Overview of Singaporean Economy

Question:

Discuss about the Economy of Singapore and Policy Debate for GDP.

The significance of the Singaporean economy rights lies in the developed and free market economy that it has holding 37th position globally in terms of Gross Domestic Product. The country ranks third in terms of per capita GDP estimated as per purchasing power parity. The nation is marked as pro-business encouraging business through adoption of various policies that favor the growth of the business. One of this is lower tax rates which accounts only 14.2% of the GDP. In terms of fairness, the country falls within top 10 and ranks 7th as least corrupt nation. The nation is mostly exporter to the world and connected with various countries through trade. This makes even the smaller economy important globally and the global impacts play greater role in determining the national economic health.

The macroeconomic policies of nations play important role not only to ascertain economic growth in the nation over period but also helps the economy move toward stable equilibrium that is optimum (Ghosh,Jonathan and Marcos 2016). Major instruments of such macro policies are monetary policy or changes brought through modified exchange rate system

The paper attempts to present an overall snapshot of Singaporean economy and detect its potential as well as lacking. The paper aims to prescribe whether a monetary policy or a exchange rate policy would be better strategy for the nation to solve the recent problems and move toward integrated and more developed economic situation.

Upon achieving freedom from the shackles of Malaysian rule in 1965, Singapore started its solo journey with presence of small domestic market, higher unemployment and consequently poverty poor standard of living and lack of education and health. The poor condition of the nation showed in the estimated unemployment figure, which reached as high as 14% (Tremewan 2016). Since then the nation focused on making the country attractive destination for investment and capital inflows. The imitative proves its success in the fact that by 2001 the nation has been able to receive foreign investments in the manufacturing production by 75% and in the manufacturing export by 85% (Tremewan 2016). The investment boosted the production to meet increased demand and this further led to capital accumulation. Overtime this led to increased savings and interest rates. This enhanced the capital stock of the nation by 33 times since it was in 1992. The capital-labor ration increased 10 times. With rising wage shares of GDP and household consumption backed by increased income the standard of living improved and the nation reached middle income level from low income nation

Singapore's Journey to Success

Two biggest strategies adopted by the nation was self-reliance and skill development within workforce that took care of the deficiencies the nation had in terms of income and basic amenities of life. Public companies driven by government comprise the major part of the national economy. These companies are held through sovereign wealth funds that buys majority shares in those firms. The nation is biggest financier in terms of foreign direct investment outflow. Positive economic and political climate of the nation has also made it receive capital inflows from global institutions. The policies and strategies brought 8% of GDP growth rate in the nation from 1960 to 1999. The rate fell to 5.4% following Asian Financial Crisis (Rodan 2016). The economy picked up its growth reaching 9.9% in 2001 even though the slumps in the USA, Japan, European countries had negative impact on the growth condition of Singapore. Since 2004 the nation showed remarkable growth rate

The economy of the country lies mostly on three broadly visible sectors Banking, Biotechnology and Energy & Infrastructure. Apart from these, telecommunication and retail sector also plays significant role in determining the growth of GDP overtime. The manufacturing sector accounts highest almost 21% to GDP followed by retail and whole sale contributing 17%, business by 14, financial services and transportation by 12%, construction by 4% and others 20% (Rodan 2016). Though the nation is dominant in service production, it also pioneers in manufacturing of chemicals and electronics.

In the recent time period the nation records GDP at US$298.1 billion with current growth rate of 1.7% in 2016 and 2.9%v in 2017 (Tremewan 2016). The increasing trend of the growth trend is due to increasing industrial production as well as export. The industrial production growth rate has been in 1% in 2016 estimation.

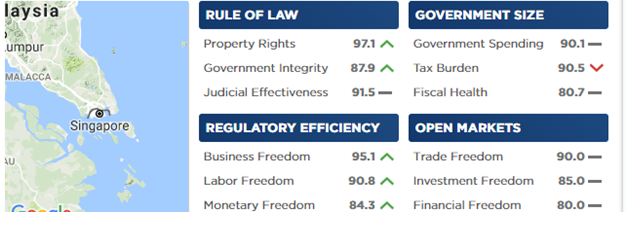

The open market operation of the nation has allowed it to receive freedom in trade, business, investments and financial operations. The efficient regulation of the economy has led to relaxation in the business operation as well as provided freedom to labor and money market. The country has managed to maintain good fiscal health with lower tax burden and higher level of government spending.

Source: (2017 Index of Economic Freedom)

The driving reason behind continued growth of Singapore is the stable macroeconomic policies combined with political, legal and financial stable environment. This has led the economy to become more dynamic and adaptive as well as responsive to various global and national events. The growth in business is promoted and consolidated by the strong and secured property rights. Efficient judicial framework, lower level of corruption and sustained rule of law led the economy move toward increasing pattern of growth line. The country is open to the global economies for trade and investment. Moreover the decisions and activities are taken incorporating environmental sustenance that makes the country more attractive globally in terms of efficient production. Even though the nation is mostly consists of public companies held and operated by government, the private sector determines the resilience and the competitiveness of the nation. State ownership in the enterprises as well as key sectors of economy reflects substantial balance in the economic growth. Public housing services, heath care, education and various other programs are administered by the provident fund of central government and statutory authorities.

