Inflation and Unemployment: An Analysis of Relationship between Them

(a) Explain whether there is a relationship between inflation and unemployment. Should government interfere and reduce inflation and unemployment? Provide real life examples.

(b) Using your home country as a case study outline and analyse inflation, unemployment and growth trends. Identify what range of the aggregate supply curve your country is operating in.

(c) Explain how monetary policy can influence an economy, including the exchange rate and employment levels.Economic analysis requires the consideration of various important factors such as the performance of inflationary situation within the economy, unemployment situation as prevalent with it etc. These factors indicate about the ways in which an economy is performing and their consideration would allow for an analysis of the direction towards which the economy is heading. Although these economic indicators have direct level of impact over the performance of an economy, yet they have significant level of interrelationships between them. As such, it is essential to perform an analysis of the existence of relationship between these important economic indicators. This report involves a critical analysis of these important economic indicators such as inflation and unemployment and also the existence of relationship between them. As a part of analysing the relationship between these factors, this report also includes an analysis of whether there should be any interference of government in the process of managing the inflation and unemployment levels across the economy. This is followed by an analysis would be carried out in relation to these economic indicators with regard to their performance in the home country. The analysis of the ways in which monetary policy affects the performance of an economy would also be carried out. The analysis in the report therefore resolves around these factors of inflation and unemployment and their impact over the performance of the entire economy.

Inflation and unemployment are identified as crucial factors indicating the performance of an economy. These concepts represent different meaning and they affect the economic performance in a different way. As for instance, an analysis of the concept of inflation indicates that it is an important concept that indicates the pricing level of products and services which is generally higher and it thereby reduces the purchasing power of people in general. As a result of inflation, people are required to pay more for the same unit of products and services which they could have purchased earlier. The purchasing power of people therefore gets lowered as a result of inflationary situation and this therefore affects their overall ability to buy consumption related activities. Inflation affects the performance of the economy in both the positive as well as negative way. Unemployment on the other hand is another important concept that indicates the employed people and unemployed people in an economy. Unemployment condition is therefore a situation which represents the people that remain unemployed or do not get any jobs. They are usually in search of jobs but their non accessibility to any job situation affects the performance of the economy in a negative way (Gordon, 2004).

Examples of the Relationship between Inflation and Unemployment

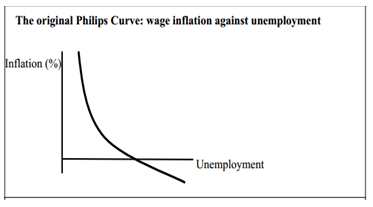

An analysis of the existence of relationship between these important concepts implies that there has been the existence of certain major relations between them and this relationship affects the ways in which they affects the performance of the entire economic conditions. The relationship is better identified between inflation and unemployment through the application of Phillips curve which has been an important development by A.W. Philips and this tool indicates the existence of relationship between these two important economic indicators. The theory was developed by Phillips in 1958 and it involved the collection of data with respect to the wage level changes for a certain period of time. The collected data has been analysed and it has resulted into identification that there is trade off between the economic indicators such as unemployment and inflation levels and there has been the identification of inverse relationship between these two economic indicators. The existence of such inverse relationship suggests that with the decrease in one particular factor, there would be an increase in the other. As for example, an increase in the inflation would contribute negatively and results into a decline in the unemployment levels across the economy. This signifies the existence of negative relationship between the important elements of economic performance (Gowland, 1991). Philips curve explains the existence of this relation through the diagram as indicated below:

There has been the negative relationship between unemployment and inflation as revealed by the Philips curve above. This shows that with the increase in one factor, there is likely decrease being identified over others. There can be different types of examples that could be applied in explaining this phenomenon of inverse relationship between unemployment and inflation rates in the economy. As for example, a decline in the unemployment rates is an indicator of employee empowerment and they in turn has the better opportunity of demanding higher wage rates from them employer. This example gives an indication of how the inflation and unemployment condition is related to each other. The overall activities that are carried out in an economy at the time of recession are generally lower, but there has been an increase in the demand levels from the economy back into its normal position. The increase in the demand as a result of rise in the momentum provides employees with the opportunity of claiming higher wage rates (Lindauer, 2013).

