Jeff Immelt's Strategy

Describe about the Case Analysis for Jeff Immelt and the Reinventing of General Electric

GE was founded in 1892 under the leadership of Charles Coffin, from the merger of two great innovative companies which were Thomas Edison’s Electric Company and Thomas Houston Company. Under his leadership span of 30 years, GE was able to transform itself from a research and development of electrical products to a much marketable product based company. After Charles, the patron was handled by many great leaders such as Ralph Cordiner, Fred Borch, Reg Jones and Jack Welch. Jack Welch is considered to be one of the great management gurus who transformed GE’s portfolio from manufacturing business to financial services in particular. However, Jeff Immelt who was appointed CEO in 2001 has a different perspective towards the growth of business which involved retransforming of GE’s business portfolio mainly focusing on two core sectors, infrastructure and financial services.

Under the leadership of Immelt, the company has gone through various obstacles in their business which has been exaggerated by the 9/11 incident which has plummeted the revenue of GM to a greater extent. Therefore Immelt has identified main four areas where they decided to explore new opportunities which have become essential for the continuous growth of the business, which are as below:

- Demography: GE has visualized the increasing trend of the older population resulting in the increase of demand of the healthcare services. They have also forecasted the population growth in developing countries which creates the opportunities for the entertainment businesses.

- Infrastructure: GE predicted a huge increase in demand in the infrastructure sector hence decided in positioning itself much more in the infrastructure sectors and related financial services including the opportunities in energy, aviation, rail transport and many other areas related to infrastructure.

- Emerging Markets: Immelt has gauged the growing development in the Asian countries and Middle East countries which can prove to be great hub for setting their base to increase the profitability growth.

- Environment: The problems associated with the global warming, climate change, water scarcity and conservation created opportunities for GE to trap these opportunities and convert them into profitable business.

But in capturing these opportunities, GE has decided to change their management model which was prevalent from the time of Jack Welch. During the period of Jack Welch’ leadership, the major industrial sectors were divided into smaller sub units which has created a more responsive company and have clear defined roles and responsibilities whereas Immelt has opted for the cross business integration approach where the industrial sectors were divided into smaller number of broad based sectors and they have to work cross functionally to achieve their goals and targets. He has reduced the number of business units which were direct reporting to him from twelve to five but looking at the company’s un-stability, in 2010 he further increased it to seven.

The key challenge was to maintain the profitability and cost control with increase in investments in innovation involving smaller or bigger risks. GE’s performance metrics as devised by Immelt also lead to discouragement in business unit heads in taking up new opportunities. The managers in GE were not satisfied with the new working culture of working cross-functional, cross-market and cross-company which created complex coordination problems. GE’s performance based metrics and the culture of internal competition are proving much more difficulties in working cross-functional and cross-divisional.

Market Dynamics and Opportunities for GE

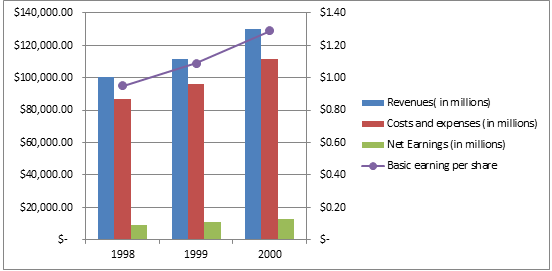

1. From the period of Charles Coffin when GE was formed from the merger of Thomas Edison’s Electric Light Company and THC, it’s main competencies has been the innovation based product oriented organization. Chairman Ralph Cordiner along with Peter Drucker had formalized a new approach to corporate management. Under the leadership of Fred Borch, the company’s management system was based on SBU and portfolio analysis which also became the benchmark for the management model of many companies. During the period of 1973 to 1981, Reg Jones collaborated the strategic planning to its financial management systems. The period of 1981 to 2001 were the golden days in the history of GE, Jack Welch became CEO of the company and during that period, company’s revenue grew fourfold and net income grew seven times from under $2 billion to $14 billion. But after 2001, GE went through a turbulence of problems created through the changes in the global market and socio-economic condition of the US and during this period Immelt has taken the leadership to maintain the stability of the company and also to diversify the company’s progress in many different un-trapped opportunities.

