Risk factors associated with estimation of mineral, oil, and gas reserves

1. Identify what you consider to be the ‘key’ inherent risk factors that could have an impact on the audit of BHP Billiton Limited for the year ended 30th June 2016 and/or future audits. For each of the inherent risk factors identified, describe the risk clearly and state how and why you consider the issue may create the risk of potential material misstatement in the financial statements of BHP Billiton Limited for the year ended 30th June 2016 and beyond. You are expected to identify five (5) critical inherent risks.

2. Using the audit risk model, discuss briefly how each inherent risk you identified will impact on the evidence mix for the planning of the audit of BHP Billiton Limited in the relevant segment of the audit. When referring to the balance between tests of balances, transactions and analytical procedures, indicate which main areas would be critical and comment on the nature and extent of the testing in the relevant segment.

1. Inherent risk refers to those risks that are faced due to error or else omissions in a particular financial declaration owing to different facets other than inadequacy of control (Louwers et al. 2013). This inherent risk is considered to be high in case of high degrees of judgment as well as estimation or in cases of highly intricate transactions of the business (Alles and Vasarhelyi 2015).

In case of BHP Billiton Ltd, several uncertainties are associated to the process of estimation of mineral, oil as well as gas reserves (Bhpbilliton.com 2016). Different geological estimations related to the mineralization that were legitimate during the time of estimation might possibly change at the time when new information becomes available. Approximations regarding the reserves that the company pulls through or else the cost that is used to anticipate recovery of such reserves are purely founded on uncertain suppositions. Again, the unsure global financial outlook might also adversely affect the entire economic suppositions associated to reserve recovery and possibly will necessitate reserve restatements. These Reserve restatements might possibly depressingly affect the overall results along with prospects. Therefore, this business risk can be considered to inherent that might lead to potential changes to the overall portfolio of assets and material misstatements in the financial reports. In addition to this, the inherent risks associated to the functionalities of the company BHP Billiton Ltd includes the uncertainties of identification and arrangements for reserves, additions and divesting assets and managing different capital development ventures (Bhpbilliton.com 2016).

Inherent limitations to the efficacy of control procedures and human error

Adding to this, there remain inherent limitations to the overall efficacy of any method of controlling disclosure as well as procedures, counting the chances of human error along with the circumvention otherwise the overriding of different controls as well as procedures. Consequently, effectual control procedure of disclosure and practices can provide sensible assurance of attaining the control purposes. Further, the management of the company has the need to apply judgments as well as estimations in the process of evaluation of cost benefit associations of different feasible controls while undertaking the process of design as well as evaluation of disclosure controls and procedures. This judgment and estimation might also lead to human errors of assumptions and poses inherent risks to the entire business.

