The research conducted here is about the assessment of the interrelation between the different exchange rates and the effect of their fluctuations on the value of the currency of the different countries. The researcher aimed at understanding the basic forex market and the factors that affect the currency value in the forex market. Further the researcher’s objective was to understand the relation between the different major currency exchange rates. The researcher in this project also aimed to understand the effect of the exchange rate fluctuations on the current trading policies between the BRIC countries and the G 20 countries. The effect of the currency rate fluctuation on the economy of a country was also ascertained.

Afraid of Drafting Lengthy Dissertation Papers?

Submit a Remarkable Dissertation Paper by Availing Dissertation Help from Our Experts.

For fulfilling the aims and the objectives of the research the researcher undertook a systematic method of conducting the whole research work effectively. The researcher prepared a Gantt chart detailing the time schedule of each stage of research and also adopted the necessary philosophy and approach for the proper completion of the project. The researcher adopted the secondary research analysis so that the analysis of the data could be done from the observed trends in the preset forex market. For this reason the researcher took the help of various academic journals, published e journals and website data to understand the fluctuation rates and their effect on economy. The researcher adopted a qualitative analysis technique because it was not possible for the researcher to collect data from the participants as the research was based on the economic analysis of the countries.

The findings that the researcher derived from the analysis showed that the fluctuations in the rates are mainly affected by the inflation, interest, current account deficit and political changes. The researcher was also able to deduce a positive relation between the yen and the dollar and an inverse relation between the dollar, pound and euro.

The research which I conducted here was one of my best experiences and it helped me to enhance my knowledge about the different financial sectors and their implications on the market scenarios. The research provided me to expand my analytical skills. However the research would not have been successful without the help and guidance of my peers and professors. Their support has been very helpful for me during the research process. I would specially like to thank my supervisor ____________ for the continuous effort and support and directing me in various stages of the research process. My friends also helped me in collection of the secondary data from the different applied research projects. The support from all these people motivated me to complete my project effectively.

Thanking you all,

Yours sincerely

Introduction

1.1 Introduction

1.2 Rationale of the study

1.3 Purpose of the study

1.4 Background of the topic

1.5 Definition of special terms

1.6 Research aim

1.7 Research objectives

1.8 Research questions

1.9 Structure of the study

Research Methodology

1.10 Summary

Literature review

2.1 Introduction

2.2 Conceptual framework

2.3 Concept of Foreign exchange market

2.4 Factors affecting exchange rates

2.5 Theories of Currency exchange rate

2.5.1 Purchasing power parity (PPP)

2.5.2 International Fisher effect (IFE)

2.5.3 Interest Rate Parity (IRP)

2.5.4 Asset market Model

2.5.5 Balance of Payments theory

2.6 Different types of market efficiency

2.7 Effect of exchange rate volatility on bilateral trade flows

2.8 Conclusion. 24

Research methodology

3.1 Introduction

3.2 Method outline

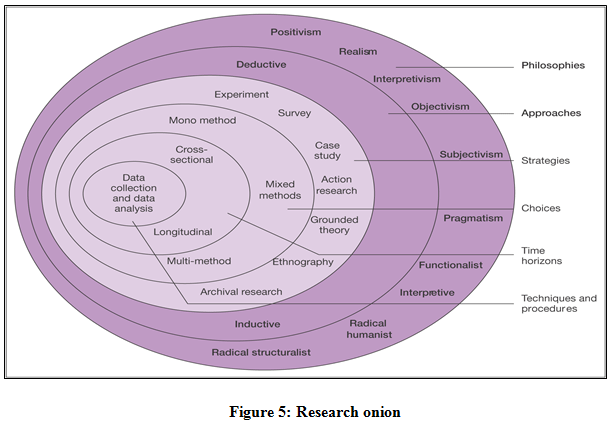

3.3 Research onion

3.4 Research philosophy

3.4.1 Justification of chosen research philosophy

3.5 Research approach

3.5.1 Justification of the chosen research approach

3.6 Research design

3.6.1 Justification for selection of the research design

3.7 Data collection methods

3.8 Research methods

3.9 Research ethics

3.10 Research limitations

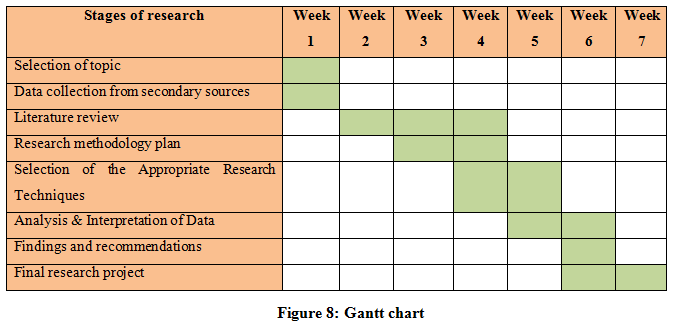

3.11 Time horizon

3.12 Summary

Data analysis and data findings

4.1 Introduction

4.2 Qualitative research analysis

4.2.1 Effect of exchange rates on the trading policies of different countries

4.2.2 Relationship between exchange rates and stock prices

4.2.3 Effect of different factors on the currency trading in the global economy

4.2.4 Interrelation between different exchange rates

4.2.5 Effects of exchange rates on the economy

4.3 Summary

Conclusion and recommendations

5.1 Introduction

5.2 Conclusion

5.3 Objective linking

5.4 Recommendations

5.5 Future scope of the project

Reference list

Appendices

Appendix A: Purchasing power parity model

Appendix B: Interest rate parity calculation

Appendix C: Fluctuations in the exchange rates of different countries ascertained by the FEER

Appendix D: Estimated differences between real effective exchange rate and the consistency of the same with the policies of the countries

Appendix E: US inflation rate of 100 years from 1910 to 2010

Appendix F: EU interest rate differences

Appendix G: US current account deficit for 5 years

Appendix H: Depiction of USD / JPY relation by S&P 500

List of Figures

Figure 1: Structure of the Research

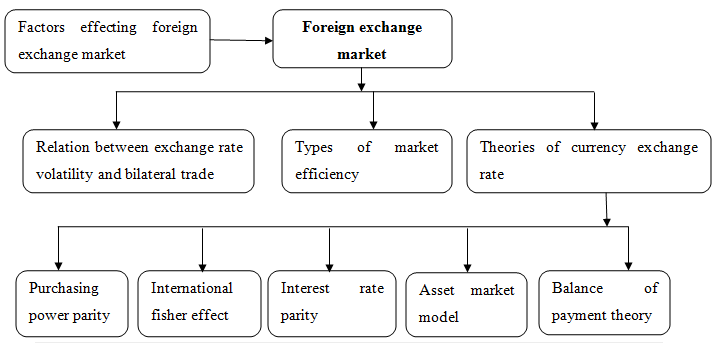

Figure 2: conceptual framework

Figure 3: Asset market model

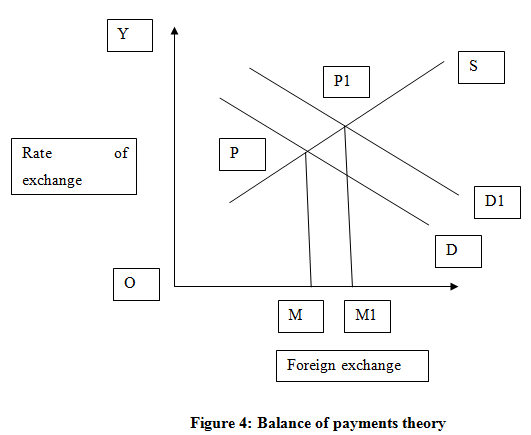

Figure 4: Balance of payments theory

Figure 5: Research onion

Figure 6: Types of Research philosophy

Figure 7: Stages of deductive approach

Figure 8: Gantt chart

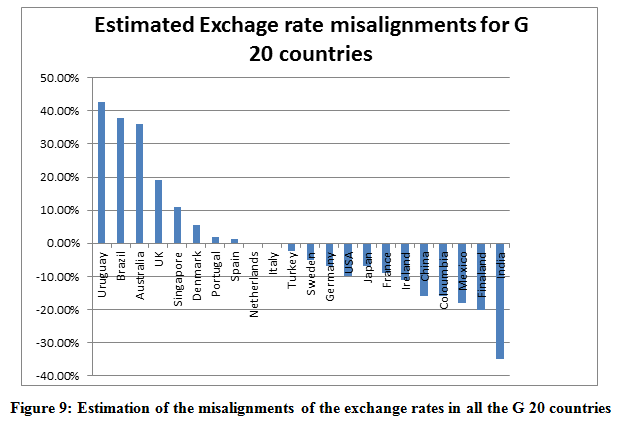

Figure 9: Estimation of the misalignments of the exchange rates in all the G 20 countries