Major Contributors to Slow Growth

To prescribe suitable policy for growth, the nation needs to indentify its shortcomings and deficiencies. Major issues the nation facing right at this period are:

Slow Growth: The recent economic trend of slower growth stems from the massive hit that Global Financial Crisis gave to the world economy. The interconnection of the countries through international trade made the impact of the crisis chronic and spread too many countries (Aggarwal and Shujiro 2013). This had huge impact on economy of Singapore too with lowering the employment stemmed from cut in production due to fall in international demand of export. The world economy is yet under reconstruction and this restructuring creates economic vulnerability for the nation. Almost 3460 lost job and huge amount people got affected facing challenges in employment (Tremewan 2016). Almost 42000 business units could not thrive the economic hit and led toward shut down situation. The recent slump in the national economic output is the combined effect of cyclical fluctuation in short-term and structural concerns of the long run. Key contributors to slower growth are:

Slow Global Growth: Growth of largest world economies like USA, China has slumped which had clearer impact in reduced trade, demand and consequent impact on Singapore ‘s falling export and growth respectively. T he trade dependent national economy is greatly affected by the downturn global economy is facing.

Slump in Global Oil Price: The oil and gas industry has faced plunging prices that affected their business growth since middle of 2014 continued till recent years. The downturn in prices for long time has led to loss of $35.5 billion revenue from the top oil companies of the country.

Shift in Flow of Trade: The international trend of trade has shifted towards consumption and services than industrial and manufactured goods production. This has led to reduction in demand and export has fallen as a result creating a gloom fro economy of Singapore.

Disruptions and Changes: Advancement of technology has updated almost every industry of the nation bringing forth both the challenges along with opportunities. This factor has affected the labor market most. On one hand the advent of technology creates room for new jobs in emerging sectors like engineering, IT, healthcare and education. (Aggarwal and Shujiro 2013) On the other hand it creates challenges in terms of loss of employment.

Few of the services in which the country aced like aviation and national carriers, has eroded its value due to excessive competition coming from Southeast and East Asia. Problem of higher manufacturing cost, shortage of lands, poor policies that restricts access to foreign workers, weak performance of productivity, required a structural change for the entire economy, which the nation is unable to provide. The health services of the nation are also performing under strain being unable meet the huge demand at low cost even after the central provident fund has been initiated to provide basic health services. Moreover poor stock market performance an retrenchment in banking, oil and gas, electronic and real estate sectors created much more negative vibes for the economic output.

Suitable Policy for Growth

The monetary policy of a country is crucial to its economic growth as it stabilizes various economic shortcomings it has. A good monetary policy take s care of the inflationary pressure the nation has. It helps in cash control through open market operation. Moreover, interest rates goes up and down depending upon the mode of monetary policy being expansionary or contractionary (Tan 2012). An expansionary monetary policy would make the interest rates lower and the contractionary one would push the rates to be higher in order to control the supply of money in the market. Moreover to bridge the gap of balance of payment deficit, ensure price stability and manage debt of the nation, well planned monetary policy is unequivocally important.

Exchange rate affects price stability and growth of a nation. It determines the prices of goods and services in international trade. Suppose for $1, SGD 1.379 is exchanged. Now if dollar appreciates that is suppose $1 is exchanged for SGD 2 which also implies depreciation of Singaporean dollar, then that makes import cost higher and export brings more revenue for the nation. This leads to more export and less import improving balance of trade (Bäurle, Gregor, and Daniel 2014). On the other hand, depreciation of the dollar happens when Singaporean dollar appreciates, suppose $1 = SGD 0.98 now. The value of dollar falls and makes US goods become cheaper and more import is encouraged. The exports of Singapore falls as the national product become expensive in international market (Von Mises 2012). As a result, balance of trade runs in deficit. These affect the domestic price as well as national output strongly.

|

Year |

Exchange Rate of (SGD/$) |

|

2011 |

1.2573 |

|

2012 |

1.2498 |

|

2013 |

1.2513 |

|

2014 |

1.2671 |

|

2015 |

1.3748 |

|

2016 |

1.379 |

(Source: Author)

The table shows that the exchange rate of the Singapore has been steady over the past 5 years with recent insignificant depreciation in last 2 years. This ensures the country doesn’t require exchange rate modification that much but the monetary policy which can enhance the money market operation

The major problem Singapore is facing right now is lesser economic growth stemming from recessionary impact of Global Financial Crisis spread worldwide. As a result, volume of international trade has declined due to fall in export demand from big economies like USA, China. This situation can be survived only by expanding and diversifying domestic economy. For this, a suitable monetary policy is best way to boost the domestic consumption. From the national income identity Y = C + I + G + NX , Y the national output or income can be enhanced by boosting the components like C, I or G apart from NX which is well managed by a suitable exchange rate policy (Ghosh,Jonathan and Marcos 2016). The country being mostly trade dependent needs to shift focus toward creating more demand in nation and go for market expansion in various sector.

