Short-term investment options

Questions:

Investment policy:

Firstly give a general outline of the investment style of your team, including your attitude to risk, the ways you will manage risk as well as any financial targets you have.

Secondly explain the theories that you will use to select individual stocks to buy or sell. This is may include fundamental analysis, technical analysis as well as portfolio and risk management theory. It is expected that you will refer to books and a range of other sources for this information, please ensure you use Harvard referencing for this.

Asset selection:

This will include how you analysed and selected particular stocks or other assets to trade. Relevant financial and other details about these companies should be included to justify your trading, (randomly selecting shares will not gain marks). It is also important that you are consistent with the general principles set out in your investment policy, for example if you state that your investment policy is low risk but you select only high risk shares this would not make sense.

This section should also refer to and link to the record you keep of your trading meetings that are included in the appendices.

Performance review:

Discuss whether the trading went according to what you expected or hoped for and any possible reasons why it did not happen as you expected. (Note that trading rarely goes to plan so do not be disappointed if this happens but try to identify why it went wrong).

There are some of the investment policies that entail a shorter term of profits while then there are some that entail profits that extend to a longer term. The first step in investing is to assess the individual requirements for cash, competence to undertake the risks that are involved and assess the returns that an investor is expecting. The following are some of the investment options that an investor can undertake:

(Maps of India, 2015)

For the purposes of the short term investments, the following are the investment options that could be undertaken:

- Online savings accounts

- Certificate of deposits and money market accounts

For the purposes of the long term investments, the following are few of the options:

- Managed mutual funds

- Index funds

- Exchange traded funds

(US news, 2015)

The following is the investment policy framework:

(Invest climate, 2015)

The team would like to undertake the investments with the return of up to 20% and risk of 10%.

The team wants to invest $10, 00,000 and would invest in the following:

- Mutual funds

- Shares of Mc Donald’s

The funds have been selected due to the following reasons:

One can earn money from the following:

- Payments from the dividends and interest on the securities in the portfolio

- Amount received from the selling of the shares and earning capital gains on the same.

The prices of the securities can increase and when any fund sells its security in price, the fund earns a capital gain on it. In the end of the year, the capital gains arise to the investors. The net assets value is increased and the expenses and the liabilities are deducted from the same. The higher net asset value gives a higher value to the investment, when it comes to payment of dividend and the distributions of the capital gains, one could have the dividends and the distributions are re-invested in the fund in order to buy more number of shares.

Long-term investment options

(SEC, 2015)

The following are the reasons to invest in the shares:

1. The UK market is currently yielding the return of 4.5pc and the shares are considered to be the attractive source of an investment when compared with the other income producing assets. This is especially given the inherent potential for the capital appreciation.

2. There is a growing income especially in the sectors like the utilities that could offer the investors the robust and the reliable stream of income. There are many small and medium sized companies that have a fair and a healthy dividend to invest and there is a potentiality of growth.

3. Overseas potential: the dividends is a predominantly a phenomenon whereby the cash is returned to the shareholders. Cash is given to the investors in return to their investment.

4. Once the shares are purchased, it becomes easier to invest in the world. An investor has the potential to gain an exposure in the fast growing areas, sectors, companies irrespective of the locations.

5. The ownership from the shares allows one to take the stakes in the companies in the new and the exciting industries and the areas from those that experience the rapid amount of changes. The property and the investment in the bonds allows one to participate in the growth of the usage of the mobile phones and the development of the market economies or the magnetic growth of an investment.

6. Real growth: the shares never expire or never mature, they are very different from the fixed income investments. The shares offers an access to the real growth of an asset and allows to participate in the company as it develops and grows.

7. The portfolio has to be reviewed on the regular basis so as to know that whether the shares need the maintenance or not. This is in contrary to the investment in the property, wherein the ongoing effort is necessary in order to maintain the value of the existing capital and the future returns.

8. The slower economic growth entails slower growth in the dividends since the profits grow at a slower rate. The good new here is that the bad news is always reflected in the price with the banks cutting back on its dividends.

(Telegraph, 2015)

The performance:

Investment in Mc Donald’s:

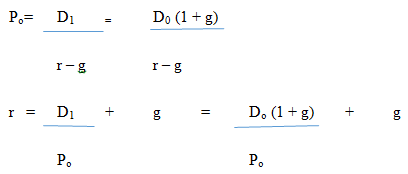

The following is the formula for the calculation of return and the price of the share.