During the period of 1981-2001, GE was under the transformational leadership of Jack Welch where the company was undergoing through a transformation from a product based company more towards concentrating on the financial services. The performance was measured by the achievement of the targets which were continuously monitored and powerful incentives were also rewarded to the one who accomplish in achieving the high standard of targets. He was very much against the bureaucracy and removed the hierarchy layers (Styler 2003). His management style was direct and personal where the managers were assigned high targets and his team was always under huge pressure to achieve those targets. He introduced Six Sigma to improve quality and reliability and also started the initiative to adopt the internet technologies in their working environment. Jack Welch used three circle concepts where he has divided the services, technology and core competencies of GE which helped to devise the strategies clearly and realistically.

Three Circle Concepts

Jeff Immelt was appointed CEO of GE in 2001 after Jack Welch. Jeff had stablished the company during the turbulent times of 2001-2012. The central theme of Immelt’s strategy is based on the organic growth. He has identified four key areas where he developed strategies to trap the opportunities as forecasted by him in the days ahead. The four external trends which proved to be the growth opportunities for GE are:

Recommendations for GE

Jeff Immelt decided to exit slow and dormant businesses and to reallocate its resources to business where there is strong growth prospect and to enter new industries. Therefore Jeff has bought many companies to increase its innovative capabilities and also sold few of its units which were not making much profit and becoming the dead assets. GE identified few existing sectors where certain reshaping and transformation is required to increase the growth and to meet the future demands, which are mainly four technological units i.e. healthcare, energy, broadcasting and entertainment and technology infrastructure.

2: The market condition has become very dynamic these days and the continuous development of a company depends on the dynamics of markets as well as on the socio-economic condition of a country. Since nowadays, the Asian market comprising mainly China and India and Latin American countries such as Brazil are developing at a much faster rate and are transforming into the hub of many big players of market. There is abundance of growth opportunities in these nations and resources are also available at much higher quantity and at lower cost. However the customer demands are changing at such an tremendous rate that continuous innovation in the existing products as well as development of new products have become the necessary part of the market strategies. Considering GE as a company which has a strong base in the innovation and high technology in developing healthcare products, entertainments services, construction equipment and services, infrastructure services and in financial services needs to be very proactive in gauging the opportunities as well as the threats which are present in the current market scenario.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2017). Case Analysis For Jeff Immelt And The Reinventing Of General Electric: Essay.. Retrieved from https://myassignmenthelp.com/free-samples/case-analysis-jeff-immelt-and-the-reinventing-of-general-electric.

"Case Analysis For Jeff Immelt And The Reinventing Of General Electric: Essay.." My Assignment Help, 2017, https://myassignmenthelp.com/free-samples/case-analysis-jeff-immelt-and-the-reinventing-of-general-electric.

My Assignment Help (2017) Case Analysis For Jeff Immelt And The Reinventing Of General Electric: Essay. [Online]. Available from: https://myassignmenthelp.com/free-samples/case-analysis-jeff-immelt-and-the-reinventing-of-general-electric

[Accessed 16 May 2025].

My Assignment Help. 'Case Analysis For Jeff Immelt And The Reinventing Of General Electric: Essay.' (My Assignment Help, 2017) <https://myassignmenthelp.com/free-samples/case-analysis-jeff-immelt-and-the-reinventing-of-general-electric> accessed 16 May 2025.

My Assignment Help. Case Analysis For Jeff Immelt And The Reinventing Of General Electric: Essay. [Internet]. My Assignment Help. 2017 [cited 16 May 2025]. Available from: https://myassignmenthelp.com/free-samples/case-analysis-jeff-immelt-and-the-reinventing-of-general-electric.