Again, the fixed investments assets are generally mentioned at a cost after deductions for provisions for different impairments. However, the fixed investments are fundamentally evaluated to make it certain that the carrying amounts do not surpass the overall approximated recoverable amounts. The value that is used is normally determined by way of discounting future cash flows by utilizing a risk adjusted pre tax rate of discount that is appropriate for different inherent risks in the assets. However, this estimated rate of discount might pose inherent risk for the functionalities of the company and can lead to material misstatements. In addition to this, there exists many more significant variables, suppositions as well as imprecision intrinsic in process of development of the Standardized measure. This standardized measure is essentially prepared as well as presented based on certain presumptions that states that the previous year’s economic and functional conditions is expected to persist over the upcoming times in which year-end reserves would be generated. However, this estimation in the standardized measures exclude the consequences of future rate of inflation, upcoming alterations in rates of exchange, anticipated future transformations in technology, rate of taxes, working practices and some other regulatory changes (Bhpbilliton.com 2016). Therefore, this might affect the predetermined level of proved reserves of oil and gas of the company BHP Billiton Ltd as well as the production rate thereof. The factors also pose different types of inherent risk that might lead to material misstatements in the financial declarations of the firm BHP Billiton Ltd. The inherent risks beyond the control of the company include ascertainment of the production commencement dates, related costs or else the production output, expected life of operation as well as mines or other facilities (Bhpbilliton.com 2016). In addition to this, there also exist inherent risks in gauging the capability of the firm to profitably generate as well as transport the minerals, petroleum as well as metals extracted to different relevant market. The changes in the foreign currency exchange rate can influence the overall market prices of the minerals, petroleum, metals in addition to other products that the company produces. Therefore, the change in the market prices of the products also poses the inherent risks that might lead to the material misstatements in the financial announcements (Eilifsen et al. 2013). The activities of different government of authorities where the company carries out the operations of exploration as well as development projects can also affect the assumptions by impositions of changes in rates of taxes. This can be viewed as uncertainties that are inherent in the process of estimations of production and reserves of the mineral, oil and gas and possible will lead to material misstatements in the financial declarations of the firm BHP Billiton Ltd. Again, the unexpected natural as well as the functional catastrophes might adversely affect the overall operations of the corporation. This can be regarded as an inherent risk to the operations of the corporation owing to the environmental damages. As mentioned in the annual report of the company BHP Billiton Ltd, the functionalities of the BHP Billiton Ltd are essentially subject to different operational accidents. The operational accidents include the port fire as explosion in addition to the open-cut pitt wall failures, total loss of power supply, diverse rail road accidents, inadequate well control, environmental pollution as well as critical technical failures. The functionalities of the firm are also prone to different unexpected natural catastrophes that include the earthquakes, hurricanes, tsunamis as well as hurricanes. As mentioned in the annual report of the firm, the iron ore, Queensland coal as well as the oil and gas functions in the Gulf of Mexico are situated in areas that are primarily subject to environmental upheaval such as the cyclones or else hurricanes. BHP Billiton Ltd’s Chilean copper operations are essentially situated in a very well known earthquake as well as tsunami prone zone. Therefore, all these factors might lead to the damage of the property of the company, interruptions in the business operations, risk associated to construction, marine cargo as well as primary liability risks. The business plans therefore might not provide protection for different costs that might probably stem from these kinds of uncertain events (Songini and Pistoni 2012). Thus, the damages of this kind of uncertain events might possibly lead to the misappropriations of costs and consequently the material misstatements in the financial declarations of the firm.

Impairment of fixed investment assets

Again, many of the non-operated assets of the corporation BHP Billiton Ltd might not possibly conform to the pertinent standards. As per the annual report of the corporation BHP Billiton, it can be hereby ascertained that there are various assets of the company that are primarily operated and at the same time managed by diverse joint venture partners or else by other corporations. As a result, the management of these non-operated assets might possibly not conform to the management as well as benchmark of operations, procedures of controls, systems of operations, counting the health, safety, environment as well as community standards. Therefore, the failure to acclimatize to equal standards, controls, procedures of these assets can lead to huge costs, at the same time reduced amount of production, and adversely influence the outcomes as well as reputation (Porter et al. 2014). The assets controlled by different third also pose the inherent risks that too can lead to the material misstatements in the financial statements of the corporation BHP Billiton Ltd. Besides this, different types of violations of the security of the information technology processes might adversely influence the business activities of the firm. As mentioned in the annual report of the corporation BHP Billiton Ltd, the information technology system of the company comprises of the infrastructure, different business applications as well as communication networks to uphold the business actions. This kind of system might be subject to different security infringements such as the cyber crimes that in turn can lead to misappropriation of funds, escalated health as well as safety risks to different members of the staff (Hayes et al. 2014). In addition to this, the breach of the IT system can also lead to disruptive operations, diverse environmental damage, poor quality of product, loss of intellectual property, inappropriate disclosure of different commercially sensitive information as well as damage to reputation and goodwill. The losses caused due to the identified operational risk are essentially out of the control and can pose inherent risks that lead to the financial misstatements (Skaife et al. 2013).

Furthermore, health impacts for a long period might stem from different unexpected workplace revelations or else historical exposures of the workers to different perilous substances. This in turn might possibly generate future financial reimbursement requirements (Hayes et al. 2014). Again, the environmental incidents also have the capability to in turn direct towards different material adverse influences on the functionalities of the corporations. Therefore, these kind of uncontrolled factors include unrestrained tailings containment violations, subsidence from diverse mining functions, break away from of different polluting materials as well as unrestrained discharge of hydrocarbons. Alterations in different regulatory as well as community anticipations might lead to different pertinent plans that are not sufficient but the risks associated to the community might consist of different community protests as well as civil unrest and might possibly lead to stoppages to diverse proposed improvements. Therefore, the operations or else the actions also face the risk of different unintentional violations of relevant human rights, worldwide laws and conventions. However, diverse probable conformity costs, litigation expenditures, regulatory impediments, rehabilitation expenditure as well as operational costs stemming from this kind of legislation can adversely affect the financial outcomes and lead to the material misstatements (Wang et al. 2013).