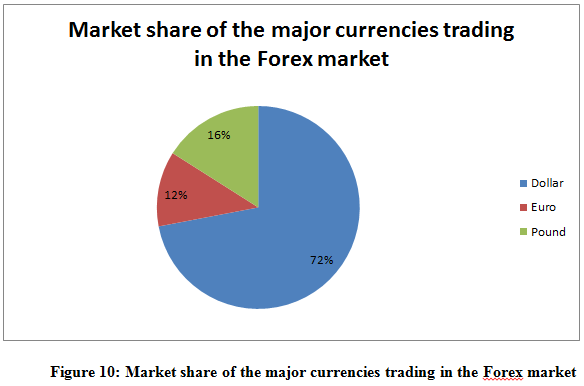

Figure 10: Market share of the major currencies trading in the Forex market

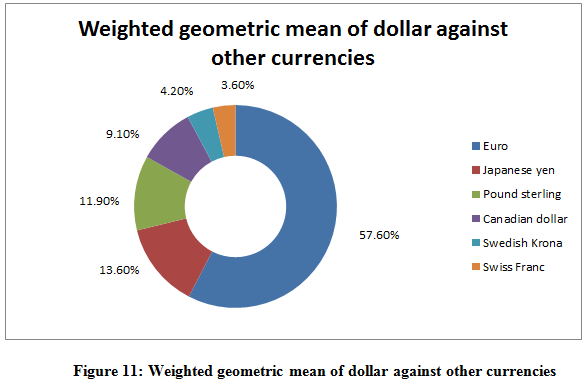

Figure 11: Weighted geometric mean of dollar against other currencies

List of tables

Table 1: Relation between the three major currencies

Table 2: Weighted geometric mean of dollar in comparison to six other currencies

1.1 Introduction

The foreign exchange market is a market for trading the currencies of different countries. The major participants of the foreign exchange market are the government and the central banks, the financial institutions, hedgers and speculators (Argy, 2010). Since the currencies are traded in the foreign exchange market hence it s considered to be the most liquid financial market. The efficiency of this market can be determined from the fact that it operates for 24 hours in a day except for weekends. The researcher conducted the research to test the market efficiency of foreign exchange market.

The basic reason for choosing this topic is the importance of the topic relates on the fact that forex market is the backbone of the international market. The study of the forex market will help to understand the import and export policies and the gains and losses that the countries will derive from the imports and exports of the products. According to Beneda (2009), if the countries are not aware about fluctuations of the market exchange rate then the global economic growth will be limited. The rationale behind adoption of this study is to understand the risk of the fluctuation of the currency exchange rates. The fluctuation of the exchange rates makes it difficult for the UK exporters and European economies to forecast the foreign revenues.

Data Analysis and Findings

The fluctuations of the currency in the eastern part of Asia had a huge effect on the people of the country. The factories were shut down, around 67% of the people lost their jobs and the major investors decided to remove the capital (Branson, 2009). Hence it is advisable to understand the currency pairs and their movements to ascertain the correct currency to be invested.

The research will mainly help the currency speculators who buy and sell currencies to gain profit from the fluctuations of the currency values. Among them some of the speculators may get involved into forward trading and knowledge of the currency pairing or the fluctuation in the value of the currency in the future is required for analyzing market trend and establishment of a successful forward trading (Campa and Goldberg, 2009).

Another problem that affects the market efficiency of the foreign exchange market is that the one month forward exchange rate may be a biased predictor of one month ahead spot rate. The researcher here also deals with the analysis of the market efficiency of the exchange market.

The selection of this topic will focus on the issues of the foreign exchange market. For the purpose of investment the investors are required to have knowledge about the interest rates of the different countries. A higher rate of interest does not necessarily mean that the investor will get high returns on the investment. Hence the researcher in particular will give emphasis on the interrelation between the different interest rates and the exchange rates of the countries. The researcher will also focus on the efficiency rate of the market. The behavior of the forward exchange rate is also analyzed in the research because it affects the efficiency of the market. According to Bodnar and Gentry (2010), the fluctuations in the exchange rates have a high degree of effect on the investment decisions hence the researcher will also focus on the effect of the rates on the investment decisions. The analysis of the impact of the different currency rates on the national and the domestic market scenarios will also be done in the research which will help the completion of the project fruitfully.

During 1970, the operators transformed the foreign exchange market from the Bretton Wood’s system to the modern day exchange system. The new system adopted the Floating exchange rate transaction and hence a large fluctuation was noted in the major currencies (Apte et al.2009). According to Allen (2010), the efficiency of the foreign exchange market depends upon the degree of the prices can reflect on the available information. The market efficiency of the Forex market is divided into three categories namely weak, semi strong and strong. The major determinant of the foreign exchange market efficiency is the interrelationship between the different currencies. Hence, in order to understand the market efficiency it is advisable to understand the correlation of the different currency pairs and their movements. If the currency pairs move in the same directions then it is advisable for the trader to trade in those currencies. For instance, in case of Euro and USD, the trader would have to pay a certain amount of USD to purchase a certain amount of Euro and in 99% of the cases, they move in the same direction.

Conclusion and Recommendations

Currency speculation: The process of purchasing a foreign currency with an intention to sell the currency at a higher value in the future (Chan et al.2010).

Forward Exchange: According to Allayannis et al. (2009), the speculators may at times entre into forward trading. The concept of forward trading shows that the speculator may promise to sell a certain foreign currency in the future on a specific time period with a knowledge that in future the speculator will be in possession of the currency or the speculator makes a simple guess that the foreign currency will move at a predicted direction.

The research here aims to understand the factors affecting the market efficiency of the foreign exchange market. The research will also give an overview on the interrelation between the different foreign exchange market rates and the effect of the exchange rate fluctuations on the trading decisions. The researcher will also focus on the issues that are faced by the speculators and the readers for the fluctuation in the exchange market.

The framing of the research objectives will help the researcher to make a deep penetration of the topic. In the context of the issues and the present scenario of the currency exchange market the following objectives are framed by the researcher.

- To identify the effects of exchange market on local and national economy

- To identify the factors affecting the efficiency of the exchange market

- To identify the interrelated factors that influences the currency trading in global scale

- To identify the relation between the different foreign exchange rates

- What are the effects of exchange rates on the local and national economy?

- What are the factors that affect the efficiency of the foreign exchange market?

- What are the factors that affect the currency trading on a global economy?

- How is the different foreign exchange rates interrelated?

The researcher has made a short structure of the research project and based on the five following chapters the researcher will analyze the given project.

Chapter 1: Introduction

In this part the researcher will give basic details about the chosen topic and will also explain the importance behind choosing this topic. The researcher in this chapter has focused on the concept of forex trading and has also highlighted the issues that the speculators are facing in respect of fluctuations in foreign market.

