Discuss about the Impact of Oil Price Fall on United Arab Emirates.

Oil prices have had an economical downturn since the 1990s (Al-Maamary, Kazem and Chaichan 2016). Apart from the oil importing nations across the globe, the producers have felt a hard pinch due to its degrading prices. It is noted that the collapsing situation brings with itself a contained fiscal and financial growth. Further, the complicated aspect of falling prices has also had a significant impact on business and industrial sectors. In addition to several macro economic impacts, the downfall of prices have affect micro factors as well.

The project tends to discuss the various impacts oil price fluctuations have had on the United Arab Emirates. Concerning, UAE the country greatly depends on export of the valuable resources to various nations in the world. In addition to a description of the situation, the report seeks to exaggerate the various economical and financial impacts the collapse has on various sectors of the nation.

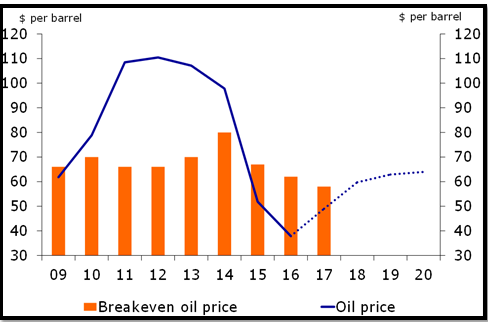

Figure: Oil Price Falls

(Source: Farzaneh et al. 2013)

As compared to the other nations, the UAE is recognized as one of the most richest and wealthiest in terms of its extraordinary oil resources. As stated by Kilian (2016), with more than 10% of the total reserves of the resources, the seven emirates and its sub parts greatly rely on its sources for GDP growth, foreign exchange and further expansion of the country. However, Dubai of all lacks oil sources. It is noted that for more than over five decades the UAE has been greatly dependent on its import - export of oil for stability and global finance.

Figure: Background of UAE

(Source: Basher 2014)

As opined by Basher (2014), a downfall in oil prices has affected investment, business, wealth generation, infrastructure, and every other sector in the emirates. With a higher elasticity of the legislative body, GDP rates and fossil fuel shares, the economical diversity portrays an elevated specialisation towards oil as compared to any other industry. A fluctuation in the price levels directly affects the nation`s political stability and human development figures as well.

According to Kilian (2016), oil prices in the Gulf tend to be at a highly fluctuating situation over the years. It is noted that there exists various factors that has greatly affected cost of the resources. The demand and need for oil has changed drastically over time, thereby affecting its prices. Moreover, the OPEC`s role has greatly shaped decision making of UAE`s oil producers as well. A drop of $90 to $100 per barrel in the recent times was the result of four major elements, which are:

- Low demand: Countries like Europe and others, unlike the earlier times now tends to more self sufficient in terms of energy requirements. The development of various importing nations has enabled them to be more efficient in nature, thereby affecting demand patterns in the Gulf (Allegret, Mignon and Sallenave 2015). Moreover, the poor economic functions of China and most of the other countries have also contributed in lowering export of oil from the UAE.

- Political instability: One of the major aspects that have greatly affected prices of oil is the situation of conflict between Iran and Libya. Further, counter fighting the US militarism over oil resources has also affected stability in the UAE. As per Mohaddes and Pesaran (2016), in addition to signing nuclear a deal with US, Iran has greatly tends to control over the Persian Gulf regions and also build up volatility of its neighbouring nation. Factors like the attacks in Nigeria and fighting in Libya has also directly impacted political condition of the country.

Factors Affecting Oil Prices in United Arab Emirates

Figure: Oil Price Reserves in UAE

(Source: Amin, Amin and Zadeh 2016)

- Extensive competition: The increased development of the United Sates has not helped to self sufficient in nature but also ensured the top position in the oil market. The highly competent resources, technology and business options of the foreign nation has also enabled it to be one of the most flexible and dominating nations across the globe. It is with the help of the oilmen from North Dakota and Texas and a comparatively advanced mechanism which has enabled the US to extract oil from the shale. Additionally, many other developing countries have also tended to engage in production activities thereby lowering import of the resources from UAE (Rowland and Mjelde 2016).

