Describe the Case Study for Unilever and his Strategic Management.

Strategic management is an important part of every organization. This helps the firm to focus on its long term goal. In this report, a corporation with multiple business units will be selected for analysing its strategies. The paper will identify different business units and its product lines. The greatest source of revenue for the organization will be identified. The report will also present external environment analysis. The source of sustainable competitive advantage of the chosen firm will be identified in this paper.

Corporation is a large business or organization or group of companies act as a single entity with legal authorization. Corporation enjoys the rights and responsibility of an individual owner. In this kind of business owners have limited liability. Some legal rights separate this entity from the owners. The tax implication is also different for a corporation. The ownership structure of a corporation is also managed flexibly (Moore 2016).

Product portfolio is the collection of all products that are offered by the organization. It comprises of different product categories; product lines and the product itself. The product portfolio should be focused on achieving the goal of the organization. Those products should be in the portfolio that brings extra revenue. Based on the performance of the product, the management decides invest on the particular product (McNally, DurmuÅŸoÄŸlu and Calantone 2013). A service portfolio is comprised of list of service irrespective of their positions in the life cycle. Service portfolio tackles performance of the various department and ensures that company is offering right mix of services. The service portfolio focuses on consumers’ satisfaction that will help to bring profit to the organization.

In this report, Unilever has been chosen for the analysis. This in an Anglo-Dutch multinational consumer goods company. The company was founded in 1930 by the merging of a Dutch margarine producer and the British soap makers. Later it has diversified its production. Unilever N.V and Unilever Plc, these two companies operate as a single entity. It has common board of directors. Therefore, this company meets the feature of a corporation. Unilever has its headquarters at Netherland and United Kingdom. It is the third largest consumer goods company after Procter & Gamble and Nestle, as of 2012. The company operates worldwide and has subsidiaries in almost 190 countries (Unilever 2016). Hindustan Unilever is one of the notable subsidiaries, as Unilever holds 67% share. This multinational company operates companies and factories in every continent apart from Antarctica. The company owns more than 400 brands, therefore, it has to maintain product portfolio that extents multiple business units.

Business Unit is logical segment of an organization that represents specific business function. A corporation has different business units and each unit is responsible for profit generation (Abernethy, Bouwens and Lent 2013). The business units of a corporation can be production unit; accounting team; marketing unit and so on. All of these units contributes to improve the profit level. Business units are focused on each set of products.

Business units are essential for a company that has multiple products. Group of related products under single brand is sold by the company, which is known as product line. A company can expand by offering many product lines, i.e. it sells multiple product under various brands (Best 2012). Product line is created as marketing strategy in order to capture the market. The consumers prefer the brand they are already using. Therefore, launching different but related product under same brand is likely to have more positive response. Product line helps to gauge the trends in the market.

Unilever has different business units as well as multiple product lines. The business units of this company can be broadly classified into two groups; production and sales. There are four major units of this corporation, such as, Foods; Personal Care; Home Care and Refreshments. This company owns more than 400 brands. The Foods unit includes production and sales of soups; sauce; snacks; salad dressings; bouillons; mayonnaise; margarines and spreads. The Home care product line includes powders; liquids and capsules; soap bars; detergent and other cleaning products. Personal care incorporates deodorants; skin care and hair care products; oral care products etc. The Refreshment product line incorporates ice cream; tea-based beverages; coffee; weight management products etc(Unilever 2016). Some of the famous brands of this corporation for multiple product lines are as follows:

Body Wash: Lux; Liril; Dove; Pears; Lifebuoy; Breeze; Rexona

Laundry: Surf Excel (Drive); Vim; Wheel; Rin; Comfort

Deodorants: Axe; Rexona; Lever 2000

Skin Care: Vaseline; Ponds; Lakme; Fair & Lovely

Hair Care: Clinic Plus; Sunsilk; TRESemme; Dove; Clear

Oral Care: Pepsodant; Close Up

Ice Cream: Cornetto; Magnum; Streets (Heartbrand)

Spreads: Flora (Becel); Bertolli

Tea: Lipton; Brooke Bond; Bushells; Lan-Choo

Coffee: Bru

Revenue is the amount of money received by a company during a particular timeframe. Revenue is earned from normal business activities that are by selling goods and services. An organization focuses on maximizing the revenues collected through sales. The more will be the revenue, the more profit is assured and the corporation can invest more in its next venture (Wang 2013). A company or a corporation reviews its revenue obtained from its respective product lines and from the product itself. This is because, a corporation will not invest in a product or certain product line, which has failed to bring sufficient revenue.