Chapter 2: Literature review

This part of the research will focus on the theories and the concepts in relation to the topic. The relevant theories will help the researcher to understand the pros and cons of the topic and the researcher will be able to analyze the exchange market fruitfully.

Chapter 3: Research methodology

This chapter will deal with the use of the various research techniques to analyze the data collected for the purpose of deriving results pertaining to the aims and the objectives of the research. In this part of the research project the researcher will showcase the different tools that have been used for the purpose of the research and the philosophy adopted for the purpose of analyzing the collected data.

Chapter 4: Data analysis and interpretation

Based on the data collected in this part of the research the researcher will try to make correct analysis by using various applicable techniques and derive a common result. The researcher with the help of the various tools and techniques will analyze the response of the participants and reach a conclusion

Chapter 5: Conclusions and recommendations

This is the concluding part of the research project. This chapter will give an overall view of the research topic and will include the results as well. The analysis of the result is not the only part that will be showcased in the chapter; the researcher will also show the linking of the research questions with the objectives to determine the feasibility of the study.

This chapter focuses on establishing a foundation about the current foreign exchange market fluctuations on the basis of the existing theories relating to the currency exchange rate determination and their effect on the trading issues in both local and national context. With the help of the various theories the researcher will be able to analyze the current position of the foreign exchange market. Application of various proposed theories, models and concepts will add value to the research work and help in better analysis of the results.

The conceptual framework helps in categorizing the list of theories and concepts that has helped the researcher to understand the basic of the research topic. The main concept adapted by the researcher in this study is the role of exchange rate volatility in assessing the trade levels, economic conditions and the effect of the currency values on the product pricing of the countries. Various theories have been adopted to understand the movement of the exchange rate.

Figure 2: conceptual framework

(Source: Created by author)

The major market for trading the currencies is the foreign exchange market. The international banks are the major participants of the foreign exchange market. The major functions of the participants of the foreign exchange market is buying and selling of the currencies for the different countries. The traders in the foreign exchange market have to speculative to understand the fluctuations in the currency values and to finally ascertain the profitable return (Giddy , 2009).

The major clients operating within the foreign exchange market are the commercial banks of the different countries, the central banks and the investors dealing in the financial assets (Engel and Wang, 2011). The retail market is the part of the forex market that deals with the conversion of the currencies from one country’s exchange rate to the other. Whereas the whole sale market initiates the international transactions of the commercial banks and central banks in order to establish a common exchange rate.

According to Apte (2009) the following are the basic functions of a foreign exchange market namely

Transfer function: The basic function of the exchange markets is to convert the currency of one country to the other. Hence the purchasing power of one country is transferred to the other.

Credit function: The other function of the foreign exchange market is to provide credit to the local and the national countries in order to promote trade in both the countries. However Bartov and Bodnar (2012) opined that if the debt borrowing by the countries increase then the countries will face depreciation in the level of the currency.

Hedging function: The foreign exchange market also helps the investors to hedge against the risks. The speculation of the risks plays an important role in the forex market. According to Baum and Caglayan (2009), if the price of one currency changed in terms of the other currency then an investor may incur a gain or a loss in the investment made. This risk of losing or gaining against the currency rates can be reduced with the help of the hedging function of the forex market.

The exchange rate of a country’s currency is the major determinant factor for determining the value of the currency and also to ascertain the profit which the country will be able to gain from the level of trade. According to Giddy (2009), there are various economic factors that contribute to the fluctuations of the exchange rates.

Differences in the inflation rates: According to Bartov and Bodnar (2012), a country with a lower inflation rate will have higher currency value. Hence the effect of the inflation on the exchange rate will increase the value of the exchange rate for that particular country in comparison to the other countries. Initially countries like Japan, Switzerland and Germany encountered low rate of inflation. The investors would have to pay even high rates of interest for the countries with high rate of inflation.

Differences in the interest rates: The higher the rate of interest the higher will be the return for the investor. Hence the investors tend to deposit money in the country where the interest rates tend to rise because they have expectations of earning high returns from that country. However Branson (2009) opined that the borrowing from that country tends to decreases because the rate of exchange will increase and the loans will become costly. Hence the monetary earnings of that particular country tend to decrease.

Current account deficits: The current account is the balance of payments between the domestic country and its foreign counterparts which reflects the payments between both the countries. (Duangploy et al .2010) stated that a depict in the current account shows that the domestic country is spending more for the foreign trade in comparison to the amount earned. The deficit further indicates that the domestic country is required to borrow from the foreign counterparts to make up for the deficit. Hence this affects the currency rate of the domestic country because the currency rate tends to decrease as the monetary supply if the domestic country decreases.

Public debt: According to Engel and Wang (2011) the social and the health care projects within any country needs to be financed either from the internal financing or from the loans taken by the domestic country from the other foreign counterparts. The exchange rates of the countries having large public debts are generally high and the investors are not willing to either purchase the products of these countries nor are they ready to make any investment.

Terms of trade: The part of the Balance of payment which determines the comparison between the export and the import prices is called the terms of trade (Apte , 2009). The currency value of the country improves if the export of the country improves and if the import of the country increases then the country will experience depreciation in the value of the currency.

Political stability and economic performance: The issues and the uncertainties with the political environment of a country will reduce the currency value of the country (Giddy, 2009). The political environment of the country may also be affected by the cause of recession which will decrease the economic growth of the country. At time the government of a country may undervalue the currency. For instance Chinese government generally keeps the currency undervalued so as to increase the rate of exports.

According to Allen (2010), The purchasing power parity deals with the concept of maintaining same price level in the local as well as the national economy. It involves a relationship between the country’s local exchange rate and the movement of the same with respect to that of a foreign country. Bartov and Bodnar (2012) opined that there are two types of PPP namely the absolute PPP and the relative PPP. In case of the absolute PPP the purchasing power of one unit of the domestic currency is equal to the purchasing power of one unit of foreign currency. In absence of a purchasing parity between the currencies of the two countries it is to be assumed that either one of the currencies is overvalued or the other is undervalued.

According to Anderton and Kenny (2010), the major advantage of applying this theory on the currency rate is to determine the standard of living of the countries. The other advantage which the economist will derive is to understand the current GDP of the country. For instance in case of China the domestic currency is undervalued hence this will misguide the investors and the economist in producing the current economic scenario of China. However Branson (2009) is of the opinion that in this case the use of PPP along with that of United States will show the purchasing power of China against the national currency. (Refer to appendix A)

However Allen (2010) opined that the major defect of this theory is the difference in the actual exchange rates and the calculated purchasing parities for two different countries. The theory aims to establish a direct link between the purchasing power of the currency and the exchange rate of the two countries. However there are several other factors like tariff, speculation and capital flows which affect the rate of exchange. Allayannis et al. (2009) further stated that PPP is applicable only in case of goods entering into foreign trade however the theory cannot be applied in case of goods which are only sold in the domestic market and has no relevance to the international market. Hence (Chan et al.2010) added that this confirms that the overall economic position of the country cannot be ascertained form this theory.

According to Beneda (2009), the major criticism against the theory is the difficulty of calculation of exchange rate. The PPP is calculated using the changes in the price indices. However Campa and Goldberg (2009) opined that there are various numbers of price indices like the cost of living price index and the wholesale price index. The PPP calculation does not mention which price index is taken into account for the calculation purpose.

The international Fisher effect or commonly known as the Fisher’s open hypothesis states that the currency of a country with a higher rate of interest will depreciate in value compared to the country with a currency of lower rate of interest (Branson, 2009). The theory was formulated based on the concept that the real interest rate in an economy is linked to the local inflation rate and is independent of the government’s policies. Hence Bartov and Bodnar (2012) stated that there exists an inverse relationship between the rate of inflation and the value of the currency. With the increase in the rate of inflation the value of the currency decreases.

For instance a rise in the Swedish inflation rate compared to the US dollar will cause depreciation in the currency value of Sweden relative to the US dollar and the nominal interest rate in Sweden will also rise in comparison to the US dollar (www.imf.org , 2014).

