Operating Activities

Question:

Describe about the cash flow statement, cash flow ratios and building wealth of the shareholders of Woolworths Ltd company?

Each and every investor invests his hard earned money in the company in the hope that his investment will multiply and will result in a regular inflow of the income in the years to come.

Every investor has to think about the growth in his investment when it comes to investing in a company. This report aims at discussing the cash flows of the company and the other topics such as the strategy involved by the company, the ways in which the wealth of the shareholders could be increased.

Woolsworth is the Australian company that was founded in the year 1924 in Sydney. When the first store was opened up, the CEO of the company stated the following:

Every man, woman and child needs a handy place where good things are cheap.

This principle is important today as well. The company strives to meet the expectations of its customers and therefore, offer best possible convenience, value, range and quality to the 28 million customers. The company has more than 3000 stores across the country and New Zealand and deals in span food, liquor, petrol, general merchandise, home improvement and hotels.

(Woolworthslimited.com.au, 2015)

The IAS 7, statement of cash flows is the statement that is prepared by the companies as the part of the primary financial statements. The cash flows are divided into operating activities, investing activities and the financing activities.

The operating activities are the activities from which the revenue is earned from the normal course of the business such as from the customers and the suppliers

The investing activities are the activities of acquisition and disposal of the long term assets and other such investments are considered to be the equal to cash.

The financing activities are the activities that alters the equity capital and the structure of borrowing of the company.

(IAS, 2015)

The following table shows the changes in the cash flows during the year:

|

Particulars |

|

2014 |

2013 |

% Change |

Normal or abnormal |

|

Receipts from customers |

65851.8 |

63789.8 |

3.23% |

||

|

Receipts from tenants |

39.9 |

47 |

-15.11% |

Abnormal |

|

|

Payments to suppliers and employees |

-60918 |

-59685 |

2.07% |

||

|

Interest and costs of finance paid |

-348 |

-476.7 |

-27.00% |

Abnormal |

|

|

Interest received |

9.8 |

22.2 |

-55.86% |

Abnormal |

|

|

Income tax paid |

-1162.5 |

-977.3 |

18.95% |

Abnormal |

|

|

Net cash provided by operating activities |

|

3472.7 |

2719.9 |

||

|

Proceeds from the sale of property, plant and equipment |

|

181.7 |

100.3 |

81.16% |

|

|

Proceeds from the sale of property to the Shopping Centres Australasia Property Group |

12.2 |

802.8 |

-98.48% |

Abnormal |

|

|

Payments for property, plant and equipment – property development |

-519 |

-767.4 |

-32.37% |

Abnormal |

|

|

(Advances)/repayments of property related receivables |

-15.9 |

14.8 |

-207.43% |

Abnormal |

|

|

Payments for property, plant and equipment (excluding property development) |

-1321.5 |

-1136 |

16.33% |

||

|

Payments for intangible assets |

-42.3 |

-66.7 |

-36.58% |

Abnormal |

|

|

Proceeds from the sale of subsidiaries |

37 |

105.8 |

-65.03% |

Abnormal |

|

|

Payments for the purchase of businesses |

-371.5 |

-235.4 |

57.82% |

||

|

Payments for the purchase of investments |

0 |

-28 |

-100.00% |

Abnormal |

|

|

Dividends received |

7.9 |

8.1 |

-2.47% |

||

|

Net cash used in investing activities |

|

-2031.4 |

-1201.7 |

||

|

Proceeds from the issue of equity securities |

36.1 |

188.1 |

-80.81% |

Abnormal |

|

|

Proceeds from the issue of equity securities in subsidiary to non-controlling interest |

