Overview of National Income Accounts and Economic Activity in the UK

Question:

Write a report outlining the current state of the UK government’s spending and revenue plans?

The national income accounts give the insight of all economic activity within the union territory of UK. These activities include both domestic and external activities which has been influencing the country’s economy. These all accounts are being fully integrated which helps in transparency within its approach and also shows the entire spending of the funds which has been paid by the individuals and the company for which the government is accountable. Most of the well known economic statics are given in the national accounts such as GDP, GNP, Public sector borrowings ratio and Balance of trade etc (Geroski and Gregg, 1997). The study deals with various areas of the national accounts of the UK that also includes before and after recession country performance. Apart from that, the study will also highlight the issues and reason for investment high in various sectors. The national income is being made in the line of internationals standards which is ESA 29 (Hartwick, 2000).

Institutional sectors:

In order to bring the transparency on the accounts certain key analysis based on which various institutional sectors are grouped into number of manufacturing unit along with who own and controls them. Some of the major sectors and sub sector are given below:

|

Financial corporations

|

GDP |

Institutional sector accounts |

|

NON financial corporations |

Production approach |

Production accounts |

|

General government |

Expenditure approach |

Generations of income |

|

Household |

Income approach |

Allocations of primary income accounts |

|

NON profit institutions |

Distribution of income statements |

|

|

serving household |

Use of disposal income |

|

|

Rest of the world |

Balance sheet |

The annual trade of the country = (net exporting)+ importing –at (current market prices) of 2002 to 2012 shows that fluctuations within the economy because of recessions in 2007-2008 which has severely hit the country trade (Higgins, 2013). Between 2002-2012 the UK has been consistency running a trade deficit. In 2013, the trade deficit in the current process was 33.9 billion. This shows that, country has been able to increase its net trade by 45.7% from 23.3 billion in 2011(www.ons.gov.uk, 2015). The rest of the world performance in 2008 is poor in compare to the UK trade deficit.

In the recent interviews conducted by the BBC news, British Prime Minister Mr. David Cameron has addressed that, ”His government is paying the Britain’s debt”. This allegation has come after the resolution of budget cut in the NGO sector and reduces in the Military budget. Apart from that other member of the members of his group Chancellor George Osborne has also claimed that deficit has been reduced by 1/3rd since the party came in to the power (www.bbc.com, 2014).

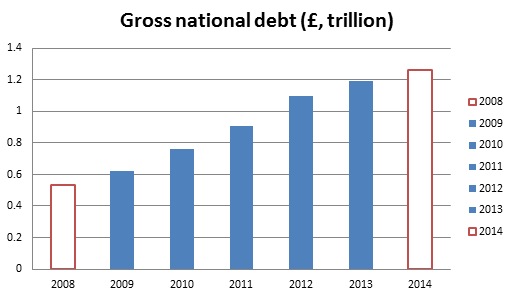

Debt here refers to amount of money borrowed by the UK government for maintaining the national security. This debt has been result of many year of unwanted borrowings by the past government. In UK the debt is calculated total debt less government liquid asset (Humphries, 1996). As the chart below shows the debt has increased in the recent year which is to double has double the existing borrowings to £1trllion in past 6 years. This has been increased due to large financial crisis and resulting into recessions. In order to assess the debt percentage with the total output, debt to GDP ratio will give an actual debt and expenditure of the government. The debt to GDP ratio is been rise since 2007-2008 (Iley and Lewis, 2007). Since 1974, there has been eight years when the treasury of UK has ended the year in the black. The GDP of Britain is very much shows the deficit during the financial crisis which jumps from the 109pc in 2009 to 10.1 pc a year later (www.ons.gov.uk, 2015).

|

Year |

Gross national debt (£, trillion) |

|

2008 |

0.53 |

|

2009 |

0.62 |

|

2010 |

0.76 |

|

2011 |

0.91 |

|

2012 |

1.10 |

|

2013 |

1.19 |

|

2014 |

1.26 |

Institutional Sectors in the UK

Graph 1: GNP debt of UK

(Source: Jenkins, 2013, pp-125)