As a result of such higher wage rates that are provided to employees of the organisation, there has been a rise in the prices being charged to the customers for all the products and services offerings. Such higher rates are charged in order to achieve a proper balance in respect to higher wage rates that have been offered to employees. This higher price for the products and services allows the organisation in compensating against the higher wage rates that are offered by them to their customers. However, such higher prices as charged tend to increase the overall pricing level in the economy and the resulting impact is inflationary conditions within the performance of entire economy. This indicates the existence of relationship between unemployment and inflation whereby lower inflation rates contributes in a positive way towards higher inflationary conditions and vice versa. But this existence of relationship between inflation and unemployment is generally of short term in nature, and this is not at all evident in respect to the long run. The unemployment conditions in the long run achieve back its normal rates and as a result, there is no any relationship being identified in respect to them (Solow and Taylor, 1999).

Government Intervention: Should It Be Done?

Another major feature that explains the existence of relationship between inflation and unemployment conditions in an economy is the production bottlenecks. The levels of productions that are maintained in an economy are the important indicator of unemployment conditions and the inflation levels. As for example, the lower output leads to excess capacity available and this in turn indicates a higher unemployment rate. As a result of this, it is highly difficult in such situation to perform an increase in the pricing levels. But with the aggregate demand increases, the level of output also gets increased and the resulting impact is therefore evident in terms of decline in the unemployment levels. This leads to decline in the excess capacity and the increase in the capacity indicates how much businesses can produce in the short run. The price level as a result of such increase in the demand and the production limits also gets increased. As a result of this particular situation, unemployment rates decline and this ultimately results into a rise in the inflationary trends across the economy (Ricci and Benigno, 2009).

The aggregate demand and aggregate supply levels are also the important indicators of explaining the relationship between inflation and unemployment situation across the economy. This model of aggregate demand and aggregate supply is highly effective from the point of view of price levels as against the nation’s real output. This model suggests that with an increase in the level of pricing, the situation as prevalent in the economy would be similar to that of inflationary trends. In addition to this, unemployment situation is defined as the situation similar to that of decline in the level of output across the economy. The demand and supply curve is therefore highly effective in this situation in explaining the trade off in respect to unemployment and inflation levels. The price levels are pushes up from the increase in the aggregate demand and this ultimately reduces the unemployment levels (Ricci and Benigno, 2009).

Thus, the analysis above has indicated that inflation is related to unemployment situation in the economy but this relationship is mainly of inverse nature which suggests that when unemployment increases, inflation decreases and vice versa.

Government is an important authority that accounts for ensuring that the entire economy performs in an efficient way. Government in an economy undertakes various such measures aimed at enhancing the overall performance level of the entire economy such as fiscal polices, monetary policy etc and these policies are aimed at achieving maximum level of control over the performance of the entire economic conditions. Government therefore has a direct level of influence over the performance of the economy and since inflation and unemployment levels affect an economy’s performance, they need to be properly addressed by the government in ensuring that the economy performs in an efficient way. There can be the application of fiscal policy that would be carried out by the government in ensuring that inflation levels are controlled in a positive way. There can be important initiatives that could be considered by the government with a view to control these aspects and these can be reducing expenditure levels and raising taxes within the economy. But this policy is highly suitable in respect to demand caused inflation and its application is performed with a view to ensuring that the level of inflation is maintained within controlled limit. The impact of unemployment rate is negative in respect to the performance of the entire economy, and it is therefore essential that government should identify measures aimed at achieving minimum level of unemployment conditions so that the performance of the entire economy can be enhanced to a significantly higher level. Thus, the influence of government is identified as direct in achieving improvement over the inflationary trend and the unemployment rates across the economy (Gottheil, 2013).

Case Study: Inflation, Unemployment, and Growth Trends in the Home Country

As there have been certain major relations being noted especially in respect to the inflation and the unemployment rates, the analysis is therefore specifically focused regarding these factors especially in respect to Australia. As inflation is identified as negative factor from the point of view of the performance of entire economy, this particular economic trend is mainly addressed by appropriate regulatory authority in an economy. As in respect to Australia, the Reserve Bank of Australian (RBA) in particular accounts for the regulation of inflationary trend, and it monitors the entire trend so as to achieve a proper control in this respect (Reserve Bank of Australia, 2014). An analysis has been carried out especially in respect to inflation across Australia, and it is identified that inflation is evident in Australia at 2.3% in 2013 in the third quarter. With respect to the monetary policy in Australia, there has been a target been achieved between the treasurer and the governor for the same and this is mainly to achieve an inflation rate equivalent to 2%-3% on an average. This agreed rate of inflation level is aimed at ensuring that the economy performs in a highly efficient manner. But this can be achieved through ensuring the attainment of effectiveness with respect to the decision making process and also the monetary policy across the economy (Reserve Bank of Australia, 2014). The inflationary trend as prevalent across the economy over the period of last five years is indicated as follows:

The above chart indicates about the prevalent rate of inflation in the Australian economy and it is evident that the inflation level was at its highest during 1970s as it has exceeded the rate of 16%. However, the country has been able to manage a decline in the performance of inflation rates across the economy since then and this is evident from the downward slopping curve as indicated in the chart above. The current level of inflation rate in the Australian economy has been 2.3% which has been within the reasonable acceptable limit of 2% to 3% that has been targeted across the economy (Reserve Bank of Australia, 2014).

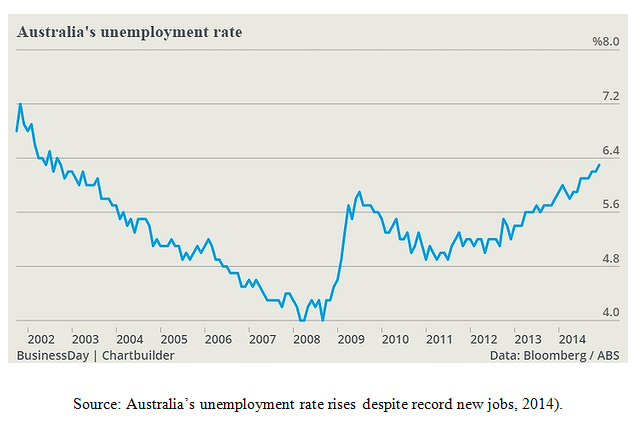

Apart from the performance of inflationary situation across the economy, the unemployment rate as prevalent across the economy has also been significant. As unemployment situation is identified as the people that remain unemployed in the economy, it is identified as a negative indicator from the point of view of economy’s performance. An analysis of the unemployment conditions across Australia indicate that it has been maintained at a rate of 6.3% which has been little bit higher as per economy’s performance. This higher rate of unemployment in Australia is despite the fact that there has been an additional job opportunity that have been created within the economy (Unemployment rate rises to 6.3%, 2014). The performance of unemployment condition in Australia is evident from the chart as indicated below:

The above chart gives an indication of the fact that there has been a declining unemployment rate being evident in respect to the Australian economy since 2002 and this trend is evident till 2008 as the unemployment level has reached the minimum in 2008. The unemployment rate has been increasing since then and the financial year 2014 has indicated the unemployment rate has reached a position of 6%. This unemployment rate has increased significantly despite there has been job creation across the economy. Thus, the analysis above indicates about the inflation and unemployment conditions as prevalent across the economy and it is assessed that the inflation rate has been kept under control but the unemployment condition has showed that it has not achieved the favourable condition. There has been an increasing trend being identified especially in respect to the unemployment rate and this has therefore been regarded as a negative factor affecting the performance condition of the entire Australian economy (Australia’s unemployment rate rises despite record new jobs, 2014).

This section is now focused towards addressing the aggregate supply curve which is currently operational across the Australian economy and the aggregate supply curve with regard to the Australian dollar is indicated as follows:

The supply curve has been indicated in the above curve and this curve is mainly with regard to the Australian dollar and the supply is expressed especially in respect to US dollar. As per the above graph, it has been identified that the Australian and US dollar are intersected at quantity 1.

Monetary policy has a significant role over an economy’s performance and it has a direct level of impact over the growth of an economy. The major ways in which monetary policy affects the performance of an economy are mainly in terms of maintaining equilibrium position in respect to the balance of payment, affecting the cost availability and also the credit availability, and also influencing the inflation level to maintain it at a position that is favourable to the performance of the entire economy. Monetary policy is quite useful in controlling the level of inflation across the economy and this is achieved primarily through the application of qualitative and quantitative methods of credit control. Monetary policy is also quite crucial in achieving positive performance level by way of achieving stability in respect to the price levels across the economy. Monetary policy of an economy is an important way in influencing the entire economy’s performance conditions as it is quite effective in bridging the balance of payment deficit of an economy in a positive manner. This implies that there can be control over the important economic indicators that could be established through the application of monetary policy within the economy (Mishkin, 2007).