183 |

230 |

-20.43% |

Abnormal |

|

|

Proceeds from external borrowings |

7859.8 |

5974.4 |

31.56% |

||

|

Repayment of external borrowings |

-7927.1 |

-6501.8 |

21.92% |

Abnormal |

|

|

Dividends paid |

-1491.1 |

-1396.7 |

6.76% |

||

|

Dividends paid to non-controlling interests |

-32 |

-20.1 |

59.20% |

||

|

Movements in employee share plan loans |

-0.6 |

5.6 |

-110.71% |

Abnormal |

|

|

Net cash used in financing activities |

|

-1371.9 |

-1520.5 |

||

|

Net increase/(decrease) in cash and cash equivalents held |

69.4 |

-2.2 |

-3254.55% |

Abnormal |

|

|

Effects of exchange rate changes on foreign currency held |

4 |

6.2 |

-35.48% |

Abnormal |

|

|

Cash and cash equivalents at the beginning of the period |

849.2 |

845.2 |

0.47% |

Abnormal |

|

|

Cash and cash equivalents at the end of the period |

922.6 |

849.2 |

8.64% |

(Woolsworths Limited, 2015)

The company has a tranche of $580 million that revolves around the Syndicate bank that has given the facility of the loan and which has matured in October, 2014. The facility during the year 2013 was undrawn. A further amount of US $100 million, which is fully hedged at AU$127 million tranche of the US $500 million US private placement is scheduled to be matured in April of the year 2015. This excess amount will be repaid using the cash flow that is surplus or the undrawn committed bank loan facilities. The free cash flows that were generated by the business, before the movement in the borrowings stood at $136.7 million after the dividend were paid off. The company acquired Ezibuy and the other capital expenditures indicated that the company had the ability of generating the strong cash flows when it was investing in the future growth as well. The company had the cash flows from the operating activities before the interest and tax and increased the same by 19.8% and were impacted by the timings of the creditor’s payments that were relative to the dates of the reporting. This excluded the cash flows from the operating activities before the interest and taxes and increased this by 4.3% on the normalised 52 week basis. The net interest that the company paid were $338.2 million for the entire year.

Investing Activities

The company sold many of its properties and this led to the reduction in the long term debt. The amounts of the taxes increased to $1162.5 million during the year and this was due to the change in the legislation of Australia that was effective from January 2014. This required the income tax instalments to be paid either monthly, quarterly. The cash was used in the activities of investments that ranged to $2031.4 million. The expenditure on property, planta and equipment were $1321.5 million which was higher than that of the prior year.

The proceeds from the shares were $35.5 million which were lower than that of the previous year.

(Woolsworths Limited, 2015)

The price to cash flow ratio is the ratio that is used by the investors to evaluate the investment form the point of view of the shares of the company. This is the ratio that takes into account the cash flows and not the noncash items like depreciation. The formula for the same is by dividing the net cash flows from the operating activities by the common shares that are outstanding.

(Financial ratios, 2015)

This is the ratio that compares the operating cash flows of the company with its sales revenue. The more, the better it is for the company, it is the ability of the company to generate the cash from its sales it further shows the ability of the company to turn sales into cash and is always shown in %.

(Financial ratios, 2015)

|

Ratios |

2014 |

2013 |

|

|

Free cash flow |

CFOA-capital expenditure |

||

|

1,433.40 |

1,538.10 |

||

|

Cash flow coverage ratio |

0.253856051 |

0.2176843 |

|

|

Operating cash flows |

3,472.70 |

2,719.90 |

|

|

Total debt |

13,679.80 |

12,494.70 |

|

|

Operating cash flows to sales ratio |

0.056974154 |

0.0463561 |

|

|

Operating cash flows |

3,472.70 |

2,719.90 |

|

|

Sales |

60,952.20 |

58,674.10 |

|

|

Price to cash flow ratio |

2.76 |

2.21 |

|

|

Operating cash flow-preferred dividend |

3,472.70 |

2,719.90 |

|

|

Common shares outstanding |

1,259.80 |

1,231.90 |

|

The ratios expressed above are quite healthy and have only shown an upward growth.

The free cash flow is positive which shows that the company has enough cash to meet the capital expenditures. The capital expenditure is required in order to keep the present level of the activity.