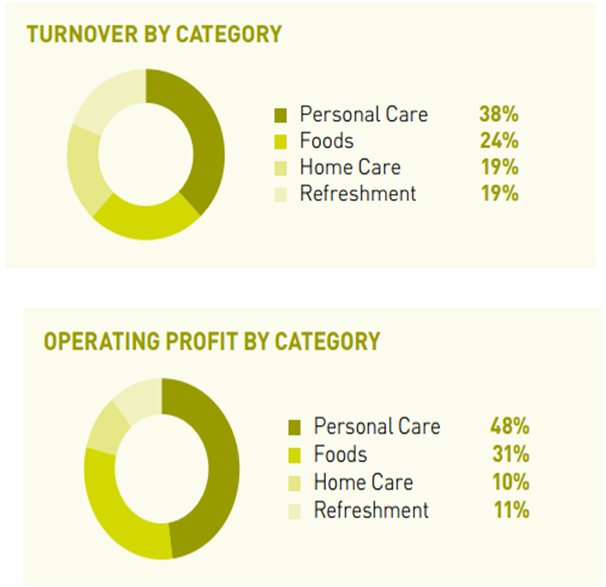

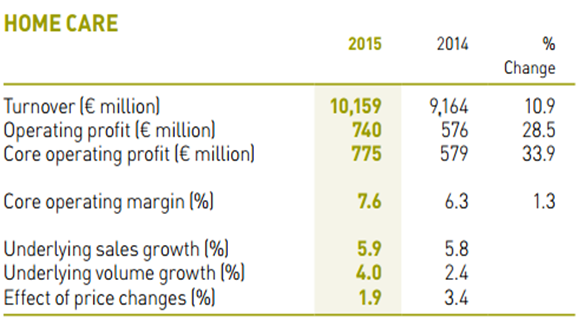

Unilever turnover from its different product lines during 2015 are as follows:

Revenue from Personal Care: €20.1 Billion

Revenue from Foods: €12.9 Billion

Revenue from Home Care: €10.2 Billion

Revenue from Refreshment: €10.1 Billion

Therefore, it can be said that Personal Care products of Unilever have generated maximum revenue(Unilever 2016).

Source: Unilever 2016

Source: Unilever 2016

Source: Unilever 2016

Source: Unilever 2016

Source: Unilever 2016

Unilever have 13 brands that have sales of €1 Billion or more. Some of them are also Sustainable Living Brands, such as Knorr. The €1 Billion brands of Unilever are as follows:

- Axe

- Dove

- Knorr

- Lux

- Rexona

- Lipton

- Hellmann’s

- Heartbrand

- Magnum

- Surf

- Sunsilk

- Omo

- Rama(Unilever 2016)

It is important to analyse the scenario or the circumstances where the business is operating. The operating environment includes both external and internal environment (Shroff, Verdi and YU 2013).The external factors that effects the environment of the corporation are: political factor (P); economical factor (E); social factor (S); technological factor (T); legal factor (L) and environmental factor (E). Therefore, the PESTLE Analysis will help to analyse the external environment of Unilever.

Political Factor: Unilever is a Corporation that acts as single entity behalf of two firms, one in Amsterdam and the other in London. Both the British and Dutch political systems are instable. The governmental frameworks have major impacts on the conduct of business. Netherlands changed its rate of VAT thrice since 2010 (Wolf 2014). This affects the business of Unilever.

Netherlands and UK are members of European Union that enables trade among the member nation with certain rules regarding the business and lowering trade barriers. However, during 2012, Netherlands wanted to pull the nation out of EU in order to ease local Dutch economy, whereas, UK wanted to continue on EU membership. Withdrawing of membership could have massive impact on the business like Unilever (Rankin 2014).

Since 1960s and 1970s, many countries have adopted nationalization policy. The companies were subject to local control on price; quantity; employment and imports. This was quite hazardous for Unilever, as it has lost some control over the market operation (Nyuur, Osabutey and Debrah 2014). For example, Unilever subsidiary in Africa, UAC, remitted a significant share of profit to its parent company. However, nationalizing in many African countries reduced the control of Unilever over the market operated by UAC.

The political unrest in the Middle East hindering the opportunity of Unilever to grow in those region. The most of the revenue comes from developing and emerging countries. Hence, globalization and policies of that regional government affects the corporation. However, Unilever utilizes its experience and goodwill to make agreements or contracts in many countries by bargaining with the respective governments to modify their regulations.

