Reason for Topic Selection

How CS as Gatekeeper enhancing Corporate Governance Standards in global organizations?

1.1 Reason for Topic Selection

The topic about How Company Secretary acts as a Gatekeeper enhancing Corporate Governance Standards in global organizations has been selected as it is evident that corporate governance practice is a complex issue which is not possible for everyone to have a control over such issue. It is known that Company Secretary, external auditors and internal auditors of the corporate governance are considered as traditional gatekeepers within the ecological unit of the corporate governance. The main role of Company Secretary is distinct from auditors in context to the corporate governance. It is understood that, today companies are involved in many serious activities which make impossible for them to look after all the operation whether relating to operation management or financial management (Abbas, 2011). Therefore, companies face lot of trouble in their affairs and finds difficulty in making conformity of their activities with the standards and procedures. Thus, the company seeks a gatekeeper that can provide them effective service in verifying and certifying the trust worthiness of organisation’s affairs. Moreover, they help in monitoring any flaws and also play effective role in detecting errors in governance standards and governance procedures. Apart from that, the company secretary or corporate secretary also effectively involved in board meetings, agenda setting and works with committees and liaise among the non executive directors and Chair directors with the management.

On the other hand, the global scenario is changing at rapid pace which is making tough for the business houses to take strong decision relating to financial matters or assessing the internal controls. The act of Company Secretary as gatekeeper can play handsome role in improving the standard of corporate governance which can help the company in decreasing the burden relating to regulatory discipline on industries along with regulators. Therefore, Company Secretary as gatekeepers can ensure quality governance. According to the report published by the KPMG Fraud Survey Report in 2009, it reflects the majority of the respondents mentioned that internal controls are the common tool in detecting fraud. Therefore, fraud in the company is a serious issue which can be control by the gatekeepers (Apostolides, 2010). The Company Secretary as gatekeepers can provide important measures that can help in controlling fraud. The Company Secretary can provide assistance to the directors of company in formulating regulations and adhering to the corporate governance standards. The Company Secretary helps the directors of the company in approving the financial statements, assessing the internal controls of the company, interpreting laws, provides advice on the quality and reliability of the disclosures and compliance state and also helps in corporate finance expertise (Armour, 2012).

The major purpose of the study is to figure out the effectiveness of company secretary as gatekeepers in enhancing the corporate governance standards in global organisations. The role of company secretary as gatekeeper will be assed in order to know their contribution in the standards of corporate governance. Therefore, to develop coherent illustration, the objective has been outlined so that study can be carried in one path.

- To understand the role of Company Secretary as a gatekeeper

- To examine the need of Company Secretary as gatekeeper in global organisations

- To understand the relationship between gatekeepers and company secretary

- To analyse the Company Secretary role in ensuring sound governance standards

Academic Objectives of project

Part 1: Introduction- The particular section will be focusing on the nature of the study and the reason behind selection of the carried topic will be discussed. The background will provide details why the particular topic has been adopted and the rationale behind it. On the other hand, the objective of the study will be outlined so that a clear understanding can be gained what exactly need to be concentrated upon.

Part 2: Scene Setting- This section will be highlighting the background of the company secretary. The secondary data will be concentrated to explain this specific part so that clear image can be received. Moreover, a brief outline will be mentioned that will help in explaining the effectiveness of Company Secretary as gatekeepers.

Part 3: Literature Review: The current section will be accounting on the major theories and concept relating to the company secretary, gatekeepers and corporate governance. Further, there specific role will be discussed. Therefore, this chapter is the main part of the study which will explain the important concepts to understand the main points of the study.

Part 4: Summary and Conclusion- This will be the last part of the proposed study which will summarize the analysis and evidence provided in the above mentioned sections. It will let us know whether the purpose of the study was fulfilled or not. Moreover, a further scope of research will be mentioned so that similar project can be handled well in future.

2.1 Background of Company Secretary and Gatekeepers

According to Bainbridge (2012), the company secretary is engaged with high responsibilities that range from the conventional role of arranging the meetings for directors, liaising with the executive directors with the management of company, developing the agenda, and working together with the committees, etc. The business landscape is transforming at rapid pace which force the company to involve the company secretary in the business decision procedure On the other hand, the growth in the expectations of the governance has changed the role of company secretary and they are not restricted to only external consultant. Therefore, the company secretary acts as a navigator to the company to develop regulation that can bring success to the institutions. Moreover, Balaji (2012) discussed that Company Secretary helps the board members of the company to remain informed about the trends and development in governance by briefing materials. Therefore, it helps in formulating effective policies and ensures that company operates within the best business practice boundary. Apart from that, Basthomi (2012) corporate secretary assists in developing innovative policies for corporate governance so that the objectives of the company can be achieved. Therefore, the demand of company secretary has increased over the years. It is evident that there has been significant rise in the employment of people as Company Secretary in Australia. For instance, New South Wales has 39.3% of Company Secretary; in Victory 23.6% is Company Secretary whereas in Queensland there is 18.3% of Company Secretary.

On the contrary, Beller, Keller and Mahoney (2012) mentioned that the gatekeepers are considered to the people working as company secretary, external auditors, internal auditors, credit rating agencies, etc. Therefore gatekeepers help in making balance in the corporate governance and act as an intermediary. Moreover, they are engaged in providing valuable service to the investors. For instance, the credit worthiness of the company can be evaluated by the credit rating agencies and business prospects can be assessed by securities analysts. The Company Secretary of the company checks the tendency of the management to concentrate on the short term income and as well as the cost of long term value of shareholder (Berthelot, Morris and Morrill, 2010). It is known that auditors are mostly engaged in working for issuers and report the details of work to the management, therefore, the investors consider gatekeepers to help them out in assessing the financial statements of the company. Apart from that, gatekeepers can help in decreasing the number of frauds relating to the corporate governance. It is evident from the published report that regulatory compliance malfunctions such as insider trading profitability and Accounting and Auditing Enforcement Release (AAER) frauds has drop down to a minimum level. Therefore, it can be understood that gatekeepers can help in monitoring the fraud and reporting it to the management so that firm regulation can be established to secure the company (Beuve and Saussier, 2011).