- Russia`s intervention in Syria: The incursion of Putin in Syria has affected oil prices since the last few years. It is noted that the fade of Gulf`s support has lead to a rise of political disruptions and further price levels (Allegret, Mignon and Sallenave 2015). Moreover, the downfall of Russia`s economic plan greatly affected fiscal conditions of the UAE, thereby affecting oil prices. The lowering of resource prices is a reminder of Putin to the nation of Russia`s power.

In the words of Griffin and Teece (2016), the lowering of price has a direct impact on the UAE` s economical and financial conditions. Based on the reports of the nation, it can be inferred that there has been a noticeable downfall due to various reasons. Despite of the government not agreeing to the negativities the situation has provided, fiscal statements show a completely different story. UAE`s score of 52.6 on the purchasing index, portrays a shrinking economical condition. In addition to a control on purchasing power of the people, the falling prices also affected currency exchange rates (Farzaneh et al. 2013). Moreover, there has also arrived a situation of budget deficit due to a fall of US $110 to US $30 over the last nine months period. It is noted that a shortening of the situation has affected growth and expansion options of the nation as well.

As stated by Al-Malkawi and Pillai (2013), the fluctuation in price levels has lowered international relationship levels, thereby mounting up limitations of market movements. Additionally, the downfall in economical conditions has also affected business growth in UAE. Apart from the deterioration of oil exchange rates has lead to a consequent dominancy of the US dollar in the global market. The fluctuating situation along with contributing to increase the dirham to dollar ratio by 10%, also affected the real estate business of the nation. A cut down of spending patterns by the people resulted in an economical raise by 2.8% only. Moreover, the budget cut down lead to failure of government initiatives by 9.9%. It is noted that the insufficient funding not only impacted infrastructural development but also cut down subsidies (Amin, Amin and Zadeh 2016). On the other hand, the situations worsened competitive nature of the UAE as a whole. However, the decrease in oil prices ensured a lower living and transport cost as well. Also, a deceased rate of inflation tends to benefit the people of the nation.

Furthermore, the decline of profit rates put a direct pressure on the employment structure and stock market as well. It is noted despite of the present largely financed firm, there existed a poor job structure in the nation. The diversified economy suffered huge losses due to the fall of oil price levels. With a growth rate of 2.1% in 2016, the government expects a further drop in 2017. As opined by Anandan, Ramaswamy and Sridhar (2013), it can be inferred that the oil price fall will have a affect UAE on the medium as well as long run. Refer to Appendix (1)

Impact of Oil Price Fall on United Arab Emirates

As stated by Mohaddes and Pesaran (2016), UAE`s GDP rates fell from 41% to 29% from the year 2013 to 2015. However, the nation has continued its expenditure trend, rising from 30 % to 34% in the past few years which further lead to situation of fiscal deficit. Further, the government tend to invest in the business sectors of the country excluding oil. A proper management and control of the economy help in stabilizing conditions and also ensure financial strength of the emirates. Additionally, there were noticeable improvements in areas of real estate, airlines, tourism, infrastructure, transport, retail and various other sectors. It is noted that production and customer oriented services regained health and achieved new heights. A focus on strengthening Dubai and Abu Dhabi helped in developing UAE as a whole.

Further, 2014 provided the country with a new set of challenges affecting export of hydrocarbons and profit generation. However, the government was able to maintain growth at 4.6% and thereby a downfall to 3.3% in the coming year of 2015. According to Al-Maamary, Kazem and Chaichan (2016), the implication of VAT policies on non-oil sectors shall help in developing conditions. Also, a reduction in water and electricity consumption subsidies will help in building up competencies of the UAE. It is noted that various developmental projects are also being taken into consideration.