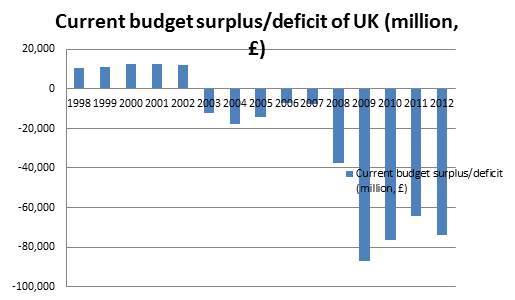

Government spends lesser than it receives will given the government budget surplus. During the time of 1998-2001, UK has four straight year of surplus. As matter of fact, country had huge amount of surplus in the between the year 1947-1974. However, since 2000 to till date government is facing huge deficit, it is because of overspending. As per the latest figures newt borrowings was £15.4 billion in December 2012 (Jenkins, 2013). This shows £0.6 billion higher than December 2011 which was 14.8 billion only in public sector unit. Deficit in public sector unit was 13.0 billion in December 2012; this shows 0.5 billion increase in deficit from 2011 (Parker, 2011). This is because one of the overspending payments recorded as part of the Royal pension plans transfer. In 20213, economic activity as measured of GDP suggest that, it was 1.7% higher than 2012, compared with growth of 0.7% in the previous year. In 2008 the GDP was fell by 0.3% and fell again in 2009 by 4.3% because of the financial recessions (www.theguardian.com, 2014). However, the recovery of GDP by 1.9% in 2010 was one of the positive sign for the UK economy.

|

Financial year |

Current budget surplus/deficit (million, £) |

Net debt as a % of GDP |

|

1998 |

10,427 |

40.3 |

|

1999 |

10,891 |

39.9 |

|

2000 |

12610 |

40.6 |

|

2001 |

12,476 |

29.7 |

|

2002 |

12,144 |

30.8 |

|

2003 |

-12,367 |

32.2 |

|

2004 |

-17,720 |

33.9 |

|

2005 |

-14,476 |

35.1 |

|

2006 |

-7236 |

35.8 |

|

2007 |

-7,491 |

43 |

|

2008 |

-37,553 |

150.4 |

|

2009 |

-86,756 |

153.6 |

|

2010 |

-76,219 |

149 |

|

2011 |

-64,217 |

141 |

|

2012 |

-74,064 |

140.3 |

Graph 2: Current deficit of UK

(Source: Wanna et al. 2010, pp-259)

From the above graph, it has been found that UK national accounts shows that, country overspending in defence and household has incurred company financial deficit. Since 2007-2008 was the bad phase of the world economy, sparing the 2008, country defence arises from 2003- till date (Simon and Proops, 2000). As the UK is known as the power economy in worldwide, country has been not been able perform as per its potential. Some of the major issues of for the increase in the deficit in UK are as given below:

Consumer spending is lowered: When there is failing prices, this often encourages people to delay in the purchase of products and services because of the cheaper products and services. Apart from that, high deflations is another major issues in UK, sometimes it discourages the consumers to buy the luxury goods because most of the consumer feels by waiting for it would be decrease in price of the products (Pettinger, 2012). Therefore, period of deflations crates lower consumer spending which resultants in to reduce in the lower economic growth.

Increase in real value of debt: Other major reason is increase in real value of money and the real value of debt. One of the major reason that government UK is not able to pay off its debt is because of the rise in the value of money which increasing the deficit and borrowings. Consumer s and forms are not been has to pay higher amount of disposable income on meeting the debt repayments (Rowley et al. 2002). This leaves the country for less money for spending and investment. This is also known as the balance sheet recession because half of the money is paid of in debt interested. There is huge problem in Europe as to exposure to debt is higher which making very much difficult to reduce its debt to GDP ratios (Felstead et al. 2012).