Outline of Sections

On the other hand, the role of company secretary is to help in providing corporate advisory work to the organisations. Therefore, it assists in enhancing standard of corporate governance and helps in forming rules and regulations so that effective decision can be enforced in context to the corporate affairs. Company Secretary as a gatekeeper can help in developing feasible process for the corporate governance that can help in setting objective and goals (Corvo and Symons, 2012). Moreover, the actions, corporation decision and policies can be monitored that can help in detecting errors which may be beneficial for the company to match up with the global institutions. Apart from that, it is known that corporate governance relates with the processes, mechanisms and associations via which the organisations are navigated (Coyne, 2010). Therefore, Company Secretary as gatekeepers can help in facilitating and promoting complete and open communication associations among the corporations and can also ensure right flow of information among board of directors, management, outside advisors and committees of the company. Further, Davis (2012) discussed that Company Secretary as gatekeepers can navigate and support the processes of governance by comprising orientation of fragmentary board education, new directors, formulating, implementing parameters and criteria in enhancing the performance of board members of the institutions.

The role of company secretary has significantly changed over the time and moreover due to growing criticality in accounting effective corporate governance has made the company secretary. The Companies Act 2014 has depicted that there is high requirement for a company secretary in both the public firms and private firms. Therefore, the responsibilities of the company secretary in the modern day has taken a leap from being only restricted to a note taker at the meetings of board members or acting as an administrative employee of Board to a much broader role of Board Advisor and significantly takes up the responsibility for the corporate governance of the organisations (David, 2014). Therefore, the role of company secretary is to provide large service to the organisations and helps in setting corporate governance standards. It is evident that today board of the company seek advice from the company secretary not only advice only on the matter relating to statutory duties of the directors under the rules and laws, listing requirements of rule and disclosure obligations but also helps in providing advice regarding corporate governance practices and requirements and also in developing effective processes for board in conducting activities (Hawkes, 2011).

Horn (2011) mentioned that the role of company secretary is not restricted to basic statutory obligations but moved away in helping organisations in various other matters. The company secretary has effectively taken the responsibility in formulating and executing the processes so that good corporate governance can be promoted and sustained in context to global organisations. The particular role is recognising the code of corporate governance of UK and also falls into Financial Reporting Council (FRC) guidance relating to board effectiveness. Apart from that, Jalilvand and Malliaris (2012) pointed that Company Secretary have considerably changed which made the directors to realise people that possess technical knowledge and specialist skills. Further, the interest of the shareholders of the organisations can be balanced by enhancing corporate governance. Moreover, it is known that corporate governance is considered as a system which comprises rules, regulations, processes and practices that assists the company in moving towards right direction and have better control over the activities (Jamali, Hallal and Abdallah, 2010).

Setting the Scene

The company secretary can be allowed to provide their support in forming effective corporate governance plan that can help in gaining higher benefit from both international and national market. Furthermore, acting as gatekeepers can prevent company from any fraud activity and can monitor the progress of processes implemented (Kirkbride and Letza, 2005). Thus, the Company Secretary as gatekeeper can help in building link between investors and issuing company and contribute largely in financial market. As a result, strong association can be established among Company Secretary and Company Secretary can provide financial advice and also direct in development of effective corporate governance (Kogut, 2012).

3.1 Gatekeeper

The author Reinier Kraakman focuses on the theory of classical gate-keeping which highlights that strategy of gate-keeping needs gatekeepers that can help in prevent and averting misconduct reliably in spite of preferences of the wrong doers (Alâ€ÂNajjar, 2010). Moreover, he mentioned that a successful gatekeeper must not be agreeable but also able to avoid misconduct. Therefore, gatekeepers must not be ready to interdict delinquency but also to monitor to identify any happenings in the prime point. Thus, it can be determined that gatekeepers role can be identified on the keenness to monitor and interdict and their capacity relating to interdict and monitor (Bonechi, 2012). Therefore, Kraakman pointed gatekeeper as an effective actor that can control and monitor any detected wrong things. The author designed a framework which describes the effectiveness of traditional gatekeepers comprising accountants, securities analysts, investment bankers, etc.

Apart from that, the author John C. Coffee who is a professor of Corporate Law propounded the reason behind the development of gatekeepers and the level of failure has been focused by the author. Moreover, he also mentioned about the reforms that may be feasible (Chen et al., 2010). Apart from that, the author examined the changes in the institutional and pressures that lead gatekeepers to neglect their responsibilities and to underperform. Therefore, he tried to focus on the effective changes that can reinstate gatekeepers as the faithful agents of the numbers of investors. On the other hand, John Coffee points that probably all the boards of directors abide to the advice given by the gatekeepers. Moreover, he mentioned that gatekeeper failure has played an effective role in aiding failure of the corporate and collapse of the corporate (Chizema and Shinozawa, 2011).

According to, Clarke and Branson (2012) a company secretary is a person that positioned usually in the public sector entity and private sector entity. The Company Secretary is also called as corporate strategy as per the public listed organisations of Canada and America. The company secretary is normally involved in efficient administration of firms and ensures compliance in regarding to regulatory requirements and statutory. Therefore, the Company Secretary makes sure that decisions made by the company’s board of directors are enforced effectively. On the other hand, Cormier et al. (2010) mentioned that company secretary takes hold that the company abide by the relevant regulation and legislation and also make the members of the board aware about the legal responsibilities so that they can perform their duties with high dignity. Moreover, they provide advice relating to the conduct of business and the advice can be of nature something like accounting advice and can also provide advice on the strategy formulation and helping in corporate planning. For instance, in public organisations in North America, the company secretary provides suggestion on the issues relating to corporate governance. Apart from that, (Elizabeth Abraham, 2012) pointed that company secretary is also involved in encouraging the members of the boards to conduct review of corporate governance on frequent basis. Therefore, it is evident that many large business houses entails that company secretary has to be well trained and professionally qualified to handle the different matters of the company.

