Analysis of the Refinancing Process

The bank of Vintage Building Society has been receiving growing number of refinancing applications due to economic downturn. In order to handle the situation efficiently, the bank had introduced a new system for conducting the refinancing activities. However, dissatisfaction of the customers has assisted in identifying some major flaws of the existing refinancing system. This report focuses on scrutinizing the existing system of refinancing. Moreover, the major flaws o the existing system has been identified with the aid of customer complaints. Therefore, this report has produced a new design for the service blueprint in order to carry out the refinancing activities efficiently.

Executive Summary. 2

Introduction. 4

Analysis of the Refinancing Process. 4

Problems of the Refinancing Process in Vintage Building Society. 8

Design of new Service Blueprint for Improving the Overall Process. 10

Conclusion. 16

References. 18

The Vintage Building Society was established early 1950s in the winegrowing district of the Hunter Valley in New South Wales. The Society is possessed only by its members and involved in business with the members. During the account opening procedure, prospective clients are obliged to take the membership of the society. The financial institution of the society has been experiencing slow as well as steady growth. The growing mining sector and wine industry has assisted the society in flourishing. But the economic downturn in the recent years has accelerated the rate of refinancing of home loans in this particular region. As the prospective as well as existing customers are in search of economical loans, number of applications for refinancing is increasing. The new procedure of loan approval is consisted of five stages. As the customers have complained regarding various service issues, the present refinancing process needs to be reviewed. Moreover, the report also contains suggestions for improving the present service.

In this section, the present refinancing process of the Vintage Building Society will be analyzed in order to find the significance of this process. It has been observed that, due to economic downturn customers are looking for economical loans. Consequently, Vintage Building Society is receiving huge number of applications for refinancing. A new procedure is essentially needed for handling the increasing volume of refinancing application. Hence, the retail bank of Vintage Building Society has developed a five-stage process. The service blueprint of the method must be analyzed to identify its flaws. A service blueprint is responsible for recognizing a suitable service procedure and it must consider the perspective of the customers. The new service design has identified five distinct stages and in order to execute each activity experienced and skilled personnel are appointed. The five stages of the refinancing process will be discussed in this section.

For starting the procedure, the clients have to complete loan application with the help of a loan officer. In this stage, the loan officer explains the choices accessible to the client. Thus the customer will get exposed to the various type of loan options available and choose the best one for him. The loan officer also checks whether the client fits the bill for loan approbation with the aid of customer-reported data. If it is found that the loan can be approved, the customer needs to sign the application form and all the official documents for authorizing the credit check and access to other relevant information for approving loan. The client is additionally asked to provide all the necessary documents for continuing the process of loan application. Therefore, the customer must be assured that the loan application will be processed soon and ask them to wait for the approval notification. Hence, this procedure will assist the customers obtaining information regarding various loan options. Moreover, it will also aid in collection of relevant documents if the client is apparently found to be eligible for the loan application (Greasley, 2008).

Problems of the Refinancing Process in Vintage Building Society

When the process of loan application is completed, the customer file is sent to the department of loan processing. In this stage all the verification activities take place. The loan processing officer gets involved in the credit check process and verifies other loans or mortgages issued in other financial institutions. Moreover, valuation off property and employment verification of the loan applicant is done in this phase. During the verification, if the loan processing officer faces any issue or complication, he must ask for advice from the loan officer. In the verification report if any anomaly is identified or if it does not match with the information provided in the application, the loan applicant is asked for clarifying and explaining the discrepancies. If the loan processing department finds the explanation acceptable, it is included in the file and therefore the file is moved to the loan officer (Heizer and Render, 2009). In case the loan amount is exceeding $750,000, the file is sent to the Society’s board for obtaining final approval of the loan. Hence, it can be implied that this phase is emphasizing on the evaluation of the credit worthiness of the applicant. The verification I prepared in this phase so that in the next step, based on this report the loan officer or the Society’s board can make decisions regarding loan approval. This step is essential as the verification report is the determinant factor for the decision making or loan approval. Expert and qualified officials are given this role so that the organization does not encounter any loss as a result of taking wrong decision. This step is one of the most significant steps of the loan process.