Analysis of Debt and Deficit

Increased in real interest areas:

Rise in the interest from the year 1999-2012 has been one of the major headaches for the Cameron government to control the deficit. If the deflation is of 2%, this earns the government has real interest rate of +2%. In other words saving money gives the country reasonable returns. Therefore, real interest rate has tightened the monetary policy of UK (Gregg and Wadsworth, 2010). This is particularly a problem majorly in Euro ozone nations which do not have any other monetary policy for examples like Quantities easing. However, UK has been lead to lower growth and higher unemployment during time if 2008 recessions period to 2014 (Ukpublicspending.co.uk, 2015).

Wage rate unemployment: As the real wage rate in UK labour market show the sticky Wages. Particularly, worker resist nominal wages cuts especially when the people are use to annual pay increases ever year. Therefore during the time of recession, most of firms including government nations have decreased the real wages which has increases the unemployment in Europe which is major concern for the rise in the budget deficit (Hodson, 2011). Rise in the inflation rate since 2008 was rise by 4.05% which has now become 1.3% in October 2013 has made people to control in its spending which again tends the government to invest to increases the job opportunity to reduce the problems of the inflation within the nations (www.ons.gov.uk, 2015).

The GDP of the UK shows the slow growth of GDP but steady by 0.2% in 2012. The total expenditure has been very much invested in the right sector and components (Kaiser, 2011). There has been six equal component out of six were split into three negative and three positive contribution which enables the public to analyse the expenditure done by the government.

|

Components |

£Million |

Percentage points |

|

Household and NGO’s |

10201 |

70% |

|

General government expenditure |

9357 |

60% |

|

Gross fixed capital |

1056 |

10% |

|

Change in inventories |

-5204 |

-30% |

|

Net trade |

-9326 |

-60% |

|

Other |

-3523 |

-20% |

|

Total |

2561 |

20% |

From the above, it has been found that, country has spent more in household expenditure and NGO with 10201 million. Country ahs net trade or export is in less than 3523 for -0.2%. There has been rise in the goods final expenditure which shows that, country consumption expenditure on final sue of goods and services produced and imported by the UK in 2012 (Kersting, 2008). Export of goods and service of the country shows that, 23.5% growth. 16.30% is being spent by the general government final consumptions (www.ons.gov.uk, 2015).

Graph 3: Gross final expenditure of UK

(Source: Mody and Sandri, 2012, pp-201)

In 2002, there was similar kind of patterns household and nonprofit institution serving the households which was accounted for more than 51% of gross final expenditure which is followed by the exporting of products and services with 20.1% (Mody and Sandri, 2012). The gross final expenditure approaches various measures to extricate the over production of productions. From the national statics of the UK, it has been seen that, most of the companies are being using new and innovative products to sell the customers. Apart from that, in 2013, most of the corporation like British telecom and other major companies has done exceptionally well which gain brought the lots of advance tax to the country which was fruitful for the managing the deficient (www.ons.gov.uk, 2015).

Government Spending and Revenue Plans

GDP at market prices from the year 1995 has changed the economic policy of the UK.

|

Years |

Current market prices |

|

1995 |

723080 |

|

1996 |

768905 |

|

1997 |

815881 |

|

1998 |

911945 |

|

2000 |

958931 |

|

2002 |

1055793 |

|

2003 |

1118245 |

|

2006 |

1299622 |

From the above, it has been found that, GDP at current prices are being approached as per the expenditure which shows that country is progressing before the time of recessions. Apart from that the output and volume measures of VAT shows around 80% of the total of the productions. the national accounts of the UK is much transparent and much clear which can be read and understand by the layman (Thompson, 2005). During the time of 2007-2008 worlds has hit by the strong financial crisis which also has affected the country as whole along with its WPI and CPI. The blue book of 2008 represents the financials history of UK and its spending and its surplus/deficit within the existing form of economy (Pettinger, 2012).

