Fundamental of CVP analysis

Question:

Outline the differences between financial reporting and managerial accounting information and explain the benefits and potential problems associated with cost–volume–profit (CVP) analysis. How might the technique that you have discussed assist your friend in the effective management of his business' resources? What advice would you give him?

Cost Volume Profit Analysis is an analysis of change in the total revenue, total cost and operating profit with a change in the level of output, variable cost per unit or fixed cost or the selling price of a product or service. The CVP analysis helps in decision making and formulating strategies for effective business operations and also helps in pricing decisions.

Contribution Margin

Fundamental to CVP analysis is the profit equation which states that profit is equal to total revenue minus total costs.

Profit = SP (x) – VC (x) – TFC

SP = selling price per unit

VC = variable cost per unit

X = number of units sold

TFC = total fixed cost

Profit = (SP – VC) (x) – TFC

Profit = Contribution margin per unit(x) – TFC

Contribution margin per unit signifies the contribution of each unit sold to cover the fixed costs and increase profits. The concept of contribution margin can be used to determine the units of output needed to be produced or sold to achieve a targeted level of operating income.

In the case of the client, the client is not able to earn desired amount of profits, however, if he applies CVP analysis and pre determines the required amount of profit after taxes, he can attain the output needed to be produced to achieve the targeted profit levels with the help of contribution margin.

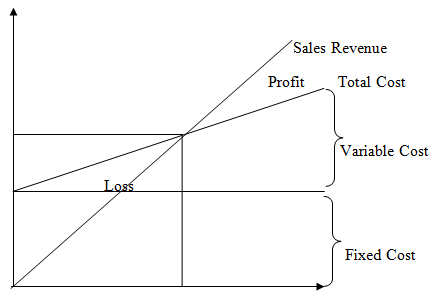

Breakeven point is the point at which the company earns no profit or loss. It is the number of units sold at which the company break evens. This can be calculated with the help of contribution margin per unit. The graph for breakeven point can be shown as below:

Break Even Units sold

Breakeven point is important because it is not advisable to operate below the point where the company is not making any profits as there would be losses, hence breakeven point helps in deciding when not to produce the product or service.

Sensitivity analysis is used to deal with uncertainty in the business. The technique examines how the operating income will change with a change in any of the factors of the profit equation like a change in variable or fixed cost, change in selling price or units sold. Such analysis helps managers in taking calculative risks and broadens their perspective.

One aspect of sensitivity analysis is Margin of Safety. MOS is the amount of revenue in excess of breakeven revenues. Sensitivity analysis helps the managers in deciding the level to which the revenues with a higher MOS might fall before reaching the breakeven point.

Another aspect of sensitivity analysis is the cost structure of the company. A company may consider different cost structures based upon its risk appetite. The risk return of different cost structures can be measured as operating leverage. The operating leverage is said to be high when fixed costs are higher than variable costs and vice versa. A change in fixed costs leads to a change in operating income and contribution margin and operating leverage measures just that. For a company having high operating leverage, a small change in quantity leads to large change in operating income.

Profit equation and contribution margin per unit

For a company having multiple products like in our case also CVP analysis can be used. For similar products, the weighted average contribution margin per unit can be used.

However, if the products are strikingly different like in case of a retail store, the contribution margin ratio should be used in CVP analysis. This is because the total sales becomes more important than the per unit sales. Hence the break even sales or the sales to achieve targeted operating income can be obtained with the help of contribution margin ratio.

CVP analysis is a very useful tool for managers in decision making. The company can decide on its targeted profit and work on its inputs accordingly. Due to the breakeven point analysis, a manager can increase its spending and increase production in order to increase profits. Also what if analysis helps in decision making process as the decision can be broken down into various probabilities.

The CVP analysis provides a detailed snapshot of the activities of a business including the costs and production details.

One of the basic limitations is the assumption made by CVP analysis that all costs can be categorised into fixed and variable costs, however, companies producing multiple products may have complex costs which cannot be categorized properly. Also it assumes that fixed costs do not change however with large changes in activities even the fixed costs can change.

Financial reporting provides information on financial statements which is useful for various stakeholders and includes business information provided in balance sheet, income statement and cash flow statement. It is mandatory to prepare financial accounts.

Managerial accounting provides information on company’s cost structures which are useful for the managers of the company for effective conduct of business and in making policies and strategies for the company. It is not mandatory. Some of the tool of management accounting include Activity based costing, capital budgeting, CVP analysis, and many more.

Based on the above discussion of CVP analysis, it is recommended that a company should adopt the CVP analysis as it helps in avoiding wastage of resources by proper planning. The breakeven point helps in deciding the level till which the product should be produced and the sensitivity analysis helps the manager in deciding the various alterations that can be made to the variable and fixed costs and selling price and units to achieve a desired level of profits. Also the profits available to the company after payment of taxes can be determined by the contribution margin approach; hence the company will have a clearer picture of the company activities and will be able to decide upon the alternative course of action to be taken to achieve desired results.

References

Kaplan, R.S. & Cooper, R. (1997) Cost and effect: using integrated cost systems to drive profitability and performance. Boston: Harvard Business School Press.

Code Connect, (2006), Cost – Volume – Profit Analysis, Journal of Corporate Accounting and Finance, pp.

Kim, S.H., (2014), Cost – Volume – Profit for a Multi – Product Company: Micro Approach, International Journal of Accounting and Financial Reporting, Vol. 5(1)

Chung, K.H., (2006), Cost-Volume-Profit Analysis under Uncertainty When the Firm Has Production Flexibility, Journal of Business Finance and Accounting, Vol. 20(4), Wiley Online Library.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2017). Understanding The Basics & Applications Of Cost Volume Profit Analysis In An Essay.. Retrieved from https://myassignmenthelp.com/free-samples/applying-cvp-analysis-in-a-company.

"Understanding The Basics & Applications Of Cost Volume Profit Analysis In An Essay.." My Assignment Help, 2017, https://myassignmenthelp.com/free-samples/applying-cvp-analysis-in-a-company.

My Assignment Help (2017) Understanding The Basics & Applications Of Cost Volume Profit Analysis In An Essay. [Online]. Available from: https://myassignmenthelp.com/free-samples/applying-cvp-analysis-in-a-company

[Accessed 30 May 2025].

My Assignment Help. 'Understanding The Basics & Applications Of Cost Volume Profit Analysis In An Essay.' (My Assignment Help, 2017) <https://myassignmenthelp.com/free-samples/applying-cvp-analysis-in-a-company> accessed 30 May 2025.

My Assignment Help. Understanding The Basics & Applications Of Cost Volume Profit Analysis In An Essay. [Internet]. My Assignment Help. 2017 [cited 30 May 2025]. Available from: https://myassignmenthelp.com/free-samples/applying-cvp-analysis-in-a-company.