Brand auditing process

Discuss about the Case Study for Brand Auditing on Emirates NBD.

Brand Auditing is a process of analyzing brand’s position in the market. It facilitates the organization to determine the strength of the brand in the market. Moreover, it identifies the weakness and opportunities for the particular brand for expanding into the large market space (Kapferer, 2012). Without auditing the brand, the organization cannot enhance its business opportunities in the global platform. For example, a powerful brand can enhance the customer’s base with its presence in the market (Wilson, 2012). Consequently, it enhances the profits of the business in an effectual manner. On the contrary, most of the business analysts have agreed with the fact that the strong brands also needs to conduct the reality check about their positioning in the market, so that they can review their brand (Plambeck, Taylor & Zhang, 2012).

It has been seen that the large brands do not need to spend adequate financial resources for the promotional activities (Rosenbaum-Elliott et al., 2015). It automatically engages the customers with the strong brand presence in the competitive market. Moreover, the brand values often facilitate the organization to raise their product pricing for generating a huge amount of revenue out of the business. The powerful brand always facilitates in the business enhancement in the global platform. On the contrary, a weak brand appearance would cause market shrinkage for the organization (Chen & XU, 2013). Consequently, it would gradually decrease the sales of the business.

With the involvement of the brand auditing, the organization would be able to identify several growth opportunities in the foreign and domestic market (Biedenbach, 2012). On the other hand, the brand auditing brings new ways for making the brand resonate with the existing and new customers in the market. The brand audit facilitates sin many segments such as brand resource strength, brand values, brand awareness in the competitive market, identification of new trends in the market, identifying the outside threats, effectiveness of the brand management efforts (Brand, 2013).

In this context, the organization called Emirates NBD needs to focus on their brand auditing process for the enhancement of the business opportunities. The particular organization has a limited presence in the international market (Jacka & Scott, 2013). Consequently, it reduces the profit margins in the business. With the involvement of the strong brand audit activities, the organization would be able to refocus on the brand management efforts and congruency. On the other hand, by implementing the brand auditing strategies in the business, the organization would be able to sharpen the marketing communications on both online and offline platforms (Xia, 2013). In this context, the particular organization is unable to develop its online communication (Emiratesnbd.com, 2016). Consequently, they are unable to spread product and services related information in the large market space. Moreover, the organization would obtain an insight into the brand architecture, brand structure, and brand portfolio by including the brand auditing process in the business (Greenstein & Hunton, 2015).

Preparing framework

At the initial stage of the brand auditing process, the organization needs to identify the objectives of the audit in the business (Carson, 2013). The brand audit process depends on the depth of the audit. If the organization tries to conduct a general audit of the brand, the can instruct the management for accomplishing the same. On the other hand, the organization can hire an agency for conducting the brand audit of the business in an in-depth method. The brand auditing process includes several factors (Cheskis, 2012). The brand agency needs to evaluate whether the current brand strategy is working properly or not. Moreover, the strategic issues of the business need to be evaluated in a detailed manner. In this context, the organization called Emirates NBD needs to identify the strengths and weakness of the business while conducting the brand auditing (DeFond & Zhang, 2014). On the other hand, the external opportunities and threats need to be evaluated in an effective manner, so that the organization can develop strategies according to them. There are several advantages of the brand auditing including brand awareness, and consistency in the marketplace. On the other hand, the organizations often face difficulties in conducting the brand auditing process in the business. For example, most of the small and medium enterprises face challenges in hiring brand-auditing agency due to lack of financial sources in the business (Pratoomsuwan, 2012). Consequently, they are unable to identify the key issues in the business. On the contrary, organizations need to follow the proper attribute in the brand auditing process so that it delivers the sustainable outcome. Due to the negative attributes, many brands have lost their potentiality in the existing market (King, Grace & Funk, 2012). Hence, it can be assessed that the brand auditing needs to be executed in an effective manner. In this context, Emirates NBD has engaged a brand agency for auditing their brand in an effectual manner. Moreover, by involving the brand auditing process, the organization would be aware of their potential risks in the business (Padayachee & De Jager, 2015).

The organization would follow a certain process to audit their brand in an appropriate manner. These processes include creating a framework, questioning to the customers, reviewing the web analytics, review the social data, review the sales data, competitors analysis and taking action and monitoring the outcomes (Dauvergne & Lister, 2012). The brand audit processes have been discussed below in a detailed manner.

Feedback from customers

Preparing framework:

The organization needs to analysis their mission and strategic objectives for preparing the framework in an efficient manner. On the other hand, the organization needs to identify the target customers of the business. Moreover, the management needs to prepare a layout of the business. Some companies prefer to consider their marketing strategies (Padayachee & De Jager, 2015). By reviewing the marketing strategies, the organization would be able to enhance the business opportunities. Emirates NBD s

Feedback from the customers:

Accumulating feedbacks from the customers is one of the integral parts of the brand auditing, as it facilitates the management to understand the key issues in the business process management (Hassan Al-Tamimi, 2012). Without accumulating feedbacks from the existing and new customers of the business, the organization would not be able to build right strategy for the business. The feedback process can be a survey method, which allows the respondents to provide their individual feedbacks on the research. The particular process can be executed on the online platform for involving a large number of respondents.

Review of web analytics:

It has been seen that 81% of the customers prefer conducting research on the product before purchasing it (El-Bannany, 2013). Consequently, they rely on the product related data available on the online platform. Hence, it can be assessed that the online platform plays a major role in the business. The management needs to review their online activities so that the customers can obtain the valid information on the product easily. Moreover, they need to review their websites.

Review of the Social data:

The review of the social data can identify the flaws into the promotional activities. The demographic information can be accumulated from the social media (Kapferer, 2012). Hence, it would facilitate in enhancing the business opportunities in the large demographic areas. On the other hand, the demographic information allows the management to understand their audience. Consequently, it would facilitate in the brand auditing process. In this context, the particular organization does not engage adequate promotional activities on the online platform. Hence, the organization needs to enhance their social presence in the UAE. Moreover, the proper promotional activities would facilitate the organization to enhance their business opportunities in the foreign market (Wilson, 2012). In the competitive market, the particular banking organization needs to enhance their online promotion process so that they can spread their product information in both domestic and internal market.

