The trial balance, comprehensive income statement and the balance sheet of Jackson and sons have been prepared in the first part. The second part of the report comprised of the analysis of the performance of the two selected companies that is a Tesco and Sainsbury. The analysis has been done using the profitability ratio, liquidity ratio and efficiency ratio.

1:|

In the Books of Jackson & Sons |

||||||

|

Trial Balance |

||||||

|

as on 30/11/16 |

||||||

|

|

Trial Balance |

Adjustment |

Updated Trial Balance |

|||

|

Particulars |

Debit |

Credit |

Debit |

Credit |

Debit |

Credit |

|

|

|

|

|

|

|

|

|

Retained Profit |

|

£173,475 |

|

|

|

£173,475 |

|

Sales |

|

£950,000 |

|

|

|

£950,000 |

|

Share Capital |

|

£100,000 |

|

|

|

£100,000 |

|

Share Premium |

|

£200,000 |

|

|

|

£200,000 |

|

Inventory |

£55,000 |

|

|

|

£55,000 |

|

|

Purchases |

£350,000 |

|

|

|

£350,000 |

|

|

Trade Payables |

|

£98,000 |

|

|

|

£98,000 |

|

Trade Receivables |

£205,000 |

|

|

|

£205,000 |

|

|

Bank |

£83,900 |

|

|

|

£83,900 |

|

|

Motor Expenses |

£8,700 |

|

|

|

£8,700 |

|

|

Maintenance |

£2,000 |

|

|

|

£2,000 |

|

|

Salaries & Wages |

£120,000 |

|

|

|

£120,000 |

|

|

Administration Expenses |

£67,545 |

|

|

|

£67,545 |

|

|

Telephone |

£2,100 |

|

£2,100 |

|

£4,200 |

|

|

Heat & Light |

£3,800 |

|

|

£1,000 |

£2,800 |

|

|

Equipment at Cost |

£450,000 |

|

|

|

£450,000 |

|

|

Provision for Depreciation equipment |

|

£45,000 |

|

£40,500 |

|

£85,500 |

|

Motor Vehicle at cost |

£120,000 |

|

|

|

£120,000 |

|

|

Provision for Depreciation motor vehicle |

|

£6,000 |

|

£18,000 |

|

£24,000 |

|

Rent |

£128,000 |

|

|

£8,000 |

£120,000 |

|

|

Advertising |

£12,980 |

|

|

|

£12,980 |

|

|

Bad Debts |

£5,450 |

|

|

|

£5,450 |

|

|

Provision for Bad Debts |

|

£2,000 |

|

|

|

£2,000 |

|

Long Term Debt |

|

£50,000 |

|

|

|

£50,000 |

|

Interest |

£10,000 |

|

|

|

£10,000 |

|

|

Equipment Depreciation |

|

|

£40,500 |

|

£40,500 |

|

|

Motor Vehicle Depreciation |

|

|

£18,000 |

|

£18,000 |

|

|

Prepayments |

|

|

£9,000 |

|

£9,000 |

|

|

Accrual |

|

|

|

£2,100 |

|

£2,100 |

|

Income Tax Expense |

|

|

£12,000 |

|

£12,000 |

|

|

Provision for Income Tax |

|

|

|

£12,000 |

|

£12,000 |

|

|

|

|

|

|

|

|

|

TOTAL |

£1,624,475 |

£1,624,475 |

£81,600 |

£81,600 |

£1,697,075 |

£1,697,075 |

b)

|

In the Books of Jackson & Sons |

||

|

Income Statement |

||

|

for the period ended 30/11/2016 |

||

|

Particulars |

Amount |

Amount |

|

|

|

|

|

Sales Revenue |

|

£950,000 |

|

Cost of Goods Sold: |

|

|

|

Opening Inventory |

-£55,000 |

|

|

Add: Purchases |

-£350,000 |

|

|

Less: Closing Inventory |

-£85,000 |

-£320,000 |

|

Gross Profit |

|

£630,000 |

|

|

|

|

|

Operating Expenses: |

|

|

|

Motor Expenses |

|

-£8,700 |

|

Maintenance |

|

-£2,000 |

|

Salaries & Wages |

|

-£120,000 |

|

Administration Expenses |

|

-£67,545 |

|

Telephone |

|

-£4,200 |

|

Heat & Light |

|

-£2,800 |

|

Rent |

|

-£120,000 |

|

Advertising |

|

-£12,980 |

|

Bad Debts |

|

-£5,450 |

|

Equipment Depreciation |

|

-£40,500 |

|

Motor Vehicle Depreciation |

|

-£18,000 |

|

Total Operating Expenses |

|

-£402,175 |

|

Earnings before Interest & Tax |

|

£227,825 |

|

Less: Interest |

|

-£10,000 |

|

|

|

|

|

Earning before Tax |

|

£217,825 |

|

Less: Income Tax Expense |

|

-£12,000 |

|

Net Profit for the Period |

|

£205,825 |

c)

