Functions of the Money Market

Describe about the nature of Money Market?

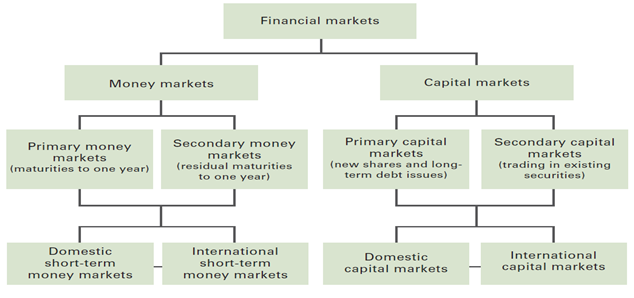

Money market is the part of the fiscal market which deals with the fiscal instruments. In the money market, it deals with short term maturities and with very much liquidity in the fiscal market. The money markets are one of the safest places to invest the money. The securities of money market is mainly content of Treasury bills, federal funds, certificate of deposits, repurchase agreements, municipal notes, bankers acceptance and commercial paper.

In this research analysis, the analyst studies the nature of the money market, the interest rates of the money market and the different strategies used during the trading by the investors in the money market.

The investors in the money market can trade in the money market. The investor in the money market can buy securities and sell securities according to the investor’s state of mind. The investors can borrow the money and can lend the money in the money market. The money market is mainly known as the short term market. This is because the trading in the money market is for a very short term period (Von Mises, 2013). The investor should trade for less than one year in the money market. If the trader in the money market traded for more than one year then, the market is known as capital market or fixed interest market.

The money market is a technique where the transfer of funds are traded and has urbanized to make the trading a muscular scale of consistency and security. The most essential function of money market is the trading of funds which is short term from the surplus units to the shortfall units.

The other function of the money market is the method of raising the fund which is in short term by the Government of the country. This is a crucial technique of implementing the financial policy of the country. It can also help in determining the structure of rate of interest of the country.

The Central Bank:

The central bank plays an important role in operating the money supply and the intensity of the rate of interest. The central bank all over the world execute on the policy, predominantly in fiscal policy. The economic policy of the Government mainly aims at the growth of economics, external balance, full employment and the stability of price (Vogel, 2010).

The commercial bank always accepts the deposits and arranges loans of the peoples and also for the companies who want to take loans from the market. It also supplies resources of funding for the Government by purchasing the securities of the Government (Schwager, 2012). It also helps in raising the funds in the companies and to the persons by straight financing.

In the money market, Investment bank also participates in trading. The participation of commercial bank in the money market by affording a wide array of fiscal forces for cost and commissions. The merchant bank always accepts the short period loans and the fixed deposits.

Major Participants in the Money Market

The finance companies always take part in various activities. One of the activities of the finance companies is to provide finance in leasing and by hire purchasing. It also takes part in investing and in the portfolio management. But finance company loves to play in long term activities mainly in the capital market (Schwager, 2012). It should also participate in the short term activities to get more finance and to control the liquidity.

There are different types of interest rates in the money market. They are:

a) The borrowing funds cost

b) The lending funds rate of interest.

c) Time value of monetary value.

d) The cost of opportunity of holding monetary value.

Interest rate is usually viewed as the price of funds that are borrowed from the lender. When the borrower borrows some amount of money from the lender, the lender gets interest on the borrowing amount. The interest paid by the borrower to the lender on certain interest rates. The interest rates are calculated on the principal amount that is the borrowing amount.

The time value of the monetary value shows the variation of money in the present value (PV) and the future value (FV) of the money (Schmidt, 2011). The variation of money is presented by the interest amount (I) paid by the borrower.

FV = PV + I

The term simple interest is also known as the flat interest. The simple interest or flat interest is calculated on the principal amount that is the borrowing amount, borrowed by the borrower from the lender (Hur, 2005). The formula of simple interest is calculated by:

I = PV * i * t

Where, i is the annual interest rate

t is the term of the investment in years

and the formula for the future value, based on simple interest can be derived as follows:

FV = PV + I

= PV + (PV * i * t)

= PV (1 + it)

Assume $200 is invested today for 6 years at 6 % simple interest:

I = PV * i * t

= 200 * 6 * 0.06

= 72

FV = PV + I

= 200 + 72

= 272

Alternatively, using the formula for the future value:

Fv = PV (1 + it)

= 200 (1 + 0.06 * 6)

= 200 * 1.36

= 272

In the money market, the technique simple interest is used if the borrowing money is less than twelve months.