Review of web analytics

Sales data reviewing:

The review of the sales data would facilitate the organization to identify the current situation of the business. Without reviewing the sales data, the organization would not be able to evaluate the progress of the business (Plambeck, Taylor & Zhang, 2012). Moreover, the particular process facilitates in monitoring the growth of the business in an effectual manner. In this context, Emirates NBD has the total assets of $98.8 billion as of 2015, which is quite satisfactory in compared to other ventures in the UAE (Emiratesnbd.com, 2016). With the engagement of the sales data reviewing process, Emirates NBD would be able to track their progress within the certain time frame. Consequently, it would facilitate to understand the current situation of the business in the UAE and international platform.

Competitor analysis:

Competitor analysis is one of the key factors for identifying the issues in the business. In the competitive market, the organizations face several challenges from the existing companies and new entrants in the market. Hence, the competitor analysis would facilitate the organization in implementing new strategies for the enhancement of the business. In the competitive market, the Emirates NBD has strong competitors including Abu Dhabi Islamic Bank, Bank of Sharjah and Mashreqbank psc (Chen & XU, 2013). Hence, the competitor analysis would facilitate the particular organization to identify the key improvement areas in the business.

Strategy implementation:

At the final stage of the brand auditing process, the organization needs to implement strategies in the business for obtaining proper outcome. Without implementing unique strategies into the business, the organization would not be able to enhance their sales revenue in the competitive market. For example, in this context, the Emirates NBD needs to focus on their promotional activities for the enhancement of the business in the global platform (Mohamed Shahwan & Mohammed Hassan, 2013). The particular organization has limited presence in the global market. Consequently, it creates barriers for the business to accumulate a huge amount of the sales revenue within a short timeframe.

Monitoring the outcomes:

After the implementation of the strategies into the business, the organization needs to include an enhanced monitoring system for identifying the outcome of the strategies. With the involvement of the monitoring system, the organization can understand the effectiveness of the strategy (El-Bannany, 2012). On the other hand, if there are any issues regarding the implemented strategies, the organization can change that accordingly. Hence, it can be assessed that the brand auditing is one of the key factors that facilitates in enhancing the business presence in both domestic and international platform (Mubarak, 2012). In this context, the Emirates NBD would apply an enhanced monitoring process in the business for identifying the outcome of the implemented strategies.

Review of social data

Figure 1: Brand auditing process

(Source: Pratoomsuwan, 2012)

1) Introduction:

Brand auditing is one of the key factors for identifying the major issues in the business. In this particular assignment, the brand auditing process of Emirates NBD has been highlighted in an effectual manner (Mehta, 2012). Emirates NBD has engaged the banking and financial services. In the UAE, the particular organization is a market leader across the core banking sectors. In the recent years, most of the banking organizations have been facing challenges in executing the business due to the volatility of the cost. However, the Emirates NBD has successfully maintained their growth in the competitive market. Emirates NBD provide services for the retail banking, corporate banking, treasury banking and investment and brokerage services (Abu Hussain & Al-Ajmi, 2012). Although the organization has adequate financial strengths, it faces challenges in making strong brand image on the global platform. Due to the limited global presence, the organization has failed to accumulate adequate sales revenues from the business (Al-Tamimi, Hussein & Jellali, 2013).

EmiratesNBD is a merger between the Emirates Bank International (EBI) and the National Bank of Dubai (NBD). The organization was formed on 16th October 2007 when the shares of Emirates NBD were officially listed on Dubai financial market (DFM) (Al-Tamimi & Hussein, 2014). Emirates NBD is a market leader in the banking and financial organization in UAE. The USP of the organization is that Emirates NBD is a socially responsible corporation in the UAE market. The position of the company indicates its strong presence in the domestic market. The particular organization has been recognized as one of the dynamic financial service providers in the Middle East (Cader et al., 2013). The target of the organization is small, medium and large organization seeking for the enhanced financial solutions. The organization has been providing the diverse financial solutions to the monetary organizations. Although the organization has huge financial resources, they show a lack of interest in expanding their brand in the foreign market (Randeree, Mahal & Narwani, 2012). Due to the limited expansion of the business in the foreign market, the organization has a limited market share. Consequently, it creates challenges for the organization to experience better sales revenues in the business.

In this particular assignment, brief analysis on the brand auditing of Emirates NBD has been provided. The particular brand auditing process includes internal and external analysis of the business. On the other hand, the situational analysis on the business has been discussed in an effectual manner. With the involvement of the situational analysis, the organization would be able to identify the current market situation. Moreover, the particular assignment has highlights the growth of the company. A brief history of the company has been sketched in the assignment under the company’s background section. At the end part of the assignment, a brief conclusion has been drawn, which is a summarization of entire project. On the other hand, the provided recommendation would facilitate the organization to undertake the strategy implementation process in the business. Hence, it can be assessed that the particular assignment consists of adequate information on the organization and its brand auditing analysis.

Review of sales data

Emirates NBD is one of the largest banking groups in the Middle East by its total assets (Masood et al., 2012). The particular organization was established on 16th October 2007. The headquarter of the company is located in National Bank of Dubai Building in Dubai, UAE. The organization consists of different types of financial products including investment banking, commercial banking, retail banking, private Banking, Mortgage and Credit cards. Emirates NBD has total assets of $98.8 billion as of 2015 (Emiratesnbd.com, 2016).

History of the Company:

During the formation of the particular organization, the shares of Emirates NBD were officially listed on the Dubai Financial Market (DFM). The organization had enhanced their strength by merging between Emirates Bank International (EBI) and the National Bank of Dubai (NBD) (Said, 2012). It was merged with second and fourth largest banks in the UAE. Consequently, it provides adequate opportunities for the organization to experience the profitable outcome from the domestic and international market. The organization is a market leader in the banking sector in UAE. Emirates NBD has more than 220 branches and over 900 ATMs and Cash Deposit Machines (CDMs) across the country and the overseas market (Banerjee & Anand). By providing the diverse financial solution to the monetary organizations, the organization has established a strong brand image in the domestic market. The particular banking group plays a major role in the corporate banking sector. It is the fastest growing Islamic bank with strong investment and private banking services (Al Suwaidi, 2013). The particular organization is a leader in the field of the asset management products and brokerage services. Most of the business analysts have discussed that the robust growth of the organization has indeed facilitated in engaging a huge number of shareholders in the business. Consequently, it facilitates them in enhancing their total assets of business. By analyzing the financial report of Emirates NBD, the total assets of the organization were AED 388.1 billion as of 30th June 2015 (Trabelsi & Trabelsi, 2014). Emirates NBD banking group has the operations in different regions including UAE, the Kingdom of Saudi Arabia, Singapore, Egypt and the United Kingdom. Moreover, the organization has representative offices in some of the Asian countries including India, China, and Indonesia. Currently, the particular organization has more than 9000 people providing flawless services to their clients. The huge workforce engagement has made the organization as the largest employers in UAE. Emirates NBD group of companies include 14 companies, 9 subsidiary companies, and 3 associated companies (Emiratesnbd.com, 2016).