Uncertainties in the standardization of measures

The inherent risks that are identified from financial declarations of the corporations declared for the year ending 30 June 2016 include improper outlook towards worldwide growth. Worldwide growth over the remaining of the period of the year 2016 is anticipated to stay more or less modest and is subject to different downside risks, counting different uncertain economic results of the ‘Brexit’. The outlook section of the financial report mentions that the global growth rate is assumed to remain between the 3% and 3.5% during the year 2017 whereas the global trade needs to accelerate at a modest rate (Bhpbilliton.com 2016). The reform programs of the government can improve the productivity and the governing authorities need to improve the overall level of efficiency of capital allocation, lessen surplus capacity in segments that includes coal as well as steel whilst boosting the function of consumer demand and preserving the support for employment (Bhpbilliton.com 2016).

Therefore, it is concluded that BHP Billiton faces various inherent risks at the time of conducting the auditing of financial statements. The above report explains the identification of key inherent risk factors affecting audit of BHP Billiton for the year ending 30 June for the year 2016 for future analysis purpose. This study explains the inherent risk factors with justification in aligning issues governing risk of potential material misstatement in the financial statements.

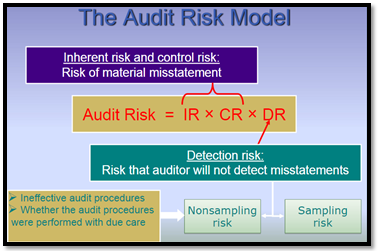

2. Audit risk model refers to the risk that a particular auditor articulates and expresses an inappropriate viewpoint on examination of the financial declarations of the corporation. As per the audit risk model, the risk of audit may be regarded as the product of different risks that might be encountered while performance of the entire program of audit (Messier Jr 2016). Therefore, in order to keep the overall audit risk within the acceptable limit, the auditor needs to assess the particular level of the risk that can be attached to each element of the audit risk.

Figure 1: Audit Risk Model

(Source: Messier Jr 2016)

The different types of tests that the auditors can apply include the risk assessment procedures as well as the further audit procedures. As per the audit risk model, the sufficient competent evidence is equal to addition of the test of control, substantive tests of different business transactions, analytical process as well as tests of details of balances (Songini and Pistoni 2012). The different types of evidences include the physical examination, confirmation, documentation as well as observation. The tests of controls require documentation as well as observation as evidence. Again, the substantive tests of business transactions require documentation as evidence. In addition to this, the tests of different details of balances require physical examination, confirmation as well as documentation. Apart from this, the further audit procedures such as the tests of controls also create further evidences of inquiries of the clients and reperformances. Again, the substantive tests of transactions also correspond to the inquiries of the respective clients, reperformances as well as recalculations. Adding to this, the analytical procedures also correspond to the inquiries of the client, analytical process whereas the tests of details of balances also create the evidence such as the inquiries of the client, reperformances as well as recalculations. Therefore, the evidence mix varies with the alterations in different circumstances (Songini and Pistoni 2012).

Risks associated with operational accidents and natural calamities

Figure 2: Variations in Evidence Mix

(Source: Songini and Pistoni 2012)

The management of the corporation BHP Billiton Ltd can carry out tests such as the risk assessment processes, different tests of controls, substantive tests of transactions, analytical procedures as well as tests of details of balances. Thereafter, the management can undertake the evidence decisions that include audit procedures, size of the sample, selected items and timing. This process also comprises of ascertainment of different types of evidences that includes the documentation, inquiries of client, analytical processes, observation, reperformance, recalculation, physical examination as well as confirmation. Therefore, the process includes the planning and designing the audit approach, performance of tests of control as well as different substantive tests of transactions, performance of analytical procedures as well as tests of details of balances and finally the completion of the audit and issuance of the audit report (Alles and Vasarhelyi 2015).

The company encounters inherent risks arising out of the uncertain environmental condition, global financial outlook, unintentional human errors as well as omissions. In addition to this, the company also faces inherent risk due to uncertainties of identification and arrangements for reserves, method of controlling disclosure, estimation in the standardized measure, ascertainment of the production commencement dates, related costs or else the production output, expected life of operation as well as mines or other facilities (Alles and Vasarhelyi 2015). Unexpected natural as well as the functional catastrophe, operational accidents, assets controlled by different third party , violations of the security of the information technology, uncontrolled factors include unrestrained tailings containment violations, subsidence from diverse mining functions, break away from of different polluting materials as well as unrestrained discharge of hydrocarbons also hereby poses inherent risks. These risks therefore lead to the material misstatements in the financial declarations of the firm. Understanding the internal control of the firm can help in the process of evaluation of the control risks (Alles and Vasarhelyi 2015). Thereafter, the auditor can gather requisite information for assessment of the fraud risks. The auditors can utilize the level of detection risk in order to ascertain the requisite audit resources.