Compound interest is another technique for calculating the interest amount like simple interest. The compound interest is also calculated on the principal amount that is the borrowing amount, borrowed by the borrower from the lender (Faltin, Fleischmann and Feuerle, 2013). The formula of compound interest is calculated by:

FV = PV (1 + i)t

If the compound period is more than one in the year then the equation will be,

FV = PV (1 + i/m)t * m

Interest Rates

Here, m is equal to the total number of compound periods in a year.

i / m is equal to the rate of interest per compounding period.

t * m is equal to the total number of compounding periods.

To calculate the future value in the compound interest is

FV = PV (1 + r)n

Here, r is equals to the rate of interest per compounding period

N is the total number of compounding periods.

The comparative rate is also known as the effective interest. The comparative rate of interest is calculated if the compounding period is more than one year. It is very much essential to compute the rate of interest and to compare the rate of interest with various compounding periods (Homer and Sylla, 2005). The formula used to find the Nominal and Comparative Interest Rate is:

ie = (1 + i / m)m – 1

Discount rate means the calculation of the total amount of interest paid by the borrower to the lender, which is the variation among the present value of money and the future value of the money (Alonso and Blanco, 2005). The formula used in the discount rates to calculate the interest amount:

FV = PV + I

= PV (1 + it)

The above equation can be arranged in

PV = FV / (1 + y * t)

Here, y is equal to i which is the yield or the discount rate.

The flow of cash that take place more than 1 year, then the formula can be written in:

PV = FV (1 + r) –n

= FV / (1 + r)n

The interest rate structure reflects the affiliation among the current various rate of interest in the fiscal system. The structure of interest rate is of two types. They are

a) Risky structure of rate of interest.

b) Term structure of rate of interest.

The fund suppliers always seem to be risk reluctant. It means that the point of risk of a fiscal asset is higher, then the point of return claimed by the trader of cremation is higher. The two fiscal risks which will sway the rate of return by the traders are:

a) Liquidity Risk.

b) Credit Risk or Default Risk.

Liquidity Risk: This type of risk has various prospects which depend on the traders fretful. For the trader, this type of risk should not be traded in the market. In this market, the assets cannot be traded by the investors, so the investor cannot convert the assets in to the cash.

Credit Risk: Credit risk is also known as the default risk. The default risk is the risk that the borrower cannot repay the borrowed amount to the lender (Cantwell, 2013). During the year 2007 and 2008, the house mortgage trader cannot repay the borrowed loan to the bank which causes market crash in the USA market.

The different types of strategies in the money market are mentioned below:

Interest Rate Calculations

Minimum Price Fluctuation: The minimum price fluctuation is legalized on the bottom of the swap is 1 basis point, which is appreciated at $25.

One-Month LIBOR Futures: One-month LIBOR futures starts trading on the IMM in the year 1990. The one-month LIBOR contract means the three-month Euro and dollar agreement mentioned in the research, excluding that ending settlement is based on the 30-day LIBOR. Contract decision is like Eurodollar contract for the three months, the LIBOR for one month contract is cash established. Arrangement is based on a speculative principal amount of $3 million. For one-month LIBOR futures Price Quotation and Minimum Price Fluctuation Prices are found as an index almost indistinguishable used in Eurodollar futures for three-month. The index is calculated by subtracting the 30-day futures LIBOR from 100. The smallest amount of price increased is 1 basis point.

Final settlement Price: For the one month Libor, the ending agreement price depends on the daily interest rates.

The traders should have some trading strategies. The trader can invest in the capital market in some shares, bonds or securities when the market price of the shares, bonds or securities are lower in the market (Halsey, 2013). And the trader can sell his or her shares, bonds, securities when the market price gets higher. If the trader follows this strategy while investing and selling in the market, the trader can make a profit from the investment in the capital market.

The trader should buy the shares, bonds or securities when the market price is getting down. That time the trader should go for the long position that is invest the money in the capital market. After buying the shares at a lower cost the trader should wait for the market to get into the bullish condition (Katsanos, 2008). When the market is in “Bullish” condition the trader should sell the shares and get into the short position.

When the trader invested in the capital market and the market price went high and the trader is expecting a fall in the market price, the trader can go into the short position on securities, bonds or shares in the market price to earn a profit (Katz and McCormick, 2000). And can wait for the price to go down in the market. If the market price gets down the trader can again invest the money in the capital market earn a profit.