However the Allen (2010) opined that the use of the IFE theory is not reliable in case of short term analysis because of the effects of different factors on the exchange rate predictions and nominal interest rates but the theory is feasible to be applied in the context of long term determination of the currency value.

According to the original theory as proposed by American economist Irvin Fisher, the IFE can be calculated as follows:

( 1+ r ) = ( 1+ R ) ( 1 + E (i) )

Where r = nominal interest rate of a country

R = real interest rate

E (i) = Expected inflation rate over the interest rate

Anderton and Kenny (2010) is of the opinion that the theory s based on the fact that the capital market is perfect and the capital is mobile hence the real interest rates are equal in all countries. However the assumption dosenot relate to the real market scenario. Chan et al.(2010) is of the opinion that there is no direct relationship between the interest rates and the expected inflation rates. However Bartov and Bodnar (2012) added that relation between the current interest rate and the pats inflation rates can be found for many countries and the IFE can be applied for those countries only.

According to Chan et al.(2010) this theory is used to analyze the relationship between the spot rate of a country and the future rate of currencies of the same country. The theory is based o the assumption that the risk free rate of the currencies of a particular country will determine the rate at which the currency can be converted to each other in a forward transaction. According to Allen (2010), a forward contract is the agreement to buy or sell the currency at a future date and at a predetermined price. Hence with the help of the IRP if the future value of the currency can be determined then the trader trading in the different currencies will be able to analyze the return they would get from exchange of the currency. (Refer to appendix B)

Baum and Caglayan (2009), further opined that with the help of the interest rate parity theory the differences in the interest rate between the home country and the foreign country can be analysed. If domestic interest rates are less than the foreign interest rates then the foreign currency must trade at a forward discount. This helps the investors to borrow the money from any country no matter what is the present exchange rate because the cost of borrowing is same for all countries.

Farmer and Joshi (2009) opined that the IRP theory is however based on certain assumptions namely the capital is mobile which means the investors can borrow by exchanging domestic assets for foreign assets. Secondly the assets are substitutable. Hence the investors will get the option to choose from the assets which will earn higher rates of profit. However Apte (2009) stated that based on the assumptions it is certain that the change in the exchange rate will not affect the return of the assets. Hence the domestic as well as the foreign investors will both get the same amount of return for the asset.

According to Giddy (2009), the currency rate of a particular country will increase if the country experiences high capital flow and the demand for the currency will also increase resulting in an appreciation in the value of the currency. This is the main theme of the asset market model. Engel and Wang (2011) further added that the asset market model gives emphasis on the flow of the financial assets only because the financial assets are the assets that can be readily converted into cash and has liquidity in the market. Hence a country with high rate of financial assets will experience low amount of loans and high demand in the currency.

This theory is based on the assumption that the price of the foreign currency in terms of the domestic currency will be changed with the changes in the demand and supply rate of the currency in the domestic as well as the foreign countries (Duangploy et al .2010). The external value of the currency will depend upon the demand for the particular currency in the domestic and the foreign countries. Hence DeFusco et al. (2010) opined that the deficit in the balance of payments will decrease the value of the currency. While a surplus in the balance of payments indicates that the domestic country holds high amount of currency reserves and have a strong financial background. Hence if the demand for the domestic currency exceeds the supply of the foreign currency then the deficit will arise in the balance of payments.

Farmer and Joshi (2009) opined that the deficit in the balance of payment will result in a decrease in the exchange rate of the domestic currency. Hence the fall in the domestic currency will reduce the demand for the currency of that particular country. However if the balance of payment experiences a surplus then the demand for the currency will also increase and consequently the rate of exchange for that particular country also improves. However Engel and Wang (2011) opined that the determinations of the exchange rates are more effectively done with the help of the balance of payment theory rather than with the Purchasing power parity theory. Baum and Caglayan (2009) further added that this is because the exchange rates are a combination of the demand and supply of the currency. Hence the determinants should be demand and supply rates of the currencies of the country.

However Sheng and Liao (2004) argued that the theory has a fundamental defect because it assumes that the market of all the countries will have a perfect competition and the movement of money is done smoothly from one country to the other. This condition is unrealistic. Engel and Wang (2011) further opined that the theory states that the demand and supply interaction is the base determinant of the exchange rate. However the fact that the changes in the exchange rate are affects the change in the balance of payments is avoided in the theory. However Farmer and Joshi (2009) argued against the stated fact saying that the theory brings into notice the influence of the supply of goods apart from the exports and the imports of the goods.

A foreign exchange market is said to be efficient if the investors dealing in the market are able to earn normal profits using the fluctuating exchange rates (Giddy, 2009). The major condition for a market to be efficient needs to have rational and profit maximizing investors. The major types of efficient market are namely the Weak form of market, the semi strong form of market and the strong form of market. Duangploy et al (2010) defines the market to be efficient when the participants in the market are competing in nature and are trying to predict future markets values of the shares and the securities.

Strong market efficiency: The market is said to be efficient if the information relating to the present, past and future fluctuations are accurately reflected within the current price of the exchange rates. According to Campa and Goldberg (2009), the investors in this type of market make use of the private information of the companies and countries so that the fluctuations in the exchange rate can be managed effectively by the investors. The attainment of the equilibrium price level by the currency value in a country is a feature of the strong efficient market. The investors in this type of market will stop purchasing the currency when the demand for the currency equals to the supply.

Semi strong market efficiency: In this type of market the investors keep a mindset that the current price is the beast price that can exists within the market. According to Sheng and Liao (2004), they generally trade on that fact that the current price will remain the same in the future. The investors in this type of market generally make an analysis of the public information that are available in the market and assess the risks accordingly.

Weak market efficiency: The market where the investor only deal with the past prices of the share and try to predict the fluctuations on the basis of the past prices is known as the weak form of market (Bodnar and Gentry, 2010). Since the investors are not able to predict the future circumstances hence the excess returns on the investments are not possible in this type of market.

Hakala and Wystup (2010) is of the opinion that to make a market efficient the investor will have to make use of the present and the future information both in terms of private as well as the public information. The market cannot be made efficient with the help of the past and stale information. However it is not always possible for an investor to analyses the present situations and calculates the excess demand for the currency.

There s a mixed effect of exchange rate volatility on the trade flows of a country. According to Sheng and Liao (2004), factors like the risk aversion factors and costs of factors of production will create a negative impact on the exports due to high volatility of the exchange rates. The use of the gravity flow model can predict the bilateral trade flows between different countries based on the economic sizes of the countries. According to Baum and Caglayan (2009), the model can be useful for determining the effect of alliances on the trade of a country.

The gravity flow model was first introduced in the year 1962 by Tinbergen and was used to determine the bilateral trade flows of a country based on the economic size of the countries (Duangploy et al .2010).

Fij = G (M I β1 M j β2 / D ij β3)

Here F = Trade flow

M = economic mass of each country

D = Distance

G = Constant

The model helps to estimate the pattern of international trade. The fluctuations of the exchange rate have an effect on the bilateral trade policies of the country. However Farmer and Joshi (2009) opined that this theory states that the other relative factor also contributes to the effectiveness of the trade agreements between two countries. Keeping the essence of the Heckscher Ohlin theory it can be sated that the country having high amount of raw materials generally produce a particular goods in which the country has the highest amount of raw Materials. Hence the trade relation of that country depends upon the trading agreements between the product that is produced abundantly and the product that are scarcely present in the particular trading country (timera-energy.com, 2014).