Competitors analysis

Brand architecture:

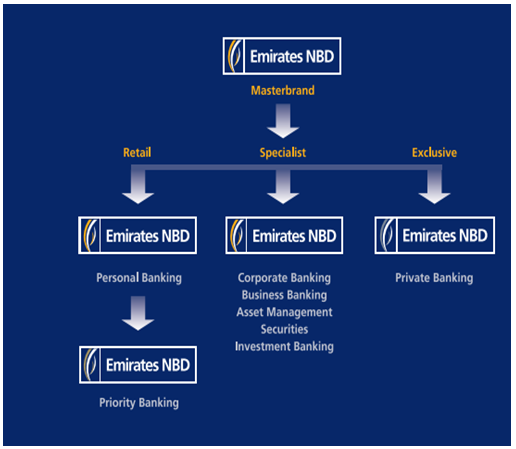

The Emirates NBD brand architecture has been developed for upholding master brand integrity across all products, divisions of the bank. Consequently, it would facilitate in maximizing the brand value in an effective manner. The brand architecture depends on two factors including flexibility and usability and restructuring and simplicity (Kamal Hassan, 2012). The brand architecture is based on the core set of the standard elements. The organization believes that the business flexibility facilitates them in maintaining the consistency in the process (Miniaoui & Gohou, 2013). On the other hand, the restructuring and simplicity of the product facilitates to engage a huge customer’s base in the business. As per the management of the organization, they have taken initiation for simplifying their products by removing the complexity. The architecture of the organization can be categorized into two sections including internally and externally. The architecture of the organization internally facilitates the organization to drive the business growth through several unique initiatives such as improved collaboration and higher sense of belonging (Rusu & Shen, 2012). It makes easier for the customers to understand the products features in an effective manner. On the other hand, the external architecture would ensure the establishment of the brand in both domestic and global platform (Cherian & Farouq, 2013). The brand structure of the organization has been included below:

Figure 2: Brand Structure

(Source: Almonayirie & Dubey, 2014)

ENBD maintains the largest branch in the UAE, which provides the infrastructure for attracting granular, low-cost, and stable current and saving account deposits from the small and retail business customers. This particular approach of the organization has facilitated them in experiencing 10% enhancement in the compound annual growth rate (CAGR) between 2012 and 2015. On the other hand, during 2012 to 2015, near-zero cost current and savings accounts were increased by a CAGR of 21% (Nobanee & Ellili, 2016). Consequently, it contributes to the enhancement of the total deposit to 56% by December 2015, whereas, the total deposit was estimated 43% in 2012. Due to the reduced liquidity, flows and economic slowdown has been observed in the banking sector in the UAE (Mobarek & Kalonov, 2014). Consequently, the banks have faced challenges in enhancing the deposits in the business. On the contrary, the Emirates NBD was still able to manage in expanding its deposits base by 11%, while other banks have only expanded their deposits on an average of 4% (Ibrahim & Alqaydi, 2013). Consequently, this particular situation has facilitated the organization in growing its lending activities on the market rate. For being the fastest growing Islamic bank in UAE, the organization had to focus on their financial products so that it could attract a huge number of people in the large domestic areas. 99.8% of shares are owned by the Emirates NBD itself. By analyzing the history of the organization, it can be identified that the NBD investment bank was first incorporated on 31st May 2006 in the DIFC (King, 2012). The principal activity of the organization is to execute the investment banking. In 2001, the Emirates international security was established. By analyzing the assets graph of the organization, it can be identified that the business has experienced major growth in the last decade.

Taking action and monitoring outcomes

Figure 3: Emirates NBD assets diagram

(Source: Kumar & Sujit, 2015)

It can be assessed that Emirates NBD has the largest assets in GCC. With the engagement of the enhance distribution, the organization has obtained profitable outcome within a timeframe. By analyzing the above diagram, it can be assessed that the particular bank has the adequate strengths and opportunities for expanding the business in the large demographic market. Without having the strong presence on the global platform, Emirates NBD would not be able to enhance the market share (Agnihotri & Bhavani, 2013). Hence, it can be assessed by analyzing the background of the company that Emirates NBD has experienced huge growth in the domestic arena. By adopting the merger and acquisition policy, the organization can improve their global presence within the short timeframe.

EmiratesNBD is a leading and vibrant financial services provider in the Middle East. By conducting the internal analysis of the organization, different factors of the business can be evaluated in an effective manner. SWOT analysis facilitates to highlights the key issues and threat of the business. It indicates the strength, weakness, opportunity, and weakness of the organization. In this context, the internal environment analysis would highlight the opportunities of the organization for expanding the business into the foreign market. Although Emirates NBD has huge potentialities, it is often unable to take strategic decisions for the enhancement of the business. The particular internal analysis would facilitate to identify the risk factors of the business, which might create challenges for the particular organization to execute the business process management. By identifying the potential risk factors, the organization would be able to gain their profit margin in the business.

|

Strengths · The organization has the huge financial base in the Gulf Cooperation Council region conducting the operation in different regions including the UAE, the Kingdom of Saudi Arabia, Qatar, the United Kingdom, and Singapore. Moreover, it has the representative office in both India and Iran (Saji, 2012). · Emirates EBD is the leading retail banking franchise in the UAE. It has more than 140 branches and 750 ATMs or the cash deposit machines across the UAE (Emiratesnbd.com, 2016). · EmiratesNBD has been recognized as the “Best Bank in UAE.” On the other hand, it also wins the award for being ‘Best SME Internet Banking Service’ (Jham, 2012). · The particular bank offers the retail services along with the private banking and credit card facilities. · The prime strength of the business is that the particular organization has the experienced business units, which facilitates them in executing the process in the large domestic market. · The organization has been experiencing the high profitability and revenue margin due to its effective business approaches. · The skilled workforce has facilitated the organization in enhancing the productivity of the business in an effectual method. · The management of the company has reduced its labor costs for experiencing the high growth in the business. |