(Accounting coach, 2015)

The following is the focus areas of the company and is very well placed in terms of growth.

The company had a very great access to the country of Africa and it soon became an opportunity for the retailers and there were a number of retailers that supported the development if the retail presence in these countries.

The company also undertook the research that would increase the customer understanding of the ethical, environmental and the issues of the community.

The company continues to strive and concentrate on the global economy and continues to invent new ways with which the operational efficiencies could be achieved and the cost of the businesses could be lowered.

(Woolworthsholdings.co.za 2015)

The fact that the supermarket of Australia, Woolsworth had lifted the annual earnings from its New Zealand Countdown stores to 4.2% of its widened margins. The pre-tax earnings of the company rose to about $309.8 million during the period of 52 weeks from $302.7 million.

These figures show a very good sign and a good opportunity for the growth in the earnings and the profits aspects.

(The National Business Review 2015)

The company can increase the amounts of its borrowings and put that money in productive use and could also invest the money wisely. The company could either build the money for itself or could maximise the wealth of its shareholders. The maximisation of wealth is done by maximising the value of the shares that the shareholders hold.

The following are few of the ways through which the wealth of the shareholders could be built.

- Building the credit: the company could plan the borrowings and build a reputation on the market and could grant an access to the larger sums of the money that is desirable loans when it comes to the terms of the wider range of the lenders. The greater access to the capital could help the company in strong expansion and also, allow the company to real wealth.

- Investing: the companies must invest in the real estate since that is the option that will help in the growth of the company. The company could alternatively invest in the mutual funds, insurance products. The companies owe the shareholders the responsibility of acting in their best interests and must invest only in the less risky options.

- Retained earnings: the company must always keep aside their retained earnings and use the borrowed funds for investing.

(Small Business - Chron.com 2015)

The following are the other way through which the wealth of the shareholders could be maximised:

- No management of the earnings and no provide of the guidance on earnings management

- Undertake the strategic decision of maximising the expected values even if it means to lower the near term earnings

- Making the acquisitions that could maximise the expected values even when the same meant to lower the near time earnings

- Owing the assets that would lead to the maximisation of the values

- The shareholders must be rewarded with the cash when there is no alternative course in which the money of the company could be invested

- The employees of the company must be rewarded for their long term hard work towards the company

- Provide the investors with the information that could add value to their decision.

(Harvard Business Review 2006)

Conclusion:

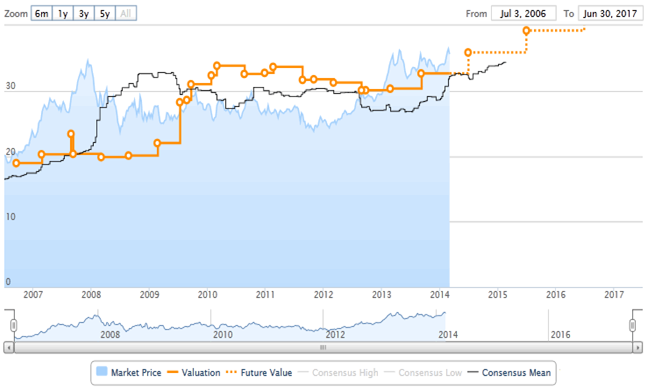

The company’s health is quite good and it is best that an investment be made in the company. Even when the company is still undergoing its consistent and is accompanied with a good operating performance, the share price of the company is still fluctuation with 20 % and the share price ranges from over the last 12 months. The main distraction for the company are the losses from the masters roll out.

The company has a very strong growth in the years to come and is expected to continue with the varying returns that may extend to about 10% and is based upon the current profit estimates.

The financial results of the company show that the company is quite stable and have also reported that there is an increase in the revenue by about 6% and were matched by the growth in the earnings of 6%. The dividend growth in the share was 5% which was the sole result of the shares on issue. The operating performance of the company can be predicted with certainty and it would be fair to suggest that the company has a very bright future.

