Discuss about the Strategic Management Process for Implementation and Evaluation.

Telstra Corporation Limited or Telstra is the largest telecommunications company in Australia. Telstra was privatised in three different stages- T1, T2 and T3 in the years 1997, 1999 and 2006 respectively (Telstra.com.au, 2016). Telstra effectively completed its privatisation in 2011 and is one of the largest Australian companies listed on the Australian Securities Exchange with over one million shareholders. The company has come a long way since its foundation 41 years ago on the year 1975 (Telstra.com.au, 2016). The history originates in the year 1901 where the Australian telecommunication services were controlled by Postmaster-General's Department (PMG). The size of the company is as huge as a workforce of 36,165 employees with a motto ‘Thrive On’ (Telstraglobal.com, 2016). The company is running its operations not only in Australia, but 22 other countries outside Australia. The major products and services offered by the company are network services, fixed line and mobile connections, internet and data services and digital television (Telstra.com.au, 2016). According to the 2015 figures, the company had revenue worth 26.7 billion AUD (Telstra.com.au, 2016). The major market of Telstra is the customers in both homes and businesses. The business scope is growing internationally and the company is grabbing opportunity to increase its market share in the global market (Bingemann, 2014).

Macro-environment AnalysisThe purpose of this framework is to assess the external environment and identify possible opportunities and threats that shall impact the telecommunications sector as a whole. The PESTEL framework is used to assess the macro-environment.

Political- The telecommunications in Australia is governed by Australian Communications and Media Authority (ACMA) as they are responsible for broadcasting, radio communications and internet (Acma.gov.au, 2016). It provides stringent regulations for telecommunications as it aims to protect consumers. It allows the companies to provide social and technological developments for its customers. They aim to make media and communication in the best interest by delivering specific programs. The Minister for Communications also imposes license conditions for carriers that affect supply of services (Acma.gov.au, 2016).

Economic- According to the World Economic Forum, Australia is the lowest scoring country when it comes to affording internet access. There are millions of households without an internet access (Edwards, 2016). The Australians are facing a digital divide due to inequalities in income and the people with lower incomes are unable to afford internet. The people with income under $19,000 are less likely to have internet connection (Aph.gov.au, 2016). There is a labour shortage in the telecommunications industry that makes business weak (Employment.gov.au, 2015).

External Environment Analysis

Social- The Australians are becoming greatly attached to their mobile phones and internet connection. According to the Digital Australia report, an average Australian spends 10 hours and 24 minutes on the internet-connected devices daily (Carmody, 2016). Internet and network connections have become an absolute necessity rather than indulgence in the people’s lives. There is continued improvement in the digital and networking world (Carmody, 2016).

Technological- With the wired and wireless carriers are experiencing rapi shift in the technology, there is always a scope for making technological advancements. The telecom companies need to monetize their infrastructure investments to sustain in the industry and offer broader digital ecosystems. The shift to experience-based pricing, promoting data-heavy content and phasing out the unlimited plans need to be worked upon. The telecom companies also need to develop the new 5G systems and continue deploying 4G systems (Strategyand.pwc.com, 2016).

Environmental- The Commonwealth Department of Environment, Sport and Territories (DEST) is designed to protect and conserve the water, environment, climate and heritage. Telecommunications carry information in oral, visual, written or electronic modes thereby reducing greenhouse emissions, atmospheric pollution and savings in fuel. Currently, all carriers in Australia such as Vodafone, Optus and Telstra are exempted from the local, state and territorial environment and planning laws (Alrc.gov.au, 2016).

Legal- According to the Telecommunications Act 1997, license and standards must be met in the telecommunication industry (Acma.gov.au, 2016). A breach of act leads to criminal punishment. Any telecommunication equipment such as modems or phones purchased in another country is not suitable to use in Australia. Penalties shall be imposed for illegal connection. The service providers violating Telecommunications Consumer Protection and Service Standard Act 1999 shall also be penalized (Acma.gov.au, 2016).

Conclusively, there are several threats identified from the regulatory and legal forces as the bodies are stringent. There are significant opportunities looking at the social and technological trends as it favours the telecom industry.