On the basis of the credit report, the loan closing officer sends an offer letter to the customers along with the all necessary mortgage documents. In this document, the terms, conditions and cost of the loan is described in detail. If the customer agrees upon all the conditions and terms, he needs to sign on the relevant documents and send those back to the loan closing officer. Once the signed copy is received by the officer for finalizing the loan, he calculates the amount of the final loan as well as payout amount for the previous loan. Therefore, the arrangement of settlements is done between the solicitor of the customer and the bank or financial institution which is holding the previous loan. This phase is extremely important as terms and conditions are clearly described and the loan closing officer asks the customers to agree upon it. Hence, the loan finally closes in this phase. Moreover, the payout is calculated for the previous loan and settlement is completed. This stage has been designed for completing the loan closing process smoothly and aims to make an agreement based on the defined terms and conditions (Russell and Taylor, 2009).

This is a very short phase where the loan servicing specialist establishes a new account. The activity of the loan servicing specialist is dependent upon the advice from the loan closing officer. Additionally, in this stage the settlement cheques are arranged and the customer is ensured that the loan is properly set up.

Design of new Service Blueprint for Improving the Overall Process

In this stage, the loan-payment specialist is responsible for issuing payment books. Additionally, he sets up an automatic system for withdrawing mortgage fee and calculates the monthly payment amounts. The loan payment specialist is responsible for monitoring the late payment of mortgages. This step emphasizes on ensuring that the regular loan repayment is done by the customers.

Every step of this service design has specific objectives. The roles and responsibilities are delegated among the expert employees so that the huge number of refinancing application can be evaluated, processed and closed promptly. The entire procedure is aiming to assist the customers in refinancing process so that it becomes convenient to them. Moreover, this process also monitors the repayment of the loan and late payments.

Due to increasing number of refinancing application, the retail bank of the Vintage Building Society is encountering lot of issues. From the customers’ complains it can be inferred that the refinancing process in the Vintage Building Society is not efficient. According to the complaints of the customers the major drawbacks of the new system has been identified in this section.

The complicated procedure of the loan application is creating a lot of problem for the customers. According to the customers’ opinion, lengthy forms need to be filled by them in the refinancing application. Customers suggest that the loan officer can choose verbal communication methods which will save time. It takes a lot of time to fill up the form and reverting to the mails sent by the loan officer. Instead of making the procedure complicated, the customers want to have a simplified method. The forms require a lot of information which needs to be filled by the loan applicant. This has become a serious problem for the refinancing process of the bank of Vintage Building Society.

A customer had complained that process of refinancing took two months to get completed which is too long. The customer had pointed out that if he had chosen any other bank it would have saved his time as well as money. For the lengthy method of loan processing he has to bear the extra cost for these two months’ mortgage payment. In the previous section it has already been discussed that in the second step i.e. loan processing, the information provided in the loan application is verified. A lot of verification is undertaken in this phase which is necessary for checking the credit worthiness of loan applicant. But, the process is time consuming while the other banks are completing this process within shorter time period. Consequently, the customer has to pay higher mortgage payment due to the long time period for processing the refinancing application. Moreover, one customer has complained that the loan approval process took so much time that his credit report, termite inspection report and valuation report got expired. The customer has complained about the so much time-consuming approval process. Additionally, he blamed the bank for expiration of the reports an asked the bank to pay for new reports. A customer complained about that no addition was made to his house property which was valued last year. However, the bank had undertaken valuation of property although it has access to the tax assessment of the client. The time consuming loan approval procedure is affecting the customers in terms of time and money (Omara, 2007). On the other hand, bank is failing to gain customer satisfaction and reputation is affected. It is a major problem for the refinancing process of the retail bank of Vintage Building Society.