Weaknesses · Although the organization has successfully established its business in the large domestic area, the management has faced difficulties in enhancing the online activity of the business. Without improving the online presence, the organization would not be able to experience the adequate profits from the business (Chowdhury, 2015). · The limited global presence has been a problem for the organization as it causes the limited market share of the particular business. · The lack of brand portfolio has created difficulties of the organization to promote their effective products in the domestic market. · The organization needs to enhance its investment in the research and development sections so that they can identify new and innovative strategies for the business expansion in the domestic and international platform. · Due to the competitiveness in the market, the organization has been facing several challenges from the existing and new entrants. · The tax structure needs to be developed for the better execution of the business in the large domestic market (Hightower, 2016). · For obtaining the future profitability, the organization needs to develop its strategic approaches in the business (Bose & Sampath, 2015). |

|

Opportunities · The focus of the business lies within the growth to the benefits from the local government spending drive. · The particular banking sector is lending to the private companies in the Saudi Arabia. However, the growth of the business is still 15% per year (Fernandez & Kumar, 2013). · By expanding the business over the international market, the organization could enhance its profitability in an effectual manner. Consequently, the business expansion would cause enhancement of the revenues. · The particular organization must employ the online platforms for expanding its business within a short span of time. With the involvement of the online market, the organization would promote their products to the wider customers across the globe. · By undertaking new venture into the new market, the organization can expand their business and diversify their portfolio of the products and services. |

Threats · In the competitive market, the organization needs to enhance its market share to expand the business in an effectual manner. However, it is quite difficult and expensive for the organization to enhance the market share of the mature market. · The lending situation in the UAE is very competitive. There are a small number of local banks in the location. The margins would be tight while the banks would book new assets (Tai, 2012). · The increasing cost is one of the major threats to the business. · In the competitive market, the organization face challenges due the existing competitors including Abu Dhabi Islamic Bank, Bank of Sharjah, and Mashreqbank psc (Ghoul, 2012). · Due to the volatile costs, Emirates NBD may face difficulties in business execution in the large demographic areas. Consequently, the organization needs to implement strategic approaches for avoiding such situation (Kashmoola, 2016). |

By discussing the internal analysis, it can be assessed that Emirates NBD has successfully established the business in the domestic market. However, the organization has not yet taken strong foot step into the international market. Consequently, the business opportunities are getting shriveled due to the small market size. The USP of the organization is that it is the market leader across the core business line, and it is quite responsible for the social engagement (Banerjee & Rafiuddin, 2015). The prime targets of the organization are small, medium and large enterprises searching for the diversified financial solutions. The strength of Emirates NBD indicates its position in the market. The organization is globally recognized for being one of the dynamic and leading financial services providers in the Middle East (Saito, 2016). Although the organization has huge financial resources, it does not expand its business in the foreign market. Consequently, it decreases the profit margins in the business. By discussing the weakness of the organization, it can be assessed that the particular venture shows a lack of interest in involving the online market. Due to the lack of online activities, the organization is unable to spread the product related information in the market. Consequently, it creates huge impacts on the business. Due to the limited global establishment, the organization has a limited market share. The organization has several growth opportunities. However, the organization is unable to utilize its financial sources properly. Consequently, the growth rate of the business is only 1.5% per year (Thye Goh, Mohd Suki & Fam, 2014). The financial analysts have discussed the fact that the international expansion would boost up the revenues in the business. In the mature market, the organization has been facing huge competitiveness from its rivals including Abu Dhabi Islamic Bank, Bank of Sharjah, and Mashreqbank psc. By implementing the strategic approaches, the organization would be able to compete with these rivals in the market. In the recent years, the banking sector has been facing difficulties in the business execution due to the volatility of the cost (Altwijry & Abduh, 2013). Hence, it can be assessed that the cost-reducing policy needs to be developed for enhancing the business opportunities in both domestic and international market.

Political:

In the recent years, most of the banking sectors have been facing challenges in expanding their business into the foreign market due to several political factors. Although Emirates NBD has a strong presence in the domestic market, it has not succeeded in making a strong brand impact on the global platform. In the UAE, there are seven dependent emirates. The seven emirates have united since 1971 (Altwijry & Abduh, 2013). Moreover, the president becomes the ruler of Abu Dhabi. Although there is no elected government in UAE, it has optional Federal National Council containing 40 members selected by the seven emirates. The UAE is also the member of GCC. The rising cost of the domestic deposits across the competitive market, and reduced access to the international debt capital market are the major challenges in fueling the banking sector. Hence, Emirates NBD had face challenges in enhancing the deposit cost in the business due to the several political dilemmas. However, it mainly affected the ailing banks in the UAE. With the merger and acquisition policy, Emirates NBD has been a successful bank in the Middle East (Kumar, 2015). Funding and liquidity pressures remain in the banking sector in UAE. Consequently, it creates the challenges in expanding the business in the foreign market. On the other hand, most of the business analysts have discussed the fact that most of the foreign banks show interest in opening a new venture in the UAE due to the stable political environment. On the other hand, it has very strong relation with some of the developing countries. Consequently, the particular organization would get adequate opportunities in expanding the business to the foreign market. Over the last few decades, many countries have implemented several rules and regulations on the exemption of citizens for investing funds in the foreign lands. In the recent years, the government has been focusing on the implementing new rules and regulations for the foreign investors, which can affect the banking sectors. Moreover, it would narrow the business process of the banking sector in the Middle East. Despite the presence of several political barriers, Emirates NBD has successfully enhanced its market share based on the both domestic and international market.

Economical:

The economic environment is based on the free trade. Moreover, it encourages the local and foreign investors to invest their money in the UAE. However, the banking sector in UAE has several growth opportunities due to the increased foreign traders. There are three different factors affecting the financial investment in the UAE such as Gross Domestic Product (GDP), interest rates, Inflation, and a number of workers. During the economic crisis in 2008, foreign exchange rates were fallen, which creates the difficulties for the banking sector to execute the business in an effectual manner (Chang, 2013). During that particular time, most of the banking organizations were facing challenges in the business execution due to lack of funds. Most of the people have surrendered their bank accounts due to the global recession. Consequently, Emirates NBD had to face huge loss due to the recession in the industry. By analyzing the different factors of the financial investment, it can be assessed that the GDP purchasing power parity has been increased. On the other hand, the GDP per capita was unstable though the last 6 years. For example, the GDP per capita was $18,839 in 1997, whereas it was increased to $19,173 in 2002 (Abu Hussain & Al-Ajmi, 2012). With the implementation of the strategic approaches, the government could improve the economic strength of the nation. The government would decrease the interest rate so that the foreign investors could invest huge capital in the domestic market. Consequently, it would enhance the business opportunities for Emirates NBD. The inflation rate in the UAE is 1.5% in 2000 (Al-Tamimi, Hussein & Jellali, 2013). However, the inflation rate was 3.1% in 1999. Although Emirates NBD has successfully enhanced their economic structure by maintaining a proper growth rate of the business, they have faced several challenges in executing the business in both domestic and international platforms.

