfect for investors who want to invest in short term instruments. The nations which suffer from inflationary pressure are mostly dependant on gold. When it is said, investment in gold, it is not meant over here to invest in gold jewelries, as a lot of gold wastages and a higher amount of making charge is involved in that. Raw good biscuits or coins are real investment in such case. The opportunity cost to invest in any other kind of alternative investment assets is a risk involved in such case. Examples of investment in gold are by gold exchange traded funds, gold stocks, gold futures and options. (Robert Johnson, 1997) (Wadhwa, 2014)

Investment in wine is also another type of alternative investment, like investment in gold or real estate. For example, someone invests in a bottle of wine and sells it later in order to get a higher return, or buying units of stock in wine fund that fetches required return. But investment in wine suffers from some deficiency as until and unless it is sold in the market it does not fetch any amount of return. The costs involved in preserving such wine would turn out to be a loss if there remains no increase in the value of investment. (Walne, 2014)

Financial derivatives can be termed as most complex from all of the types described above as of now. The general types of derivatives are futures, options, forwards, swaps, swaptions. Derivatives are like that of bets; it is a contract between parties and can be used as a financial asset and are traded over the counter. For example, a contract relating to crop futures can also be regarded as derivative. An agriculturist at present might allow selling its product to a broker or vendor during the winter season. Now if the price increases, the agriculturist may not earn sufficient return but if price decreases, it does not incur any loss. Lack of clarity or transparency, lack of professional advice and human error can be major drawbacks involved with the investment in such instruments. (Milton)

Another important type of alternative investment is investment in the arts and antiques. For long term investment it is a good catch. (Brown, 2013) Buying from globally renowned artists or from an art and antiques international fair and selling it in the home market among the people or businessmen who have sophistication in such artifacts is a mechanism involved in such investment. One should take help from experts to confirm the originality of the article. (Wright, 2013)

Exchange Traded Funds: Short-term Investing

A portfolio is constructed with various types of assets. The composition of each type of asset involves a decision making process that at what time, one needs to hold or sell the units of investment. The risk averse investors follow a conservative investment strategy in which the instrument has greater level of return or fixed level of return.

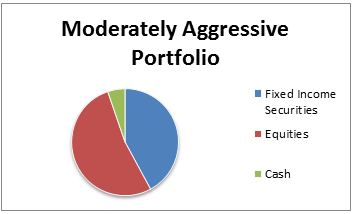

An investor who is ready to tolerate risk would prefer long term investment and a moderately aggressive portfolio. For example, a moderately aggressive portfolio would be constructed with atleast 50% of Equities, 40% fixed income securities and 10% cash.

There are several strategies involved with the types of alternative investments. Strategies relating to hedge funds have been discussed above. Those strategies can mitigate the level of exposures of risk in such instruments and can increase diversification, generate capital gains unlike traditional investment. A portfolio shall always consist of such units of financial assets the value of which will increase or decrease irrespective of the directions of stock market. While constructing a portfolio which involves an alternatives strategy, at least 20% of such portfolio’s asset should be out of alternative investments. Alternative investments have several strategies to manage risk and therefore it would not be wise for an investor to invest only in stocks, bonds and cash. (Pavia, 2013) (Hussey, 2010)

Image Source: (HOWARD, 2014)

In the above image, it is seen that alternatives did not bring as much as return as brought by equity or fixed income investments but they worked as a risk reducer and helped in diversification as well which could be seen from the calculation of sharpe ratio (Data has been taken from (HOWARD, 2014) ) .

|

Assets Type |

1year return (as of 11/30/2013) |

1year risk (as of 11/30/2013) |

Sharpe Ratio( Return-Risk free rate)/ standard deviation |

|

Alternatives |

6.65% |

2.46% |

2.68 |

|

U S Equity |

31.71% |

13.85% |

2.29 |

|

Bonds |

-1.61% |

3.93% |

-0.42 |

(Risk free rate is 0.06, as of 11/30/2013)

Reasons for investing in alternative investments are reducing the risk by employing certain strategies meant for securities, diversification, inflation hedge and lastly higher amount of return. Unlike traditional assets, in alternative assets risk is managed without affecting the earned profits. Institutional investors mainly want to invest in alternatives due to its advantage of diversification. There are many options available in alternative investments unlike traditional investments, and unit of investment can be properly chosen accordingly. The benefits of investing in the alternatives can also be explained with the help of Markowitz Efficient Frontier.

The above is the illustration of Markowitz Efficient Frontier, shows portfolios with lowest risk and a particular return or portfolio of highest return and a particular portion of risk. The efficient frontier for both traditional and alternative investments is on upper level representing return is more in that alternative. (Karavas, 2000)

- Recommendations :

- An investor trading in the traditional markets would be benefitted if invests in alternative securities along with bonds and stocks.

- The investors who have lesser knowledge about the derivative markets or are not confident about investing in such markets, it can be recommended to invest in precious metals, gold stocks, stamps, antiques as information regarding these instruments are available in a seamlessly cogent language which is understandable for all kinds of investors.