The purpose of the industry or competitive analysis is to assess the attractiveness of the organization by evaluating the competitor’s strengths and weaknesses. The Five forces model is used to assess the competition.

|

Porter’s Five Forces |

Intensity (High/ Medium/ Low) |

Analysis |

|

Bargaining power of customers |

Medium |

There is a large pool of buyers of the organization. The telecommunications and network providers do not have much product differentiation. This leads to low switching cost for the customers in which they can easily switch from one service provider to the other. The customers may switch on the basis of price. However, the switching depends on the quality and coverage of service network which is the main concern of the buyers (Ahmad, Hussain, & Rajput, 2015). |

|

Bargaining power of suppliers |

Low |

Telstra is the largest network suppliers in the telecom industry. The suppliers and partners are a critical part of the organization. It has a large control over network capacity and is able to manage its business market in other countries. They use own network cabling. The products sold by Telstra are high in quality that helps gain customers trust. The other service providers’ dependency allows Telstra to have significance over other suppliers and cost of competitors where network access is necessary (Verikios & Zhang, 2016). |

|

Intensity of competitive rivalry |

Medium |

Optus and Vodafone are the main rivalries of Telstra. However, Telstra still maintains a dominant position in the telecommunications market. Telstra has expanded its business in the Asian regions that are opening up opportunities to compete in the global market. Few competitors are able to sustain in the market because of the low product differentiation factors and quality of services (Evans, 2014). |

|

Threat of substitutes |

Low |

The subscriber base for accessing networks and services are increasing. There is no substitute to communications and internet facilities. With the increasing technological and social trends, it seems like there is no alternative to internet. The customers can only switch between companies but not the internet and network. Network and internet forms a necessary part in people’s lives which cannot be substituted while communicating at a long distance (Rajasekar & Al Raee, 2013). |

|

Barriers to entry |

Low |

Telstra has a strong hold in the telecommunications industry for its research and development and technological advances. For competing with Telstra, the new entrants require large set-up cost. Also, highly specialized assets are required which makes it difficult to exit the industry. Telstra is established across the globe and it is not easy to gain a market share like Telstra easily (Rajasekar & Al Raee, 2013). |

Table 1: Porter’s Five Forces Analysis

Source: Created by Author

Conclusively, with the existing rivalry, Telstra needs to devise new ways to differentiate with its customers. It may be in the form of new product packages or services, but the key differentiating factor needs to be recognized.

The internal environment of an organization can be analyzed. The organizational capabilities, strengths and resources that enhance the internal environment of Telstra need to be assessed. A few major resources and capabilities of Telstra are strong global presence, large customer base, strong finance, innovation and marketing and wide product portfolio (Peng, 2016).

Competitive Analysis

According to Barney’s VRIO framework, the internal resources and capabilities of Telstra can be evaluated across various dimensions. The VRIO shall assess the internal resources and competences on their Value, Rareness, Cost to Imitate and Organization (Peng, 2016).

|

Resource or capability |

Valuable |

Rare |

Imitable or Non-substitutable |

Organized to Exploit |

Competitive Implication |

Economic Performance |

|

Strong global presence |

Yes |

Yes |

Yes |

Yes |

Sustained competitive advantage |

Above normal |

|

Large customer base |

Yes |

Yes |

Yes |

Yes |

Sustained competitive advantage |

Above normal |

|

Strong finance |

Yes |

Yes |

Yes |

Yes |

Sustained competitive advantage |

Above normal |

|

Innovation and Marketing |

Yes |

Yes |

Yes |

Yes |

Sustained competitive advantage |

Above normal |

|

Wide product portfolio |

Yes |

Yes |

No |

- |

Temporary competitive advantage |

Above normal |

Table 2: VRIO Framework

Source: Created by Author

It is interpreted that Telstra has abundant core competences and resources. It needs to add value to the activities conducted by them. The product portfolio needs to be enhances so that it can give tough competition in the global market. The company has a sustained competitive advantage in all aspects except for the product portfolio.

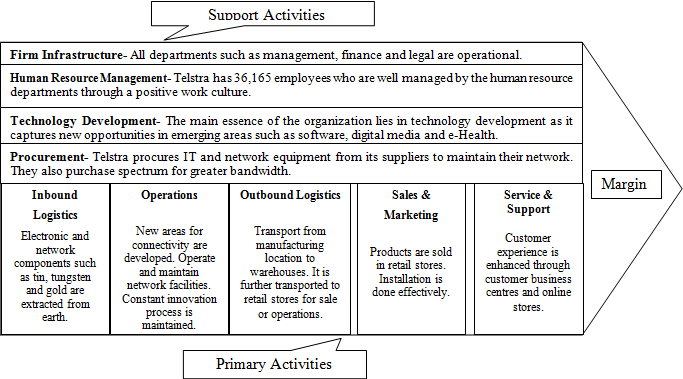

According to Porter, a value chain is a chain of activities for a firm operating in a specific industry. The activities are divided into two categories: primary and support activities. The primary activities involve the functions of an organization that provides competitive advantage to the firm in which it operates. The support activities add value to the primary activities (Fearne, Martinez, & Dent, 2012).

