Background of Research

Describe about the Impact of Internet Banking In Account Opening – A Case Study of HSBC Holdings PLC ?

1.0 Introduction

With rapid advancements in technology and increasing competition in the business environment it has become important on the part of the organizations to make an effective use of technology for offering quality services to the customers and build a pool of satisfied customers. Moreover implementing modern technology in the operation facilitates the organizations to remain competitive and achieve sustainable competitive advantage in the business environment. Similar is the case in the banking sectors. Thus it shows that today’s organizations are focused upon the sales and products to customer and clients oriented market. Today’s main aim of the organization is to supply the customer’s needs and wants with better quality of the service and improving the customers service (Abu Bakar Munir, 2004). Now a day’s organization is achieved competitive market with the help of delivering better customer’s service because customer service works as a competitive weapon for organization. Thus in order to achieve customer’s perceptions and quality of the better service organization needs to adopt internet technology.

Toady internet helps the organization to provide better opportunities and new ways of carrying out their business with more efficiency. Internet gives the better opportunities to the banking sectors in order to deliver their services to customers (Cronin, 1997). Electronic commerce is used to transfer the strategies of the business in the ways they deliver and sell their goods and services to the customers with the help of internet. Supply chain management, electronic fund transfer, electronic market, and electronic data exchange, online line processing and online marketing are the services provided by the electronic commerce to their customers.

Internet banking provides more market opportunities and innovative services and products for both the customers and the bank. With the help of the internet banking customers transfer their funds, open new account, enquiry their account and pay their bill in an efficient manners from one place to another place. Online banking or internet banking service is adopted by the bank with the help of electronic commerce (EC). With the help of internet banking, bank delivering financial and banking services by ubiquitous nature. Mobile banking, internet banking, automatic teller machine, EFT and telephone banking are provided by the bank though online to their users or customers (Jayawardhena and Foley, 2000). Adoption of the internet banking by bank is beneficial to the bank customers and it has also some disadvantage. The main disadvantages of the internet banking are Protection and security of the client’s financial data and information. With the help of internet banking system or process, organization has to improve their services and retain more customers, customer’s satisfactions and customers loyalty also increased.

Thus the researcher in order to gain an overall understanding of the impact of internet banking in accounting opening focuses upon the operations of the HSBC Holdings Plc which is British multinational banking and financial services and is the second largest bank in the world. It has its headquarter in London in United kingdom.

Statement of Research Problem

Competition in an international market has increased due to deregulations and globalization, and today it is easier for the organization to compete within the international market. Due to increased number of customers in market, organization needs to try producing better quality of the products with low cost. Information technology is one of the ways by which the organization can achieve more customers and more profits.

With the help of the information technology organization has changed their way of delivering services to the customers. Today customers want to self service options which are more fast and convenient and in addition advancement of the internet technology has changed the activity of the customs like banking and shopping. With the help of the internet bank delivery service is increased in recent year. Online service or internet services like online banking services are more attractive (Wagner and Yezril, 1999). Continence, providing better services, better control, saving more time and avoiding human contact is the reasons to prefer online banking services by the customers. Apart from then it is much easier to identify and compare with the other competing services regarding benefits.

The main aim of the banking sectors is to provide better quality of services to their customers and with the help of better services organization retain more customers through online. Now the bank has to invest in internet infrastructure in order to achieve customer’s retentions and customer’s satisfaction. Today’s bank focuses not only to achieve new customers but also retaining the existing customers and with the help of e-banking services bank is maintained better customers relationship management.

In additions several financial institutions are using internet technology in order to deliver high quality of services and in this way manage customer relationship. Delivering the better quality of the services to the customers, organization is achieved high customers satisfactions and though it organization gain loyal customers or clients from the market (Loshin and Vacca, 2004). The financial institutions provided undifferentiated service and products to the customers and with the help of these services organization has to enhance service quality that is the main tool to sustain in the market for long terms.

Thus from above it is observed that the customers satisfactions is the main aim of the organization and this is done if an organization has to give better services to their customers as compare to other organization or financial institutions. Thus in order to maintain better customer’s relationship organization like bank sectors gives the online services to their customers through internet. Online account opening facilities are introduced by the banks in order to achieve more customers and profits. Now it is seen that the approximately more than 54 percent users or customers are using internet services and in order to attract those customers, banks have introduced internet online banking service to the customers.

Now it is seen that the information technology play the vital role and with the help of information technology bank introduced the internet banking service to their users. Thus it is said that the information technology is back-bone of the bank or finance system. Thus the advancement of the information technology has to change the current market scenario to provide better service and products (Hanna and Boyson, 1993). The research is based upon the impact on the internet banking in account opening. Therefore, privacy and security are the important issues and apart from them the customers have a several requirements and expectations regarding their service and website design. Apart from them several bank provides different type of the services that are raised issues in front of the organization due to lack of direct contact between the banks and customers. Delivering of the services through internet has rapidly changed. In order to develop better services and products through internet banking system banks are remained unnoticed to their customers that create problems in front of customers. Therefore financial instructions need to understand the needs of users and their expectations that help the organization in order to identify factors that affect customer’s intentions through internet. This is important issues and banking sectors have to formulate their strategies though internet banking in future. Lack of the banking services and the security are the problems of internet banking. Lacks of internet awareness and infrastructure are also creating problems in front of the users.