The term spread refers to the continuous purchasing and selling of commodities like shares, bonds or securities. The main aim of the traders to gets into the spread position is to earn a profit from the portfolio made by the traders in the capital market. The difference in price between the long and short position helps the trader to generate profit (Miner, 2009).

Time spread is also known as calendar spread and horizontal spread. This is a strategy which involves the buying and selling of call options and put options with the similar strike price but having diverse date of expiration (Schmidt, 2011). If the trader enters into the time spread strategy it decreases the risk of the market.

Hedging strategy means when the traders gets into the long position or in the short position in the capital market the trader can use the hedging strategy. When the traders make the portfolio, the traders should keep in mind that from all the securities or the shares, the trader cannot earn a profit. May be the trader may run in loss while investing in the market (Tang and Li, 2007). To minimize the loss the traders should hedge their portfolio with different shares or securities so that the loss from one share gets minimize by making a profit from other securities.

Perfect hedge is a position which reduces the risk of the market from a portfolio. This perfect hedge is a position which may have hundred percent contrary correlations to its initial position (Schmidt, 2011).

Cross hedge means when the trader is in the long position or in the short position of a commodity takes an opposite position of a different commodity.

Conclusion:

From the above study, the research analyst studied the concept of money market in the financial market. The research analyst also studies the different rates of interest rate imposed in the money market. It also describes the different trading strategies of the money market which gives an idea that how to protect the investors money in the money market so that the investor cannot face loss in the investor’s investments. The rate of return of the investor is in profit situation.

References:

Barrow, C. (2013). 30 Day MBA. London: Kogan Page.

Cantwell, D. (2013). The Brewers Association's Guide to Starting Your Own Brewery. Lanham: Brewers Publications.

Faltin, G., Fleischmann, F. and Feuerle, L. (2013). Brains versus Capital. Berlin: Stiftung Entrepreneurship- Faltin Stiftung.

Halsey, D. (2013). Trading the Measured Move. Wiley.

Johnson, B. (2010). Algorithmic trading & DMA. London: 4Myeloma Press.

Katsanos, M. (2008). Intermarket trading strategies. Chichester, England: Wiley.

Katz, J. and McCormick, D. (2000). The encyclopedia of trading strategies. New York: McGraw-Hill.

Miner, R. (2009). High probability trading strategies. Hoboken, N.J.: John Wiley.

Schmidt, A. (2011). Financial markets and trading. Hoboken, N.J.: Wiley.

Schwager, J. (2012). Market wizards. Hoboken: John Wiley & Sons.

Tang, Y. and Li, B. (2007). Quantitative analysis, derivatives modeling, and trading strategies. Hackensack, NJ: World Scientific Pub.

Vogel, H. (2010). Financial market bubbles and crashes. New York: Cambridge University Press.

Von Mises, L. (2013). The Theory of Money and Credit. New York: Skyhorse Publishing, Inc.

Alonso, F. and Blanco, R. (2005). Is the volatility of the EONIA transmitted to longer-term euro money market interest rates?. Madrid: Banco de España.

Homer, S. and Sylla, R. (2005). A history of interest rates. New york: John Wiley & sons, inc.

Hur, S. (2005). Money growth and interest rates. Cambridge, Mass.: National Bureau of Economic Research.

hnique where the transfer of funds are traded and has urbanized to make the trading a muscular scale of consistency and security. The most essential function of money market is the trading of funds which is short term from the surplus units to the shortfall units.To export a reference to this article please select a referencing stye below:

My Assignment Help. (2016). Nature Of Money Market. Retrieved from https://myassignmenthelp.com/free-samples/money-market-treasury-report.

"Nature Of Money Market." My Assignment Help, 2016, https://myassignmenthelp.com/free-samples/money-market-treasury-report.

My Assignment Help (2016) Nature Of Money Market [Online]. Available from: https://myassignmenthelp.com/free-samples/money-market-treasury-report

[Accessed 30 May 2025].

My Assignment Help. 'Nature Of Money Market' (My Assignment Help, 2016) <https://myassignmenthelp.com/free-samples/money-market-treasury-report> accessed 30 May 2025.

My Assignment Help. Nature Of Money Market [Internet]. My Assignment Help. 2016 [cited 30 May 2025]. Available from: https://myassignmenthelp.com/free-samples/money-market-treasury-report.