Background of Company Secretary and Gatekeepers

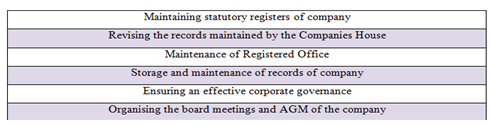

Figure 1: Role of Company Secretary

Erismann-Peyer, Steger and Salzmann (2008) explained corporate governance as a set that comprises system, principles and processes which make sure that the organisations are governed and carried in the best interest in context to company’s stakeholders. It is the structure that helps in directing and controlling the company. Therefore, corporate governance is all about promoting accountability, transparency and fairness of the corporate. Furthermore, the De Kluyver (2013) depicted that corporate governance ensures and adequate disclosures and provide effective decision making bridge that can help in attaining objective of corporate. It also provides transparency in regards to business transactions and ensures compliances relating to statutory and legal obligations. On the contrary, Dennehy (2012) discussed that corporate governance aims to ensure that board of company is highly committed in managing the different aspects of the company and that too in a transparent way in order to increase the long term value. Therefore, it can benefit to both shareholders and to the company as well. The corporate governance integrates both social participants and economic participants in the process. Moreover, the corporate governance helps in enhancing the corporate accountability and performance that helps in maintaining balance in the organisational activities (Elizabeth Abraham, 2012).

The company secretary role is highly valued in companies as it provides valuable advice to the boards on crucial matters that helps in gaining large benefit from their processes. In recent times, major changes have been acknowledged that have widely taken place in the financial market globally (Erismann-Peyer, Steger and Salzmann, 2008). Therefore, changes have been too noticed in Hong Kong which is one of the biggest stock market in world on the basis of market capitalisation of shares. Hong Kong Stock Exchange has revised their Listing Rules and Corporate Governance Code in 2012 which emphasizes that the Company Secretary is required to provide large support to the board of organisations by ensuring right and effective flow of information within the board (Cheung et al., 2011). The professional development and induction of directors are facilitated by the company secretary as per the rules of Hong Kong (Connelly et al., n.d.). Therefore, the company secretary role under Hong Kong Rules can be explained with an example,

Facts summary: Company X intended to retain Mr A as their Company Secretary after listing. Nevertheless, Mr A did not hold any specific qualifications that are mentioned under Listing Rule 8.171.

Rule 8.171 proposes that the issuer’s secretary must be a person that is typical resident in Hong Kong and that has the mandatory experience and knowledge to carry the secretary function of the issuer are:

1. In the case relating to a issuer that has already been listed on 1st December 1989 is bound to held the secretary office of the issuer on that particular date.

2. Is a associate of Hong Kong Institute of Company Secretary, a barrister or solicitor as mentioned in a professional accountant or the Legal Practitioners Ordinance.

3. Is an individual that is by rectitude of his professional or academic qualifications or applicable experience is in the verdict of the Exchange competent of discharging that functions.

Literature Review

Therefore, in the case relating to People’s Republic of China (PRC) issuer, the above requirement has been altered by Rule 19A.182 that provides as: The PRC issuer secretary must not be usually resident in Hong Kong, given that such people can convene the other obligations of Rule 8.171 (Hilb, 2012).

The company secretary caters an effective role in the issuer’s corporate governance; more importantly assist the issuer as well as the directors of issuer to act in accordance with Listing Rules and the company law applicability. Therefore, for the given case, the person has to possess required experience, skills and knowledge to operate the functions as an impressive company secretary.

On the other hand, the note relating to Rule 19A.182 points out a non-exhaustive record of factors that the Exchange will consider for determining the significant experience of a intended Company Secretary of a PRC issuer. Further, the person does not hold a professional qualification that is needed in Rule 8.17(2)1. The factors can comprise the employment period relating to the PRC issuer and the person acquaintance with the Listing Rules (Horn, 2011). Moreover, it is known that PRC issuer does not carry any work in Hong Kong and also the management of issuer does not inhabit in Hong Kong. Apart from that, the Company Secretary of issuer should have enough knowledge in disbursing their function. Furthermore, if the company secretary does not compose required professional qualifications under Rule 8.17(2)1 and Rule 8.17(3)1, for protecting shareholders and promoting corporate governance, then Company Secretary need to be guided by the qualified person so that the person can meet the criteria of Rule 8.17(3)1. Therefore, as per the proposed example, Mr A can operate his operation as Company Secretary of Company X after listing given that an extra person has been engaged by Company X that possess the professional qualifications which is mentioned in Rule 8.17(2)1 for the period of three-year.

Apart from that, the role of company secretary in Hong Kong is linked with the direction, administration, governance and management of the industry. Moreover, the Company Secretary is not only engaged in interacting with shareholders, directors and managers of companies but they are also effectively involved in working with government (Jalilvand and Malliaris, 2012).

The role of the company secretary under the rule of UK is composed of advising on governance cause to the board, playing an active role as a communication and information channel for autonomous directors and helping the chairman by offering training and induction for directors. They also help in producing meeting minutes and papers of the committees and board. Therefore, the major duty is to maintain statutory registers (Hawkes, 2011). For instance, in public limited companies of UK, the role of Company Secretary is highly valued as the work of public limited requires developing statutory obligations that can benefit the company. Moreover, the Company Secretary is responsible for making sure that the organisations follow the standard legal and financial practice and helps in maintain corporate governance standards. On the other hand, the Company Secretary is engaged in building strong communication (Zhang, 2012). For example, the Company Secretary of UK is effectively involved in making a communication channel among the shareholders and board members so that interest of shareholders can be protected.