Aim and Objective

The main aim of the research is to identify and understand the impact of the internet banking on account. With the help of this research study, research also identified the effectiveness of the internet technology or online banking on customers and how internet banking improved customer and quality of the services. Thus, according to the aim of the research researcher has to establish the objective. These objectives are given below;

- To determine the impact of internet banking on customers satisfaction leading to number of account openings in the context of HSBC Holdings Plc.

- To gain and understand of the perception of the consumers towards internet banking.

- To identify the factors that motivate customers to adopt the services provided through internet banking in the context of HSBC Holdings Plc.

- To identify the impact of internet banking on the performance of the banking personal and performance of the bank as a whole in the context of HSBC Holdings Plc.

According to the objective and aim of the research, following questions are framed. These questions are given below;

- What are the impacts of internet banking on customers satisfactions?

- What are the different factors that motivate customers to adopt the service provided through internet?

- What is the impact of internet banking on the performance of the banking personal and performance of the bank as a whole taking into consideration the HSBC Holdings Plc performance and operations?

- What is the perception of the customers towards internet banking?

The main significance of this study is to identify the importance of the internet banking. This study also helps the researcher to indentify the important of the customer’s satisfactions. How internet banking helps the customers in order to deliver the products and services in an efficient manner is identified with the help of this research paper (Whalen, 2001). The main significant of the internet banking is to ease of use, high performance, transactions efficiency and safety realizable.

Null Hypothesis: H0: Internet banking makes a significant impact on account opening.

Alternative hypothesis: H1: Internet banking does not make any significant impact on account opening.

2.0 Introduction

Internet banking can be defined as a term that describes the banking transactions like payment of bills, reviewing account statements, fund transfer, repaying of loan and mortgages performed through secured internet applications (Annamalah, 2010). Again it has been observed that internet banking is popular among the young individuals who are looked upon as tech savvy youngsters, but in the recent years its popularity has increased to a new level. This is mainly because of the fact that it tends to facilitate both the individuals as well as the bank with various advantages and benefits. Moreover the studies conducted by Fox, (2005), reveal the fact that internet banking in the recent times has gained popularity in most of the banks and financial institutions and thus it has facilitated them to enhance the banking experience on the part of the customers and the also on the part of the service providers and thus quality of the service provided can be looked upon as one of the most important aspects in the context of the services provided by the banks via internet. Thus with the help of internet banking the banks have been successful in achieving efficiency in the performance of the banking personnel, the performance of the bank as a whole together with enhancing the banking experience of the customers.

HSBC Holdings Plc is the world’s second largest bank in the world and it was founded in the year 1991in London and the international network of the company is operated through 9500 offices in almost 85 countries and territories including Asia, Europe, Africa, South and North America. It has also been observed that the company enjoys a customer base of 60 million customers across the globe. The company is listed on Hong Kong, New York, London, Bermuda and Paris stock exchanges (Hsbc.co.uk, 2008). The company has 200000 shareholders in almost 100 countries and territories. Moreover the bank with the help of an international network which is linked through advanced technology together with enhanced and effective utilization of e-commerce, the organization strives to cater to the specific needs of the customers by offering them wide range financial services that includes commercial banking, private banking, personal financial services, investment banking and various other financial services.

Thus taking into consideration the above facts and figures, it can be inferred that the position that is enjoyed by HSBC Holdings Plc in the industry is justified and thus it possesses a positive perception on the part of the customers and also on the part of the investors.

The studies conducted by Kaneshige, (1995), proposes the fact that advancements in technology led to the introduction of various innovative and new ways of offering banking services to the customers in the form ATMs and internet banking. Thus, banks can be looked upon as one of the early movers in the context of the adoption of advancements in technology. As a result of these advancements and innovations, internet banking in the recent times is looked upon by the banks as a means for replacing the traditions baking functions that were conducted in the branch of the banks.

Various studies conducted by Sahut, (2006), reveal the fact that e-banking evolved in the early 1970s and this was considered by the banks as a replacement of the traditional functions and operations that are conducted within the branch. The main reasons behind such perception of the banks were identified as:

- Setting up and maintaining new branches is expensive and involves huge overhead costs.

- Internet banking services and products that include electronic fund transfer, online review of the account statement, etc was viewed upon as the factors that can facilitate the banks to achieve competitive advantage in the industry.

Moreover innovations that have taken place in internet and mobile platforms has led to video banking, customer relationship management and social integration and these aspects provide assistance to the financial institutions and banks to remain connected with their customers on a virtual level (Abeka, 2013). It also facilitates them in gaining an understanding of the specific needs of the customers and catering to those needs accordingly.

