Formula for ROCE

Discuss about the Return on Capital Employed.

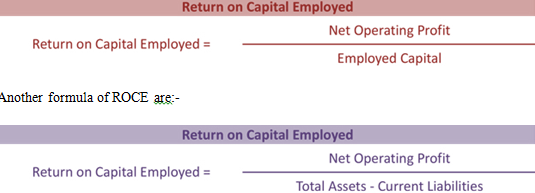

Return on capital employed or ROCE is a kind of profitability ratio which measures the efficiency of a particular enterprise to generate revenue from the capital employed by comparing operating revenue to capital employed. ROCE demonstrates how efficiently the assets of the enterprise are performing taking long term financing into consideration. For this reason it is termed as long term profitability ratio. ROCE is based on two major parts such as operating profit and capital employed. The formula of ROCE:

As per the given question the ROCE of the company has increased from 16.2% in 2015 to 22.7% in 2016. The reasons for such a huge improvement are discussed as follows:

Curtailment of cost:- During February when Qantas decided to reduce the cost for the business by $2 billion for next three years many analyst considered that the aim of achieving cost curtailment is not possible by the company. But the company has become successful in achieving the target of cost savings Qantas also moved quickly on the job cuts, with 4000 of the 5000 planned redundancies to be completed by June, in the process saving it hundreds of millions of dollars annually on wages.

Lower oil price:- Qantas has chosen to keep the majority of the gains from the lower oil price rather than pass it on to consumers in the form of lower ticket prices. Qantas loyalty program members redeeming their frequent flyer points for tickets will receive a benefit in the form of an average 14 per cent fall in fuel surcharge on some routes, including flights to the US, Asia, South America and South Africa. It has yet to lower the surcharge on routes covered by its partnership with Emirates, including the Middle East, Europe and North Africa.

Lower depreciation charges:- Qantas surprised with even lower depreciation charges than expected in the first half as a result of the retirement of ageing Boeing 767 aircraft. In total, it expects depreciation charges of $1.1 billion this financial year, compared with $1.42 billion last year. That means the bigger depreciation benefit was realised in the first half.

Less international competition:- The international capacity outlook is also improving, with rivals lowering their growth rate into Australia as a result of the lower dollar.

An organization's cost of debt is the effective rate that it pays on all its debts. The debt of a company usually consists of bonds, debentures, bank loans, term loan etc. Cost of debt forms a part of a company's capital structure.

Reasons for improvement of ROCE

Cost of debt is usually expressed in percentage in either of two ways: Before tax or after tax. In cases where interest expenses are tax deductible, the after tax approach is generally considered. The after-tax cost of debt is usually lesser than the before-tax (Pratt and Grabowski, 2008)

After tax cost of debt = (Before tax cost of debt) x (1 – Marginal tax rate).

As of Jun. 2016, Qantas Airways Ltd's interest expense (positive number) was $210.214655811 Mil. Its total Book Value of Debt (D) is $3945.24117937 Mil.

Cost of Debt = 210.214655811 / 3945.24117937 = 5.3283% (Gurufocus,2016).

Cost of equity (also known as cost of common stock) is the minimum rate of return which a company must generate in order to convince investors to invest in the company's common stock at its current market price. Cost of equity is estimated using the capital asset pricing model.

Cost of equity under the capital asset pricing model:-

Cost of Equity = Risk Free Rate + Beta Coefficient × Market Risk Premium

Cost of Equity = Risk Free Rate + Beta Coefficient × (Market Rate of Return − Risk Free Rate)

The current risk-free rate is 2.48%. Beta is the sensitivity of the expected excess asset returns to the expected excess market returns. Qantas Airways Ltd's beta is 1.07. (Expected Return of the Market - Risk-Free Rate of Return) is also called market premium. Market premium is estimated to be 7.5%.

Cost of Equity = 2.48000000% + 1.07 * 7.5% = 10.505%

Weighted average cost of capital (WACC) is the minimum average after-tax necessary rate of return, which a company must earn for all of its stake holders such as common stock-holders, preferred stock-holders and debt-holders (Armitage, 2005).

WACC = r(E) × w(E) + r(D) × (1 – t) × w(D)

WACC = E / (E + D)*Cost of Equity +D / (E + D)*Cost of Debt*(1 - Tax Rate) =0.5669*10.505%+0.4331* 5.3283% *(1 - 28.38%) = 7.61%

Weighted average cost of capital (WACC) is the minimum average after-tax necessary rate of return which a company must earn for all of its stake holders such as common stock-holders, preferred stock-holders and debt-holders (Armitage, 2005). The return on invested capital (ROIC) is the percentage amount that a company is making for every percentage point over the Cost of Capital| Weighted Average Cost of Capital (Wilkinson, 2013).

As per the given situation, the present ROIC before charging tax is 22.7% but after charging tax the ROIC is 15.9%. On the other hand, WACC of the company is 7.61%. The company is earning 8.29% (15.9% - 7.61%) over and above the weighted average cost of capital. The company is earning well enough to meet the requirement of the shareholders. Therefore the ROIC of 15.9% is well acceptable. But the company have to adapt strategies so that it can increase the wealth of the shareholders.