Monetary Policy for Singaporean Economy

This would require more government expenditure too bring out new projects that would create employment while supplying to meet demand. The country has to remain open to international trade without adopting protectionism as adopted by many developing s well as developed economies in order to save themselves from contagious effect of global downturn. This requires the nation to participate more in trade agreements and partnerships like Trans-Pacific Partnership as member of Asian Economic Community.

Conclusion

Singapore has left its mark on the global economy through its huge export made to various countries of world. Mostly the big market economies like USA, Japan, and China India created more export demand for Singapore and the recent global financial crisis has hit the Singaporean economy pretty bad that evoked slower growth throughout in the nation in recent time. Since volume of trade and as a result, export of the country has been falling which it can counteract by an expansionary monetary policy that would increase money supply. Increased money supply can call for more demand through more income generation and more investment should be made in sectors and enterprises in order to diversify the production in national economy. The country needs to prepare for the seen as well as unseen challenges to recover the downfall by adopting innovative production to meet the expanded and diversified demand in the domestic market. Re-skilling the labor force can make the enterprises produce more efficiency and productivity.

References

Aggarwal, Vinod, and Shujiro Urata, eds. Bilateral trade agreements in the Asia-Pacific: Origins, evolution, and implications. Routledge, 2013.

Bäurle, Gregor, and Daniel Kaufmann. Exchange Rate and Price Dynamics in a Small Open Economy: The Role of the Zero Lower Bound and Monetary Policy Regimes. No. 2014-10. Swiss National Bank, 2014.

Bruno, Valentina, and Hyun Song Shin. "Capital flows and the risk-taking channel of monetary policy." Journal of Monetary Economics 71 (2015): 119-132.

Fiore, Fiorella De, and Oreste Tristani. "Optimal monetary policy in a model of the credit channel." The Economic Journal 123, no. 571 (2013): 906-931.

Gambacorta, Leonardo, Boris Hofmann, and Gert Peersman. "The effectiveness of unconventional monetary policy at the zero lower bound: A cross?country analysis." Journal of Money, Credit and Banking 46, no. 4 (2014): 615-642.

Ghosh, Atish R., Jonathan D. Ostry, and Marcos Chamon. "Two targets, two instruments: monetary and exchange rate policies in emerging market economies." Journal of International Money and Finance 60 (2016): 172-196.

Hamilton, James D., and Jing Cynthia Wu. "The effectiveness of alternative monetary policy tools in a zero lower bound environment." Journal of Money, Credit and Banking 44, no. s1 (2012): 3-46.

Ozga, Jenny, Terri Seddon, and Thomas S. Popkewitz, eds. World Yearbook of Education 2006: Education, Research and Policy: Steering the Knowledge-Based Economy. Routledge, 2013.

Pudukudy, Manoj, Zahira Yaakob, Masita Mohammad, Binitha Narayanan, and Kamaruzzaman Sopian. "Renewable hydrogen economy in Asia–Opportunities and challenges: An overview." Renewable and Sustainable Energy Reviews 30 (2014): 743-757.

Rodan, Garry. The political economy of Singapore's industrialization: national state and international capital. Springer, 2016.

Stein, Jeremy C. "Monetary policy as financial stability regulation." The Quarterly Journal of Economics 127, no. 1 (2012): 57-95.

Tan, Kenneth Paul. "The ideology of pragmatism: Neo-liberal globalisation and political authoritarianism in Singapore." Journal of Contemporary Asia 42, no. 1 (2012): 67-92.

Towbin, Pascal, and Sebastian Weber. "Limits of floating exchange rates: The role of foreign currency debt and import structure." Journal of Development Economics 101 (2013): 179-194.

Tremewan, Christopher. The political economy of social control in Singapore. Springer, 2016.

Tsangarides, Charalambos G. "Crisis and recovery: Role of the exchange rate regime in emerging market economies." Journal of Macroeconomics 34, no. 2 (2012): 470-488.

Von Mises, Ludwig. On the manipulation of money and credit: three treatises on trade-cycle theory. Liberty Fund, 2012.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2019). Snapshot Of Singaporean Economy And Its Potential For Growth. Retrieved from https://myassignmenthelp.com/free-samples/economy-of-singapore-and-policy-debate-gdp.

"Snapshot Of Singaporean Economy And Its Potential For Growth." My Assignment Help, 2019, https://myassignmenthelp.com/free-samples/economy-of-singapore-and-policy-debate-gdp.

My Assignment Help (2019) Snapshot Of Singaporean Economy And Its Potential For Growth [Online]. Available from: https://myassignmenthelp.com/free-samples/economy-of-singapore-and-policy-debate-gdp

[Accessed 26 April 2024].

My Assignment Help. 'Snapshot Of Singaporean Economy And Its Potential For Growth' (My Assignment Help, 2019) <https://myassignmenthelp.com/free-samples/economy-of-singapore-and-policy-debate-gdp> accessed 26 April 2024.

My Assignment Help. Snapshot Of Singaporean Economy And Its Potential For Growth [Internet]. My Assignment Help. 2019 [cited 26 April 2024]. Available from: https://myassignmenthelp.com/free-samples/economy-of-singapore-and-policy-debate-gdp.