Internet banking refers to a diverse range of banking services that include making inquiries regarding the balance of the account, application for loans, transferring funds from one account to another and other services by making use of internet. With the emergence of internet banking, the traditional ways of offering banking services to the customers has faded away. However various researchers like Wah, (1999), also argued the fact that the emergence of internet baking would not pose significant impact on traditional banking i.e. traditional banks would not disappear in the future. Moreover the rapid advancements in technology would facilitate the banks to take care of the customers in a more effective and efficient manner and thus ti would prove to be much more beneficial to the customers. The various types of e-banking can be illustrated with the help of the following figure:

Fig. 1: Forms of Banking

[Source: www.anxiv.org]

Again Hadden et al., (2002), proposed that the banking services can be accessed by the customers through different channels like interactions that take place between the banks and the customers within the bank branch, mobile banking and internet banking. Out of the abovementioned channels, it has been observed that internet and mobile banking is the most flexible forms of channels and they are also free from limitations like location and time. Again taking into consideration some secure transactions, the bank branches are considered as the primary banking channels which strives to offer physical locations in order to carry out some secured transactions Karjaluoto, 2002). The various banking channels can be illustrated with the help of the following figure:

Fig. 2: Banking Channels

[Source: www.banktech.com]

Daniel, (1999), proposes the fact that internet banking is characterized with several features that tends to add value to the customers and the various features include the wide range of choices, effective control over one’s own personal banking activities, convenience of access, security and the speed of transactions. Thus taking into consideration the point of view of the customers, it can be inferred that internet banking strives to offer a wide range of services which the customers cannot avail through the bank branches and it would also not be easy on the part of the bank offices to offer those services by operating through physical locations (Mattila, 2001). So internet banking facilitates the banks in offering customized services to individual customers.

From the point of view of the banks, it is observed that internet banking facilitates in cross selling, approaching and targeting new customer segments, providing quick response to the customers in order to deal with their complaints and the problems, saving cost and all these lead to customer satisfaction (Hiltunen et al., 2004) . This internet banking can be looked upon as a practice that strives to save time and cost together with providing easy accessibility and convenience to the customers.

The studies conducted by Rogers, (2008), puts forward the fact that behavior of the customers towards adopting internet banking technology can be explained with the help of a theoretical approach which is related to the attitude, perception and feelings of the customers while availing the services offered by the technology. Lee, (2008), moreover identified that spread of innovations follows an S-curve and this curve is used to identify the rate at which an innovation is adopted in the society. This model can be illustrated with the help of the following diagram:

Fig. 3: The S-Curve

[Source: www.maxwideman.com]

The above model also takes into consideration the various characteristics of innovation which tends to make a significant on the acceptance on the part of the customers. So in case of internet banking characteristics are:

- The benefits provided to the customers by the innovation can be looked upon as greater than the technology that is being replaced i.e. the relative advantage.

- The effectiveness and efficiency of the new technology to fir into the society i.e. its compatibility.

- Ease of access on the part of the customers i.e. its complexity.

- The benefit of the technology can be experienced before purchasing i.e. observability.

So the ability on the part of the new technology to satisfy these characteristics tends to accelerate the level of acceptance. Again various studies have been conducted to identify the perspectives on the part of the customers that tend to motivate them so accept the new technology and willingness on their part to use the new system. In this context it has been observed that the level of education and income on the part of the customers makes a significant influence on the degree and extent to which customers focus upon adopting new technology like internet banking. Focusing upon the two factors like education and income, the study of Sathye, (1999) proposed that the degree of acceptance of new technology is enhanced on the part of the customers who are well educated and who are wealthy. On the other hand, age of the customers also makes a significant impact on the adoption of new technology like internet banking and thus it was revealed that, young customers are more attracted towards internet banking in comparison to the old customers. In addition to the above aspects, it has also been observed that the process of adopting new technology is also impacted by the factor gender of the customers. In this context, the studies of Kolodinsky et al., (2004), revealed that men are more prone towards making use of and adopting new technology in comparison to women.

Focusing upon the perception of the customers towards internet banking, Buys and Brown, (2004) enumerated the fact internet banking has been widely accepted across the globe and the simple process following which an individual can review his account, make his payments online and transfer funds between his accounts had led to the popularity of the service among individuals who face time constraints to visit the bank branches in order to carry out such transactions. On the other hand, in addition to these transactional features, internet banking also facilitates the customers with various non transactional features and these features appear to be handy on the part of the customers. Thus while evaluating the perception of the customers; various benefits that were recognized include the following:

- Convenience

From the customers’ point of view it has been observed that internet banking provide convenience to the customers in carrying their transactions and make their payments from their office or form their home simply by the click of a button. Again they can also track their accounts over internet without having to visit to the bank branch and stand in a queue (Ngurukie, 2007). Other wide range of services include making inquiries regarding the interest rates of the financial products, account updating, etc. and thus the customers perceive internet banking as much more convenient on their part in comparison to the traditional way of banking.

- Services

With the advancements in technology it has become extremely consentient on the part of the customers as well as on the part of the banks to host a wide range of services and which could easily be accessed by the customers by logging in from anywhere and at any time. The various services that are offered include loan calculators, financial planning, equity trading, forecasting and budgeting tools and in addition to these the banks also facilitates the customers with online tax preparation and tax forms. Thus ease of access to various services is perceived as one of the most important factors that attract the customers towards internet banking.