Conclusion

Analyzing the several aspects of the project, it can be inferred that the United Arab Emirates has been confronted with various challenges due to the degrading oil prices. As compared to the other nations across the world, being a huge producer and exerting dominancy in the market share, the emirates have greatly been affected by the collapsing situations. Further, the US $100 fall in price per barrel majorly is due to the four differentiated reasons. It is noted that despite of facing several degrading conditions, the government of the nation seeks to improve situations by implementing management skills and further investing in non-oil sectors as well.

References

Allegret, J.P., Mignon, V. and Sallenave, A., 2015. Oil price shocks and global imbalances: Lessons from a model with trade and financial interdependencies. Economic Modelling, 49, pp.232-247.

Al-Maamary, H.M., Kazem, H.A. and Chaichan, M.T., 2016. The impact of oil price fluctuations on common renewable energies in GCC countries. Renewable and Sustainable Energy Reviews.

Al-Malkawi, H.A.N. and Pillai, R., 2013. The impact of financial crisis on UAE real estate and construction sector: analysis and implications. Humanomics, 29(2), pp.115-135.

Amin, M.Y., Amin, Z.Y. and Zadeh, H.R., 2016. Oil Price Shocks, Asymmetric Effect and Volatility Spillover; Case of Stock Market in Oil Exporting Countries. Journal of Insurance and Financial Management, 1(2).

Anandan, M., Ramaswamy, S. and Sridhar, S., 2013. Crude Oil Price Behavior and Its Impact on Macroeconomic Variable: A Case of Inflation. Language in India, p.147.

Basher, S., 2014. Stock markets and energy prices. University Library of Munich, Germany.

Farzaneh, H., Ishihara, K.N., Utama, N.A., McLellan, B. and Tezuka, T., 2013. An optimization supply model for crude oil and natural gas in the Middle East. In Zero-Carbon Energy Kyoto 2012 (pp. 17-29). Springer Japan.

Griffin, J.M. and Teece, D.J., 2016. OPEC behaviour and world oil prices. Routledge.

Kilian, L., 2016. The Impact of the Fracking Boom on Arab Oil Producers.

Kilian, L., 2016. The impact of the shale oil revolution on US oil and gasoline prices.

Mohaddes, K. and Pesaran, M.H., 2016. Oil prices and the global economy: is it different this time around?.

Rithuan, S.H.M., Abdullah, A.M. and Masih, A.M.M., 2014. The Impact of Crude Oil Price on Islamic Stock Indices of Gulf Cooperation Council (GCC) Countries: A Comparative Analysis.

Rowland, C.S. and Mjelde, J.W., 2016. Politics and petroleum: Unintended implications of global oil demand reduction policies. Energy Research & Social Science, 11, pp.209-224.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2018). Impact Of Oil Price Fall On United Arab Emirates. Retrieved from https://myassignmenthelp.com/free-samples/impact-of-oil-price-fall-on-united-arab-emirates.

"Impact Of Oil Price Fall On United Arab Emirates." My Assignment Help, 2018, https://myassignmenthelp.com/free-samples/impact-of-oil-price-fall-on-united-arab-emirates.

My Assignment Help (2018) Impact Of Oil Price Fall On United Arab Emirates [Online]. Available from: https://myassignmenthelp.com/free-samples/impact-of-oil-price-fall-on-united-arab-emirates

[Accessed 20 May 2025].

My Assignment Help. 'Impact Of Oil Price Fall On United Arab Emirates' (My Assignment Help, 2018) <https://myassignmenthelp.com/free-samples/impact-of-oil-price-fall-on-united-arab-emirates> accessed 20 May 2025.

My Assignment Help. Impact Of Oil Price Fall On United Arab Emirates [Internet]. My Assignment Help. 2018 [cited 20 May 2025]. Available from: https://myassignmenthelp.com/free-samples/impact-of-oil-price-fall-on-united-arab-emirates.