Emphasis has been given on understanding the audit risk model for discussing on inherent risk factors as per evidence mix for planning of company named as BHP Billiton. It refers majorly to audit as referred in balance between test of balances as well as transactions and analytical procedures at the same time. The current segment describes the main areas and critical analysis regarding the nature as well as extent of testing for the company named as BHP Billiton. Audit Planning is explained in the study as it renders guidance for assisting the auditors during the process of auditing activities (Eilifsen et al. 2013). This enables audit assistance for business firm in evading with the misrepresentation identified in the financial statement of BHP Billiton. Audit Planning for BHP Billiton enables the auditor for identifying the feasible concerns as far as possible. This reveals identification of required inherent risks in aligning with audit risk models. It helps in directing as well as administrating on appointing experiencing team members for evaluating the risk in an effective way.

Reference

Alles, M. and Vasarhelyi, M.A., 2015. Adopting continuous auditing.Managerial Auditing Journal, 30(2), pp.176-204.

Bhpbilliton.com. 2016. [online] Available at: https://www.bhpbilliton.com/~/media/bhp/documents/investors/news/2016/160816_bhpbillitonresultsyearended30june2016.pdf?la=en [Accessed 18 Oct. 2016].

Bhpbilliton.com. 2016. BHP Billiton | A leading global resources company. [online] Available at: https://www.bhpbilliton.com/ [Accessed 17 Oct. 2016].

Eilifsen, A., Messier, W.F., Glover, S.M. and Prawitt, D.F., 2013. Auditing and assurance services. McGraw-Hill.

Hayes, R., Wallage, P. and Gortemaker, H., 2014. Principles of auditing: an introduction to international standards on auditing. Pearson Higher Ed.

Hayes, R., Wallage, P. and Gortemaker, H., 2014. Principles of auditing: an introduction to international standards on auditing. Pearson Higher Ed.

Louwers, T.J., Ramsay, R.J., Sinason, D.H., Strawser, J.R. and Thibodeau, J.C., 2013. Auditing and assurance services. New York, NY: McGraw-Hill/Irwin.

Messier Jr, W., 2016. Auditing & assurance services: A systematic approach. McGraw-Hill Higher Education.

Messier Jr, W., 2016. Auditing & assurance services: A systematic approach. McGraw-Hill Higher Education.

Porter, B., Simon, J. and Hatherly, D., 2014. Principles of external auditing. John Wiley & Sons.

Skaife, H.A., Veenman, D. and Wangerin, D., 2013. Internal control over financial reporting and managerial rent extraction: Evidence from the profitability of insider trading. Journal of Accounting and Economics, 55(1), pp.91-110.

Songini, L. and Pistoni, A., 2012. Accounting, auditing and control for sustainability. Management Accounting Research, 23(3), pp.202-204.

Wang, C., Chow, S.S., Wang, Q., Ren, K. and Lou, W., 2013. Privacy-preserving public auditing for secure cloud storage. IEEE Transactions on computers, 62(2), pp.362-375.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2018). Essay: Risk Factors In Audit Of BHP Billiton Limited.. Retrieved from https://myassignmenthelp.com/free-samples/auditing-bhp-billiton-ltd.

"Essay: Risk Factors In Audit Of BHP Billiton Limited.." My Assignment Help, 2018, https://myassignmenthelp.com/free-samples/auditing-bhp-billiton-ltd.

My Assignment Help (2018) Essay: Risk Factors In Audit Of BHP Billiton Limited. [Online]. Available from: https://myassignmenthelp.com/free-samples/auditing-bhp-billiton-ltd

[Accessed 29 May 2025].

My Assignment Help. 'Essay: Risk Factors In Audit Of BHP Billiton Limited.' (My Assignment Help, 2018) <https://myassignmenthelp.com/free-samples/auditing-bhp-billiton-ltd> accessed 29 May 2025.

My Assignment Help. Essay: Risk Factors In Audit Of BHP Billiton Limited. [Internet]. My Assignment Help. 2018 [cited 29 May 2025]. Available from: https://myassignmenthelp.com/free-samples/auditing-bhp-billiton-ltd.