Value of the bond (PB) = c/(1+r) + c/(1+r)2 + c/(1+r)3+ ....... + c/(1+r)10 + B/(1+r)10Cost of debt

PE = 5.5/(1+0.08) + 5.5/(1+0.08)2 + 5.5/(1+0.08)3 + 5.5/(1+0.08)4 +.......+ 5.5/(1+0.08)20 + $20/(1+0.08)10

= 5.5 * 0.9259 + 5.5 * 0.8573+ 5.5 * 0.7938 + 5.5 * 0.7350+ 5.5 *0.6806+5.5*0.6301 + 5.5*0.2145 + $20 * 0.2145

= 26.8521

WACC = E / (E + D)*Cost of Equity +D / (E + D)*Cost of Debt*(1 - Tax Rate) + debt/ cost of debt

=0.5669*10.505%+0.4331* 5.3283% *(1 - 28.38%) + 5/(1-26.8521) = 7.80%

The company has three investment plans that is equity, debt or debenture or newly issued bonds. As a student of finance, I should like to suggest that the company should like to take finance through equity and debentures.Equity shares are the ordinary shares. The holders of these shares are the real owners of the company. They have a voting right in the meetings of holders of the company. They have a control over the working of the company. Equity shareholders are paid dividend after paying it to the preference shareholders.

Advantages of Equity Shares:

Equity shares do not create any obligation to pay a fixed rate of dividend.

Equity shares can be issued without creating any charge over the assets of the company.

Disadvantages of Equity Shares:

If only equity shares are issued, the company cannot take the advantage of trading on equity.

As equity capital cannot be redeemed, there is a danger of over capitalisation.

If a company needs funds for extension and development purpose without increasing its share capital, it can borrow from the general public by issuing certificates for a fixed period of time and at a fixed rate of interest. Such a loan certificate is called a debenture.

Advantages of debentures

- Interest on debenture is a tax deductible expenditure and thus it saves income tax.

- Cost of debenture is relatively lower than preference shares and equity shares.

Disadvantages of debentures

- Redemption of debenture involves a larger amount of cash outflow.

- Payment of interest on debenture is obligatory and hence it becomes burden if the company incurs loss.

Risk can be defined as the change in investor’s actual return which will may totally different from the investor’s expected return. Risk involves the chances of losing the whole investment or the part thereof by the investor (Harrison, 2009). Risk can be sub divided into systematic risk and unsystematic risk.

Systematic risk refers to the portion of total variability in return caused by factors affecting the prices of all securities. Economic, Political and Sociological changes are sources of systematic risk. The risk arises out of the uncertainty surrounding a particular firm or industry due to factors like labour strike, consumer preference & management policies are called Unsystematic risk. Unsystematic risk is also called “Diversifiable risk’’ (Francis, 2010).

The Expected Return on a Portfolio is computed as the weighted average of the expected returns on the stocks which comprise the portfolio. The weights reflect the proportion of the portfolio invested in the stocks (Zenwealth, 2016).

Risk and return are highly correlated. If an individual takes high risk then that individual will get high return and vice versa. Now as per the given situation, I have own $50000 at the Casino in Canberra. Now, I have an option of buying the shares of Qantam or else i can buy the newly issued bonds, or I can return to the Casino and again start gambling with $50000.

Now as the price of the shares are cheapest in the share market I can opt for buying shares of the company with the hope of increasing the share price in future. But the share price may also fall. But as the company has re gained its financial position and started making profit so it will be a wise decision to invest in shares rather than investing it in new issue bonds or reinvesting it in casino for gambling.

Armitage, S. (2005). The cost of capital. New York: Cambridge University Press.

Francis, A. (2010). Risk and Return in Portfolio Investments. [online] MBA Knowledge Base. Available at: https://www.mbaknol.com/investment-management/risk-and-return-in-portfolio-investments/ [Accessed 14 Sep. 2016].

Gurufocus.com. (2016). Qantas Airways Ltd (OTCPK:QUBSF) Intrinsic Value: DCF (FCF Based). [online] Available at: https://www.gurufocus.com/term/Intrinsic+Value+%28DCF%29/OTCPK:QUBSF/Intrinsic-Value-DCF-FCF-Based/Qantas-Airways-Ltd [Accessed 14 Sep. 2016].

Harrison, C. (2009). Risk. New York: Picador.

Pratt, S. and Grabowski, R. (2008). Cost of capital. Hoboken, N.J.: John Wiley & Sons.

Wilkinson, J. (2013). Return on Invested Capital (ROIC) • The Strategic CFO. [online] Strategiccfo.com. Available at: https://strategiccfo.com/return-on-invested-capital-roic/ [Accessed 14 Sep. 2016].

Zenwealth.com. (2016). Portfolio Risk and Return. [online] Available at: https://www.zenwealth.com/businessfinanceonline/RR/Portfolios.html [Accessed 14 Sep. 2016].

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2018). Understanding Return On Capital Employed (ROCE). Retrieved from https://myassignmenthelp.com/free-samples/return-on-capital-employed.

"Understanding Return On Capital Employed (ROCE)." My Assignment Help, 2018, https://myassignmenthelp.com/free-samples/return-on-capital-employed.

My Assignment Help (2018) Understanding Return On Capital Employed (ROCE) [Online]. Available from: https://myassignmenthelp.com/free-samples/return-on-capital-employed

[Accessed 19 May 2025].

My Assignment Help. 'Understanding Return On Capital Employed (ROCE)' (My Assignment Help, 2018) <https://myassignmenthelp.com/free-samples/return-on-capital-employed> accessed 19 May 2025.

My Assignment Help. Understanding Return On Capital Employed (ROCE) [Internet]. My Assignment Help. 2018 [cited 19 May 2025]. Available from: https://myassignmenthelp.com/free-samples/return-on-capital-employed.