|

In the Books of Jackson & Sons |

||

|

Balance Sheets |

||

|

as on 30/11/16 |

||

|

Particulars |

Amount |

Amount |

|

CURRENT ASSETS: |

|

|

|

Bank |

|

£83,900 |

|

Trade Receivable |

£205,000 |

|

|

Less: Provision for Bad Debts |

-£2,000 |

£203,000 |

|

Closing Inventory |

|

£85,000 |

|

Prepayments |

|

£9,000 |

|

TOTAL CURRENT ASSETS |

|

£380,900 |

|

NON-CURRENT ASSETS:- |

|

|

|

Equipment at Cost |

£450,000 |

|

|

Less: Provision for Equipment Depreciation |

-£85,500 |

£364,500 |

|

Motor Vehicle at Cost |

£120,000 |

|

|

Less: Provision for Motor Vehicle Depreciation |

-£24,000 |

£96,000 |

|

|

|

|

|

TOTAL NON-CURRENT ASSETS |

|

£460,500 |

|

TOTAL ASSETS |

|

£841,400 |

|

CURRENT LIABILITIES: |

|

|

|

Trade Payables |

|

£98,000 |

|

Accruals |

|

£2,100 |

|

Provision for Income Tax |

|

£12,000 |

|

TOTAL CURRENT LIABILITIES |

|

£112,100 |

|

NON-CURRENT LIABILITIES: |

|

|

|

Long Term Debt |

|

£50,000 |

|

TOTAL NON-CURRENT LIABILITIES |

|

£50,000 |

|

TOTAL LIABILITIES |

|

£162,100 |

|

EQUITY: |

|

|

|

Share Capital |

|

£100,000 |

|

Share Premium |

|

£200,000 |

|

Retained Earnings |

£173,475 |

|

|

Add: Net Profit for the Period |

£205,825 |

£379,300 |

|

TOTAL EQUITY |

|

£679,300 |

|

TOTAL EQUITY & LIABILITY |

|

£841,400 |

|

Workings for Depreciation:- |

||

|

Particulars |

Equipment |

Motor Vehicle |

|

|

|

|

|

Cost Price |

£450,000 |

£120,000 |

|

Less: Accumulated Depreciation |

£45,000 |

0 |

|

Net Cost |

£405,000 |

£120,000 |

|

Depreciation Rate |

10% |

15% |

|

Depreciation for the period |

£40,500 |

£18,000 |

The selected companies are Tesco and Sainsbury. For the purpose of analysis, the ratios selected from the profitability ratio are net profit margin and return on equity. The analysis of liquidity ratio is done using the current ratio and quick ratio. Under the efficiency ratio, the selected ratio for the analysis are receivables collection period and inventory turnover period.

Looking at the calculated profitability ratios of Tesco, the net profit margin was 004% in the year 2013 and it rose to 153% in the year 2014. The ratio was -9.26% in the year 2015 as compared to other years. The ratio turned out to be negative in the financial year because it incurred net loss of £ 5766 million. The gross loss of the group reported to be £2695 million. All this was the reason attributable to the negative net profit margin. The return on equity also went down in the subsequent year. The ROE of the year 2013 was 0.14%, the ratio increased to 7% in the year 2014. The ratio was negative at -82% in the year 2015. It can be seen that the ratio have fallen and turned out be negative in the financial year 2015 and this was because the group incurred comprehensive loss(Collier 2015).

Graph 1: Return on Equity

Source: (created by author)

There was a fall in the net profit margin of Sainsbury in the financial year 2015. The ratio for the year 2013 stood at 258% as compared to 2.99% in the financial year 2014. The ratio fell to -0.70% in the year 2015. The return on equity for the year 2013 was 10% as compared to 12% in the financial year 2014. The ratio turned negative and fell to -3% in the financial year 2015. The company incurred a loss in the financial year 2015 and the total comprehensive loss stood at £ 195 million for the year 2015.

Graph 2: Net Profit Margin

Source: (created by author)

The quick ratio initially increased and subsequently decreased in the year 2015. The ratio stood at 1.59 in the year 2013 as compared to 2.06 in the year 2014. The ratio was reported at 1.15 in the financial year 2015. The fall in the quick ratio is indicative of the fact that the company is relying too much on its inventories to clear off its short term obligations. The quick ratio of Sainsbury had an increasing trend. The quick ratio was calculated at 0.30 in the year 2013, which increased to 0.50 in the year 2014. The ratio further increased to 0.51 in the financial year 2015. The high quick ratio indicates that the company is able to meet its financial obligation suing the funds available in hand. It also indicates that the company might facing difficulties in collecting its receivables(Stoer and Bulirsch 2013).

Graph 3: Quick Ratio

Source: (created by author)

The current ratio of Tesco stood at 2.67 in the year 2014 as compared to 2.22 in the year 2013. The ratio fell to 1.52 in the financial year 2015. Though the current ratio has fallen, the company is able to meet its short term obligations using its current ratio. The current ratio fell as there was reduction in the current assets held and the current liabilities increased.