In the year 1998 the US economy got involved in the foreign currency market to stabilize the situation of the Japanese Yen by purchasing the Japanese currency. This helped to increase the value of the Japanese Yen since the demand of the currency increased. This also helped to revive the Japanese economy. Hence it can be said from the above analysis that the exchange rates generally determine the economic condition of a country. By appreciating the currency value the countries can increase their economic condition. The demand for the foreign currency has to be increased for increasing the currency value as stated in the theory of balance of payments. Giddy (2009) further added that a number of factors can add to increasing of the demand of the currency value. The selling price of the domestic country can ascertain the level of demand for its products by the other nations. If the selling price is low then the demand will be high. Similarly Sheng and Liao (2004) added that if the income of the domestic country increases and the inflations rates are higher than also the currency rate will appreciate. The other determining factor is if the interest rate of the domestic country is lower than that of other international countries then the investors would take the safe option of investing in the domestic countries with a view to pay low interest against high returns. Thus this increase in the rate of demand for the currency pushes the currency higher and the currency value appreciates.

However Engel (2010), is of the opinion that a strong value of a certain currency may also have a negative effect on the currency values of other countries. Since the exchange rates are derived by comparing the currency values of the different countries hence a drastic change in the value may affect the value of the other countries. For instance in case of Dollars of USA the value of the currency is higher in the forex market compared to the other currencies hence the currencies of the Asian countries like India tends to decrease n comparison to the appreciating value of dollar. Moreover this acts as a benefit for the appreciating country. Baum and Caglayan (2009), opined that the retail stores in US, the gas stations, the electronic outlets are able to purchase goods at a lower price from the dealers of the Asian and South Asian countries who have lower value d currencies. The stores in US then sell the goods to the citizens at higher prices than the purchase price and gain considerable amount of profit out of that. Sheng and Liao (2004) opined that from the example it is clear that the rate of exchange has a both positive as well as negative impact on the trade relations and outcomes of the different countries. Here US are benefiting from the low pricing strategy and the Asian countries are losing as they are not able to secure considerable amount of imports from the US economy.

2.8 Conclusion

The completion of this chapter allowed the researcher to gather knowledge about the concepts of Currency exchange market and the ways the exchange rates affects the different economic conditions and trade relations of the countries. The researcher will be able to analyze the data collected by the primary and secondary research and will be to arrive at a fruitful conclusion after gaining an in-depth knowledge about the fluctuations in the exchange market.

This chapter helps in defining the most appropriate approaches used by the researcher to conduct the research effectively. Cameron (2009) opined that the show case of the justifications of using the techniques and the limitations that the researcher has faced in the context of conducting the research is mentioned in this chapter which makes the research process feasible.

According to Magilvy and Thomas (2009), method outline provides the basic structure of the methodologies that were used by the researcher. For the purpose of conducting the research the researcher has used the positivism philosophy, deductive approach and descriptive design. The data have been collected mainly from secondary sources. The researcher has also mentioned the points about the maintenance of the ethics, validity and reliability in the research process.

The researcher used the concept of research onion to follow the structure of research methodology. According to Saunders et al. (2009) the structural unfolding of each layer of the research onion helps the researcher to effectively conduct the research process. The research onion is categorized in six divisions starting from the outer layer of the onion namely philosophies, approaches, strategies, time horizons and finally the inner most layer the data analysis techniques and procedures.

Conducting the research process by adopting the research onion helped the researcher to sequentially complete the research process. This helped the researcher to set a time frame for the completion of the different stages (Bernard, 2011).

According to Ellis and Levy (2009), research philosophy is the belief or the idea that the researcher will adopt for collection of the data and the completion of the research process. Generally the researcher for conducting the process adopts the common forms of research philosophy that is positivism, interpretivism and realism. According to Truscott et al.(2010) the selection of the positivism philosophy helps the researcher to analyze the facts in a scientific manner. The interpritivism on the other hand defines the concepts of natural laws in analyzing the data rather than taking a scientific approach. Realism is a mixed approach which incorporates both positivism and interpretivism.

The researcher adopted the positivism philosophy for the present study because this philosophy helped the researcher to collect the data in a scientific manner and derive at fruitful conclusions. According to Corbetta (2009), the conclusions derived from choosing this philosophy is actual and scientific which would not have been possible if the other two philosophies were used. However the positivism philosophy regards human behaviors within the research process as passive and experienced by external environment. Hence the adoption of the subjectivity approach in analyzing the human behavior hampered the findings of the study.

The second outer layer of the research onion is the adoption of the suitable research approach. There are two types of approaches namely deductive approach and inductive approach. Harrison and Reilly (2011) opined that the adoption of the deductive approach helps the researcher to arrive at conclusions from the facts. On the contrary the adoption of the inductive approach will help the researcher to deduce the conclusions based on the broad theoretical facts. Since the deductive approach uses the observations to arrive at the conclusions hence it is less time consuming.

The researcher here chose the deductive approach for conducting the study. Since the researcher is not evaluating any new theory or the researcher is not inventing any new concept hence the deductive approach helped the researcher to arrive at conclusions from the observations of the primary and secondary data collected. However the choice of the inductive approach would have made the researcher to adopt a specific situation and then arrive at the general conclusions. The researcher observed the present status of the exchange rates in the market and conducted a research and then derived at the conclusions. Since there are no new concepts present in the research topic hence the adoption of the deductive approach will help the researcher to analyze fruitfully.

In general there are three types of research designs namely the exploratory, explanatory and descriptive. The use of the exploratory design will help the researcher to observe and idea and understand the situations. Onwuegbuzie et al.(2009) opined that the descriptive research design will help the researcher to explore and explain the additional information about the topic. On the contrary the explanatory research aims to connect ideas to understand the cause and effect relationship between the topics.

The researcher here conducted the research with the help of the descriptive research design. This helped the researcher to define the detail concepts involved in the exchange rate market and helped the researcher to conduct an in-depth analysis. The descriptive research design has the ability to provide a basis for the decision making for the researcher here. However Crowther and Lancaster (2012) is of the opinion that the use of the descriptive design doesn’t allow the researcher to modify the aspects that are discovered.

The data collection methods are generally of two types the primary data collection methods and the secondary data collection methods. According to Bernard (2011), the primary data are generally collected by conducting surveys through the use of the questionnaires to the respondents related to the research topic. The secondary data on the contrary are collected from the past and present research evidences. Primary data collection was not carried depending on the nature of the topic and the research problems identified.

The researcher here had collected the data from the secondary sources to analyze the present currency market situation. The researcher for the purpose of fruitful analysis used both internal as well as external sources of secondary data collection. The internal sources included the company websites, the exchange rates sites, and the official stock exchange market information. The external sources included the periodicals, government data, journals and academic writings related to the topic.

According to Corbetta (2009), the two major methods of data analysis that are used by the different researchers are the qualitative and the quantitative techniques. The quantitative techniques are used to analyses the primary data using the statistical tools to arrive at the conclusion. This technique helps the researcher to calculate the percentage change in issues of the questions asked to the related respondents. The qualitative technique is used for the analysis of mainly the secondary data because the researcher in analyzing the secondary data takes the help of the literature theories and analyses the views theoretically providing an in-depth knowledge about the topic (www.ihmgwalior.net, 2014).

Qualitative data collection -- The researcher in this project used the qualitative technique to analyses the problems and the issues faced by the different countries and the companies in dealing with the currency rate fluctuations in the market. This helped the researcher to link the present problems with the academic research inputs and analyze the same effectively.

The research ethics involves the application of the legal aspects in the research project (Onwuegbuzie et al. 2009). During the course of the research work the researcher needs to follow a code of conduct that helps in identifying the right and the wrong aspects of a research project. The researcher in this respect has to ensure the reliability, legality and confidentiality of the data collected.

The researcher here confirmed that the research that was conducted was done keeping mind the confidentiality of the data collected from the different websites of the exchange market as well as the companies. The researcher also confirmed that the data collected are reliable and valid for the purpose of making the analysis.