When we calculate the return of the investors, we get 3.67%.

This shows that the company is giving a good return to the shareholders.

The following table shows the risk and return on the shares along with the Sharpe ratio:

|

Date |

Close |

Dividends |

Holding period return |

|

|

02-01-2015 |

92.44 |

-1.73 |

-1.84% |

|

|

02-01-2014 |

94.17 |

0.81 |

-0.31 |

-0.33% |

|

02-01-2013 |

95.29 |

0.77 |

-2.99 |

-3.02% |

|

03-01-2012 |

99.05 |

0.7 |

26.08 |

35.40% |

|

03-01-2011 |

73.67 |

0.61 |

11.85 |

18.98% |

|

04-01-2010 |

62.43 |

0.55 |

4.96 |

8.55% |

|

02-01-2009 |

58.02 |

0.5 |

4.41 |

8.15% |

|

04-02-2008 |

54.11 |

0.375 |

54.485 |

|

|

std deviation |

17.463467 |

|||

|

return |

3.68% |

3.68 |

||

|

Risk free return |

2.50% |

2.5 |

||

|

Sharp index |

Expected return-risk free rate of return/standard deviation |

|||

|

0.0675696 |

||||

|

Date |

Dividends |

||||

|

26-11-2014 |

0.85 |

0.146123128 |

Point to point |

||

|

28-08-2014 |

0.81 |

||||

|

29-05-2014 |

0.81 |

1.000315506 |

|||

|

27-02-2014 |

0.81 |

0% |

compound using regression |

||

|

27-11-2013 |

0.81 |

||||

|

29-08-2013 |

0.77 |

D1 |

= |

3.4 |

|

|

30-05-2013 |

0.77 |

P0 |

= |

92.44 |

|

|

27-02-2013 |

0.77 |

r |

= |

3.6780614452617900% |

|

|

29-11-2012 |

0.77 |

dividend yield |

= |

0.036780614 |

|

|

30-08-2012 |

0.7 |

||||

|

31-05-2012 |

0.7 |

||||

|

28-02-2012 |

0.7 |

||||

|

29-11-2011 |

0.7 |

||||

|

30-08-2011 |

0.61 |

||||

|

27-05-2011 |

0.61 |

||||

|

25-02-2011 |

0.61 |

||||

|

29-11-2010 |

0.61 |

||||

|

30-08-2010 |

0.55 |

||||

|

27-05-2010 |

0.55 |

||||

|

25-02-2010 |

0.55 |

||||

|

27-11-2009 |

0.55 |

||||

|

28-08-2009 |

0.5 |

||||

|

04-06-2009 |

0.5 |

||||

|

26-02-2009 |

0.5 |

||||

|

26-11-2008 |

0.5 |

||||

|

28-08-2008 |

0.375 |

||||

|

05-06-2008 |

0.375 |

||||

|

28-02-2008 |

0.375 |

(Yahoo finance, 2015)

The volatility measures the uncertainty or the risk of change in the value of the security.

|

Standard Deviation |

12.55 |

|

Mean |

1.67 |

|

Sharpe Ratio |

1.59 |

|

Bear Market Decile Rank |

37 |

(Money, US news, 2015)

The following shows the calculations in respect of the excess returns of the fund and the benchmarks in the returns. The same are based on the returns of the month.

|

Standard Index |

Best Fit Index |

|

|

R-Squared |

72.43 |

94.91 |

|

Beta |

1.17 |

0.93 |

|

Alpha |

-2.41 |

3.34 |

|

Total Return % |

+ / - S&P 500 TR USD |

+ / - Russell 2000 Growth TR USD |

% Rank |

|

|

Year-to-date |

6.38 |

-7.31 |

0.77 |

17 |

|

1-Month |

1.12 |

1.37 |

-1.85 |

77 |

|

3-Month |

6.76 |

1.83 |

-3.30 |

72 |

|

6-Month |

3.64 |

-2.48 |

0.33 |

23 |

|

1-Year |

6.38 |

-7.31 |

0.77 |

17 |

|

3-Year (Annualized) |

21.07 |

0.65 |

0.93 |

16 |

|

5-Year (Annualized) |

19.19 |

3.74 |

2.39 |

5 |

|

10-Year (Annualized) |

10.20 |

2.52 |

1.66 |

5 |

(US News, 2015)

The following are the reasons for not getting the expected returns:

The prices of the shares fluctuate over time. Any stock that is trading at $40 may drop at $2 after a few months. And could end up at $100 by the end of the year. But the investor panics the moment the share price drops. It is very difficult to predict the price movement of the share and to know with surety whether the price will increase or decrease over the time. The risk of volatility will reduce if the investor keeps on investing with the long term perspective.