The following is the fluctuating share price of the company.

(Clime Asset Management 2014)

References:

AccountingCoach.com, 2015. 'Financial Ratios - Statement of Cash Flows | Accounting coach'. https://www.accountingcoach.com/financial-ratios/explanation/4.

Clime Asset Management, 2014. 'Why You Should Keep Woolworths In Stock - Clime Asset Management'. https://www.clime.com.au/latest-news/keep-woolworths-stock/.

Digital, Buynary. 2015. 'WOOLWORTHS HOLDINGS LIMITED'. Woolworthsholdings.Co.Za. https://www.woolworthsholdings.co.za/default.asp.

Harvard Business Review, 2006. 'Ten Ways to Create Shareholder Value'. https://hbr.org/2006/09/ten-ways-to-create-shareholder-value.

Iasplus.com, 2015. 'IAS 7 — Statement of Cash Flows'. https://www.iasplus.com/en/standards/ias/ias7.

Moneyweb.co.za, 2015. 'The Investment Case –Woolworths Holdings Ltd - 101: For Beginners | Money web'. https://www.moneyweb.co.za/moneyweb-101-for-beginners/the-investment-case--woolworths-holdings-ltd.

Readyratios.com, 2015. 'Operating Cash Flow / Sales Ratio'. https://www.readyratios.com/reference/cashflow/operating_cash_flow_sales_ratio.html.

Readyratios.com, 2015. 'Price/Cash Flow Ratio'. https://www.readyratios.com/reference/cashflow/price_cash_flow_ratio.html.

Small Business - Chron.com, 2015. 'Strategies & Methods Corporations Use To Maximize Wealth'. https://smallbusiness.chron.com/strategies-methods-corporations-use-maximize-wealth-3958.html.

The National Business Review, 2015. 'Woolworths' NZ Supermarkets Lift Annual Earnings 4.2% in 'Subdued' Conditions'. https://www.nbr.co.nz/article/woolworths-nz-supermarkets-lift-annual-earnings-42-subdued-conditions-bd-161642.

Woolworthslimited.com.au, (2015). Annual Report 2013 | Woolworths Limited 2013 Annual Report. [Online] Available at: https://www.woolworthslimited.com.au/annualreport/2013/ [Accessed 24 Jan. 2015].

Woolworthslimited.com.au, (2015). Who We Are - Woolworths Limited. [Online] Available at: https://www.woolworthslimited.com.au/page/Who_We_Are/ [Accessed 24 Jan. 2015].

www.woolworthslimited.com.au, (2015). Annual report 2014. [Online] Available at: https://www.woolworthslimited.com.au/annualreport/2014/files/Woolworths_Annual_Report_2014.pdf [Accessed 24 Jan. 2015].

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2016). Cash Flow Statement Analysis Of Woolsworth Limited Essay.. Retrieved from https://myassignmenthelp.com/free-samples/cash-flow-analysis-woolworths-ltd.

"Cash Flow Statement Analysis Of Woolsworth Limited Essay.." My Assignment Help, 2016, https://myassignmenthelp.com/free-samples/cash-flow-analysis-woolworths-ltd.

My Assignment Help (2016) Cash Flow Statement Analysis Of Woolsworth Limited Essay. [Online]. Available from: https://myassignmenthelp.com/free-samples/cash-flow-analysis-woolworths-ltd

[Accessed 10 June 2025].

My Assignment Help. 'Cash Flow Statement Analysis Of Woolsworth Limited Essay.' (My Assignment Help, 2016) <https://myassignmenthelp.com/free-samples/cash-flow-analysis-woolworths-ltd> accessed 10 June 2025.

My Assignment Help. Cash Flow Statement Analysis Of Woolsworth Limited Essay. [Internet]. My Assignment Help. 2016 [cited 10 June 2025]. Available from: https://myassignmenthelp.com/free-samples/cash-flow-analysis-woolworths-ltd.