The researcher generally faces certain limitations while conducting a research project.Cameron (2009) opined that the limitations faced by the researcher narrows the scope of the research project. The researcher here being a student faced certain complications in obtaining the accurate data for the exchange rates. The other complications data the researcher faced was calculating the data collected using the statistical tools. Hence the researcher adopted for the secondary analysis which helped the researcher to analyze the issues and impacts of the exchange rate fluctuations on the currency value of each country. The problem of limited accessibility and limited financial resources also created a constraint in the research process of the researcher.

The time horizon for a research project is framed by the researcher to understand the feasibility of the project Harrison and Reilly (2011). The researcher here used the simple method of Gantt chart to prepare the time schedule for the research work. Segregating the work in time divisions helped the researcher to complete the tasks systematically

The present chapter described the various research tools that helped the researcher in completing the research project. The use of the appropriate methods and the use of the secondary data helped the researcher to conduct the analysis of the various complex fluctuating currency rates in a easier way. This chapter has helped the researcher to create a blueprint of the research project so that the research project can be smoothly conducted.

According to Magilvy and Thomas (2009), the data analysis helps the researcher in gaining an in-depth knowledge from the theoretical aspect of the research project. The use of the secondary data which the researcher has collected from the websites and the academic journals will enable the researcher to perform the study effectively. Since the researcher in this project is using the secondary research method hence the researcher will focus on the issues that the countries are facing for the currency rate fluctuations and also the impact of the fluctuations on the trading policies between the countries. The completion of this chapter will help the researcher to deduce the answers to the problems that were focused in chapter 1.

The Creation of International Monetary fund (IMF) and General agreement in tariffs and trade (GATT) in the late 40’s was done to abolish the gold dollar system of exchange and establish the present exchange rate system (marketoracle.co.uk, 2014). The changes in the exchange rates affect the trading policies of the Asian countries particularly.

The economists of the Peterson Institute for international Economics have estimated the misalignments in the exchange rate equilibrium. This misalignment is the major source of fluctuations of the trading policies. The fundamental Equilibrium Exchange rate (FEER) ascertains the fluctuations in the exchange rate from 2010 to 2012 on a quarterly basis. (Refer to appendix C)

The Consultative group on Exchange rates (CGER) has adopted a method to estimate the misalignment in the exchange rates of the different countries. The production of a Pilot external sector report in the year 2012 shows the estimated differences between real effective exchange rate and the consistency of the same with the policies of the countries. (Refer to appendix D)

The figure estimates the misalignments of the exchange rates in all the G 20 countries. The figure shows the difference between the real exchange rate and the ideal exchange rate adopted for the trade policies by these countries. The negative exchange rates are occurring because the real exchange rate is undervalued than the ideal exchange rate. Whereas the positive exchange rates suggest that the exchange rates are more than the ideal exchange rates.

The fluctuations in the real exchange rate may affect not only the economic policies but also the trade policies of that country. The negative real exchange rate regime in the countries like Netherlands and Italy has provided weak incentives from the exports and also resulted in a drop in the agricultural sector.

The inter dependence of the exchange rate on the stock market movement hampers the current currency valuation of the developed countries. For instance in case of USA it was seen that in the year 2003 to 2004 the US dollar kept on depreciating against the other currencies whereas the US stock market showed an upward trend in the market.

The researches show that an upward trend in the stock market for USA and UK shows depreciation in the currency value of both the countries. The major contributing factor in this respect may be the increase in the stock prices increase the inflation opportunities in these two markets simultaneously and hence the foreign investors perceive that the rising inflation will cause an effect on the returns. Hence the demand for both US and UK currencies fall simultaneously. With the falling demand the currency value depreciates (bloomberg.com, 2014).

Secondly the foreign investors will be unwilling to hold the assets in the countries where the currency rates are depreciating as that would reduce the return on their investment. Now in this case in the year 2005 it was seen that the investors tend to sell the assets because of the reduction in the value of the US dollar. This resulted in an opposite reaction. Since the investors sold the assets hence the price in the US stock market reduced significantly which again appreciated the value of the Dollar.

Thirdly the effects of the exchange rate depreciation will be different again for the different types of companies. On the basis of the survey reports of 2010 two case scenarios are adopted for analyzing this situation namely the worst case scenario and the best case scenario. The worst case scenario here portraits the conditions of the importers of USA. Around 36.85% of the US companies in all sectors import goods like raw materials, energy products or commodities to make money. 52% of the manufacturing sector of USA depends on the import of the raw materials to create the final goods. Hence the reduction in the dollar value will make the US manufacturer to pay more for the raw materials that they could have purchased earlier at a low price.

However in the best case scenarios the exporting companies of the USA will benefit from the high demand for the goods of USA. The depreciation in the currency value will generate high demand for the low priced products of USA by the Asian countries like China, Japan, Malaysia, and India. Although the price of the products will be reduced however the number of sales will increase which will generate larger number of US dollars. The conversion rate of US dollar is 40% more against the Asian currencies hence the companies will benefit from the same.

Hence from the above research analysis and the different survey reports it can be analyzed that the devaluation in the dollar rate will have a positive effect on the domestic production of USA. The domestic production of USA in the year 2005 increased by 1.5% due to decrease in the currency rate. Hence the devaluation in the dollar rate is seen as a positive indicator which supports the economic condition of the country. It boosts up the economic position of the country.

Effect of inflation: The value of the US dollar has fluctuated widely since the introduction of the floating exchange rate policy. Between 1970 and 1980 the dollar rate depreciated by 0.25% and the inflation increased. Again between 1980 and 1985 the dollar rate was appreciating while the rate of inflation was falling. (Refer to appendix E)

Due to the rise in the oil prices in the year 1973 the rate of inflation as measured by the Consumer price index (CPI) rose from the initial 3.3% in 1972 to 11.0% in 1979. Hence the dollar value fell after 1978 as US inflation increased more than the other countries. Again in the early 1983 it was observed that the US inflation feel by 10.4%. This gain caused an increase in the value of the dollar.

However from the survey reports of 1983 it can be noted that the rise in the dollar value and the fall in the inflation rate had a negative effect on the economic condition of USA. The tightening of the monetary policy of USA by the Federal Reserve increased the unemployment rate by 1.2%.

Effect of interest rates: The federal reserve of USA has kept the short term interest rate near zero for several years. The intention behind doing this was to increase the rate of loans taken by the foreign investors. The investors are speculating that the interest rates are likely to rise up in the second half of 2015. However the rising in the rate of interest will appreciate the present value of the dollar. This is will appreciate the rate of the dollar to a high extent in comparison to the currency value of other developed countries like UK. (Refer to appendix F)

From the given appendix table above it can be analyzed that from the year 2003 to the year 2013 the rise in the interest rate has positively affected the currency appreciation of the Dollar rate.

Effect of current account deficit: The survey reports of 2004-2005 shows that US is experiencing high current account deficit. The current account deficit was -5.7% and it increased to -6.2% in 2005. The major reasons behind the high and increasing are of deficit is namely an increase in the US demand for foreign goods. Due to the trade deficit created in the balance of payments in the US economy, the shifts were seen in the import and export levels of the goods by around 40%. The exchange rates however were positively affected by the same. (Refer to appendix G)

However the bilateral trade policies of USA with the other countries were affected due the current account deficit of 2004. The US trade deficit in goods for the year 2004 was $ 652 billion and this deficit was a result of the combined deficit of the following countries namely $75 billion with Japan, $ 71 billion with Europe and $ 160 billion with China.

The current account deficit of USA has been in the deficit for the past years expect for one year that is 1982. In the year 2008 and 2009 the GDP of USA rose to 3%. As a result of this it is analyzed that the rate of domestic savings is higher, the rate of domestic private investment is lower and also the rate of foreign borrowings are lower.