Socio-cultural:

Socio-cultural factors had a great impact on the performance of Emirates NBD. The socio-cultural factors involve the demographic and the cultural aspects of the external environment. It facilitates the organization to take valid decision for the enhancement of the business in the large domestic market space. The banking sector must consider some of the essential forces during the planning for opening a new venture in the UAE (Cader et al., 2013). These essential forces include religion, language, population, ethnic groups, literacy etc. most of the UAE banks are aware of the fact that the corporate social responsibility is one of the major factors for enhancing the brand value on the global platform. Emirates NBD has focused on their social responsibilities. For conducting the social responsibilities, the particular bank consults with the stakeholders and participates in the program. By analyzing the World Bank data, the total unemployment rate in UAE is 3.80%. As of 2016, both male and female unemployment rate is 8.80%, whereas the youth unemployment rate is 9.90% (Randeree, Mahal & Narwani, 2012). Consequently, the unemployment rate is a major factor affecting the business of Emirates NBD. However, the local government has taken initiatives for reducing the rate by inviting the foreign investors in the domestic market. The higher rate of employment would facilitate the banking industry in enhancing their business opportunities in an effectual manner. The particular organization has been providing diverse financial solutions to the monetary companies in the large domestic area (Masood et al., 2012). By providing the unbiased and fair solutions to the financial organization, Emirates NBD has been enhancing their business opportunities in an efficient manner. On the other hand, the non-national population in UAE is 48.1% as of 2015 (Said, 2012). Hence, it can be assessed that UAE has enhanced industrial growth. Consequently, it increases the job opportunity of the foreigners and other people belonging to the GCC countries. It indicates a good opportunities for the banking industry in UAE. EmiratesNBD has encouraged the foreign investors for investing in UAE so that it can facilitate the particular organization in increasing the total assets (Al Suwaidi, 2013).

In the recent years, the technological advancement has facilitated the banking industry to improve their business opportunities in an effectual manner. With the involvement of the technological growth, the banking industry can expand their business in both domestic and international market (Trabelsi & Trabelsi, 2014). Emirates NBD has engaged enhanced technologies in the process for providing the diverse financial solutions to the monetary organizations located in the different parts of UAE. As per the management of the organization, technology influence in most parts of the business such as distribution channel, transaction processing, marketing, credit analysis and risk management. With the involvement of the technological advancement, the particular organization has spread the product related information to the large domestic market as well foreign market (Miniaoui & Gohou, 2013). In the UAE, the utilization of internet is widely spread. Consequently, it enhances the business opportunities in many ways. In the recent years, the online banking of the Emirates NBD has enhanced in an effectual manner. The management believes that the online banking has a wide range of facilities that facilitates the clients in executing the baking works. The online banking facilitates the clients to transfer the money with few clicks. On the other hand, it also has several other facilities including application for the new credit card, adding beneficiary account, account transfer, enable or disable services on online, and providing history of all completed transfer transaction. Moreover, the organization has released their latest technological advancement. For example, the organization has released online mobile application that facilitates the customers in executing transaction from their mobile. Consequently, it becomes easier for the domestic and foreign customers to avail the banking services at any point time. This type of initiation facilitates the organization to enhance their business opportunities in both national and foreign market. In the UAE, the average monthly usage of the internet is 1.6 million hours for over 500,000 people (Rusu & Shen, 2012). On the other hand, ETISALAT has identified that the average usage per users in 72 hours a month, which indicates that almost 20% of the population have the internet access (Cherian & Farouq, 2013). Consequently, it would facilitate the organization to enhance their business process on the online platform. Although the organization has been dominating in the domestic market by providing flawless financial solution to the clients, lack of the promotional activities have created barriers to enhance their brand value in the international market.

Legal:

There are various legal authorities have been facilitating in auditing the functioning of the Emirates NBD. The UAE government has applied several legislation frameworks in the banking sectors for executing the process in a systematic manner. The UAE central bank has announced the liquidity management rules for all banks. As per the circular No 33/2015, issued on May 27, 2015 all banks should abide by the provisions of the new regulations and guidance manual (Almonayirie & Dubey, 2014). With the involvement of the regulation, the government wants to reduce the liquidity risks from the banking sectors. Hence, it can be assessed that the legal frameworks have facilitated the organization to reduce the financial risks from the business. The Emirates NBD and other banks in UAE are required to follow the guidelines from the UAE Central Bank (Nobanee & Ellili, 2016). On the other hand, the UAE offshore companies need to follow some guidelines for conducting business in the particular region. For selling their products, they need to be the official agents. However, the restrictions on the offshore, onshore or the free zone companies do not apply to the foreign subsidiaries. The foreign subsidiaries are not bounded by the UAE rules. Hence, they can conduct the business in the UAE without hesitating for legal legislations or regulations.

Porter 5 forces analysis

The present stature of the organization is very high, and it is continuing to increase in an effective manner. The merger of two banks has facilitated the organization to experience the profitable outcome from the large domestic market. By analyzing the current situation of the organization, it can be assessed that the particular company has an adequate source of financial sources to expand the business in the large domestic market. The prime strength of the particular bank is its capability of providing the diverse financial solutions to the different monetary organizations. Emirates NBD is the leading Bank in the UAE consist of over 140 branches and 750 ATMs or cash deposit machines (Mobarek & Kalonov, 2014). The diversity of the bank has facilitated them in enhancing the business opportunities in an effectual manner. However, the particular bank has been facing some challenges in expanding the business in the foreign market. Due to the limited presence on the global platform, the organization has a limited market share. For enhancing the brand value, the organization needs to improve their global presence. They can enhance their position by including different promotional approaches. Without promoting the brand into the foreign market, the organization would not be able to gain their profitability in the business. There are several threats to the business. In the competitive market, the organization needs to enhance their market share for obtaining high growth in the business within a short period. The management of the organization has discussed that the volatility of cost often creates barriers to increasing the customer’s base in an effectual manner. On the other hand, the lending environment in Saudi Arabia has been competitive for some local banks (Ibrahim & Alqaydi, 2013). Consequently, the profit margins would be tight while banks book new assets into the business.