- Mobility

Advancements in technology has emerged in almost all the spheres and thus within the last few years, it has been observed that internet banking has marked its presence in the form of mobile internet banking and this strives to provide unlimited mobility on the part of the customers (Jayawardhena, 2000). This provides them an opportunity to conduct their transactions through their mobile and do not have to log in or access to personal computers or laptops. Moreover these transactions can be carried out form any part of the world and at anytime via internet. Thus the relationship that exists between customer satisfaction and internet banking can be illustrated with the help of the following example:

Fig. 4: Relationship between Customer Satisfaction and Internet banking

[Source: www.ijstr.org]

Thus from the above discussion it is observed that in the context of internet banking the customers tend possess a positive perception and this is mainly because of the various advantages and benefits that are associated with internet banking. However studies conducted by Lin, (2004), also provides a clear idea regarding the perception of the customers which can be termed as negative towards internet banking. Thus while evaluating the negative perceptions; various drawbacks identified include the following:

- Effective relationship

When the customers focuses upon conducting their transactions then they lack the opportunity to establish an effective relationship with the bankers which would be beneficial in faster processing of loan and availing special services which might not be available for the public (Sahut, 2006). Again if an individual has good relationship with the bank manager then he possesses the capability to wave service fees and penal interests and good relationship with the manager can also facilitate them to seek valuable financial advices.

- Complex Transactions

The customers often perceive that some issues take place which cannot be solved over internet and thus it requires face to face interaction with the banking personnel (Joseph & Stone, 2003). So in this case internet banking lags behind and thus it becomes necessary on the part of the customers to visit the bank branches.

- Security

The matter of security is perceived as one of the major drawbacks of internet banking and this creates a negative perception on the part of the customers in the context of internet banking. The major threats encountered include phishing, malware, identity theft, unauthorized activities and hacker attacks (Moutinho and Meidan, 1989).

Thus from the above discussion it can be inferred that even though internet banking tends to offer a wide range of services and benefits to the customers but there are some areas where it lacks to perform up to the level of expectation of the customers. Thus it leads to a mixed perception on the part of the customers.

The impact of internet banking can be analyzed on the basis of the benefits that it provides to the customers as well as to the banks. So in this context it has been observed that internet banking proves to be beneficial to both the financial institutions as well as to the customers (George and Kumar, 2014). From the perspectives of the bank it has been observed that internet banking involves low cost of transactions in comparison to the traditional ways of offering banking services and this is mainly due to the fact that it strives to lower the following expenses on the part of the bank:

- Banks can save by reducing the staff members involved in customer service since in case of internet banking the customers are involved in self service operations and functions.

- The banks can save on costs involved in processing the cherubs since in case of internet banking most of the transactions are conducted via electronic payments (Larpsiri et al., 2005).

- The costs involved in purchasing papers and mail distributions are reduced since in case of internet banking the statements of the banks and its disclosures are published online.

- The volume of data entry reduces since the applications on the part of the customers are completed and processed online.

Thus it can be inferred that it not only helps in reducing the costs but also enhances the efficiency on the part of the banking professionals and this enhances the performance of the bank as a whole. Again it has also been observed that internet banking strives to enhances the business on the part of the banks since it leads to increase in the number of accounts sold, it facilitates the bank to approach a wider segment of the market, facilitates the banks with new market opportunities and leads to enhanced satisfaction on the part of the customers (Leung and Ton, 2015).

On the other hand internet banking strives to facilitate the customers with convenience in conducting their operations, they are facilitated with an easy access to their bank accounts, they enjoy the opportunity to conduct their operations at any point of time and from anywhere across the globe (Onay and Ozsoz, 2001).

According to Featherman and Pavolu, (2003), various risks are perceived by the customers that tend to make a significant impact on the process of decision making. The various perceived risks can be illustrated with the help of the following figure:

Fig. 5: Potential Risks Involved in Internet Banking

[Source: www.finweb.com]

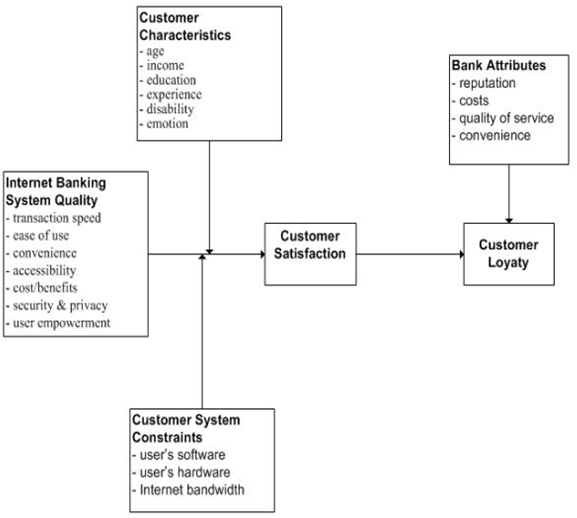

This part of the study focuses upon gaining an understanding of the variables that plays a major role in the study how these variables can be classified into dependent and independent variables and how these variables are related to each other and lead to growth of the customer base in the banks. So in this case the independent variables can be considered as the facilities and the services that are provided to the customers through internet banking and the dependent variable is the increase in the number of accounts due to these facilities and services (Ma, 2012). This can be illustrated with the help of the following figure:

Fig. 6: Conceptual Framework

[Source: self]

Thus from the above figure it can be inferred that since internet banking strives to offer a wide range of services to the customers together with various facilities that makes their transactions easy to operate and conduct and these factors lead to customer satisfaction which in turn again lead to enhanced loyalty and word of mouth marketing regarding the services provided by a particular bank. Thus as a result it leads to increase in the number of account openings i.e. increase in the customer base of the banks.