|

Spending |

2013 (£,Billion) |

|

Pension |

31 |

|

Health care |

140 |

|

Education |

98 |

|

Defence |

38 |

|

53Transport |

23 |

|

Public sector safety |

32.02 |

|

Debt interest |

53 |

|

Industry , agriculture and employment |

17 |

|

Social protection |

222 |

|

Others |

53 |

|

Total |

707.02 |

Graph 4: UK government expenditure

(Source: Kaiser, 2011, pp-342)

|

Category |

%1 |

|

Compensation of employees |

51.2 |

|

Corporations' gross operating surplus |

21.7 |

|

Other income 2,3 |

14.8 |

|

Taxes less subsidies |

12.3 |

As per the latest figures given above, UK has been one place down to be first highest spender in defence in world behind united states and US, China, Germany and Russia (Tomes, 2003). However, protection from the budget cuts in last tow budge has made the UK to reach at second positions however, France is shift to the sixth largest spender.

Apart from that, as noted by Thompson (2005), when it come s to educations, the department of UK current government has risen the investment in the educations from 90 to 98 billion. A capital budget of £7.2 bn in 2010 -11 was less because of the affect of recession on economy. However, the overall spending with budget has been fall as the inflation has decreases the educations budget as per the UK National accounts (Mody and Sandri, 2012). Apart from that, economic has spend major cash in the transport projects for which gain huge amount loan has been passed to the private sector in order to boost the private sector economy. The home and office ministry of Justice has invested more than 30 billion in maintain public safety for which the rise the recruitment of police force has been one of the major step taken by the government in order to maintain the safety and security within the nations (Ukpublicspending.co.uk, 2015).

Besides that, health care services have eaten more than 140 billion investment because of rise in the health issues. NHS get more than 114 billion for opening more of hospitals (Kersting, 2008). However, country is bee severally suffered from the high debt interest which because of huge borrowing of more than 1 trillion. The interest this is been low because of rise in the GDP rates in December 2013.

Government earnings

|

Government earnings |

2013 (£,Billion) |

|

VAT |

111 |

|

Corporation tax |

41 |

|

National insurance |

110 |

|

Business rates |

27 |

|

Income tax |

167 |

|

Excise duty |

47 |

|

Council tax |

27 |

|

Others |

118 |

|

Total |

648 |

Total deficit= total earning –total expenditure

=648-707.02

Final deficit of 2013 =59.02 billion

Graph 5: UK Government earnings of 2013

(Source: Hodson, 2011, 232)

One of the major earnings is from the excise duty which has been rise from the by 1pc by the government of Excise. This rise in duty has increased the earnings of the government by 2%. Rise in the excise duty of beer by 1.08% and wines and spirits has also been risen up. Income tax is the biggest elements of government taxes receipts; income tax was expected to be the benefit from the rise of the employments (Kaiser, 2011). As the corporation tax has been risen by 9% of total tax receipts. Corporation tax income has come down by 28% r 21% from the year in 2014. This shows that, country is not being able to motivate the new promoters to open new business. One of the biggest incomes of British economy comes out of income tax which is 167 billion (www.theguardian.com, 2014).

As per the report of IMF , it has been found that, Britain was running structural deficit with 5.2 pc in 2007. By using the various measurement amounts by which the public borrowings exceeds tax revenues by considering the external factors (Felstead et al. 2012). Britain entered into the global financial crisis in worst’s positions than the other developed nations. Before the financial crisis country position was better than before the financial crisis because of the country growth rate was increased by 11.09% per year though there was deficit. However, country has been was overspending in the unnecessarily without keeping on the tabs of the performance (Wanna et al. 2010). This has increased the country debt and increase in deficit. The scale of bank losses due to housing bubble in US has made more difficult for the banks to borrow money on money markets. Some of the major banks were running out of money in several nations such as UK, Ireland and Cyprus (www.ons.gov.uk, 2015).