Summary and Conclusion

Apart from that, in UK rules, there is no other firm specification for the Company Secretary in private company in United Kingdom unless the articles of association of company state.

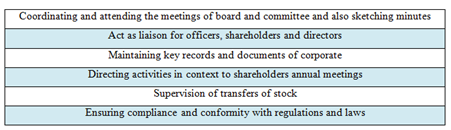

Figure 2: Role of COMPANY SECRETARY under UK Rules

On the other side, the role of company secretary has really not well defined in US context. Therefore, the US does not include any legally needed qualifications relating to the duties that are required by Company Secretary to perform function. Apart from saying that, the Companies Act of India has a slight relevancy in the US which describes the role of Gatekeeper. Therefore, the Company Secretary role in US can be explained as below:

Figure 3: COMPANY SECRETARY role under US Rules

Apart from that, Company Secretary is also involved in agenda setting. For instance, for agenda setting, company secretary closely work with the HR, CEO, accounting, investor relations, lead director, legal, etc in creating and revising agenda for ensuring compliance with Federal, listing, state and other obligations (Velayutham, 2013). Moreover, the Company Secretary is allowed to give their suggestions on different matters of the company. For example, company secretary role in banks is to help them in maintain healthy relationship with investors, stakeholders and regulators and assists the directors of bank to fully contribute after and at meetings (Veasey and Guglielmo, 2012). Moreover, they provide advice on the new regulatory and legal responsibility to the bank’s board.

The company secretary as a gatekeeper can largely help the organisations in improving corporate governance. Therefore, the company secretary may need to understand the process of organisations so that the board can be guided to develop an effective statutory regulation and follow them. Moreover, the practices of corporate governance should be known by Company Secretary in order to navigate the board members of company (Tew, 2011). Gatekeeper theory can be useful in explaining how Company Secretary can effectively perform the role of gatekeeper.

According to gate-keeping theory, gate keeping is concerned with blocking any useless or unwanted materials through employing gate so that corporate system can be protected. Therefore, company secretary has to initially decide that what kind of information has to be delivered to the board and what type of information has to be blocked (Tricker, 2012). Thus, the Company Secretary can act as decision makers that can provide direction to board in enhancing corporate governance. The Company Secretary has to provide information by employing their personal knowledge and experience so that best guidance can be catered that can help in protecting the interest of the shareholders of the organisations. Therefore, this would help in eliminating any sensible, controversial and unwanted from the standard of corporate governance and right path can be directed to board of directors (Szewczak, Ziomkiewicz and Jasiński, 2011).

Company Secretary receives information from the corporate world about the corporate governance that can be applied in the corporate governance standards. Therefore, company secretary reject some information due to the policy of organisations (Mukti and Wardhani, 2012). For instance, the Company Secretary can provide advice to the company to acknowledge legislation changes and complying with laws and regulations of international market. Therefore, it will help in setting and forming good corporate governance standard. On the other hand, the Company Secretary will block all the information that is harmful for the company and Company Secretary should block the unfaithful person from the board meetings as he/she can disclose the strategy to other company (Nietsch, 2005). Thus, in this way the company secretary can be successful in carrying the job of gatekeeper and helping company in setting corporate governance.

The company secretary can play impressive role in disclosure compliance program of the company. Therefore, to take up the responsibility of disclosure, the Company Secretary many need to maintain and monitor the compliance in context to incessant disclosure policy (Rasche, 2010). Moreover, the Company Secretary may have to maintain a link between the board, reporting officers and Listing Rules of the Securities Exchange bodies. The company secretary has to coordinate education in the system of company regarding the disclosure obligations and also about the compliance program of disclosure. The analysts, media, public, shareholders and brokers have to be informed about the disclosure program. The COMPANY SECRETARY seeks permission from the directors to take disclosure role so that corporate governance can be enhanced (Renders, Gaeremynck, and Sercu, 2010).

The disclosure role can be better explained through disclosure based regulations which concentrates on the information quality that is disclosed by the issuers. Under the regulation, it is required that the issuer has to make entire disclosure of the company’s affair to the shareholders and investor (Rheeder, 2012). Therefore, it is then the responsibility of the investors to take investment decision. On the other hand, the regulator is involved in designing and enforcing framework which can allow parties to fairly negotiate among each other but do not intervene in the relationship of investor and issuer. Moreover, the regulation commands disclosure but do not concern about the disclosure substances (Riley, 2012). Therefore, the company secretary has to follow the disclosure based regulations to provide crystal information about the company’s process and standard of corporate governance. It gave rise to fraud and interest of the stakeholders was not protected (Seth, 2012). Therefore, the Company Secretary of the company proposed disclosure based regulation which helped in providing complete information about the company’s policy and corporate governance standards to the stakeholders and shareholders.

The Company Secretary role is crucial and Company Secretary not only acts as a bridge among the organisation’s board, government, stakeholders and regulatory bodies but also takes up the responsibility in upholding records, advising board, endorsing legal obligations and communicating with the officials (Tricker, 2012). On the other hand, before taking up the role of Company Secretary, the person goes through exams and become member of Company Secretary, etc (Veasey, and Guglielmo, 2012). The company secretary also focus on guiding organisations to comply with the set corporate governance so that adopted process can be implemented and large benefit can be accumulated. Moreover, the company secretary helps in accounting the accountant, solicitor and auditor of the company in the board meetings. Apart from that, Velayutham, (2013) pointed that company secretary warn the directors about any relevant that can affect the company. On the other hand, company secretary can direct the board to meet the legal obligations and requirements and can be largely involved in preparing and issuing of proxy statements and also the documentation that may be linked with the yearly shareholders meeting (Wallace, 2012). Therefore, the company secretary can act as a channel among the senior management and directors. As a result, the company can ensure effective corporate governance that can help company to operate successfully in global scenario.