Porter’s five forces analysis:

Threats of New Entrants: LOW

In the competitive market, most of the existing banks have faced a challenge in business execution due to the threats of the new entrants. Although there are huge capital and regulatory requirement, 215 new banks were opened averagely from 1977 to 2002 as per FDIC. On the contrary, in the current scenario, the threat of new entrants in the UAE is low. There are different factors affecting the threat of new entrants. Due to the government licensing, most of the new organizations face challenges in opening the new ventures. On the other hand, in UAE, the lack of skilled professionals has created difficulties for the banking industry to open a new venture in the domestic market. Emirates NBD is a leading bank in the UAE. By providing the diverse financial solutions, the organization has successfully captured the domestic market. High initial investment is another issue for the new entrants in UAE (Kumar & Sujit, 2015). Although the existing banking organizations have been successfully executing their business, the entry of foreign bank often creates difficulties for existing companies. However, most of the foreign banks avoid making business in the UAE due to the political legislations and government’s regulations. Consequently, it facilitates the existing organizations in executing business in an effectual manner within the domestic market.

Bargaining Power of Customers: HIGH

The bargaining power of the suppliers is quite high due to several factors including customer deposits, mortgage loans, mortgage securities and loans from the financial institution. In the recent years, the investment revenues have risen in the banking sector in UAE. Consequently, it influences the customers for bargaining for a better option. On the other hand, the customers can bargain for the higher interest rates. Although the Emirates NBD has the higher brand value compared to other banks in the UAE, the customers have different other options also (Saji, 2012). Consequently, it indicates the high bargaining power of the customers. On the other hand, the switching cost is very low. Hence, the customers of Emirates NBD can switch to the other banks if they obtain low value in the business. During the recession, the Emirates NBD has also faced this kind of challenges when most of the customers have surrendered their accounts (Banerjee & Rafiuddin, 2015). Consequently, it had hugely affected business. Another reason for high bargaining power of the consumer is that the undiversified services. However, the particular organization called Emirates NBD has a wide range of diverse products, which has facilitated them in upholding a high customer’s base in the business. In the era of technology, the customers can easily avail the information on different banks providing services in the UAE (Saito, 2016). Hence, it becomes easier for the UAE customers to identify their best banking options.

The banking industry in UAE needs to follow the rules and regulations of the UAE central bank. Due to the rules and legislation made by the UAE central bank, the suppliers are unable to bargain high. Suppliers of the bank are the depositors, who have excess money and prefer the regular income and safety (Thye Goh, Mohd Suki & Fam, 2014). In the banking sectors in UAE, suppliers have low bargaining power due to the several factors including nature of the suppliers, few alternatives, UAE central bank legislations and non-concentrated suppliers. The brand value of Emirates NBD is quite high (Altwijry & Abduh, 2013). Consequently, the suppliers avoid conflicts in the business making process. The suppliers in UAE prefer low risk in the business. On the other hand, the suppliers have very few alternatives, which can provide diverse financial solutions to them. Consequently, suppliers often bargain low to be engaged with the organization for a long timeframe. The most obvious reason for low bargaining power of the suppliers is that the banks in UAE are subjected to follow the regulations of the UAE central bank. Hence, the Central Bank UAE takes all decisions regarding the interest rates (Altwijry & Abduh, 2013). Consequently, it reduces the bargaining power of suppliers. Hence, it can be assessed that the low bargaining power of the suppliers has facilitated Emirates NBD to enhance business opportunities in the domestic market.

Availability of the Substitutes: LOW

In the recent years, the financial sector has experienced robust growth due to the implementation of new policy. On the other hand, there is the invention of new product in the financial sector. The banks in UAE are not limited to the traditional business making process (Kumar, 2015). EmiratesNBD has a wide range of unique products and services for the clients. The management of the organization has focused on the substitute of the products. Substitutes of the products are those, which is different but provide satisfaction to the same set of customers. EmiratesNBD has several financial solutions for the monetary organizations. The top financial products in UAE are credit cards, personal finance, home finance, and car loans (Chang, 2013). By analyzing the current situation of the UAE banking industry, it can be assessed that the non-banking financial sectors have to grow in an effective manner, which indicates a risk factor for the existing organizations. On the other hand, the substitute of the financial product is the stock market. Customers often invest a huge amount of money in the stock market for obtaining adequate outcomes. Although there are several threats of substitutes, the organization has successfully engaged a large customer’s base by delivering a unique range of financial solutions.

Competitive Rivalry: HIGH

In the recent years, Emirates NBD has been facing several challenges due to the increased threats from the competitors. Due to the high market growth, the particular bank has faced difficulties in the business execution (Altwijry & Abduh, 2013). Most of the banks provide different offers to the new customers. Moreover, the switching cost for the customers is very low. Consequently, it is an imperative factor for decreasing customer’s base in the business. Sometimes, the high exit barriers have influenced the customers to avoid the particular organization. In the competitive market, Emirates NBD has several competitors including Abu Dhabi Islamic Bank, Bank of Sharjah and Mashreqbank psc (Rusu & Shen,). In the mature market, the organization has to implement several strategical approaches to enhancing the business opportunities in an effectual manner. The management of the organization has discussed that the volatility of the cost often creates challenges in retaining the customers for the long period. Despite the threats of the competitors, the organization has maintained a strong domestic presence.

Figure 4: Porter’s five forces on Emirates NBD

(Source: Created by author)

The banking sector in UAE has experienced the enormous growth in the recent years. EmiratesNBD has enhanced its business in the domestic market through its diverse financial solutions. With the involvement of the different strategic approaches, the organization could improve its foreign market.

Business realignment:

Business realignment is one of the major factors for enhancing the profits within a timeframe. The management needs to implement strategic approaches to engage customers in the business. By managing the performance and productivity, the organization can obtain long-term success in the market. Emirates NBD should focus on the product diversification so that they could engage a huge number of customers in the banks. On the other hand, the particular bank could minimize the restrictions for opening a new account. Moreover, the low switching cost would facilitate the bank to enhance their customer’s base in an effective manner.

Channel optimization:

EmiratesNBD has experienced huge success in the domestic market due to the merger and acquisition policy. At the initial stage, the organization has successfully merged with two large banks in the UAE. The organization could merge their business with other potential banks in the domestic market. It would facilitate them in enhancing the profitability of the business. On the other hand, the organization needs to merge their venture with the foreign companies for making strong footstep in the international market. Consequently, this particular process would facilitate them in enhancing the revenues of the business.

Staff productivity:

Without having the adequate workforce, the organization would not be able to expand their business in the large domestic market. In the banking sectors, the organization is required the skilled employees having adequate financial knowledge so that they could provide diverse financial solutions to the domestic and foreign clients. Emirates NBD has total 9000 people representing 70 nationalities. Although the particular organization is one of the largest employers in the UAE, they need to focus on retaining potential employees. Without retaining the potential and skilled employees for a long period, the organization would not be able to achieve its goals and objectives in an effective way.