- Advice of professionals, brokers or agencies are required in case an investor is lacking expertise in the field of capital market instruments.

- Daily updating of facts relating to these instruments are necessary for short term investments as well.

- The implementation of strategies is to be done in a suitable manner so that it can benefit the investors without affecting the significant portion of return or profit.

- Before investing in a particular fund, one should consider the pros and cons involved with it and the extent of pros and cons and then it should opt for investing in such fund.

- Different countries have different rules or guidelines for investing in an alternative investments made by governing body, which should be taken care of and should not be ignored at any cost.

- The risks associated with investing in a fund are required to be evaluated properly.

Summarization/Conclusion of discussion :

There are various kinds of alternative investments. Alternative investments are different from traditional investments; investing in traditional investment is a common phenomenon. If traditional investments like stocks and bonds are invested and a particular percentage of investment is made in the alternatives along with stocks or bonds, the construction of the portfolio shall be optimum. Unlike traditional assets, alternative assets benefit the portfolio of investors by diversification, inflation hedging, and risk mitigation. Different alternative investment funds have different types of strategies which are used for the minimization of risk and volatility. Currencies, hedge funds, financial derivatives instruments needs knowledge, otherwise impracticality or human errors can cause a huge loss in those sectors. Other types of alternatives like investments in gold and silver, wine, a work of art or antiques, stamps are relatively less risky than the rest of the alternatives. Real estate and investment in private equity has also helped in strengthening a portfolio structure to balance its risks and returns.

References

Baron, L. (2013). Three Things That Make A Great Real Estate Investment. Forbes , 1-2.

Brown, J. (2013). Art, antiques investing is for the long haul. USA Today , 1-2.

Diedrich, S. (2014). 'Alternative' or 'Hedged' Mutual Funds: What Are They, How Do They Work, and Should You Invest? Forbes , 1-3.

Dumon, M. (n.d.). What is Private Equity. Investopedia , 1-2.

Friedland, D. (2011). Magnum Funds -Synopsis of Hedge Fund Strategies. Retrieved 2011, from https://www.magnum.com/: https://www.magnum.com/hedgefunds/strategies.asp

HOWARD, J. (2014). Exploring the benefits of alternative investments. LifeHealthPro - Markets, Affluent , 2.

Hussey, R. M. (2010). Using Alternative Investments to Build a Stronger Portfolio. Advisor Perspectives , 1-3.

Idzorek, T. (2007). Private Equity and Strategic Asset Allocation. ibbotson , 7-9.

Jackson, L. (2013, September 9). Yahoo Finance. Retrieved September 9, 2013, from https://finance.yahoo.com/: https://finance.yahoo.com/news/ten-strategies-hedge-funds-huge-123021171.html

Karavas, V. N. (2000). Alternative Investments in the Institutional Portfolio. The Journal of Alternative Investments , 11-25.

Milton, A. (n.d.). Derivatives Markets. About Money , 1.

Myers, R. (2011). ETFs Make Alternative Investments More Accessible. The Wall Street Journal , 1-2.

Pavia, J. (2013). Alternative strategies for 'average' investors. CNBC- Alternative Investing , 1-3.

Pelletier, M. (2013). Know the risks before investing in private equity. Financial Post - Investing , 1-2.

Robert Johnson, L. A. (1997). Gold as an Investment Asset. The Journal of Investing , 94-99.

Tuchman, M. (2013). Investment Mahangement For Serious Savers. Forbes , 1.

Tuchman, M. (2013). What is Investment Management? A Primer. Forbes , 1-2.

Wadhwa, P. (2014). Should you invest in gold now? Business Standard , 1-2.

Walne, T. (2014). Don't just drink those fine wines dahling ... invest in them. This is Money- Financial Mail on Sunday , 1-2.

Wright, M. (2013). 10 tips for making money from antiques. The Telegraph (UK) , 1-3.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2016). Alternative Investments: Types, Risks, And Strategies Essay.. Retrieved from https://myassignmenthelp.com/free-samples/alternative-investment-classes-and-their-role-in-investment-portfolio.

"Alternative Investments: Types, Risks, And Strategies Essay.." My Assignment Help, 2016, https://myassignmenthelp.com/free-samples/alternative-investment-classes-and-their-role-in-investment-portfolio.

My Assignment Help (2016) Alternative Investments: Types, Risks, And Strategies Essay. [Online]. Available from: https://myassignmenthelp.com/free-samples/alternative-investment-classes-and-their-role-in-investment-portfolio

[Accessed 26 April 2025].

My Assignment Help. 'Alternative Investments: Types, Risks, And Strategies Essay.' (My Assignment Help, 2016) <https://myassignmenthelp.com/free-samples/alternative-investment-classes-and-their-role-in-investment-portfolio> accessed 26 April 2025.

My Assignment Help. Alternative Investments: Types, Risks, And Strategies Essay. [Internet]. My Assignment Help. 2016 [cited 26 April 2025]. Available from: https://myassignmenthelp.com/free-samples/alternative-investment-classes-and-their-role-in-investment-portfolio.