According to Zhang, (2012), company secretary is highly engaged in managing the logistic Company Secretary of committee and board meeting. Moreover, they provide advice on the roles and responsibilities to the board. The Company Secretary also helps in managing process of the company relating to the yearly shareholder meeting. On the other hand, Company Secretary facilitates the new directors’ orientation and guide in training and development t of director.

The gatekeeper helps in checking the tendency of the management in order to concentrate on the short term gains at the value of long term shareholders’ cost (Zubaidah Zainal Abidin, and Ali Shah Hashim., 2010). Further, they report to the company about any fraud or any error that may occur in the corporate governance standard (Wu, 2012).

Part 4: Summary and Conclusion

From the entire study, it can be summarised that the role of company secretary is highly valued in the industries. The growing complexity in the market and number of frauds taking in place, the company secretary role has extended to gatekeepers that help in reporting the organisations about any misconduct. Moreover, if any member of the company is not abiding with the corporate governance standards then the company secretary can report it to the board of directors of the organisations. The role of COMPANY SECRETARY has increased in number and it is not only limited to concentrate on the administrative part but it has enlarge to handle the corporate governance matters so that organisation can gain corporate success. On the other hand, the company secretary takes most crucial tasks of the company and directing the company to carry responsibilities in effective way. Apart from that, study has discussed that company secretary act as a vital part in building strong relationship among the investor of company and board of the company. Thus, it is effective in ensuring best practice of corporate governance. Moreover, following and catering corporate governance standards then it can protect the interest of the shareholders and company can register higher growth and can penetrate to other market either internationally or nationally.

Apart from that, the study also focused highly on the gatekeepers’ role in ensuring that company is best managed and directed as per the standards of corporate governance. The gatekeepers ensure that important or confidential information of the company is not handed to any unauthorised person that may belong outside of the company system. Therefore, gatekeeper can monitor or track any mismanagement and provide information about it corporate and it can help the corporate in taking important decisions. The gatekeeper takes account only that information that is valuable for the company as it helps the company in accounting best corporate governance guidelines. Therefore, it can be summarised from the role of company secretary and gatekeepers that both highly concentrate on enhancing corporate governance. Moreover, it can be said that Company Secretary will be much effective in their approach, acting as a gatekeeper. As a result, corporate firm can carry their activities according to the desires of stakeholders and thus corporate governance can help in shaping performance of the corporation.

On the other hand, it can be concluded from the study that purpose of the study was met and role of Company Secretary as gatekeeper has been effectively discussed. On the other side, the company secretary role under the rule of Hong Kong, UK and US has been outlined with the appropriate examples. It helped in understanding the specific role that is followed in different nations and their scope in taking up the duties. However, it is understood that responsibility of the corporate secretary is moreover same and takes care that corporate governance is followed in expected manner. Moreover, gate-keeping theory has outlined in the study which tells about how gatekeepers block the unwanted or irrelevant materials from the corporate governance criterion. Therefore, Company Secretary as gatekeepers can help organisation in performing well and adhering to set policy and standards. The disclosure based regulation is effective in understanding the act of Company Secretary and disclosing the information to the boards and shareholders.

The study on the role of CS and gatekeeper in enhancing and improving corporate governance standards was effective on my intellectual part. I learned that activities of organisation has become complex and it is not easy for the company to only seek support from CS in matters only relating to preparing reports and other financial activities. Moreover, I learned that today CS act as a gatekeeper to protect the industry from any fraud or any serious errors that can hamper the productivity and their business prospects. Therefore, I found that CS not only helps in financial matters but also helps in providing legal advice or regulatory advice to the board participants of the organisation. On the other hand, I had a great experience to study the different role performed by the both CS and gatekeepers to promote and make sure that members of the company abide the formulated corporate governance standards. Apart from that, I also understood through my study that gatekeeper plays an effective part as an intermediary in order to make right balance in the statutory obligations and corporate governance so that business operations can be carried in global scale with higher effect. I was very much pleased with the outcome of the study as I was able to know what particular job is performed by a gatekeeper in context to the corporate governance obligations of an organisation. On the other side, I came to know that company secretary role is moreover same under the rules of HK, US and UK. Furthermore, I also learnt that CS also acts as a communication medium between the board of directors and shareholders so that interest and right of the shareholders can be protected.

On the other hand, I faced some difficulties too in gathering the required information due to the limitation of time. I was not able to acquire more information that would enhance the study. Apart from that, as the study is purely based on secondary data, I was not able to have a real data from the various CS and gatekeepers of the company otherwise it would have improved my study to large extent. On the contrary, I am pleased with my study that it has shaped; I got to learn many things relating to CS and their part in corporate governance standard and how they help and advise the board to take premier and productive decision. Therefore, I can say that the particular study provided great knowledge that I would use in other similar project. Further, I used gate-keeping theory and disclosure based regulation which provided great assistance to know the activities of gatekeepers and CS’s act in disclosing information to the shareholders of the organisations and board of the organisation. Moreover, I learnt that CS today effectively takes up the role of gatekeepers so that they can monitor any wrong act and alert the company to take best decision and adopt protective measures before any crime could take place. Therefore, the study helped me to enhance my knowledge and have deep understanding about the relationship between CS and gatekeepers.

References

Abbas, E. (2011). The Seven Gatekeepers, Guardians, and Reporters in The Book of the Two Ways and in P. MMA 35.9.21. Abgadiyat, 6(1), pp.68-75.