From the above discussions, it can be inferred that there are various pros and cons associated with internet banking. So on one hand where it tends to provide certain specific benefits to the customers as well as to the banks, it also poses some risks. Moreover the there are various factors that tend to influence the perception of the customers towards the internet banking and those include the services that are offered to the customers through internet banking, technology adaptation, the perceived benefits, perceived risks and security (Alam and Dangarwala, 2011). However the above discussions also strives to point out the fact that the above mentioned factors tends to vary on the basis of the gender, age, level of education and level of income on the part of the customers and thus it becomes important on the part of the banks to establish an effective balance between providing banking services via internet and through bank branches taking into consideration the profile of the customers. Again this is important because if the banks can satisfy their existing customers then it would help them to retain their customers and again these satisfied customers would facilitate in word of mouth marketing which would facilitate the banks in attracting new customers (Zhu and Chen, 2012). This in turn would lead to more number of account openings and thus would enhance the customer base. Thus the interdependency of the factors can be illustrated with the help of the following figure:

Fig. 7: Relationship between various Aspects of Internet Banking

[Source: www.bankingandsavings.com]

3.0 Introduction

The researcher has undertaken the study to gain an understanding of the impact of internet banking in account opening i.e. increase in the customer base. The study would be conducted in relevance to HSBC Holdings Plc. Si in the particular study it becomes important on the part of the researcher to select the appropriate tools and techniques which would facilitate in accomplishing the desired goals and objectives. Thus the research methodology would provide assistance to the researcher to identify the techniques that would the suit the purpose of the study on the basis of the nature of the topic chosen (Hair and Money, 2011). Moreover the researcher in his process of conducting the study in an effective and efficient manner would focus upon adopting a synchronized process to ensure that each and every aspects of the research is emphasized upon as and when required.

Research onion provides assistance to the researcher to adopt and follow the process of the study in a synchronized manner and thus the research onion by facilitating the researcher with its various layers tends to equip the researcher to identify the various techniques that can be utilized to identify the facts (Bernard, 2011). It proposes the research approaches, philosophies and design that are available to the researcher and the ways in which they can be utilized in the most efficient manner to suit the purpose of the study. The research onion can be illustrated with the help of the following figure:

Fig. 8: Research Onion

[Source: www.showacse.derby.ac.uk]

Thus from the above the figure it is observed that the research onion consists of six layers which strives to provide the study a clear structure to the research methodology which would facilitate the researcher to efficiently analyze the impact of internet banking in account opening.

The researcher is facilitated with various upon to decide upon in the context of the research philosophy to be adopted. The options include the positivism philosophy, the realism philosophy and the interpretivism philosophy (VanderStoep and Johnson, 2009). However it is important on the part of the researcher to select the research philosophy on the basis of the nature of the study and the purpose of the research. This would facilitate him achieving the goals and objectives of the study.

Thus in this particular the researcher would focus upon adopting both the positivism and the realism philosophy. This is because in the present study the researcher would strive towards gaining an overall understanding of the impact of internet opening in account opening and thus he should focus upon various aspects like the perception of the customers towards internet banking, the impact of internet banking, and level of satisfaction on the part of the customers and the impact of internet banking on the performance of the bank as a whole. So in this case he would have to collect information and facts from both the perspectives of the managers of the bank as well as from the perspectives of the customers. The responses of the managers of the bank would contribute towards qualitative data while the responses of the customers would be quantitative data. Thus, since qualitative data is involved, realism philosophy would be suitable and again since quantitative data is involved in the study, positivism philosophy would be suitable.

Taking into consideration the research approach, it has been observed that the researcher possess the following options like the he can either adopt the inductive approach or the deductive approach as per the demand of the study.

The deductive approach is mainly concerned with the development of the hypothesis on the basis of the available theory and then the researcher tends to formulate strategy in order to test the hypothesis. Thus it can be said that deductive approach facilitates the researcher to deduce the conclusions from various propositions (Saunders et al., 2009). Thus the approach that is followed in the deductive methods moves from particular to general and if it observed that there exist a link between particular case examples or a theory then it is observed to be true in various cases. So it provides assistance to the researcher to identify the whether the relationship that has been identified can be obtained in general circumstances. So in this approach, the hypothesis is set at first and then study if conducted and structure if adopted to identify whether the set hypothesis is right or wrong. This can be illustrated with the help of the following figure:

Fig. 9: Deductive Approach

[Source: www.researchmethodology.net]

On the other hand in case of inductive approach the researcher tends to collect the data relevant to the undertaken topic of study and once the data has been collected the researcher strives to identify the relevant information from the collected data through the in depth diagnosis and analysis. Moreover he strives to identify the trend of the data and then focuses upon developing a theory in order to provide an explanation to the identified patterns (Morgan, 2007). Thus in this approach the researcher tends to move form particular experiences to more general form of propositions i.e. they move from specific to general and from data to theory. This can be illustrated with the help of the following figure:

Fig. 10: Inductive Approach

[Source: www.researchmethodology.net]

So the researcher in order to identify the impact of internet banking in account opening would focus upon adapting a deductive approach since in order to conduct the study in an effective and efficient manner he has set a hypothesis on the basis of the available theories. Thus he focuses to move form particular to general and then would collect the data to test the hypothesis.