The current ratio of Sainsbury was reported at 0.61 in the year 2013 and the ratio increased to 0.65 in the financial year 2014. However, the ratio remained constant at 0.65 in the financial year 2015. The reason behind the increasing current ratio is that the current assets of the company increased in the year 2015 and the current liabilities also increased and the increasing ratio indicates a good sign as the company is able to meet its short term obligations suing its current assets(Black and Al-Kilani 2013).

Graph 4: Current Ratio

Source: (created by author)

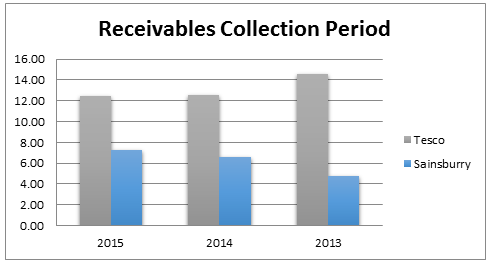

Under the analysis of efficiency ratio, there is a consecutive fall in the receivable collection period. The collection period was 14.54 in the year 2013 and it fell to 12.58 and 12.43 in the year 2014 and 2015 respectively. The fall in the receivables collection period indicating that the company is tying less of its funds in the account receivables and which can be used for other purpose. The receivables collection period of Sainsbury had an increasing trend and the figure stood at 4.79 in the year 2013. The collection period increased to 6.60 and 7.30 in the year 2014 and 2015 respectively. The increase in the collection period is not a good sign as the funds are tied up and there arises the risk of default in the payment made by the debtors(Atrill andMcLaney 2014).

Graph 5: Receivables Collection Period

Source: (created by author)

The inventory turnover period also witnessed a fall. The figure stood at 23.06 in the year 2013 and this fell to 21.92 and 16.76 in the year 2014 and 2015 respectively. The low inventory turnover indicates that the company is not able to sell off its inventories and they are lying idle and there is a lack of liquidity(Collis et al. 2012). The inventory turnover ratio of Sainsbury is more or less stable in the period of analysis. In the year 2013, the figure stood at 16.36, which fell to 16.26 in the year 2014. The turnover period further fell to 16.13 in the year 2015. The fall in the period indicates the overstocking and poor liquidity of the company.

Graph 6: Inventory Turnover Period

Source: (created by author)

The analysis of the performance of two companies have been done suing the ratios and it is concluded that the performance of both the companies is at par. In comparison to few parameters, Sainsbury has outperformed Tesco.

Kuter, M.I., 2013. Introduction to Accounting: textbook. Krasnodar: Prosveshenie-Yug, 20(3), p.5.

Atrill, P. and McLaney, E., 2014. Accounting and Finance: An Introduction. Pearson Higher Ed.

Biondi, Y. and Zambon, S. eds., 2013. Accounting and business economics: Insights from national traditions. Routledge.

Black, G. and Al-Kilani, M., 2013. Accounting and finance for business. Pearson Higher Ed.

Collis, J., Holt, A. and Hussey, R., 2012. Business accounting: an introduction to financial and management accounting. Palgrave Macmillan.

Glaum, M., Baetge, J., Grothe, A. and Oberdörster, T., 2013. Introduction of International Accounting Standards, disclosure quality and accuracy of analysts' earnings forecasts. European Accounting Review, 22(1), pp.79-116.

Shah, P., 2013. Financial Accounting. OUP Catalogue.

Maher, M.W., Stickney, C.P. and Weil, R.L., 2012. Managerial accounting: An introduction to concepts, methods and uses. Cengage Learning.

Warren, C.S., Reeve, J.M. and Duchac, J., 2013. Financial & managerial accounting. Cengage Learning.

Stoer, J. and Bulirsch, R., 2013. Introduction to numerical analysis (Vol. 12). Springer Science & Business Media.

Giles, R., 2014. Finance & Accounting New 4th Edition. Lulu.com.

Collier, P.M., 2015. Accounting for managers: Interpreting accounting information for decision making. John Wiley & Sons.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2017). Introduction To Accounting For Accounting And Business Economics. Retrieved from https://myassignmenthelp.com/free-samples/introduction-to-accounting-accounting-and-business-economics.

"Introduction To Accounting For Accounting And Business Economics." My Assignment Help, 2017, https://myassignmenthelp.com/free-samples/introduction-to-accounting-accounting-and-business-economics.

My Assignment Help (2017) Introduction To Accounting For Accounting And Business Economics [Online]. Available from: https://myassignmenthelp.com/free-samples/introduction-to-accounting-accounting-and-business-economics

[Accessed 01 June 2025].

My Assignment Help. 'Introduction To Accounting For Accounting And Business Economics' (My Assignment Help, 2017) <https://myassignmenthelp.com/free-samples/introduction-to-accounting-accounting-and-business-economics> accessed 01 June 2025.

My Assignment Help. Introduction To Accounting For Accounting And Business Economics [Internet]. My Assignment Help. 2017 [cited 01 June 2025]. Available from: https://myassignmenthelp.com/free-samples/introduction-to-accounting-accounting-and-business-economics.