Conclusion

It has been observed that that single work has been duplicated. The inefficient distribution of job responsibilities has leaded the employees to get involved in a same task. One of the customers has complained about the fact that he was asked about same information from several people. Lack of proper delegation of job responsibilities has leaded to repetition of the same work. It wasted time and disturbed the customers. Another customer complained that he had received a letter from the loan payment specialist. A lot of forms were attached to the letter. The customer complained that it had asked to know about the mortgage payments. According to the customer the same things were filled during the loan closing process and he had agreed upon all the terms. The ignorance and inefficiency of the employees have leaded to these situations. Both the customers and the bank have wasted their time and money for these activities. Lack of proper planning and designing of the work is reflected in this process (Russell and Taylor, 2009). This is a serious problem of the Vintage Building Society Bank.

It has been found that the customer is complaining about the calls from bank regarding overdue mortgage payment. An automatic system has been established for withdrawing the mortgage payment form the account of the customer. Hence, there is no point of calling the customers regarding the due payment. It can be inferred that the loan payment setup is not efficient. Moreover, the employees are not also serious as they do not make sure whether the payment has been received or not. It is not desired to disturb the customers unnecessarily. The objective of the new service design is to cater the customers in such a so that they can find a convenient way for refinancing. In this case, the customer satisfaction cannot be achieved as they are made bothered about the due mortgage payment where it has been already received at the automatic payment system (Narteh and Kuada, 2014).

In the previous section the e major flaws of the service blueprint adopted by the bank of Vintage Building Society have been identified. On the basis of the customer complains principle problems associated with the refinancing process have been discussed. This chapter will focus on improving the refinancing service of the bank of Vintage Building Society.

Modified service blueprint of the bank of Vintage Building Society is discussed below:

Customer complaints have helped to recognize that the loan application process is a complicated method. In order to enhance the efficiency of the loan application process and making it simple for the customers following points must be considered.

- Loan officers must be trained in giving advice regarding the availability of various refinancing options to its customers.

- Each loan officer must be responsible for dealing with certain number of customers. No other loan officer will be allowed to cater the same customer.

- A precise and relevant form must be sent to the applicant asking for the required documents for further proceedings.

- The customer must sign and fill all the necessary fields and submit all the documents for credit check.

- As soon as the loan officer receives the all the documents and consent from the customer, it must be immediately sent to the loan processing department.

- Introduction of e-application will helps in simplifying the procedure (Al-Sakran, 2012).

Thus the loan application procedure will be less complicated and less time-consuming. In this process, the customers need not to get disturbed several times asking for the information from different loan officers. The organized work structure will help in enhancing the efficiency of the entire refinancing process of the bank o Vintage building Society.

The loan processing is an important step of the refinancing process. The customers have complained that the refinancing process is very lengthy while compared to other financial institutions. Moreover, it was found that the duplication of work has consumed a lot of time and wasted the money of customer as well as bank. In order to improve the loan processing system in Vintage Building Society the following modifications are recommended:

- Each loan processing officer must be responsible for processing refinancing application of certain number of customers. No other loan processing officer will deal with that customer file.

- Employment verification, credit check, verification of the mortgage in case it is issued in other institution must be done simultaneously. The responsibility for the different jobs and verification process must be delegated to the concerned department or individual. Hence, all the activities will occur simultaneously and the credit and verification report can be presented soon.

- Unnecessary activities must be reduced. If the bank has access to tax returns of the customer, valuation of the property is irrelevant. Hence, bank can reduce its activities by accessing to the reliable sources of information. Thus, both time and money can be saved (Mahadevan, 2010).

- If any issue has been encountered by the loan processing officer, he can contact the loan officer immediately for clarifying the issue. The loan processing officer must approach the loan officer who had previously dealt with the file and the customer. As the loan officer has an idea about that specific case, the issue can be easily resolved with the assistance of the concerned loan officer.