Economic Factor: Unilever faces challenges because of its decline in sales due to global financial crisis. Europe was one of the regions that was severely affected due to the global economic crisis. The household consumption of Europe has severely fallen due to the recession. The household consumption level is still not at the level of pre-crisis period. The unemployed has also grew up and wage has fallen in many economies (Gerstberger and Yaneva 2013). This indicates that people have less capacity to purchase. Consumers demand less due to lack of wealth and this adversely affects the manufacturer of fast-moving consumer goods like Unilever.

Instead of global economic crisis, some of the regions like Latin America; China and India are booming and Unilever enjoys considerable opportunity to earn significant revenue from these markets. At present, most of the sales revenues are coming from these markets (Unilever 2016).

In some economies, companies have to pay duties that were uncertain due to unstable currency and high rate of inflation. This kind of uncertainty of economic variables affects the profit level of Unilever. If the tax is too high, then even after a high turnover, the profit after tax will be insignificant.

In many markets, where Unilever has expanded its operations, like Africa, per capita income is too low. In such markets the economic development has not taken place and as a result of this Unilever may not generate high revenue.

Social Factor: Due to advance medical provisions, the life expectancy rate is rising over times. Moreover, the fertility rate is falling. Due to these two facts and ageing of the “baby-boomers” has accelerated the ageing of population (Reher 2015). This demographic change will require changes in the business like Unilever. The company has to change its structure of demand in future. The needs of the older people are unique and Unilever has to meet those. For example, old people would prefer ready-to-cook or ready-to-eat meals. Moreover, due to the stagnant and aged population, Unilever faced problem of labour shortage.

People have become more aware of health and ethical issues. People now demands ethically produced goods and healthy products. As a result of this, Unilever introduced products like Flora and I can’t’ Believe it’s not Butter, two margarine brands (Rankin 2014). Due to the growing awareness, Unilever has been working to improve the hygiene and better nutrition to the people with obesity and poor people (Cunningham et al. 2015).

In some nations, literacy rate is low. This influences the marketing tool used by the company. Advertisement in print media will not be much effective as people are illiterate. Therefore, Unilever has to employ more resources in order to enhance face-to-face communication. Hence, this social factor influences the marketing campaigns of the company.

By building exclusive culture and goodwill, Unilever can create high demand for its product in the developing nations.

Technological Factor: Unilever continue to invent new technology in order to boast the production and improve the quality of its products. Technical incapability in R & D activity can adversely affect the revenue and profit of the company. Therefore, high automation level is a major success criteria of Unilever.

Uses of social media; retail website is growing and Unilever need to join internet and mobile technologies to have better access to its customers. The online discussion with the customers can influence the purchasing decision and increase the customer base (Sashi 2012).

Unilever spends on IT for improving its e-business. This will minimize the cost to the company. this will enhance the brand image and product quality. Through the improved connectivity, the price and promotional information is readily available to the consumers (Shaikh 2013). This provides the shoppers to access online store immediately.

Unilever Technology Venture work along with Unilever R & D to meet the need of the customers. A consumer goods producing corporation like Unilever is concerned with advance bioscience; Nano technology; advanced materials science and genomics.

Legal Factor: Organization like Unilever is subject to local and regional laws and regulation and global rules as well. The rules cover the areas of product safety; trademarks; copyright; health and safety; corporate governance etc. the local tax and employment laws also affect the business activity of the company. Breaching of laws and regulations can hamper the reputation of the company. Unilever has to abide national laws of the 190 countries.

Unilever is must not discriminate individuals on the basis of age; gender; race; religion etc. (Hyman et al. 2012). Mandatory age of retirement has been removed from both the Netherland and UK.

Environmental Factor: Environmental degradation is of major concern in the global economy. The focus is on the utilizing minimum resources and generating less waste. It works in association with the governing authority in regard of waste management. It reduces plastic waste to the landfill.

Unilever has maintained environmental standard by producing and designing products, which are safe and healthy for the consumers.

Establishment of EU Emissions Trading System attempts to reduce carbon emissions to meet the Kyoto Protocol (De Sadeleer 2014).

Unilever uses environment friendly materials and packages. The company is also working on projects like safe drinking water.

The internal analysis emphasises on the resources that the company possesses. The competitive advantage of Unilever depends on the nature and the competency of the resources. The more competent the resources are the more the company will enjoy sustainable competitive advantage (David and David 2016). SWOT analysis will be conducted to identify the advantage and disadvantage of the company and competitive advantage will be verified under VRIO framework.

Strength: Size of the Company is its major strength. It is the manufacturer of more than 400 brands over 190 countries (Thain and Bradley 2014).

The major advantage of this corporation is its brand recognition and longevity. It is the oldest multinational corporation.

Unilever is headquartered in two countries, thus floated on two indexes. It is also floated secondarily on New York Stock Exchange.