The exchange rates and also the employment levels as prevalent within an economy are also affected by the performance of monetary policy within an economy. Monetary policy can be applied in terms of expansionary monetary policy or contractionary monetary policy and both these policies have the potential to affect the performance of entire economy in particular. The expansionary monetary policy is undertaken by the central bank and this is mainly undertaken in order to lower down the exchange rates. However, the restrictive monetary policy is undertaken in order to achieve higher rates of exchange within the economy. The employment levels are also affected significantly from the application of monetary policy in an economy, as restrictive monetary policy could dampen the growth of an economy and require firms to lay off their workers. This ultimately result into an increase in the unemployment levels as prevalent across the economy. In these ways, there has been the impact of monetary policy over the exchange rates and the employment conditions that have been prevalent in an economy (Mishkin, 2007).

Conclusion:

A critical assessment has been carried out in this report with regard to the existence of relationship between the inflation level and the unemployment conditions in an economy and the performance of analysis indicated that there has been the existence of inverse relations being identified in respect to these two important indicators of an economy’s performance. The analysis has also indicated that the role of government is significant from the point of view of an entire economy’s performance, as government plays a crucial role in the form of monetary policy and fiscal policy in affecting an economy’s performance condition. The analysis has also indicated about the inflationary trend and the unemployment conditions as prevalent across the Australian economy, and it is evaluated that Australia is performing efficiently in respect to inflationary situation whereby the unemployment rate has been slightly higher as evident in respect to Australian economy’s performance. The analysis of the role of monetary policy over the exchange rates and the employment levels has also been significant, as it has been identified that there is a direct level of impact of these economic indicators over an economy’s performance.

References:

Australia's unemployment rate rises despite record new jobs, (2014) [Online]. Available at: https://www.theage.com.au/business/the-economy/australias-unemployment-rate-rises-despite-record-new-jobs-20141211-124ub2.html [Accessed: 31 January 2015].

Gordon, R.J. (2004), ‘Productivity Growth, Inflation, and Unemployment: The Collected Essays of Robert J. Gordon’, Cambridge University Press.

Gottheil, F. (2013), ‘Principles of Economics’, 7th ed., Cengage Learning.

Gowland, D. (1991), ‘Money, Inflation and Unemployment: The Role of Money in the Economy’, Palgrave Macmillan.

Lindauer, J. (2013), ‘The General Theories of Inflation, Unemployment, and Government Deficits’, iUniverse.

Mishkin, F.S. (2007), ‘Monetary Policy Strategy’, MIT Press.

Ricci, L.A. and Benigno, P. (2009), ‘The Inflation-Unemployment Trade-Off at Low Inflation’, International Monetary Fund.

Solow, R.M. and Taylor, J.B. (1999), ‘Inflation, Unemployment, and Monetary Policy’, MIT Press.

Unemployment rate rises to 6.3 per cent, (2014) [Online]. Available at: https://www.theaustralian.com.au/business/economics/unemployment-rate-rises-to-63-per-cent/story-e6frg926-1227152393311 [Accessed: 31 January 2015].

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2015). Essay: Inflation And Unemployment: Analysis And Examples.. Retrieved from https://myassignmenthelp.com/free-samples/inflation-and-unemployment-an-analysis-of-relationship-between-them.

"Essay: Inflation And Unemployment: Analysis And Examples.." My Assignment Help, 2015, https://myassignmenthelp.com/free-samples/inflation-and-unemployment-an-analysis-of-relationship-between-them.

My Assignment Help (2015) Essay: Inflation And Unemployment: Analysis And Examples. [Online]. Available from: https://myassignmenthelp.com/free-samples/inflation-and-unemployment-an-analysis-of-relationship-between-them

[Accessed 31 May 2025].

My Assignment Help. 'Essay: Inflation And Unemployment: Analysis And Examples.' (My Assignment Help, 2015) <https://myassignmenthelp.com/free-samples/inflation-and-unemployment-an-analysis-of-relationship-between-them> accessed 31 May 2025.

My Assignment Help. Essay: Inflation And Unemployment: Analysis And Examples. [Internet]. My Assignment Help. 2015 [cited 31 May 2025]. Available from: https://myassignmenthelp.com/free-samples/inflation-and-unemployment-an-analysis-of-relationship-between-them.