Effect of the political factors: It can be analyzed that the rate of the US dollar changes with the change in the political factors like the national debt and budget deficit. The current US national debt stands at $ 9 trillion and is growing by over $ 1 billion per day. The other qualitative factors like the terrorist attacks of 9/11 hampered the confidence level of the investors as well as the consumers. This reduced the demand for the American goods and the US dollar value depreciated accordingly.

The survey reports of 2011 suggest that the considerable amount of spending on the government expansion of new departments have resulted in a decrease in the budget deficit. The opening of new groups like the TSA and the department of homeland security lowers the value of the dollar due their high opportunity costs against the expanses in the budget.

The political opportunity that increases the value of the dollar is the dealing of the oil in the other countries. The majority of the oil is purchased in dollars and hence the other countries will have to convert their domestic currencies to pay for the price of the oil in dollars. Hence the demand for the US dollar increases in comparison to the other currencies. However the rise in the Euro value also affects the instability in the value of the dollar.

Relation between dollar, euro and pound

The interrelation between the three major currencies namely the dollar, pound and the Euro will help the researcher to understand the effect of the currency rate fluctuations on the trade policies and the economic condition of the country. The present market share of the three major exchange rates shows that the forex market is being ruled by these three major currencies. Hence the traders trading in the Forex market are required to maintain a daily update of these three major currencies and the changes in the rate of these currencies affects the profit or loss of the trader.

The recent survey report produced by the Economic Times shows that the euro has overtaken the dollar in the international bond market by gaining a market share of 47% of bonds in the international market. However 44% of the transactions in the Forex market are done through dollars and only 18 % of the transactions are done through euro. The pound on the other hand is seen to overtaken the yen by 8% to become the third most traded currency in the forex market.

From this market position it can be viewed that the euro’s rise as an international currency provides the euro an advantage over the dollar. US on the other hand can gain in the forex market by borrowing in its own country so that the country doesn’t have to pay high interests and US can invest in the stronger currencies which will help them to get high returns.

According to the reports of the exchange market it is seen that the value of the US dollar is about to get strengthened in the November of 2014 followed by a depreciation in the rate of the euro (poundsterlinglive.com, 2014).

The following are the present exchange rates in the forex market for these currencies

|

EUR / USD |

0.69 |

|

GBP / EUR |

0.65 |

|

GBP / USD |

0.04 |

Table 1: Relation between the three major currencies

(Source: Sheng and Liao, 2004, pp-34)

The rise for the dollar against the other two currencies may be noted from the increase in the sales of the domestic products of US and the increase in the expectations for inflation motivated the investor’s to invest more in expectation of high returns. This made the euro fall by 0.7% in comparison to $1.2715 which is one of the lowest close as seen in the rate of the euro. The pound on the other hand fell by 0.4% against $1.6119.

The value of the US dollar is measured against the other effective currencies using the ICE dollar index. The above forecasts of the depreciation in the value of other currencies are measured against the US dollar to check the effectiveness of the dollar.

|

Currencies |

Weighted geometric mean of dollar |

|

Euro |

57.6% |

|

Japanese yen |

13.6% |

|

Pound sterling |

11.9% |

|

Canadian dollar |

9.1% |

|

Swedish krona |

4.2% |

|

Swiss franc |

3.6% |

Table 2: Weighted geometric mean of dollar in comparison to six other currencies

(Source: ICE future U.S.)

The above table shows the weighted geometric mean as calculated by the ICE US dollar index to ascertain the weighted percentage of the dollar against the six major currencies trading in the Foreign exchange market. This weighted average index for the dollar increase with an increase in the value of the US dollar.

Relation between dollar and yen

The relation between the yen and the dollar depends upon the basic factor like the changes in the interest rates in both Japan as well as US. Hence a trader having knowledge about the domestic interest rates of both the countries will be able to gain effectively from the trading of the US dollar against the Yen. The USD/JPY prices fall when there is a significant rise in the prices of the treasury bills, notes and bonds. With the increase in the interest rates the Treasury bond prices tend to fall. Hence with the fall of the US dollar price the rate of Yen increases. Hence the relation between the USD / JPY will strengthen.

The traders generally use the USD / JPY pair as a market risk determinant. For the recent three months the USD / Yen has become the most popular and closely watched currency pair. The reason behind this is the appreciating value of the yen against the dollar. (Refer to appendix H)

The chart in appendix H shows the tracking of the USD / JYP by the Standards and Poor 500 (S&P 500) from the end of the year 2012 till mid 2013. This tracking was started in the year 2012 when the new Japanese government announced the introduction of the new fiscal policy called Abenomics. The introduction of this new policy ensured that the strategies for the private investment were increased; the corrections were made to the appreciating rate of the yen and also set negative interest rates. The unemployment rate in Japan also decreased from 4.3% to 3.7%. This had a positive effect on not only the domestic economy of Japan but also a positive effect on the international economy of all the countries (businessinsider.com, 2014).

The global markets including the US market with the introduction of the new fiscal policy anticipated that additional flow of liquidity will occur in the financial markets and since Japan is the new provider of the marginal liquidity to the global markets. Hence the dollar yen exchange rate improved.

The correlation between the Dollar and the Yen shows that there exists a positive relation between both. Hence when dollar becomes stronger the Yen beats the value of all the other currencies and likewise when dollar becomes weaker value of Yen falls even more than Dollar. Hence the relation between the Yen and the dollar shows that the appreciation in the value of the dollar will never let the dollar to gain against the Yen. The value of USD / JPY reached 87.10 on the last stock market information.

The effects of the changing exchange rates may be ascertained with the help of the following example. If the values of £1 exchanges for $ 1.50 in the foreign exchange market then a product selling for £10 in UK will cost around $15 in New York. An appreciation in the value of the US dollar will make the product costlier. This is a positive sign for the UK exporters for the products which are largely traded in the US-UK market. The revenue from the US market will increase and the exporters will benefit from the same.

Again if UK imports goods from US then an appreciation in the value of the US dollar will make the product cheaper in the UK market. Hence they will have to pay low price for importing the product. Hence from the above example it can be analyzed that the changes in the exchange rates have double effect on the rate of the export as well as the import of a country. Since the revenue generated from the export and the import are the major factors for contributing economic liquidity hence the maintenance of equilibrium in both the rates are required.

In this current chapter the researcher has observed the current data from the news journals, academic books and other published journals and has analyzed the effect of the exchange rates the fluctuations in the major exchange rates and the effects of the exchange rates on the country’s economic condition. The completion of this chapter has helped the researcher to achieve the objectives as set by the researcher earlier.

Conclusion and recommendations

5.2 Conclusion

This chapter gives a reflection of the personal views of the researcher about the project topic. The conclusions stated in this chapter that the researcher has derived from conducting the research provides knowledge about whether the research was successful or not. This chapter will present the link of the research questions with the research objectives to determine the effectiveness of the projects. The chapter will also outline the conclusions that the researcher has derived from observing and analyzing of the data. Finally the chapter will present the recommendations that the research feel can be given in the context of analyzing the data.

From the analysis of the different fluctuations in the foreign exchange market the researcher has been able to analyze the effect of the changing exchange rates on the economy as well as the trading policies of the different countries. From the analysis it is seen that the Dollar is the major traded currency and hence the rising demand for the dollar has appreciated the rate of the dollar. Hence the trading between US and the other countries will depend upon the rising rates of dollars. The supply for the currencies manages the exchange rates of the currencies. Hence the Asian countries and UK needs to increase the demand for their currencies if the demand for the other currencies increase then US dollar will not be the sole controlling exchange rate in the international monetary market.

The analysis also shows that the deficit in the value of the trade, the changes in the interest and inflation rates contributes to the depreciation in the value of the currencies. Another conclusion that can be derived from the analysis is that both exports and imports of a country are affected by the change in the currency rate. Since the revenues generated from the imports and the export are the major finance provider hence the purchasing power of that country also is affected with the change in these two factors. Since the dollar trading takes around 72% of the total international financial market hence the other currencies fall short in comparison to the highly appreciating value of the dollar.