The research design can be describe as the process with the help of which the researcher tends to design and formulate the blueprint of the process of the research and also strives to record the process and the contents of the study. The various options in the context of research design that is available to the researcher include the explanatory research design, the exploratory research design and the descriptive research design (Harrison and Reilly, 2011). The researcher strives to adopt the explanatory research design if he is equipped with a pre-planned process to conduct the study and if the study is based upon his ideas and approaches. Again the researcher strives to adopt the descriptive research design if focuses upon identifying the reasons that lie behind the occurrence of the various events and this mainly identified through verification of the theories that are available which would be helpful in conducting the study in an effective and efficient manner (Hakim, 2007). Finally the explanatory research design incorporates both the explanatory and the exploratory design and thus in this research design the researcher strives to focus upon ethnography for achieving the desired results.

Thus taking into consideration the above aspects the researcher would conduct the study with the help of the descriptive research design. This is because it would provide an opportunity to the researcher to analyze the topic that has been undertaken for the study in an in depth manner. Again the researcher by adopting the descriptive research design would not only analyze the impact of internet banking in account opening but would also strive towards identifying the shift in the paradigm from traditional banking to internet banking and its impact on the performance of the bank.

The researcher would focus upon collecting both the primary and the secondary data to identify the impact of internet banking in account opening. The primary can be collected with the help of the various tools and techniques that include the interview method and the questionnaire survey method. Thus the primary data collected by the researcher is looked upon as the first hand data which is collected for some specific purposes (Cooper and Schindler, 2010). On the other hand the researcher would also require secondary data for successful achievement of its objectives and thus the secondary data would be available from various online and offline sources that include the journals, books, websites and library sources. Thus the secondary data can be looked upon as the data that has been collected at some previous time for some other purposes and the researcher in order to pave the right way for his study would utilize those data.

In the particular study the researcher would collect the secondary data from the various published journals, academic sources and websites whereas in order to collect the primary data the researcher would strive to conduct an interview with the managers of HSBC Holdings Plc and also conduct a questionnaire survey to collect the responses of the customers.

The data that would be collected by the researcher from the managers of the bank and the customers may differ from each other on the basis of their nature i.e. the data might be quantitative or qualitative in nature. Thus on the basis of the nature of the collected data the researcher would make use of the tools to conduct an analysis of the data collected.

Taking into consideration the qualitative data, it can be said that qualitative data can be looked upon as the detailed form of the data i.e. the details of the responses collected by the researcher in a narrative form. Again quantitative data refers to those data which are recorded in the numerical form by making an effective use of the statistical tools and techniques. Moreover it is also the fact that qualitative data facilitates the researcher to collect the details regarding the topic undertaken for the study but it suffers from some drawbacks i.e. it involves a lot of time to collect the qualitative data (Crowther and Lancaster, 2012). On the other hand in case of quantitative data, less time is involved in collecting the data and it facilitates the researcher to collect large number of observations. However there exist certain limitations of the variables and these limitations tend to restrict the process of thinking of the respondents whom the researcher approaches to collect the data.

In the particular study the researcher would focus upon collecting the qualitative data from the managers of the bank in order to identify the various aspects related with internet banking. The researcher would conduct an interview with the managers by gaining prior appointment. Moreover the interview would be conducted via Skype or over telephone so that the issues of distance and traveling can be solved. The researcher would conduct the quantitative data by conducting a survey with the help of questionnaire targeted towards the customers. The researcher would make use of emails in order to collect the filled in questionnaires from the customers and only those questionnaires would be considered for the study which have been properly filled in by the customers.

The selection of the samples for conducting the study can be non-probabilistic or probabilistic in nature. So in the particular study undertaken by the researcher, the manager of the bank for the interview process would be selected on the basis of non-probabilistic sampling technique (Saunders et al., 2009). This is mainly because the questions for the interview process would mainly be targeted towards the managers of the bank. On the other hand the questionnaire would be targeted towards collecting the responses of the customers and the customers for the survey would be considered on the basis of probabilistic sampling technique.

The researcher in order to collect the responses of the managers to gain in depth understanding of the various aspects related with internet banking would strive to approach 5 managers of HSBC Holdings Plc and conduct an interview of the selected managers. On the other hand the researcher would target 100 customers to conduct the survey so that various responses would be collected and analyzed to identify the impact of internet banking ion account opening.

In order to conduct the research in an efficient and effective manner, researcher has to use some ethical rules and regulations. An ethical consideration helps the researcher to avoid the issues and maintain the rules and regulation in the research paper. Issues or problems are directly related with the research methodology (Cameron, 2009). Thus the researcher has to take the special attention in an initial stage of the research methodology i.e. research design. According to the ethics rules and regulations, researcher will not use data and information (that is collected by the researcher during the data collections methods) for future or commercialization purpose. Thus the researcher should use the data and information for academic purpose. The researcher has to maintain the ethical consideration in order to gather relevant data and information.

In this research paper researcher will use the primary data collection methods techniques, thus this process take more time and time consuming process. Apart from them time limitation is the another limitation of the research. In this research paper researcher should face the problems in order to collect the appropriate data and information from the respondents (Saunders et al., 2009). Apart from them, the interview process should be friendly. Selection of the appropriate methods and techniques in order to evaluate the quantitative data and to monitor and verify for accuracy are the limitation of the research paper. In survey and interview process researcher has to ask clarifying and related questions. The limitation related with the quantitative study is associated with the reliability and validity. Data selection and the time frame are the limitations of the research paper. Apart from them selections of the sample data and sample size, availability of the respondent is also the limitation of this research paper.