The volume of skills; knowledge; experience embodied in the employees of the company and excellent managerial skill are the strengths of Unilever.

Strong supply chain of the company has put it to an advantageous position.

Unilever invests huge amount in R & D activities.

Weakness: Many have argued that broad portfolio of the company is the reason for weakness of this company. Broad ranges of product with 400 brands are hard to manage. Therefore, the company loses focus in marketing.

Unilever charges higher price than its competitors. The company claims that high price is for the quality of the product, while critics opines that the huge investment of R & D attributed to high price.

Unilever is less connected to its customers directly.

Unilever does not have any premium market.

Opportunity: Unilever has significant opportunity to reduce its advertisement expenditure by promoting through social media.

Increasing demand for healthy products can increase the sales of the company.

There is lot of opportunity in the personal care product line as it can be more customized.

The company has huge possibility to introduce new product regularly. This is because; research facilities in England; Bangalore (India); Shanghai (China); New Jersey (USA) have the ability to refine existing products and develop new product.

Threats: Strong competition from MNCs and local company is quite strong. The top competitors are Procter and Gamble; Nestle as they have similar product line and business model.

The company has a large share of premium brands in its product line. Economic downturn possess threat to such brands as sales and sales margin are affected.

As food price has increased, Unilever has to pass on food inflation to maintain the profit margin. Thus, it has to rethink about its strategic choice.

The growth in the emerging market is also slowing down.

Social ethics and concern in the region like, India; Japan; Thailand considered as a threat to the company. Unilever has been criticized for manufacturing “fairness” products.

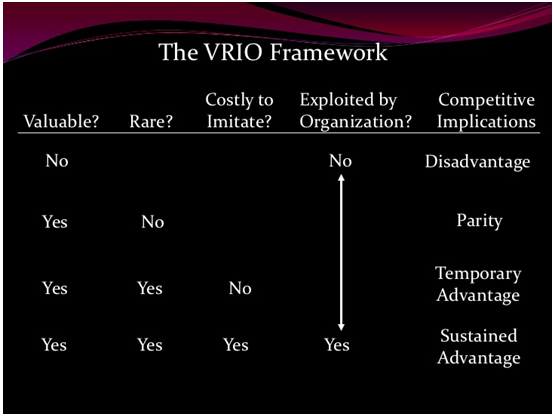

From analysing the strengths of Unilever, the competency of the available resources can be verified. Unilever is said to have sustainable competitive advantage over one resource, if it is valuable; rare; inimitable and organized (VRIO) (Stadler, Helfat and Verona, 2013). These are the four factors.

The Brand image of Unilever enables the corporation to exploit the external and internal opportunity. It can bring potential revenue to the company. Hence, this is valuable. Brand image is rare as even if other firm possesses their own brand, the brand image of Unilever is more reputed because of its goodwill. The brands of Unilever bring higher profit than the normal profit level. Therefore, it enjoys competitive advantage. The competitor cannot the imitate the brand image of this corporation, as brand value is an intangible resource of Unilever. Even if other firm wants to create their own brand image, it will require to employ high cost. Hence, it is not imitable. Unilever possesses mechanism to exploit its brand image. Hence, it is organized. The brand image of this corporation enjoys the sustainable competitive advantage.

The innovation capability of Unilever is another resource that has sustainable competitive advantage. R & D activity of the firm exploits its resources for innovation. Hence it is valuable. The competitors cannot make the same innovation; thus it is rare. The other companies cannot imitate the new innovated product line, as this will require buying patent of Unilever. It is inimitable. Unilever invests significant share of profits in innovation process. Thus, it is organized too. Hence, Innovation enables Unilever to enjoy sustainable competitive advantage.

Unilever has core competency over marketing and advertising; relationship with the customers and supplier. These resources are valuable and rare, as these help to earn high revenue for the company and other firms may not have same relationship with the stakeholders. However, the competitors can easily imitate these. Therefore, these resources have temporary competitive advantage.

Source: Metzger 2014

Strategic direction is the action that a firm undertakes to achieve its goals and objectives. Proper strategic direction enables the company to grow in the long term and to sustain in the competition (Rothaermel 2015). According to Porter’s generic Strategies, there are three strategic options to the organization, namely, “Cost Leadership”; “Differentiation” and “Focus” strategy (Tanwar 2013).

Unilever competes with the competitors in terms of price. It is recommended that the corporation should charge low price by improving internal capability. This is cost leadership that will help the firm to achieve competitive advantage. Unilever offers product line similar to that of its competitors. It must differentiate its product line by innovation so that it can enjoy competitive advantage. Therefore, cost leadership and differentiation strategies are recommended for future growth of Unilever.