Technology and automation:

Technological advancement has facilitated the banking sectors in achieving high growth in the domestic and international market. The particular organization has implemented different technologies in the business for providing flawless solutions to the customers. For instance, the organization has released its mobile application, which allows the customers to execute all banking activities without facing any difficulties. Hence, Emirates NBD needs to focus on inventing such type of technical advancement that facilitates in enhancing the business opportunities in both domestic and international platforms.

Conclusion:

It can be concluded that the Emirates NBD has been experiencing huge success in the domestic market. However, the particular organization has been trying to expand their business in the international platform by implementing different strategic approaches. By providing the diverse financial solutions to the monetary organizations, Emirates NBD has sustainable growth in the business. By analyzing the current situation of the particular organization, it can be assessed that the limited global presence of the company does not allow them to enhance their market share. Consequently, Emirates NBD is unable to achieve high-profit margin from the foreign market. In this context, the brand auditing process on Emirates NBD has been conducted in a detailed manner. By analyzing the internal and external environmental factors of Emirates NBD, different issues and growth opportunities have been highlighted. Moreover, the provided recommendations would facilitate in enhancing the business opportunities for Emirates NBD.

References

Abu Hussain, H., & Al-Ajmi, J. (2012). Risk management practices of conventional and Islamic banks in Bahrain. The Journal of Risk Finance,13(3), 215-239.

Agnihotri, M., & Bhavani, M. G. (2013) Impact Of The Customer Relationship Management Practices On The Profitability Of UAE Banks. A Comparative Study.

Al Suwaidi, T. (2013). A data envelopment analysis of banks in the UAE A Study of the Relative Operational and Intermediary Efficiency of National Banks of the United Arab Emirates.

Alatiyat, M. (2013). Banking Profitability in United Arab Emirates from 2008 to 2012. Available at SSRN 2386013.

Almonayirie, W., & Dubey, S. (2014). UAE Banks Financial Merit Diagnosis Using Dual-Classification Scheme. In CONFERENCE PROCEEDINGS IRC-2014 (p. 199).

Al-Tamimi, H., & Hussein, A. (2014). Corporate social responsibility practices of UAE banks. Global Journal of Business Research, 8(3), 91-108.

Al-Tamimi, H., Hussein, A., & Jellali, N. (2013). The effects of ownership structure and competition on risk-taking behavior: evidence from UAE conventional and Islamic banks. The International Journal of Business and Finance Research, 7(2), 115-124.

Altwijry, O. I., & Abduh, M. (2013). Customer Satisfaction and Switching Behavior in Saudi Islamic Banks: An Exploratory Study. Journal of Islamic Finance, 2(2).

Ashraf, G. (2012). Adoption of Internet Banking in United Arab Emirates(Doctoral dissertation, Eastern Mediterranean University (EMU)).

Banerjee, A., & Anand, N. AN ANALYSIS OF THE UAE BANKING SECTOR. ICAF-2014, 96.

Banerjee, A., & Rafiuddin, A. (2015). An Essay on Returns to Scale of Banks in UAE. Asian Journal of Management Sciences & Education Vol, 4, 1.

Biedenbach, G. (2012). Brand equity in the business-to-business context: Examining the structural composition. Journal of Brand Management, 19(8), 688-701.

Bose, I., & Sampath, S. (2015). Balanced Scorecard and Organizational Sustainability: An empirical Study from the Perspectives of Middle Management Executives of Retail Banking Division of Emirates NBD Bank, UAE. Pragyaan: Journal of Management, 1.

Brand, J. C. (2013). The governance of significant enterprise mobility security risks (Doctoral dissertation, Stellenbosch: Stellenbosch University).

Cader, Y., Kathleen O'Neill, K., Blooshi, A. A., Bakheet Al Shouq, A. A., Hussain Mohamed Fadaaq, B., & Galal Ali, F. (2013). Knowledge management in Islamic and conventional banks in the United Arab Emirates.Management Research Review, 36(4), 388-399.

Carson, E. (2013). Globalization of Auditing.

Chang, F. (2013). Mountains Are High and the Emperor Is Far Away: An Analysis of Recent Corporate Scandals Reveals the Solution to China's Agency Problem, The. Int'l Fin. L. Rev., 32, 20.

Chen, Z., & XU, H. (2013). Auditor Industry Expertise, Brand Reputation and Audit Fees. Journal of Shanxi Finance and Economics University, 7, 012.

Cherian, J., & Farouq, S. (2013). Does effective leadership style drive financial performance of banks? Analysis in the context of UAE banking sector. International Journal of Economics and Finance, 5(7), 105.

Cheskis, A. L. (2012). What's your brand? Winning internal audit brands are those that are designed proactively instead of happening by default. Internal Auditor, 69(5), 58-63.

Chowdhury, R. H. (2015). Equity capital and bank profitability: evidence from the United Arab Emirates. Afro-Asian Journal of Finance and Accounting,5(1), 1-20.

Dauvergne, P., & Lister, J. (2012). Big brand sustainability: Governance prospects and environmental limits. Global Environmental Change, 22(1), 36-45.

DeFond, M., & Zhang, J. (2014). A review of archival auditing research.Journal of Accounting and Economics, 58(2), 275-326.

El-Bannany, M. (2012). Global financial crisis and the intellectual capital performance of UAE banks. Journal of Human Resource Costing & Accounting, 16(1), 20-36.

El-Bannany, M. (2013). A model to explain intellectual capital disclosure in UAE banks. International Journal of Learning and Intellectual Capital, 10(1), 35-51.

Emiratesnbd.com(2016). . Retrieved 23 August 2016, from https://www.emiratesnbd.com/en/

Fernandez, M., & Kumar, R. (2013) EVALUATION OF POST-MERGER OPERATING PERFORMANCE OF EMIRATES NBD. MUSTANG JOURNAL OF ACCOUNTING AND FINANCE VOLUME 4 (2013), 97.

Ghoul, W. A. (2012). Islamic Investing Goes Mainstream: A SWOT Analysis. The Journal of Investing, 21(4), 171-181.

Greenstein, M. M., & Hunton, J. E. (2015). Retraction: Extending the Accounting Brand to Privacy Services. Journal of Information Systems,29(2), 237-237.

Hassan Al-Tamimi, H. A. (2012). The effects of corporate governance on performance and financial distress: The experience of UAE national banks.Journal of Financial Regulation and Compliance, 20(2), 169-181.