Adegbite, E. (2012). Corporate governance regulation in Nigeria. Corporate Governance: The international journal of business in society, 12(2), pp.257-276.

Ahmed Sheikh, N. and Wang, Z. (2012). Effects of corporate governance on capital structure: empirical evidence from Pakistan. Corporate Governance: The international journal of business in society, 12(5), pp.629-641.

Alâ€ÂÂNajjar, B. (2010). Corporate governance and institutional ownership: evidence from Jordan. Corporate Governance: The international journal of business in society, 10(2), pp.176-190.

Apostolides, N. (2010). Exercising corporate governance at the annual general meeting. Corporate Governance: The international journal of business in society, 10(2), pp.140-149.

Appleton, N. (2011). Letter from the UKABS Membership Secretary. brsv, 28(1).

Armour, D. (2012). The ICOMPANY SECRETARYA company secretary's handbook. London: ICOMPANY SECRETARYA.

Bainbridge, S. (2012). Corporate governance after the financial crisis. New York: Oxford University Press.

Balaji, M. (2012). The Construction of “Street Credibilityâ€Â in Atlanta's Hip-Hop Music Scene: Analyzing the Role of Cultural Gatekeepers. Critical Studies in Media Communication, 29(4), pp.313-330.

Basthomi, Y. (2012). Ambivalences: Voices of Indonesian Academic Discourse Gatekeepers. English Language Teaching, 5(7).

Beller, A., Keller, S. and Mahoney, C. (2012). 44th annual Institute on Securities Regulation. New York, N.Y.: Practising Law Institute.

Berthelot, S., Morris, T. and Morrill, C. (2010). Corporate governance rating and financial performance: a Canadian study. Corporate Governance: The international journal of business in society, 10(5), pp.635-646.

Beuve, J. and Saussier, S. (2011). Interfirm cooperation in strategic relationships: the role of formal contract. Industrial and Corporate Change, 21(4), pp.811-836.

Bonechi, M. (2012). More on the Ebla gatekeepers. Revue d'assyriologie et d'archéologie orientale, 106(1), p.33.

Bruce, M. (2012). Rights and duties of directors. Haywards Heath: Bloomsbury Professional.

Chen, W., Chung, H., Hsu, T. and Wu, S. (2010). External Financing Needs, Corporate Governance, and Firm Value. Corporate Governance: An International Review, 18(3), pp.234-249.

Chen, Y. (2012). Identifying key disseminators in social commerce. [Austin, Tex.: University of Texas.

Cheng, S. and Firth, M. (2005). Ownership, Corporate Governance and Top Management Pay in Hong Kong. Corporate Governance, 13(2), pp.291-302.

Cheung, Y., Connelly, J., Jiang, P. and Limpaphayom, P. (2011). Does Corporate Governance Predict Future Performance? Evidence from Hong Kong. Financial Management, 40(1), pp.159-197.

Chiappetta, F. and Tombari, U. (2012). Perspectives on Group Corporate Governance and European Company Law. European Company and Financial Law Review, 9(3).

Chizema, A. and Shinozawa, Y. (2011). The ‘Company with Committees’: Change or Continuity in Japanese Corporate Governance?. Journal of Management Studies, 49(1), pp.77-101.

Clarke, T. and Branson, D. (2012). The SAGE handbook of corporate governance. London: SAGE.

Connelly, J., Limpaphayom, P., Cheung, S. and Jiang, P. (n.d.). Corporate Governance and Stock Returns in Hong Kong: Carrots or Sticks?. SSRN Journal.

Cormier, D., Ledoux, M., Magnan, M. and Aerts, W. (2010). Corporate governance and information asymmetry between managers and investors. Corporate Governance: The international journal of business in society, 10(5), pp.574-589.

Corvo, T. and Symons, H. (2012). Broadband and cable industry law, 2012. New York, N.Y.: Practising Law Institute.

Coyne, I. (2010). Accessing children as research participants: examining the role of gatekeepers. Child: Care, Health and Development, 36(4), pp.452-454.

David, P. (2014). AbdulRasheed and ToruYoshikawa (Eds.), The Convergence of Corporate Governance: Promise and Prospects, Palgrave Macmillan, Basingstoke, 2012, ISBN 9780230297463, 296 pp. Corporate Governance: An International Review, 22(1), pp.70-71.

Davis, P. (2012). Reâ€ÂÂthinking the role of the corporate sector in international development. Corporate Governance: The international journal of business in society, 12(4), pp.427-438.

De Kluyver, C. (2013). A primer on corporate governance. [New York, N.Y.] (222 East 46th Street, New York, NY 10017): Business Expert Press.

Death of the Society's Company Secretary and Membership Secretary M. P. J. Garvey FCA. (2012). The Mariner's Mirror, 98(2), pp.133-133.

Dennehy, E. (2012). Corporate governance - a stakeholder model. International Journal of Business Governance and EthiCompany Secretary, 7(2), p.83.

Elizabeth Abraham, S. (2012). Information technology, an enabler in corporate governance. Corporate Governance: The international journal of business in society, 12(3), pp.281-291.

Erismann-Peyer, G., Steger, U. and Salzmann, O. (2008). The insider's view on corporate governance. Basingstoke [England]: Palgrave Macmillan.

Esa, E. and Anum Mohd Ghazali, N. (2012). Corporate social responsibility and corporate governance in Malaysian governmentâ€ÂÂlinked companies. Corporate Governance: The international journal of business in society, 12(3), pp.292-305.

Flanagan, P. and Wall, C. (2012). Coping with U.S. export controls, 2012. New York, N.Y.: Practising Law Institute.