In order to conduct the research in proper time and proper ways time table and time frame play important role Bernard (2011). The total time is used in order to complete the research is 10 week and from them 1 week is used as a buffer time. Secondary data identification, research preparation and the topic selection are done in first week. In the second week literature review and in third week research methodology is done. Data analyzing process is done in fourth week. In the last week finalization and submission process is done. The time frame or grant chart of the research paper is shown in below:

|

|

Week 1 |

Week 2 |

Week 3 |

Week 4 |

Week 5 |

Week 6 |

Week 7 |

Week 8 |

Week 9 |

Week 10 |

|

Main Activities/ Stages |

||||||||||

|

Topic selection and its scope |

• |

|||||||||

|

Identification of secondary data sources |

• |

|||||||||

|

Preparation of research proposal |

• |

|||||||||

|

Preparation of literature review |

• |

|||||||||

|

Description of research methodology |

• | |||||||||

|

Preparing interview/survey, ethics form |

• | |||||||||

|

Collecting primary data |

• |

|||||||||

|

Analyzing data |

• | |||||||||

|

Comparing findings |

• | |||||||||

|

Conclusion and recommendations |

• | • |

• |

• | • | • | ||||

|

collecting feedback from the mentor |

• | • |

• |

• | • | |||||

|

Finalizing and submission |

• |

Fig. 11: Gantt chart

References

Abeka, S. (2013) Customers acceptance of internet banking. Hamburg: Diplomica Verlag.

Abu Bakar Munir., (2004). Internet banking. London: LexisNexis.

Alam, M. & Dangarwala, D. (2011) Internet Banking Customer Satisfaction and Online Banking Service Attributes. IJAR. [Online] 1 (6), 198-199.

Annamalah, S. (2010) Factors Determining Consumer Adoption of Internet Banking. SSRN Journal. [Online]

Bernard, H. R. (2011) Research Methods in Anthropology: Qualitative and Quantitative Approaches. 5th ed. Plymouth: Alta Mira Press.

Buys, M., & Brown, I. (2004). Customer Satisfaction with Internet Banking Web Sites, An Empirical Test and Validation of a Measuring Instrument. Proceedings of SAICIT, (pp. 44-52).

Cameron, R. (2009). 'A sequential mixed model research design: design, analytical and display issues', International Journal of Multiple Research Approaches, 3(2), 140-152

Cooper, D. and Schindler, P. S. (2010) Business Research Methods, 11th ed. London: McGra-Hill.

Cronin, M. (1997). Banking and finance on the Internet. New York: Van Nostrand Reinhold.

Crowther, D. and Lancaster, G. (2012). Research Methods, 2nd ed. London: Routledge.

Daniel, E., (1999). Provision of electronic banking in the U:K and the republic of Irland. International journal of Bank Marketing,17(2), pp.72-82.

Featherman, M.S., Pavlou, PA., (2003). Predicting e-services adoption: a perceived risk facets Perspective. Int J Hum Comput Stud, 59(4):pp.451–74.

Fox, M. (2005) Internet banking, e-money and the Internet gift economy. First Monday. [Online] 0 (0), .

George, A. & Kumar, G. (2014) Impact of service quality dimensions in internet banking on customer satisfaction. DECISION. [Online] 41 (1), 73-85.

Hadden, R. & Whalley, A., (2002). The Branch is dead, long live the Internet! (or so you'd have thought if we hadn't listened to the customer). International Journal of Market Research, 44(3), pp.283-297.

Hair, J. F. and Money, A. H. (2011). Essentials of Business Research Methods, 2nd ed. New York: M. E. Sharpe. Inc.

Hakim, C. (2007). Research design: successful designs for social and economic research. 5th ed. London: Routledge.

Hanna, N. and Boyson, S. (1993). Information technology in World Bank lending. Washington, D.C.: World Bank.

Harrison, R. L. and Reilly, T. M. (2011). "Mixed methods designs in marketing research", Qualitative Market Research: an International Journal, 14(1), pp. 7 – 26.

Hiltunen, M., Laukka, M. & Luomala, J., (2002). Mobile User Experience. Helsinki: IT Press.

Hsbc.co.uk, (2008) HSBC Personal Banking and Online Banking | HSBC UK [online]. Available from: https://www.hsbc.co.uk (Accessed 20 February 2015).

Jayawardhena, C. And Foley, P. (2000) Changes in the Banking Sector: The Case of Internet Banking in the UK, Internet Research: Electronic Networking Applications and Policy, Nol.10, No.1, 2000, pp. 19-30

Jayawardhena, C. and Foley, P. (2000). Changes in the banking sector – the case of Internet banking in the UK. Internet Research, 10(1), pp.19-31.

Joseph, M., & Stone, G. (2003). An empirical evaluation of US bank customer perceptions of the impact of technology on service delivery in the banking sector. International journal of Retail & Distribution Management , 31(4), 190-202.

Kaneshige, T. (1995) Banking on the Internet. Network Security. [Online] 1995 (6), 11.