After deficit country started prioritizing of the expenditures to sustain the future economic growth and poverty reduction of UK. One of the good news is that UK has stop taking everything for granted , country has going for safety nest , protecting social spending through loans and harnessing the crisis to achieve major reforms that will help to improve the efficiency and quality (Rowley et al. 2002). On the other hand, company started on core spending techniques by making growth plan by implementing Keynesian approach within the economy with modernizing the versions. Decline in spending ahs growth rates is due to crisis risk settings bank achievement of human development goals. As per the World Bank analysis that found that financing shortfalls to cover risk spending on health, educations, safety and infrastructure with amount of more than £247 in these areas as compare to other areas (Iley and Lewis, 2007). As per the CNN report, BOE (Bank of England) has announced that, growth rates would slowly and steadily overcome the recession. Bank is keeping tab and eagle eye on the performance of domestic market of UK. In the three month ending in June, chances of rise in the GDP by 0.9%.

UK is now looking for the strong fiscal policy and policy to control the inflations and the recession’s rate. Apart from that, government has also asked the apex banks like BOE to reduce the CRR rates from 5% to 0.5% would make the borrowings for the new industries and aspires the promoters to open new business (Jackson, 2000). The recession has harmed spherically those nations who are much dependent upon the stamp duty and tax from the finance sector was US and UK. UK introduces a temporary cut in the VAT after the recession period (Higgins, 2013).

All European nations members states that, their latest deficit and debt are reviewed twice a year. As per the latest financial report of IMF, it has been found that, USA structural deficit was by 3.35pc, France was 3 pc and Germany was 1.1pc in compare to structural deficits which was 5.2 pc.

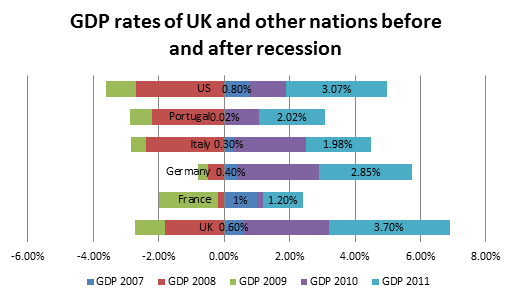

GDP growth rate during and faster the recession of UK and other Eu nations

|

Countries |

GDP 2007 |

GDP 2008 |

GDP 2009 |

GDP 2010 |

GDP 2011 |

|

UK |

0.6% |

-1.8% |

-0.91% |

2.6% |

3.7% |

|

France |

1% |

-0.2% |

-1.8% |

0.2% |

1.2% |

|

Germany |

0.4% |

-0.5% |

-0.3% |

2.5% |

2.85% |

|

Italy |

0.3% |

-2.4% |

-0.45% |

2.2% |

1.98% |

|

Portugal |

0.02% |

-2.2% |

-0.67% |

1.03% |

2.02% |

|

US |

0.8% |

-2.7% |

-0.91% |

1.10% |

3.07% |

Graph 6: GDP rates of UK and other EU nations before and after recessions

(Source: Jenkins, 2013, pp-558)

The outputs lost during the recession will not be able to manage the loss of the nations in coming years. From the above, it ahs been found that, UK recession was longer than other nations like France and Germany excluding PIGS nations form the Europe (Martin, 2007). The latest news is that EU treasury is looking to forecast the growth between 1% and 1.5% in 2010 for UK. However, the latest average the forecast suggest that, GDP may return the pre recession level in the second d quarter of UK , France , Germany and the US in 2012 (Felstead et al. 2012).

However, some of the powerful economic nations like Japan was 8.7% of GDP and Italy was 6.9% , Germany with 6.4% has suffered greater loss in GDP that UK. Both Italy and Portugal has been faced tough situation because of the negative growth.