Figure 1: Value Chain Analysis

Source: (Exchange.telstra.com.au, 2016)

It is interpreted that the value chain activities of the organization are strong. The primary and support activities are strong which must be utilized efficiently to create competitive advantage over other telecom providers.

Based on the external environment analysis, it is interpreted that the telecommunication industry faces threats from political and legal implications. There are stringent laws and regulations regarding communication and network licenses which invites heavy penalty under any case of violation. It is further observed that the telecommunication industry experiences shortage of skilled labour. Therefore, Telstra can provide training to the technicians and make them skilled. Training and development programs must be designed for them to improve their working processes and skills. The increasing social and technological trends imply that there is an ever increasing customer base for using network communications, data services and internet. Therefore, Telstra must make efforts to maintain its existing customer base and attract new customers. Good coverage and network facilities are the key attractive factors for the customers. Telstra can establish and install more network towers so that there is connectivity like no other competitor. As the Australians are facing a digital divide, Telstra may offer different pricing bundles for its customers so that maximum people can afford its products and services. This shall help in enhancing the customer base.

Based on the internal environment analysis, the key issue identified is that the organization has abundant resources, technology, infrastructure and human resources to create greater innovation and enhance its product portfolio. Not all the products and services are available globally. Telstra can consider investing in the research and development for enhancing the product portfolio. It is further interpreted that there is very less scope for creating product differentiation in the telecommunications industry. Therefore, Telstra can take initiatives to enhance its customer service for creating competitive advantage. Better strategies must be adopted than competitors such as Vodafone and Optus without compromising the quality for enhancing customer support services. There is a need to channel the firm’s internal resources in the correct manner so that every capability and resource has a sustained competitive advantage.

Porter’s Five Forces Analysis

Conclusion

Conclusively, Telstra owns a significant position and market share in the telecommunications industry. The major products and services offered by the company are network services, fixed line and mobile connections, internet and data services and digital television. The Australians are facing a digital divide due to inequalities in income and the people with lower incomes are unable to afford internet. Telecommunications carry information in oral, visual, written or electronic modes thereby reducing greenhouse emissions, atmospheric pollution and savings in fuel. The customers may switch on the basis of price. However, the switching depends on the quality and coverage of service network which is the main concern of the buyers. Optus and Vodafone are the main rivalries of Telstra. Few competitors are able to sustain in the market because of the low product differentiation factors and quality of services. With the increasing technological and social trends, it seems like there is no alternative to internet. It is interpreted that the value chain activities of the organization are strong. The primary and support activities are strong which must be utilized efficiently to create competitive advantage over other telecom providers.

References

Acma.gov.au,. (2016). Home | ACMA. Acma.gov.au. Retrieved 26 August 2016, from https://www.acma.gov.au/

Acma.gov.au,. (2016). Service provider obligations | ACMA. Acma.gov.au. Retrieved 26 August 2016, from https://www.acma.gov.au/Industry/Telco/Carriers-and-service-providers/Licensing/service-provider-obligations-licence-fees-and-levies-i-acma

Acma.gov.au,. (2016). Service provider regulation | ACMA. Acma.gov.au. Retrieved 26 August 2016, from https://acma.gov.au/Industry/Telco/Carriers-and-service-providers/Licensing/telecommunications-carrier-and-service-provider-regulation-fact-sheet

Ahmad, J., Hussain, M., & Rajput, A. (2015). Customer Loyalty Framework of Telecommunication Service Market. IJMVSC, 6(1), 69-78. https://dx.doi.org/10.5121/ijmvsc.2015.6106

Alrc.gov.au,. (2016). A review of telecommunications regulation | ALRC. Alrc.gov.au. Retrieved 26 August 2016, from https://www.alrc.gov.au/publications/71.%20Telecommunications%20Act/review-telecommunications-regulation

Aph.gov.au,. (2016). a Digital Divide in Rural and Regional Australia? – Parliament of Australia.Aph.gov.au. Retrieved 26 August 2016, from https://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Library/Publications_Archive/CIB/cib0102/02CIB01

Aph.gov.au,. (2016). ENVIRONMENTAL IMPACT OF TELECOMMUNICATIONS – Parliament of Australia. Aph.gov.au. Retrieved 26 August 2016, from https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Environment_and_Communications/Completed_inquiries/1996-99/telstra/report/c07a

Bingemann, M. (2014). Telstra chief David Thodey targets Asia for expansion. TheAustralian. Retrieved 26 August 2016, from https://www.theaustralian.com.au/business/telstra-chief-david-thodey-targets-asia-for-expansion/story-e6frg8zx-1226927500562