The factors which are analyzed in the research project show the effect of the changes of the fluctuations in the exchange rate of the different currencies. Hence from the analysis of the acts it can be said that an inverse relationship exists between the inflation rate and the value of the currency and a direct relationship exists between the interest rate and value of the currency. The analysis also shows that a positive relationship exists between the current account deficit and the value of the exchange rate. However according to the analysis of the political factors the rate of currency value dollar changes with the political risks. The introduction of the monetary policy in Japan changed the value of Yen negatively. Although the data shows that the ne monetary policy helps to reduce the unemployment rate in Japan however it did not led to an appreciation in the value of the Yen. Rather the value of the other currencies like the pound and the dollar were positively affected by the introduction of the new fiscal policy.

The analysis of the relations between the four major currencies namely the euro, dollar, pound and the yen shows the trading profit and loss. The inverse relation between the dollar with the pound and the euro suggests that the value of a product in UK and Europe will cost more than it costs in US. On the other hand the value of the Yen shows a higher positive relation with that of dollar. This indicates that if the value of dollar rises then the value of the yen will rise further. The relation creates an adverse impact of the economy of Japan. If the value of the Yen rises more than all other currencies then the foreign investors will anticipate a fall win the value of Yen in future and will not invest or take loans from Japan. On the other hand since the value of the Yen is high hence a product costing less in UK or US will cost more in Japan. Hence the imports and the export rates will also reduce. So this relation has a negative impact of the economy of Japan.

The researcher here has tried to link the findings of the different analysis with the stated objectives of the research to establish an effective research report.

This objective is linked with two research questions namely question number 1 and question number 5 of the qualitative analysis part. Question 1 of the qualitative analysis focuses on the ascertaining the effect of the exchange rate on the trading policies of the different countries in the international market whereas question 5 focuses on ascertaining the effect of the exchange rate fluctuations on the economic condition like the purchasing power of the country. Both the questions shows that the differences between the real exchange rate and the difference in the assumed exchange rate may create a high fluctuation in the financial market and this may not only effect the trading relations but also affect the living conditions of the country. The analysis also shows that the import and the export of a country will be affected due to the fluctuations in the currency rate. Hence the liquidity position of a particular country will decrease due to the same change. Hence the analysis of these two questions effectively attains the fulfillment of the objective.

The second objective is fulfilled in the questions number 2 and 3 of the qualitative analysis part. The relation between the stock prices and the exchange rates shows the efficiency of the different markets in terms of foreign exchange trading. The major factor to determine the effectiveness of the foreign exchange market is the efficiency of the stock market. If the stock market is in a right condition then the shares prices will increase affecting the economy of the country in a positive way. The upward trend in the US stock market shows a negative effect on the currency value. Form this it can be analysed that the currency rate needs to attain an equilibrium position for a market to be efficient. The rise in the stock market is necessary for the economy of a country to flourish however in the analysis it is seen that the rise in the stock prices will create a negative impact on the total currency value of the country. Hence this inverse relationship is hampering the efficiency of the market.

The efficiency of the market will also be affected by the economic conditions of the different types of companies. The analysis shows that the manufacturing companies are largely affected by the change in the rate of the dollar or other currencies since they have to depend largely on import and export of the goods from different parts of the world economy.

This objective has been explained with the help of qualitative question number 3 which states the three major factors and their effects as noted in the present scenario in the forex market. The analysis in this question shows the effect of the four major factors namely the effect of inflation, effect of interest rates, effect of current account deficit and effect of political factors on the fluctuation of the currency trade in different countries. For the ease of analysis the researcher has taken the US market which is one of the most flourishing market and the dollar changes as the issue of explanation.

The objective of the researcher here was to ascertain the effect of these four factors on the rate of fluctuation of the currency in the world economy. The factors were previously stated in the literature review which showed the link of the factors with the present US market scenarios. The fall in the inflation rate gives rise to an increase in the currency value. The other factors as stated in the literature review part are namely effect of the public debt; the terms of trade are not so significantly seen in the US economy.

This objective is explained with the help of the qualitative question number 4 where the researcher has taken the two most important relationships in the present day scenario to understand the global implication of the other currency rate scenarios. To satisfy this objective the researcher decide to observe the relationship between the four major currencies trading in the forex market namely the Dollar, the pound, the euro and the Yen. The relation between the mostly traded currencies helped the researcher to understand the profit or loss that the traders incur for the investment made in the different countries. The assessment showed that dollar is overvalued than most of the other currencies and the major reason for this being the high demand for the US products. Hence the value of the other currencies like the pound and the euro reduced in comparison to dollars. The yen on the other hand shows an aggressive relation with the dollar. The analysis shows that the appreciation in the value of the dollar will appreciate the value of the Yen more than the dollar. This shows the downturn in the economy of Japan.

The relation between the different currencies will help the researcher to understand which economy is feasible for investment purpose. Hence the objective behind analysis of this qualitative question is to understand the profit or loss from the viewpoint of a financial trader

The researchers after conducting the analysis of the observed facts have sorted pout few of the recommendations that would be relevant for any financial user to understand the exchange rate fluctuations. The following are the recommendations in this matter.

Firstly the high rate of appreciation in the value of the dollar needs to be reduced to make the value of the other currencies appreciate. US importers as well as exporters are gaining from the high demand of the domestic products by the other countries. This can be done if the other countries stop purchasing products from US. The demand for the product goes down and so do the currency value.

The introduction of the Buying Power maintenance Account (BPMA) under section 24 of the State Department basic authorities Act 1956 helps to control the adverse fluctuations in the forewing currency exchange rates, overseas wage and price changes by offsetting the expenses. The countries experiencing trade deficits may use the fund of this account to transfer the same to fulfil the deficit.

The factors that affect the fluctuation rates of the foreign currency should be reduced using effective monetary policies so that the US dollar rate can be made stable. The use of the balance of payment theory states that equilibrium between the demand and the supply of the currency will create stability in the currency value of the country. Hence the reduction of the inflation and interest rates and bringing of political stability will help the US economy to make the dollar value stable and the fluctuations can be avoided.

The above study is mainly based on assessment of the efficiency of the foreign exchange market and the interrelation of the different currencies in the foreign exchange market. However the scope of the project can be widened in the future by incorporating the affect of the exchange rate fluctuations on the investment decisions of the traders. The researchers in the future will have ample opportunity to analyze the present market trend and the project can be based on the assessment of the forex market from the view point of the trader and not the country or the economy.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2015). Essay On Exchange Rates' Interrelation And Fluctuations Assessment.. Retrieved from https://myassignmenthelp.com/free-samples/dissertation-what-are-the-major-currency-exchange-market-efficiency-and-interrelation.

"Essay On Exchange Rates' Interrelation And Fluctuations Assessment.." My Assignment Help, 2015, https://myassignmenthelp.com/free-samples/dissertation-what-are-the-major-currency-exchange-market-efficiency-and-interrelation.

My Assignment Help (2015) Essay On Exchange Rates' Interrelation And Fluctuations Assessment. [Online]. Available from: https://myassignmenthelp.com/free-samples/dissertation-what-are-the-major-currency-exchange-market-efficiency-and-interrelation

[Accessed 28 May 2025].

My Assignment Help. 'Essay On Exchange Rates' Interrelation And Fluctuations Assessment.' (My Assignment Help, 2015) <https://myassignmenthelp.com/free-samples/dissertation-what-are-the-major-currency-exchange-market-efficiency-and-interrelation> accessed 28 May 2025.

My Assignment Help. Essay On Exchange Rates' Interrelation And Fluctuations Assessment. [Internet]. My Assignment Help. 2015 [cited 28 May 2025]. Available from: https://myassignmenthelp.com/free-samples/dissertation-what-are-the-major-currency-exchange-market-efficiency-and-interrelation.