Hightower, V. P. (2016). Purposeful Ambiguity: The Pearl Trade and Heritage Construction in the United Arab Emirates. Cultural Heritage and the Arabian Peninsula: Debates, Discourses and Practices, 71-85.

Ibrahim, M. E., & Alqaydi, F. R. (2013). Financial literacy, personal financial attitude, and forms of personal debt among residents of the UAE.International Journal of Economics and Finance, 5(7), 126.

Jacka, J. M., & Scott, P. R. (2013). On unfamiliar ground: auditing marketing operations is crucial to addressing risks to the organization's brand. Internal Auditor, 70(1), 60-65.

Jham, V. (2012). Change management in retail banking in the UAE: an assessment of some key antecedents of customer satisfaction and demographics. International Journal of Strategic Change Management, 4(3-4), 229-249.

Kamal Hassan, M. (2012). A disclosure index to measure the extent of corporate governance reporting by UAE listed corporations. Journal of Financial Reporting and Accounting, 10(1), 4-33.

Kapferer, J. N. (2012). The new strategic brand management: Advanced insights and strategic thinking. Kogan page publishers.

Kashmoola, B. (2016). The Training and Development Programs in the United Arab Emirates: A Conceptual Study.

King, B. (2012). Bank 3.0: Why banking is no longer somewhere you go but something you do. John Wiley & Sons.

King, C., Grace, D., & Funk, D. C. (2012). Employee brand equity: Scale development and validation. Journal of Brand Management, 19(4), 268-288.

Kumar, B. R. (2015). Determinants of Value Creation: An Empirical Examination from UAE Market. International Journal of Economics and Financial Issues, 5(1), 75.

Kumar, R., & Sujit, K. S. (2015). Wealth Creators in the Banking Sector in UAE during 2010-2015 Period. Asian Journal of Finance & Accounting, 7(2), 152-160.

Masood, O., Al Suwaidi, H., & Darshini Pun Thapa, P. (2012). Credit risk management: a case differentiating Islamic and non-Islamic banks in UAE.Qualitative Research in Financial Markets, 4(2/3), 197-205.

Mehta, A. (2012). Financial Performance of UAE Banking Sector-AComparison of before and during Crisis Ratios. International Journal of Trade, Economics and Finance, 3(5), 381.

Miniaoui, H., & Gohou, G. (2013). Did Islamic banking perform better during the financial crisis? Evidence from the UAE.

Mobarek, A., & Kalonov, A. (2014). Comparative performance analysis between conventional and Islamic banks: empirical evidence from OIC countries. Applied Economics, 46(3), 253-270.

Mohamed Shahwan, T., & Mohammed Hassan, Y. (2013). Efficiency analysis of UAE banks using data envelopment analysis. Journal of Economic and Administrative Sciences, 29(1), 4-20.

Mubarak, A. (2012). Accounting reporting in banks: The case in Egypt and the UAE before and after the financial crisis. Journal of Accounting and Auditing, 2012, 1.

Nobanee, H., & Ellili, N. (2016). Corporate sustainability disclosure in annual reports: Evidence from UAE banks: Islamic versus conventional. Renewable and Sustainable Energy Reviews, 55, 1336-1341.

Padayachee, L. G., & De Jager, H. (2015). Integrated auditing-an internal audit perspective.

Padayachee, L. G., & De Jager, H. (2015). Integrated auditing-an internal audit perspective.

Plambeck, E. L., Taylor, T. A., & Zhang, Q. (2012). Supplier evasion of a buyer’s audit: Implications for auditing and compliance with labor and environmental standards. Working Paper.

Pratoomsuwan, T. (2012). The effect of an audit firm's brand on security pricing. International Journal of Emerging Markets, 7(4), 430-442.

Randeree, K., Mahal, A., & Narwani, A. (2012). A business continuity management maturity model for the UAE banking sector. Business Process Management Journal, 18(3), 472-492.

Rosenbaum-Elliott, R., Percy, L., Elliott, R. H., & Pervan, S. (2015).Strategic brand management. Oxford University Press, USA.

Rusu, R. F., & Shen, K. N. (2012). An empirical study on e-banking acceptance in the United Arab Emirates (UAE). Journal of Electronic Banking Systems, 2012, 1.

Said, D. (2012). Efficiency in Islamic banking during a financial crisis-an empirical analysis of forty-seven banks. Journal of Applied Finance & Banking, 2(3), 163-197.

Saito, J. (2016). Boards of Directors and Bank Performance in United Arab Emirates.

Saji, B. S. (2012). Strategic change initiatives in reward management in a merger–case study. International Journal of Strategic Change Management,4(2), 139-148.

Tai, L. S. (2012). Competition and Efficiency of National Banks in the United Arab Emirates. Journal of Applied Business and Economics, 13(5), 76-86.

Thye Goh, T., Mohd Suki, N., & Fam, K. (2014). Exploring a consumption value model for Islamic mobile banking adoption. Journal of Islamic Marketing, 5(3), 344-365.

Trabelsi, N. S., & Trabelsi, M. (2014). The Value Relevance of IFRS in the UAE Banking Industry: Empirical Evidence from Dubai Financial Market, 2008-2013. International Journal of Academic Research in Accounting, Finance and Management Sciences, 4(4), 60-71.

Wilson, P. (2012). Dissecting the anatomy of brands: Improving methodologies for strategic brand-building. Journal of Brand Strategy, 1(2), 131-148.

Xia, L. I. U. (2013). The Effect of Audit Firm Size, Brand and Competition on Audit Fee. Journal of Lanzhou Commercial College, 1, 015.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2017). Emirates NBD Brand Auditing Essay: A Case Study.. Retrieved from https://myassignmenthelp.com/free-samples/brand-auditing-on-emirates-nbd.

"Emirates NBD Brand Auditing Essay: A Case Study.." My Assignment Help, 2017, https://myassignmenthelp.com/free-samples/brand-auditing-on-emirates-nbd.

My Assignment Help (2017) Emirates NBD Brand Auditing Essay: A Case Study. [Online]. Available from: https://myassignmenthelp.com/free-samples/brand-auditing-on-emirates-nbd

[Accessed 14 May 2025].

My Assignment Help. 'Emirates NBD Brand Auditing Essay: A Case Study.' (My Assignment Help, 2017) <https://myassignmenthelp.com/free-samples/brand-auditing-on-emirates-nbd> accessed 14 May 2025.

My Assignment Help. Emirates NBD Brand Auditing Essay: A Case Study. [Internet]. My Assignment Help. 2017 [cited 14 May 2025]. Available from: https://myassignmenthelp.com/free-samples/brand-auditing-on-emirates-nbd.