Carmody, B. (2016). Australians spend 10 hours a day on internet connected devices: The digital trends your SME needs to know - SmartCompany. SmartCompany. Retrieved 26 August 2016, from https://www.smartcompany.com.au/technology/62659-australians-spend-10-hours-a-day-on-internet-connected-devices-the-digital-trends-your-sme-needs-to-know/

Edwards, M. (2016). World Economic Forum scores Australia lowest for internet access affordability.ABC News. Retrieved 26 August 2016, from https://www.abc.net.au/news/2016-04-20/millions-of-australians-living-without-internet/7340434

Employment.gov.au,. (2015). Telecommunications Trades Workers. Australia: Australian Government. Retrieved from https://docs.employment.gov.au/system/files/doc/other/3242telecommunicationstradeworkeraus.pdf

Evans, S. (2014). Australian mobile broadband network performance: Mobile apps as one possible way to provide consumer information. Ajtde, 2(1). https://dx.doi.org/10.7790/ajtde.v2n1.25

Exchange.telstra.com.au,. (2016). Our value chain - Telstra Exchange. Telstra Exchange. Retrieved 26 August 2016, from https://exchange.telstra.com.au/2016/08/09/value-chain/

Fearne, A., Garcia Martinez, M., & Dent, B. (2012). Dimensions of sustainable value chains: implications for value chain analysis. Supply Chain Management: An International Journal, 17(6), 575-581. https://dx.doi.org/10.1108/13598541211269193

Peng, M. (2016). Global business. Mason, OH: South-Western Cengage Learning.

Rajasekar, J. & Al Raee, M. (2013). An analysis of the telecommunication industry in the Sultanate of Oman using Michael Porter's competitive strategy model. Competitiveness Review, 23(3), 234-259. https://dx.doi.org/10.1108/10595421311319825

Sec.gov,. (2016). Telstra Corporation Limited. Sec.gov. Retrieved 26 August 2016, from https://www.sec.gov/Archives/edgar/data/1046126/000095012304011066/y02175e6vk.htm

Strategyand.pwc.com,. (2016). 2015 Telecommunications Trends. Strategyand.pwc.com. Retrieved 26 August 2016, from https://www.strategyand.pwc.com/perspectives/2015-telecommunications-trends

Telstra.com.au,. (2016). About Telstra - History of Telstra. Telstra.com.au. Retrieved 26 August 2016, from https://www.telstra.com.au/abouttelstra/company-overview/history/telstra-story/

Telstra.com.au,. (2016). Financial results. Telstra.com.au. Retrieved 26 August 2016, from https://www.telstra.com.au/aboutus/investors/financial-information/financial-results

Telstra.com.au,. (2016). Past. Telstra.com.au. Retrieved 26 August 2016, from https://www.telstra.com.au/aboutus/our-company/past

Telstraglobal.com,. (2016). About Telstra. Telstraglobal.com. Retrieved 26 August 2016, from https://www.telstraglobal.com/about/about-telstra-global

Verikios, G. & Zhang, X. (2016). Structural change and income distribution: the case of Australian telecommunications. Journal Of The Asia Pacific Economy, 21(4), 549-570. https://dx.doi.org/10.1080/13547860.2016.1153221

Verikios, G. & Zhang, X. (2016). Structural change and income distribution: the case of Australian telecommunications. Journal Of The Asia Pacific Economy, 21(4), 549-570. https://dx.doi.org/10.1080/13547860.2016.1153221

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2017). Strategic Management Process For Implementation And Evaluation - Telstra Essay.. Retrieved from https://myassignmenthelp.com/free-samples/strategic-management-process-implementation-and-evaluation.

"Strategic Management Process For Implementation And Evaluation - Telstra Essay.." My Assignment Help, 2017, https://myassignmenthelp.com/free-samples/strategic-management-process-implementation-and-evaluation.

My Assignment Help (2017) Strategic Management Process For Implementation And Evaluation - Telstra Essay. [Online]. Available from: https://myassignmenthelp.com/free-samples/strategic-management-process-implementation-and-evaluation

[Accessed 30 May 2025].

My Assignment Help. 'Strategic Management Process For Implementation And Evaluation - Telstra Essay.' (My Assignment Help, 2017) <https://myassignmenthelp.com/free-samples/strategic-management-process-implementation-and-evaluation> accessed 30 May 2025.

My Assignment Help. Strategic Management Process For Implementation And Evaluation - Telstra Essay. [Internet]. My Assignment Help. 2017 [cited 30 May 2025]. Available from: https://myassignmenthelp.com/free-samples/strategic-management-process-implementation-and-evaluation.