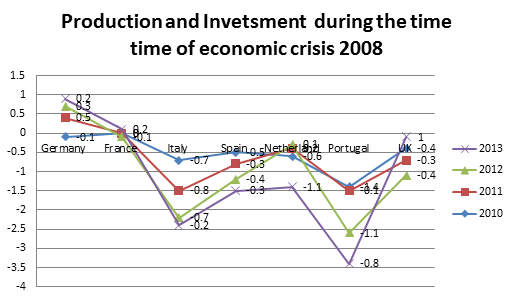

Euro zone nations economic are facing tough to survive in the competitive environment. With the help of spending by the various nations shows that how euro zone are faring in compare to the other nations.

|

Years |

2010 |

2011 |

2012 |

2013 |

|

Germany |

-0.1 |

0.5 |

0.3 |

0.2 |

|

France |

0 |

0 |

-0.1 |

0.2 |

|

Italy |

-0.7 |

-0.8 |

-0.7 |

-0.2 |

|

Spain |

-0.5 |

-0.3 |

-0.4 |

-0.3 |

|

Netherland |

-0.6 |

0.2 |

0.1 |

-1.1 |

|

Portugal |

-1.4 |

-0.1 |

-1.1 |

-0.8 |

|

UK |

-0.4 |

-0.3 |

-0.4 |

1 |

Graph 7: Production and investment of government during the time of economic crisis

(Source: Kersting, 2008, pp-172)

From the above, it has been found that most of the Euro nation are not willing consumer are spending higher than UK in both households and Government projects. Germany GDP grew by 4.2% in 2011 and 3% in 2012. Among the 17 euro nations, Germany is one who escapes worst effects of the crisis that has been treated to untangle the bloc (Mody and Sandri, 2012). However, UK government last month has announced to economic growth of 213 will be 1.6% to 1% blaming the reduction on the Euro zone crisis and weaker economic growth in the Asian and Latin American nations. Apart from that, Netherlands is shrinking by 1.1% in its third quarter of production and investment areas (Tomes, 2003). As compare to other developed nations of EU and Asia pacific, UK is perfuming well but it is not performing as per its potential because of huge amount debt and interest is needed to paid to the IMF and the Nationalized banks.

Conclusion

From the above study, it has been found that, there has been ample evidence which shows that, UK Economy has been stronger in terms of its fiscal policy and economic policy. Apart from that, country was also hit strong by the economic crisis of 2008 because of its economic policy in compare to its rival nations like US and France. However, country is strongly suffering from the debt to GDP ratio which is negative. As the defect is because of the overspending in the defence and the Social protection areas which again cost the educations and the health care. Moreover, UK national accounts also has clear that, there has been deflation within the economy and other various issues which is the reason behind the failure of the country performance in compare to strongest competitive nations.

Reference list

Geroski, P. and Gregg, P. (1997). Coping with recession. Cambridge: Cambridge University Press.

Hartwick, J. (2000). National accounting and capital. Cheltenham, UK: Edward Elgar.

Higgins, K. (2013). Financial whirlpools. Kidlington, Oxford, UK: Academic Press.

Humphries, S. (1996). United Kingdom national accounts. London: Stationery Office Books.

Iley, R. and Lewis, M. (2007). Untangling the US deficit. Cheltenham, UK: Edward Elgar.

Jackson, D. (2000). The new national accounts. Cheltenham, UK: Edward Elgar.

Jenkins, S. (2013). The great recession and the distribution of household income. Oxford: Oxford University Press.

Martin, B. (2007). Resurrecting the UK historic sector national accounts. Cambridge: University of Cambridge, Centre for Business Research.

Parker, S. (2011). Entrepreneurship in recession. Cheltenham, UK: Edward Elgar Pub.

Rowley, C., Shughart, W. and Tollison, R. (2002). The economics of budget deficits. Cheltenham, UK: Edward Elgar.

Simon, S. and Proops, J. (2000). Greening the accounts. Cheltenham, UK: Edward Elgar.