Gallo, A., Weijer, C., White, A., Grimshaw, J., Boruch, R., Brehaut, J., Donner, A., Eccles, M., McRae, A., Saginur, R., Zwarenstein, M. and Taljaard, M. (2012). What is the role and authority of gatekeepers in cluster randomized trials in health research?. Trials, 13(1), p.116.

Giuliani, E. (2011). Role of Technological Gatekeepers in the Growth of Industrial Clusters: Evidence from Chile. Regional Studies, 45(10), pp.1329-1348.

Gladson Nwokah, N. and Ahiauzu, A. (2010). Marketing in governance: emotional intelligence leadership for effective corporate governance. Corporate Governance: The international journal of business in society, 10(2), pp.150-162.

Goergen, M. (2012). International corporate governance. Harlow, England: Pearson.

Graf, H. (2010). Gatekeepers in regional networks of innovators. Cambridge Journal of EconomiCompany Secretary, 35(1), pp.173-198.

Graf, H. and Krüger, J. (2011). The Performance of Gatekeepers in Innovator Networks. Industry & Innovation, 18(1), pp.69-88.

Groce, L. (2012). The use of words by school counselors.

Haspeslagh, P. (2010). Corporate governance and the current crisis. Corporate Governance: The international journal of business in society, 10(4), pp.375-377.

Hawkes, N. (2011). England's health secretary faces increasing isolation. BMJ, 342(may10 3), pp.d2947-d2947.

Hilb, M. (2012). New corporate governance. Berlin: Springer.

Horn, L. (2011). Corporate Governance in Crisis? The PolitiCompany Secretary of EU Corporate Governance Regulation. European Law Journal, 18(1), pp.83-107.

Jalilvand, A. and Malliaris, A. (2012). Risk management and corporate governance. New York: Routledge.

Jamali, D., Hallal, M. and Abdallah, H. (2010). Corporate governance and corporate social responsibility: evidence from the healthcare sector. Corporate Governance: The international journal of business in society, 10(5), pp.590-602.

Jansson, A. and Larsson-Olaison, U. (2010). The Effect of Corporate Governance on Stock Repurchases: Evidence from Sweden. Corporate Governance: An International Review, 18(5), pp.457-472.

Jian, Z., Tingting, Z. and Shengchao, C. (2011). Cross listing, corporate governance and corporate performance. Nankai Business Review International, 2(3), pp.275-288.

Judge, W. (2010). Corporate Governance Mechanisms Throughout the World. Corporate Governance: An International Review, 18(3), pp.159-160.

Judge, W. (2010). Thomas Kuhn and Corporate Governance Research. Corporate Governance: An International Review, 18(2), pp.85-86.

Judge, W. (2012). Anglo-American versus Asian Corporate Governance Environments. Corporate Governance: An International Review, 20(4), pp.335-336.

Judge, W. (2012). Relation-based Versus Rule-Based Governance Systems. Corporate Governance: An International Review, 20(5), pp.411-412.

Karim, M. (n.d.). Relationship between Corporate Culture and Organizational Effectivenss: A Case Study on Zain Telecommunication Limited. SSRN Journal.

Khongmalai, O., Tang, J. and Siengthai, S. (2010). Empirical evidence of corporate governance in Thai stateâ€ÂÂowned enterprises. Corporate Governance: The international journal of business in society, 10(5), pp.617-634.

Kirkbride, J. and Letza, S. (2003). Corporate Governance and Gatekeeper Liability: the lessons from public authorities. Corporate Governance, 11(3), pp.262-271.

Kirkbride, J. and Letza, S. (2005). Can the Non-executive Director be an Effective Gatekeeper? The Possible Development of a Legal Framework of Accountability. Corporate Governance: An International Review, 13(4), pp.542-550.

Kogut, B. (2012). The small worlds of corporate governance. Cambridge, Mass.: MIT Press.

Krieger, G. (2012). Corporate Governance und Corporate Governance Kodex in Deutschland. Zeitschrift für Unternehmens- und Gesellschaftsrecht, 41(2-3).

Lagner, T. and Knyphausen-Aufseß, D. (2012). Rating Agencies as Gatekeepers to the Capital Market: Practical Implications of 40 Years of Research. Financial Markets, Institutions & Instruments, 21(3), pp.157-202.

Lam, T. and Lee, S. (2012). Family ownership, board committees and firm performance: evidence from Hong Kong. Corporate Governance: The international journal of business in society, 12(3), pp.353-366.

Lassoued, N. and Elmir, A. (2012). Portfolio selection: does corporate governance matter?. Corporate Governance: The international journal of business in society, 12(5), pp.701-713.

Law, P. (2011). Audit regulatory reform with a refined stakeholder model to enhance corporate governance: Hong Kong evidence. Corporate Governance: The international journal of business in society, 11(2), pp.123-135.

Mahony, P. (2012). Corporate secretaryship in southern Africa. Johannesburg: Chartered Secretaries Southern Africa.

Maltby, J. (2008). Book review: Gatekeepers: the Professions and Corporate Governance: John C. Coffee Jr. Oxford University Press, Oxford, 2006. Accounting History, 13(3), pp.383-386.

McLeod, J. (2007). Gatekeepers: The Professions and Corporate Governance. Records Management Journal, 17(2).

Mistry, H. and Toppin, P. (2011). Gatekeepers of Science and Society. Science Signaling, 4(182), pp.eg6-eg6.

Mukti, A. and Wardhani, R. (2012). Corporate Governance Mechanism, Audit Quality and Accrual Quality (Indonesia Manufacturing Company Evidance). iamure.ijbm, 3(1).

Munari, F., Sobrero, M. and Malipiero, A. (2011). Absorptive capacity and localized spillovers: focal firms as technological gatekeepers in industrial districts. Industrial and Corporate Change, 21(2), pp.429-462.

Nietsch, M. (2005). Corporate Governance and Company Law Reform: a German perspective. Corporate Governance: An International Review, 13(3), pp.368-376.