Karjaluoto, H., Mattila, M. & Pento, T., (2002). Factor underlying attitude formation towards online banking in Finland. International journal of bank Marketing, 20(6), pp.261-272

Kolodinsky, J.M., Hogarth, J.M. & Hilgert, M.A., (2004).The adaptation of electronic banking technologies by US consumer. International Journal of Bank marketing, 22(4), pp.238-249.

Larpsiri, R. et al. (2005) The Impact of Internet Banking on Thai Consumer Perception. SSRN Journal. [Online]

Lee, M.C., (2008). Predicting behavioral intention to use online banking. In: Proceedings of The 19th international conference on information management. Taiwan.

Leung, H. & Ton, T. (2015) The Impact of Internet Stock Message Boards on Cross-Sectional Returns of Small-Capitalization Stocks. Journal of Banking & Finance. [Online]

Lin, H.-J. (2004), „Information technology and cost and profit efficiencies in commercial banks and insurance companies: a global comparison‟, Unpublished Dissertation, the State University of New York at Buffalo.

Lin, M. et al. (2003) 'Banking' on the Internet: Does Internet Banking Really Improve Bank Performance?. SSRN Journal. [Online]

Loshin, P. and Vacca, J. (2004). Electronic commerce. Hingham, Mass.: Charles River Media.

Ma, Z. (2012) Assessing Serviceability and Reliability to Affect Customer Satisfaction of Internet Banking. Journal of Software. [Online] 7 (7), .

Mattila, M. (2001). Essays on Customers in the Dawn of Interactive Banking. Unpublished Doctoral dissertion, University of Jyväskylä, Jyväskylä.

Morgan, D. L. (2007). “Paradigms lost and pragmatism regained: methodological implications of combining qualitative and quantitative methods”, Journal of Mixed Methods Research, 1(1), pp. 48-76.

Moutinho, L. and Meidan, A., (1989) “Bank Customers’ Perceptions, Innovations and New Technology”, International Journal of Bank Marketing, Volume 7 No. 2, 1989, pp. 22-27.

Ngurukie, C. (2007). “Developing an Educational Module for the Purpose of Increasing the Adoption of Technology, based Financial Services in Kenya.” Microfinance Opportunities

Onay, C. & Ozsoz, E. (2001) The Impact of Internet-Banking on Brick and Mortar Branches - The Case of Turkey. SSRN Journal. [Online]

Rogers, E.M., (2008). Diffusion of Innovations (first ed.), Free Press, New York.

Sahut, J. (2006) Quality Management of Internet Banking Services. SSRN Journal. [Online]

Sathye, M. (2005) The impact of internet banking on performance and risk profile: Evidence from Australian credit unions. Journal of Banking Regulation. [Online] 6 (2), 163-174.

Sathye, M., (1999) Adoptaion of internet banking by Australian consumer:An empirical investigation. International journal of Bank Marketing, 17(7), pp.324-334.

Saunders, M. N., Lewis, P. and Thornhill, A. (2009) Research methods for business students, Page 52, 5th ed. Harlow: Prentice Hall

VanderStoep, S. W. and Johnson, D. D. (2009). Research Methods for Everyday Life: Blending Qualitative and Approaches. 4th ed. San Francisco: Jossey-Bass.

Wagner, C. and Yezril, A. (1999). Global science & technology information. Santa Monica, CA: Science and Technology Policy Institute, RAND.

Wah, L., (1999). “Banking on the internet” American Management Association vol. 88, No. 11, pp. 44-48.

Whalen, G. (2001). The impact of the growth of large, multistate banking organizations on community bank profitability. [Washington, D.C.]: U.S. Office of the Comptroller of the Currency.

Zhu, Y. & Chen, H. (2012) Service fairness and customer satisfaction in internet banking. Internet Research. [Online] 22 (4), 482-498.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2016). The Impact Of Internet Banking In Account Opening – A Case Study Of HSBC Holdings PLC. Retrieved from https://myassignmenthelp.com/free-samples/impact-of-internet-banking-in-account-opening-a-case-study-of-hsbc-holdings-plc.

"The Impact Of Internet Banking In Account Opening – A Case Study Of HSBC Holdings PLC." My Assignment Help, 2016, https://myassignmenthelp.com/free-samples/impact-of-internet-banking-in-account-opening-a-case-study-of-hsbc-holdings-plc.

My Assignment Help (2016) The Impact Of Internet Banking In Account Opening – A Case Study Of HSBC Holdings PLC [Online]. Available from: https://myassignmenthelp.com/free-samples/impact-of-internet-banking-in-account-opening-a-case-study-of-hsbc-holdings-plc

[Accessed 13 March 2025].

My Assignment Help. 'The Impact Of Internet Banking In Account Opening – A Case Study Of HSBC Holdings PLC' (My Assignment Help, 2016) <https://myassignmenthelp.com/free-samples/impact-of-internet-banking-in-account-opening-a-case-study-of-hsbc-holdings-plc> accessed 13 March 2025.

My Assignment Help. The Impact Of Internet Banking In Account Opening – A Case Study Of HSBC Holdings PLC [Internet]. My Assignment Help. 2016 [cited 13 March 2025]. Available from: https://myassignmenthelp.com/free-samples/impact-of-internet-banking-in-account-opening-a-case-study-of-hsbc-holdings-plc.