Then there are some factors that have the following types of issues:

- Competition

- Changes in the technologies

- Difficulty in obtaining loans

- Changes in the regulations

- Increase in the cost of the materials and the labour

- Fraud or illegal business procedures

- Negative changes in the economy

- Rumours about the company etc.

These are some of the factors that affect the price of the stocks of the company.

(Mass resources, 2015)

Conclusion:

In the nutshell, the following is the risk and the returns form the investment:

|

Shares |

Mutual funds |

Monthly |

||

|

Return |

3.68% |

6.38 |

3.2084 |

0.267367 |

|

Risk |

17.46347 |

12.55 |

15.00673 |

1.250561 |

It would be right to say that the return was very less when compared with the return but with the initial amount of an investment, this was safe to play.

References

Business.mapsofindia.com, (2015). Top 10 Investment Options in India. [online] Available at: https://business.mapsofindia.com/investment-industry/top-10-investment-options.html [Accessed 1 Feb. 2015].

In.finance.yahoo.com, (2015). MCD Historical Prices | McDonald's Corporation Common S Stock - Yahoo! India Finance. [online] Available at: https://in.finance.yahoo.com/q/hp?s=MCD&a=01&b=2&c=2008&d=01&e=1&f=2015&g=v [Accessed 1 Feb. 2015].

Massresources.org, (2015). Investing Money: Risks of Investing in Stocks. [online] Available at: https://www.massresources.org/investing-stocks-risks.html [Accessed 1 Feb. 2015].

Money.usnews.com, (2015). T. Rowe Price Diversified Small Cap Growth Fund (PRDSX) Performance | US News Best Mutual Funds. [online] Available at: https://money.usnews.com/funds/mutual-funds/small-growth/t.-rowe-price-diversified-small-cap-growth-fund/prdsx/performance [Accessed 1 Feb. 2015].

Money.usnews.com, (2015). T. Rowe Price Diversified Small Cap Growth Fund (PRDSX) Risk | US News Best Mutual Funds. [online] Available at: https://money.usnews.com/funds/mutual-funds/small-growth/t.-rowe-price-diversified-small-cap-growth-fund/prdsx/risk [Accessed 1 Feb. 2015].

Steinberg, S. (2014). The Best Ways to Invest $5,000 - US News. [online] US News & World Report. Available at: https://money.usnews.com/money/personal-finance/investing/articles/2014/04/10/the-best-ways-to-invest-5-000?page=2 [Accessed 1 Feb. 2015].

Telegraph.co.uk, (2009). 10 reasons to buy shares - Telegraph. [online] Available at: https://www.telegraph.co.uk/finance/personalfinance/investing/5787455/10-reasons-to-buy-shares.html [Accessed 1 Feb. 2015].

Wbginvestmentclimate.org, (2015). Investment Policy. [online] Available at: https://www.wbginvestmentclimate.org/advisory-services/international-trade/investment-policy/ [Accessed 1 Feb. 2015].

www.sec.gov, (2015). Mutual Funds A Guide for Investors. [online] Available at: https://www.sec.gov/investor/pubs/sec-guide-to-mutual-funds.pdf [Accessed 1 Feb. 2015].

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2016). Investment Policies, Options, And Performance. Retrieved from https://myassignmenthelp.com/free-samples/investment-policy.

"Investment Policies, Options, And Performance." My Assignment Help, 2016, https://myassignmenthelp.com/free-samples/investment-policy.

My Assignment Help (2016) Investment Policies, Options, And Performance [Online]. Available from: https://myassignmenthelp.com/free-samples/investment-policy

[Accessed 11 May 2025].

My Assignment Help. 'Investment Policies, Options, And Performance' (My Assignment Help, 2016) <https://myassignmenthelp.com/free-samples/investment-policy> accessed 11 May 2025.

My Assignment Help. Investment Policies, Options, And Performance [Internet]. My Assignment Help. 2016 [cited 11 May 2025]. Available from: https://myassignmenthelp.com/free-samples/investment-policy.