Ntim, C., Opong, K. and Danbolt, J. (2011). The Relative Value Relevance of Shareholder versus Stakeholder Corporate Governance Disclosure Policy Reforms in South Africa. Corporate Governance: An International Review, 20(1), pp.84-105.

Ponton, D. (2011). Getting Past the Gatekeepers: Membership and Identity in 5-Live’s ‘World Football Phone-in’. Brno Studies in English, 37(1).

Rasche, A. (2010). Collaborative Governance 2.0. Corporate Governance: The international journal of business in society, 10(4), pp.500-511.

Ratner, M. (2012). The gatekeepers of effectiveness. Nat Biotechnol, 30(6), pp.482-484.

Renders, A., Gaeremynck, A. and Sercu, P. (2010). Corporate-Governance Ratings and Company Performance: A Cross-European Study. Corporate Governance: An International Review, 18(2), pp.87-106.

Rheeder, L. (2012). The evolution of the role of company secretary in South African company law.

Rice, D. (n.d.). Gatekeepers or Ratifiers? Selective Memory and the Role of Superdelegates in the Democratic Presidential Nomination Process. SSRN Journal.

Riley, C. (2012). Company Law Whither UK corporate governance?. ac, 1997(1).

Rothenberg, S. and Levy, D. (2011). Corporate Perceptions of Climate Science: The Role of Corporate Environmental Scientists. Business & Society, 51(1), pp.31-61.

Sarkar, J. and Sarkar, S. (2012). Corporate governance in India. New Delhi, India: SAGE Publications.

Seth, V. (2012). The East India Company--A Case Study in Corporate Governance*. Global Business Review, 13(2), pp.221-238.

Shin, T. (2012). The Corporate Objective - By Andrew Keay. Corporate Governance: An International Review, 20(5), pp.509-510.

Spitzeck, H. and Hansen, E. (2010). Stakeholder governance: how stakeholders influence corporate decision making. Corporate Governance: The international journal of business in society, 10(4), pp.378-391.

Sun, L. and Tobin, D. (2005). International Listing as a Mechanism of Commitment to More Credible Corporate Governance Practices: the case of the Bank of China (Hong Kong). Corporate Governance, 13(1), pp.81-91.

Szewczak, A., Ziomkiewicz, I. and Jasiński, M. (2011). PERSPECTIVES Hiring cell gatekeepers – ABC transporters in plant biotechnology. bta, 2, pp.132-139.

Tew, K. (2011). NrF2/Keap1 as gatekeepers of redox homeostasis - do they prevent or cause cancer?. Pigment Cell & Melanoma Research, 24(6), pp.1078-1079.

Tricker, R. (2012). Corporate governance. Oxford: Oxford University Press.

Vasudev, P. and Watson, S. (2012). Corporate governance after the financial crisis. Cheltenham, UK: Edward Elgar.

Veasey, E. and Guglielmo, C. (2012). Indispensable Counsel. Oxford: Oxford University Press, USA.

Velayutham, S. (2013). Governance without boards: the Quakers. Corporate Governance: The international journal of business in society, 13(3), pp.223-235.

Vitaliano, D. (2010). Corporate social responsibility and labor turnover. Corporate Governance: The international journal of business in society, 10(5), pp.563-573.

Wallace, S. (2012). The ICOMPANY SECRETARYA Company Secretary's Troubleshooter. London: ICOMPANY SECRETARYA Pub.

Wansink, B. (2011). Empowering Nutrition Gatekeepers: The Parents. Journal of Nutrition Education and Behavior, 43(5), p.307.

Wu, R. (2012). Does Corporate Governance Quality Lend Credibility to Open-Market Share Repurchase Announcements?. Corporate Governance: An International Review, 20(5), pp.490-508.

Yan Lam, T. and Kam Lee, S. (2008). CEO duality and firm performance: evidence from Hong Kong. Corporate Governance: The international journal of business in society, 8(3), pp.299-316.

Zhang, L. (2012). Board demographic diversity, independence, and corporate social performance. Corporate Governance: The international journal of business in society, 12(5), pp.686-700.

Zheng, V. and Ho, T. (2012). Contrasting the evolution of corporate governance models: A study of banking in Hong Kong. Asia Pacific Business Review, 18(3), pp.407-423.

Zubaidah Zainal Abidin, and Ali Shah Hashim., (2010). Corporate governance. Shah Alam: Penerbit Universiti, Universiti Teknologi MARA.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2016). CS As Gatekeeper Enhances Corporate Governance Standards In Global Organizations Essay.. Retrieved from https://myassignmenthelp.com/free-samples/activity-of-company-secretary-in-enhancing-corporate-governance.

"CS As Gatekeeper Enhances Corporate Governance Standards In Global Organizations Essay.." My Assignment Help, 2016, https://myassignmenthelp.com/free-samples/activity-of-company-secretary-in-enhancing-corporate-governance.

My Assignment Help (2016) CS As Gatekeeper Enhances Corporate Governance Standards In Global Organizations Essay. [Online]. Available from: https://myassignmenthelp.com/free-samples/activity-of-company-secretary-in-enhancing-corporate-governance

[Accessed 31 May 2025].

My Assignment Help. 'CS As Gatekeeper Enhances Corporate Governance Standards In Global Organizations Essay.' (My Assignment Help, 2016) <https://myassignmenthelp.com/free-samples/activity-of-company-secretary-in-enhancing-corporate-governance> accessed 31 May 2025.

My Assignment Help. CS As Gatekeeper Enhances Corporate Governance Standards In Global Organizations Essay. [Internet]. My Assignment Help. 2016 [cited 31 May 2025]. Available from: https://myassignmenthelp.com/free-samples/activity-of-company-secretary-in-enhancing-corporate-governance.