- After successful completion of the verification process, the loan processing officer must send the file to loan officer or the society’s board for approval.

References

This process will help in cutting down the unnecessary activities of the loan processing department. Proper delegation of job roles will help in performing the job role efficiently (Kumar and Suresh, 2009). This process will require less time and save money of bank as well as the customer.

Once the verification report is received by the loan processing officer, it is set to the loan officer or to the society’s board for approval. If the refinancing application is approved, the loan closing officer is responsible for communicating with the customer regarding the terms and conditions of the refinancing. He sends a formal letter explaining about the mortgage cost, conditions attached with relevant documents (Schneider, 2003). If the customer agrees upon the terms and conditions, he must send them back signing on the required documents for finalizing the loan. In this step, the following modifications are necessary:

- The loan closing officer must send a letter where detailed information of the terms and conditions will be provided. The letter must be composed in lucid language and he must clarify each point when the customer finds difficulty in comprehending any clause (Slack, Chambers and Johnston, 2001).

- The final loan amount and the payment amount must be calculated by the loan closing officer an immediately communicated to the customer through e-mail.

- In this phase, the customer must not be made bothered by asking about the same information which has already been collected during the loan application.

- Loan closing officer must efficiently arrange settlement between the solicitor of the customer and the other mortgage holder. It must not take long time (Mckinsey.com, 2014).

Thus in this step, the settlement is done smoothly and the terms and conditions are clearly communicated to the loan applicant.

Once the refinancing is finalized, the loan-servicing specialist will generate a new account for arranging settlement cheques.

- This must be an instant process and all the documents of the new account must be immediately handed over to the customer.

- The loan servicing specialist must ensure the customer formally about the proper set up of the new loan (Brennan, 2011).

This stage is basically associated with the regular collection of the repayment of the mortgage. Some complaints have been lodged by the customers regarding the repayment of loan. The following recommendations must be considered for improving the last stage of the refinancing process of Vintage Building Society:

- An automated system must be developed for withdrawing the mortgage repayment from the account. All the automated transactions must be recorded immediately (Patr'icio, Fisk and e Cunha, 2008).

- The loan-payment specialist must calculate the exact amount of monthly payment.

- The loan payment specialist should regularly monitor the payment of mortgage loans.

- Late payments must be identified and required steps must be taken by the loan payment department.

- The customers must not be disturbed if he has opted for an automatic withdrawal system. The loan payment specialist must make sure that the payment is due before communicating with the customer regarding the overdue.

Automated repayment system will helps in reducing paper work and waste of time. Thus the modified refinancing system will assist in delivering better customer service without wasting time and money (Gaither and Frazier, 2002).

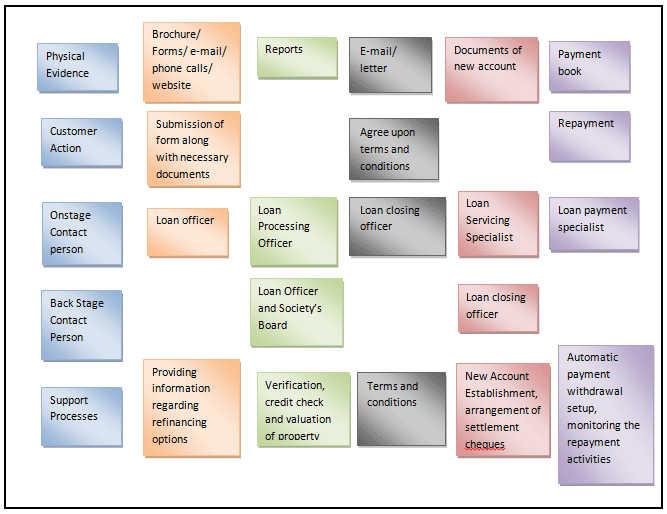

The service blueprint of the refinancing process at the bank of Vintage building Society is outlined below:

Service blueprint of the refinancing process at the bank of Vintage building Society

SERVICE BLUEPRINT OF THE REFINANCING PROCESS AT THE BANK OF VINTAGE BUILDING SOCIETY

Conclusion

This report has examined the existing refinancing process of the bank of Vintage Building Society. The major reason for adopting the five-staged process is to handle the increasing number of refinancing application efficiently. The five staged process has focused on establishment of different departments for undertaking different activities. Experienced and expert personnel were appointed for handling the refinancing process. However, some flaws are identified from the customer complaints. It has been found that ineffective delegation of works had leaded a lengthy as well as complicated refinancing process. In this report the principle limitations of the refinancing process have been recognized and discussed. Complicated application procedure, extensively time consuming loan processing method, improper delegation of job responsibilities, erroneous loan payment setup etc has leaded to increasing number of customer complaints. Some suggestions have been made for improving the refinancing process with the aid of new service blueprint. For each step, necessary modifications are discussed and effectiveness of those modifications has been outlined.

References

Al-Sakran, H. (2012). Mobile e-Loan Negotiation Architecture. Journal of Internet Banking and Commerce, 17(2).

Brennan, L. (2011). Operations management. 1st ed. New York: McGraw-Hill.

Greasley, A. (2008). Operations management. 1st ed. Los Angeles: SAGE Publications.

Gaither, N. and Frazier, G. (2002). Operations management. 1st ed. Australia: South-Western/Thomson Learning.

Heizer, J. and Render, B. (2009). Operations management. 9th ed. Upper Saddle River, N.J.: Pearosn, p.111.

Kumar, S. and Suresh, N. (2009). Operations management. 1st ed. New Delhi: New Age International.

Mahadevan, B. (2010). Operations management. 2nd ed. Upper Saddle River: Pearson, pp.56-150.

Mckinsey.com, (2014). Retail bank distribution 2015—Full digitalization with a human touch.

Narteh, B. and Kuada, J. (2014). Customer Satisfaction with Retail Banking Services in Ghana.Thunderbird International Business Review.

Omara, M. (2007). Credit assessment process and repayment of bank loans in Barclays Bank Uganda Ltd.

Patr'icio, L., Fisk, R. and e Cunha, J. (2008). Designing multi-interface service experiences the service experience blueprint. Journal of Service Research, 10(4), pp.318--334.

Russell, R. and Taylor, B. (2009). Operations management. 6th ed. Hoboken, NJ: John Wiley & Sons, pp.183-220.

Schneider, M. (2003). Operations Management. 1st ed. Cengage Learning.

Slack, N., Chambers, S. and Johnston, R. (2001). Operations management. 1st ed. Harlow: Financial Times Prentice Hall.

Stevenson, W. (2005). Operations management. 1st ed. Boston: McGraw-Hill.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2015). Refinancing Essay At Vintage Building Society.. Retrieved from https://myassignmenthelp.com/free-samples/mortgage-refinancing-at-vintage-building-society.

"Refinancing Essay At Vintage Building Society.." My Assignment Help, 2015, https://myassignmenthelp.com/free-samples/mortgage-refinancing-at-vintage-building-society.

My Assignment Help (2015) Refinancing Essay At Vintage Building Society. [Online]. Available from: https://myassignmenthelp.com/free-samples/mortgage-refinancing-at-vintage-building-society

[Accessed 26 May 2025].

My Assignment Help. 'Refinancing Essay At Vintage Building Society.' (My Assignment Help, 2015) <https://myassignmenthelp.com/free-samples/mortgage-refinancing-at-vintage-building-society> accessed 26 May 2025.

My Assignment Help. Refinancing Essay At Vintage Building Society. [Internet]. My Assignment Help. 2015 [cited 26 May 2025]. Available from: https://myassignmenthelp.com/free-samples/mortgage-refinancing-at-vintage-building-society.