Wanna, J., Jensen, L. and Vries, J. (2010). The reality of budgetary reform in OECD nations. Cheltenham, UK: Edward Elgar.

Felstead, A., Green, F. and Jewson, N. (2012). An analysis of the impact of the 2008-9 recession on the provision of training in the UK. Work, Employment & Society, 26(6), pp.968-986.

Gregg, P. and Wadsworth, J. (2010). The UK labour market and the 2008-9 RECESSION. National Institute Economic Review, 212(1), pp.R61-R72.

Hodson, d. (2011). The EU Economy: The Eurozone in 2010*. JCMS: Journal of Common Market Studies, 49, pp.231-249.

Kaiser, H. (2011). The Eurozone: Challenges and Structural Problems. Global Policy, 2(3), pp.341-344.

Kersting, E. (2008). The 1980s recession in the UK: A business cycle accounting perspective. Review of Economic Dynamics, 11(1), pp.179-191.

Mody, A. and Sandri, D. (2012). The eurozone crisis: how banks and sovereigns came to be joined at the hip. Economic Policy, 27(70), pp.199-230.

Thompson, H. (2005). Beyond Sandler: Risk tolerance and the UK investment deficit. J Financ Serv Mark, 9(4), pp.375-389.

Tomes, A. (2003). UK government science policy: the enterprise deficit fallacy. Technovation, 23(10), pp.785-792.

BBC News, (2014). UK debt and deficit: All you need to know. [online] Available at: https://www.bbc.com/news/business-25944653 [Accessed 10 Jan. 2015].

Monaghan, A. (2014). Government borrowing 10% higher than last year. [online] the Guardian. Available at: https://www.theguardian.com/business/2014/oct/21/government-borrowing-10-percent-higher-budget-deficit [Accessed 7 Jan. 2015].

Pettinger, T. (2012). UK Budget Deficit | Economics Help. [online] Economicshelp.org. Available at: https://www.economicshelp.org/blog/5922/economics/uk-budget-deficit-2/ [Accessed 5 Jan. 2015].

Ukpublicspending.co.uk, (2015). UK National Debt - Current, Recent, Historical Charts Tables. [online] Available at: https://www.ukpublicspending.co.uk/uk_national_debt [Accessed 4 Jan. 2015].

www.ons.gov.uk/, (2015). Impact of the recession on household spending. [online] Available at: https://www.ons.gov.uk/ons/dcp171766_256980.pdf [Accessed 8 Jan. 2015].

www.ons.gov.uk/, (2015). Public Sector Finances, December 2012. [online] Available at: https://www.ons.gov.uk/ons/dcp171778_295776.pdf [Accessed 9 Jan. 2015].

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2016). Report On Current State Of UK Government’s Spending And Revenue Plans. Retrieved from https://myassignmenthelp.com/free-samples/the-report-of-the-uk-governments-spending-and-revenue-plans.

"Report On Current State Of UK Government’s Spending And Revenue Plans." My Assignment Help, 2016, https://myassignmenthelp.com/free-samples/the-report-of-the-uk-governments-spending-and-revenue-plans.

My Assignment Help (2016) Report On Current State Of UK Government’s Spending And Revenue Plans [Online]. Available from: https://myassignmenthelp.com/free-samples/the-report-of-the-uk-governments-spending-and-revenue-plans

[Accessed 13 March 2025].

My Assignment Help. 'Report On Current State Of UK Government’s Spending And Revenue Plans' (My Assignment Help, 2016) <https://myassignmenthelp.com/free-samples/the-report-of-the-uk-governments-spending-and-revenue-plans> accessed 13 March 2025.

My Assignment Help. Report On Current State Of UK Government’s Spending And Revenue Plans [Internet]. My Assignment Help. 2016 [cited 13 March 2025]. Available from: https://myassignmenthelp.com/free-samples/the-report-of-the-uk-governments-spending-and-revenue-plans.