Abernethy, M.A., Bouwens, J. and Lent, L., 2013. The role of performance measures in the intertemporal decisions of business unit managers. Contemporary Accounting Research, 30(3), pp.925-961.

Best, R., 2012. Market-based management. Pearson Higher Ed.

Cunningham, K., Kamonpatana, K., Bao, J., Ramos-Buenviaje, J., Wagianto, A. and Yeap, P.W., 2015. Unilever Nutrition Strategy and Examples in Asia. Journal of nutritional science and vitaminology, 61(Supplement), pp.S39-S40.

David, F. and David, F.R., 2016. Strategic Management: A Competitive Advantage Approach, Concepts and Cases.

De Sadeleer, N., 2014. EU environmental law and the internal market. OUP Oxford.

Gerstberger, C. and Yaneva, D., 2013. Analysis of EU-27 household final consumption expenditure, Eurostat. Statistics in focus, (2).

Hyman, R., Klarsfeld, A., Ng, E. and Haq, R., 2012. Introduction: Social regulation of diversity and equality. European Journal of Industrial Relations, 18(4), pp.279-292.

McNally, R.C., DurmuÅŸoÄŸlu, S.S. and Calantone, R.J., 2013. New product portfolio management decisions: antecedents and consequences. Journal of Product Innovation Management, 30(2), pp.245-261.

Metzger, K. (2014). General Electric. Corporate Strategy Analysis.

Moore, F., 2016. Transnational business cultures: Life and work in a multinational corporation. Routledge.

Nyuur, R.B., Osabutey, E.L. and Debrah, Y.A., 2014. Doing business in Africa. The Routledge Companion to Business in Africa, p.259.

Rankin, J. (2014). EU exit could see Unilever cut investment in UK. [online] the Guardian. Available at: https://www.theguardian.com/business/2014/jan/21/unilever-warning-uk-withdrawal-european-union [Accessed 18 Aug. 2016].

Reher, D.S., 2015. Baby booms, busts, and population ageing in the developed world. Population studies, 69(sup1), pp.S57-S68.

Rothaermel, F.T., 2015. Strategic management. McGraw-Hill.

Sashi, C.M., 2012. Customer engagement, buyer-seller relationships, and social media. Management decision, 50(2), pp.253-272.

Shaikh, M.J., 2013. IT Revolutionizing the Supply chain Transformation: A Case Study of Unilever Pakistan Ltd. International Journal of Supply Chain Management, 2(1).

Shroff, N., Verdi, R.S. and Yu, G., 2013. Information environment and the investment decisions of multinational corporations. The Accounting Review, 89(2), pp.759-790.

Stadler, C., Helfat, C. E., & Verona, G. (2013). The impact of dynamic capabilities on resource access and development. Organization science, 24(6), 1782-1804.

Tanwar, R. (2013). Porter’s generic competitive strategies. Journal of Business and Management, 15(1), 11-17.

Thain, G. and Bradley, J., 2014. FMCG: The power of fast-moving consumer goods. First Edition Design Pub.

Unilever. (2016). Annual Report and Accounts 2015. [online] Available at: https://www.unilever.com/Images/strategic_report_ar15_tcm244-477387_en.pdf [Accessed 18 Aug. 2016].

Unilever. (2016). Strategic Report 2015. [online] Available at: https://www.unilever.com/Images/strategic_report_ar15_tcm244-477387_en.pdf [Accessed 18 Aug. 2016].

Wang, X.L., 2013. Revenue management and customer relationship management.

Wolf, R., 2014. Dutch Turnover Tax or EU VAT? On the Permeation of EU VAT Rules in the Dutch Turnover Tax Practise. Intertax, 42(8), pp.525-537.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2017). Unilever: Strategic Management Essay.. Retrieved from https://myassignmenthelp.com/free-samples/unilever-strategic-management.

"Unilever: Strategic Management Essay.." My Assignment Help, 2017, https://myassignmenthelp.com/free-samples/unilever-strategic-management.

My Assignment Help (2017) Unilever: Strategic Management Essay. [Online]. Available from: https://myassignmenthelp.com/free-samples/unilever-strategic-management

[Accessed 01 June 2025].

My Assignment Help. 'Unilever: Strategic Management Essay.' (My Assignment Help, 2017) <https://myassignmenthelp.com/free-samples/unilever-strategic-management> accessed 01 June 2025.

My Assignment Help. Unilever: Strategic Management Essay. [Internet]. My Assignment Help. 2017 [cited 01 June 2025]. Available from: https://myassignmenthelp.com/free-samples/unilever-strategic-management.